Millionaires in America 2020: All 50 States Ranked

How many millionaires are in America and where do they live? The states with the highest number of millionaire households just might surprise you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to where millionaires live in America, the rich keep getting richer.

Market research firm Phoenix Marketing International notes that although the total number of millionaire households rose for the 11th straight year in 2019, the gains were disproportionately seen in states that already had more than their fair share of millionaires.

"While the total number of high-net-worth households grew, these increases were largely seen in the wealthiest states, reinforcing the broader ongoing wealth-gap issues the country faces," says Carl Uttaro, VP of financial services research at Phoenix MI.

How Many Millionaires Are in the U.S.?

Phoenix MI is tracking the effects of the coronavirus pandemic, which could make for a very different landscape going forward. But last year, at least, the good times continued to roll. Indeed, a record 6.71% (or 8,386,508 out of 125,018,808 total U.S. households) can now claim millionaire status. That's up from 6.21% in 2018 and just 5.81% in 2017.

Note well that to be considered a millionaire by the standards of wealth research, a household must have investable assets of $1 million or more, excluding the value of real estate, employer-sponsored retirement plans and business partnerships, among other select assets.

Although California and New York have a great deal of millionaires in terms of raw numbers, they don't have the highest concentrations of rich households. It turns out there are numerous states with higher percentages of well-off households, several of which probably will surprise you.

And don't forget that between living costs and taxes, a million dollars goes much further in some states than others.

Here's a look at the millionaire rankings for all 50 states (plus the District of Columbia), based on the percentage of millionaire households in each. Just for good measure, we're also providing important tax and cost-of-living information.

Estimates of millionaire households provided by Phoenix Marketing International, a firm that tracks the affluent market. Investable assets include education/custodial accounts, individually owned retirement accounts, stocks, options, bonds, mutual funds, managed accounts, hedge funds, structured products, ETFs, cash accounts, annuities and cash value life insurance policies. Data on household incomes and home values are from the U.S. Census Bureau. Living costs are based on the Council for Community and Economic Research’s Cost of Living Index and the U.S. Bureau of Economic Analysis. Tax information is as of 2019.

51. Mississippi

- Millionaire households: 47,279

- Total households: 1,131,470

- Concentration of millionaires: 4.18%

- Rank: 51 (Unchanged from last year)

- Median income for all households: $44,717 (U.S. median: $61,937)

- Median home value: $123,300 (U.S. median: $229,700)

Mississippi consistently ranks as the state with the lowest concentration of millionaire households per capita in the U.S., but don't feel bad for the Magnolia State.

Thanks to low consumer prices and light taxes, Mississippi also is the second-least expensive state. Mississippi's cost of living stands at 14% below the national average, according to the U.S. Bureau of Economic Analysis. In an extreme example, Tupelo is one of the 10 cheapest cities in the U.S.

Mississippians also enjoy some of the lowest property taxes in the nation, and its income tax levy, already fairly low, continues to shrink.

That means everyone's paycheck, whether they're a millionaire or not, goes further than it does elsewhere.

50. West Virginia

- Millionaire households: 31,535

- Total households: 749,518

- Concentration of millionaires: 4.21%

- Rank: 50 (Unchanged from last year)

- Median income for all households: $44,097

- Median home value: $121,300

West Virginia has a relatively low concentration of millionaires, but the cost of living is 12.2% lower than the national average, according to the BEA.

West Virginia benefits from natural resources such as gas and coal, and it collects significant severance taxes from them. As such, the Mountain State's median real estate taxes are among the lowest in the U.S., according to the Tax Foundation. Sales taxes are reasonable, too.

But be forewarned: Income tax bites hard on higher incomes, with the top rate of 6.5% kicking in on taxable income over $60,000. Retirees will be happy to know that the tax on Social Security income is in the process of being phased out over a three-year period.

49. Arkansas

- Millionaire households: 51,532

- Total households: 1,189,790

- Concentration of millionaires: 4.33%

- Rank: 49 (Unchanged from last year)

- Median income for all households: $47,062

- Median home value: $133,100

Arkansas might not be bristling with millionaires, but it has the lowest living cost in the U.S., at 14.7% less than the national average. Heck, the cities of Jonesboro and Conway are among the least expensive places to live in the entire country.

And although median income is 24% below the national level, home prices are a whopping 42% cheaper than the U.S. median.

Arkansas is not tax-friendly. Property taxes are low in the Natural State, but sales taxes are tied with Tennessee for highest in the country. Even groceries are taxed (albeit at a lower rate). And income tax is particularly complicated in Arkansas.

48. Kentucky

- Millionaire households: 83,624

- Total households: 1,781,341

- Concentration of millionaires: 4.69%

- Rank: 48 (Unchanged from last year)

- Median income for all households: $50,247

- Median home value: $148,100

Kentucky has fewer than 84,000 millionaire households. But then, with a cost of living almost 12.2% below the national average, paychecks tend to go further. And median home prices are more than a third less expensive than the national level.

For those looking to attain millionaire status in Kentucky, the folks with the highest salaries are surgeons, anesthesiologists and obstetricians.

When it comes to paying taxes, the situation for Kentucky residents is mixed. The Bluegrass State recently moved to a 5% flat tax and opened up more items to its 6% sales tax. However, Social Security benefits are exempted from state income taxes, and property taxes are light.

47. Louisiana

- Millionaire households: 87,565

- Total households: 1,820,554

- Concentration of millionaires: 4.81%

- Rank: 47 (-8 from last year)

- Median income for all households: $47,905

- Median home value: $167,30

Louisiana's 90,000 millionaires, whose income depends on the state's economic staples, are likely to be feeling a pinch.

Tourism is under pressure from the coronavirus lockdown, while the petroleum industry has been hit by the crash in oil prices. Shipping and agriculture, the state's other major industries, aren't immune to changes in global demand either.

More happily for everyone, folks who call the Pelican State home enjoy a cost of living that's 10.9% below the national average.

They also benefit from property taxes that are among the lowest in the country, which helps make Louisiana one of the more tax-friendly states. Social Security, military, civil-service, and state and local government pensions are exempt from state income taxes. It also offers a bayou full of tax breaks to retirees.

46. Alabama

- Millionaire households: 94,259

- Total households: 1,935,466

- Concentration of millionaires: 4.87%

- Rank: 46 (Unchanged from last year)

- Median income for all households: $49,861

- Median home value: $147,900

Alabama is another state where you don't need a million bucks to live well. Although only 4.9% of its 1.9 million households hit the millionaire threshold, some of the cheapest home prices in the country help spread the wealth. Overall, the cost of living in the Yellowhammer State is 13.6% below the national average.

Physicians, CEOs and nurse anesthetists are among the state's best-paid jobs.

Happily, Alabama is a tax-friendly state, especially as it pertains to retirees. Property taxes are the second-lowest in the country, and all homeowners age 65 or older are exempt from state property taxes. Sales taxes – with an average combined rate of 9.16% – do take a bite, though.

Additionally, Alabama allows folks to deduct their federal income taxes (it's one of just of a handful of states with this break). The state also is among the most tax-friendly for retirees.

45. Oklahoma

- Millionaire households: 75,567

- Total households: 1,543,632

- Concentration of millionaires: 4.90%

- Rank: 45 (-1 from last year)

- Median income for all households: $51,924

- Median home value: $140,000

There's a lot to like about Oklahoma for wealthy retirees. The Sooner State doesn't tax Social Security benefits or Civil Service Retirement System benefits. Residents can exclude up to $10,000 per person ($20,000 per couple) of other types of retirement income.

Acts of conspicuous consumption, on the other hand, can rack up payments to local authorities. Oklahoma has one of the highest combined sales tax rates in the nation, at an average of 8.94%.

Fortunately, you don't need to be a millionaire to live well. Not only does Oklahoma boast a cost of living that's 11.6% below the national average, but its largest city offers remarkably affordable prices for its size.

Oklahoma City, a metro area with about 1.4 million people, offers a lot of big-city attractions, from a philharmonic orchestra to the National Softball Hall of Fame and Museum to the NBA's Oklahoma City Thunder. And yet it remains one of the 20 cheapest large U.S. cities in which to live.

44. New Mexico

- Millionaire households: 40,450

- Total households: 813,135

- Concentration of millionaires: 4.97%

- Rank: 44 (+1 from last year)

- Median income for all households: $47,169

- Median home value: $174,700

New Mexico is a land of stark contrasts when it comes to its millionaire population. Los Alamos, New Mexico – best known for the world-famous Los Alamos National Laboratory – seems like an unlikely place to find a lot of millionaires. But at 13.2%, it has the second-highest concentration of millionaires per capita of any city in the U.S.

In addition to medicine, top-paying jobs are found in general internal medicine, engineering management and psychiatry.

Yet outside of Los Alamos, the state's concentration of millionaires puts it in the bottom 10 in the U.S. Fewer than 1 in 20 households claiming investable assets of $1 million or more.

The upside of having fewer millionaires is that it helps keep a lid on living costs, which are 8.9% below the U.S. average.

For residents of all means, the Land of Enchantment is somewhat tax-friendly, though it's a mixed bag for retirees. Social Security benefits are subject to tax by the state, as are retirement account distributions and pension payouts.

43. Idaho

- Millionaire households: 33,656

- Total households: 654,878

- Concentration of millionaires: 5.14%

- Rank: 43 (+4 from last year)

- Median income for all households: $55,583

- Median home value: $233,100

The vast expanse of the Gem State claims only about 655,000 households, of which fewer than 34,000 can be considered millionaires. A high concentration of them live in the part of the greater Jackson, Wyoming, area that spills into Idaho.

Top-paying jobs include surgeons, computer and information research scientists, nuclear engineers and sales engineers.

Fortunately, for rich and not-so-rich alike, Idaho's overall cost of living is 7.5% below the national average.

Somewhat less upbeat is Idaho's tax picture, which is mixed. Idaho taxes all income except Social Security and Railroad Retirement benefits. And its top tax rate of 6.925% kicks in at a relatively low level.

42. Tennessee

- Millionaire households: 139,335

- Total households: 2,674,857

- Concentration of millionaires: 5.21%

- Rank: 42 (-2 from last year)

- Median income for all households: $52,375

- Median home value: $177,500

Tennessee is known for country music, BBQ and bourbon more than an abundance of millionaires, but the state should get more recognition for its affordability.

Indeed, the median home value in Tennessee is 23% below the national level. And although home values have gone up 6% over the past year, Zillow predicts they will fall 0.9% within the next year.

Affordability across a wide swath of goods and services has made Memphis, Knoxville and Jackson some of the least expensive places to live in the U.S. More broadly, the state's cost of living is 10.1% below the national average.

Tennesseans also tend to keep more of their hard-earned dollars. The Volunteer State has no broad-based income tax. A levy on stock dividends and interest income from bonds and other investments is being phased out and will be gone by 2022.

The flip side is that Tennessee has the highest combined sales-tax rate in the nation, according to the Tax Foundation.

41. Montana

- Millionaire households: 23,785

- Total households: 450,459

- Concentration of millionaires: 5.28%

- Rank: 41 (+1 from last year)

- Median income for all households: $55,328

- Median home value: $249,200

A good deal of Montana's wealth stems from its abundance of natural resources. Agriculture, oil, copper and timber all play an important role in the economy, to say nothing of travel and tourism. Heck, petroleum engineers are some of the best-paid professionals in the state.

Median incomes and home values aren't too far below national levels. And more than 5% of the state's households can claim millionaire status.

A dollar tends to go father in Big Sky Country, too. Montana's cost of living is 6.7% lower than the national average.

Montana is generally tax-friendly if you're still working. It's one of five states without a general sales tax, and it has relatively low property taxes.

The bad news is that the top income rate of 6.9% kicks in at just $17,900 of taxable income, and Montana taxes virtually all forms of retirement income, including Social Security.

40. South Dakota

- Millionaire households: 18,905

- Total households: 354,470

- Concentration of millionaires: 5.33%

- Rank: 40 (-4 from last year)

- Median income for all households: $56,274

- Median home value: $171,500

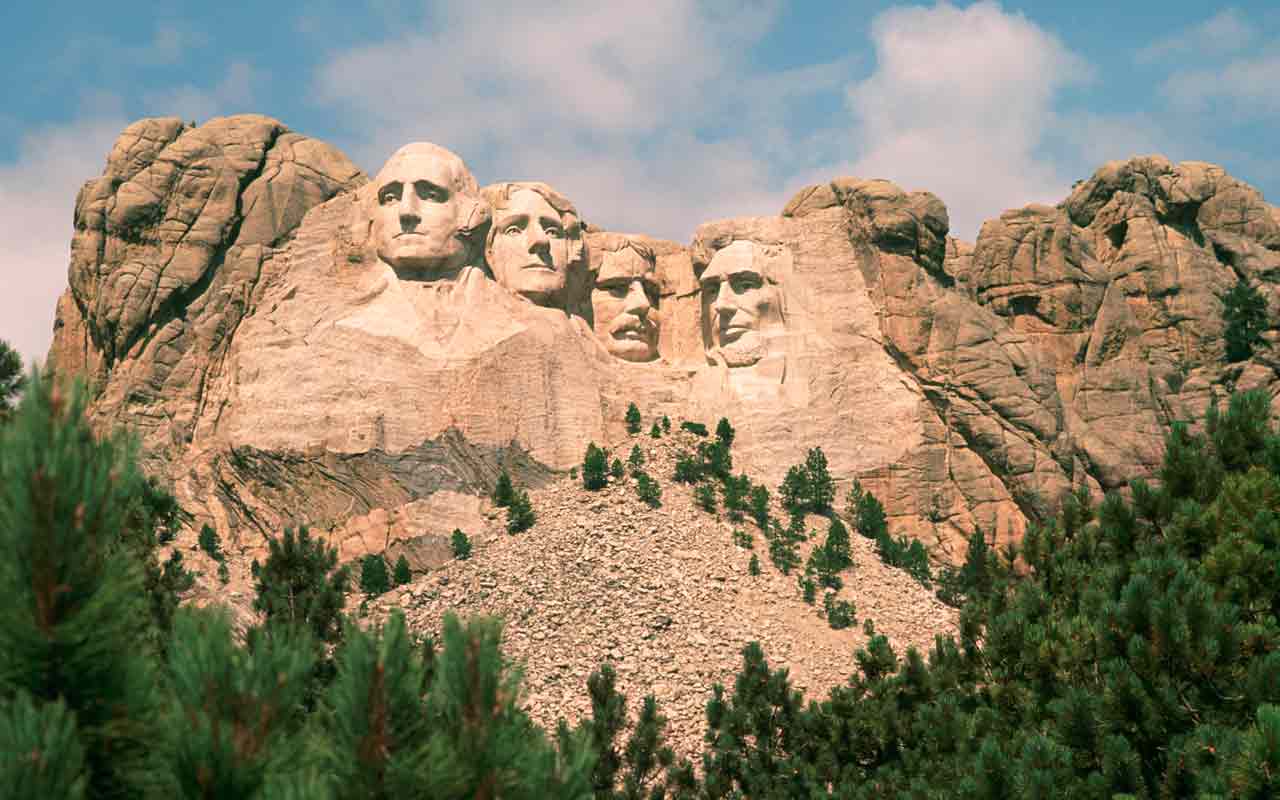

South Dakota is better known for Mount Rushmore, agriculture and the great outdoors than millionaires. But more than 1 in 20 households have at least $1 million in investable assets. Marketing managers and financial managers tend to do well in SD.

It also happens to be a great place to retire. Affordability is the main factor. The cost of living is 12.1% below the national average.

South Dakota is one of the most tax-friendly states on the whole. The state has no state income tax, so Social Security benefits and other forms of retirement income get a free ride. Sales taxes have a broad reach here (and include groceries), but they're generally low. The tax picture for retirees is a little more mixed, however. Property taxes are on the high side, and you can only get relief from that if you're a low-income resident.

Helpfully, South Dakota ranks second in the U.S. for fiscal soundness, according to a recent report from George Mason University's Mercatus Center. So you can have high confidence that it can keep up with short-term expenses and long-term financial obligations.

39. Indiana

- Millionaire households: 138,739

- Total households: 2,596,546

- Concentration of millionaires: 5.34%

- Rank: 39 (+4 from last year)

- Median income for all households: $55,746

- Median home value: $147,300

Indiana jumped four places in the millionaire rankings year-over-year.

That's significant considering that a million bucks sure goes far in some parts of Indiana. Richmond, where the cost of living runs 19.8% below the U.S. average, happens to be the second-cheapest small town in America.

The cost of living in Indiana overall is 10.7% below the national average. Median income is 10% below the national level, but then, home prices are almost 36% cheaper. That makes it easier for everyone along the wage scale to put a roof over their heads.

Although living costs are low, Indiana isn't a great state for taxes, whether you're working or retired. While the Hoosier State exempts Social Security benefits and offers limited exemptions for military pensions and federal civil-service pensions, IRAs, 401(k) plans and private pensions are fully taxable.

Oh, and state sales tax stands at 7%.

Given the state's reputation for hoops – NBA legend Larry Bird was known as the Hick from French Lick (Indiana) – it should come as no surprise that athletes and sports competitors are among the best-paid professions there. Anesthesiologists, obstetricians and gynecologists are also within the top 10.

38. Missouri

- Millionaire households: 132,176

- Total households: 2,452,321

- Concentration of millionaires: 5.39%

- Rank: 38 (Unchanged from last year)

- Median income for all households: $54,478

- Median home value: $162,600

More than 5% of Missouri's households have at least $1 million in investable assets. Sure, median income is below the national level, but the cost of living is 11.2% below the national average. And home prices are a dream compared to what the average American pays.

Anesthesiologists, psychiatrists and other medical specialties are among the state's best-paid jobs.

Low costs are great, but there's not as much to like when it comes to paying taxes. Helpfully, the Show Me State no longer taxes Social Security benefits for many taxpayers. But if you have taxable income, the rate gets high quickly. For 2019, it was 5.4% on income over $8,424.

In a notable downside for retirees of all means: Missouri ranks 39th in the nation for senior health, according to America's Health Rankings.

37. South Carolina

- Millionaire households: 108,812

- Total households: 2,016,355

- Concentration of millionaires: 5.40%

- Rank: 37 (+4 from last year)

- Median income for all households: $52,306

- Median home value: $170,800

From Hilton Head Island to the Midlands region to the Blue Ridge Mountains, South Carolina has something for everyone. They also have a higher ranking in this year's millionaire rankings, jumping four spots from last year.

And yet, happily, you don't have to be a millionaire to enjoy its many pleasures.

Relatively low prices for housing and transportation help keep the Palmetto State's cost of living under control. According to the BEA, South Carolina is 8.9% cheaper than the national average.

South Carolina is one of Kiplinger's most tax-friendly states for retirees, and one of our most tax-friendly states overall.

The Palmetto State extends some real Southern hospitality, offering a charming collection of income tax breaks. To start, Social Security benefits are completely exempt. Property tax rates in South Carolina are low too.

36. North Carolina

- Millionaire households: 224,054

- Total households: 4,111,516

- Concentration of millionaires: 5.45%

- Rank: 36 (+1 from last year)

- Median income for all households: $53,855

- Median home value: $180,600

North Carolina has a lot going for it whether you're a millionaire or not. It's 8.2% less expensive to live in the Tar Heel State than the national average, and Durham is one of the happiest places to live in the U.S., according to the Gallup-Sharecare Well-Being Index.

Medical specialists, CEOs and dentists are among the top-paid jobs in the state. Indeed, North Carolina's 3,490 chief executives have an average salary of $206,390, according to the Bureau of Labor Statistics. Oral and maxillofacial surgeons make an average of $280,940.

North Carolina's tax situation is just so-so. North Carolina has been shaking up its tax structure, switching out graduated income tax brackets for a flat tax and capturing more services with its sales tax. The tax rate for 2018 was 5.49%; in 2019 it dropped to 5.25%.

35. Wyoming

- Millionaire households: 12,849

- Total households: 235,738

- Concentration of millionaires: 5.45%

- Rank: 35 (-11 from last year)

- Median income for all households: $61,584

- Median home value: $230,500

Wyoming has the smallest population of any state, but it punches above its weight when it comes to millionaires, thanks to abundant natural resources and recreational activities.

Wyoming accounts for about 40% of the nation's coal production, and the vast majority of the state's output comes from the Gillette area, which has a high concentration of millionaires as a result. No wonder that top-paying jobs in the Cowboy State include engineering managers and industrial production managers.

Wyoming's famed Jackson Hole valley, with three major ski resorts and an abundance of other year-round recreational activities, also is a mecca for millionaires.

And thanks to abundant revenue that the state collects from oil and mineral rights, Wyoming millionaires shoulder one of the lowest tax burdens in the U.S. With no income tax, it's No. 1 on the list of Kiplinger's most tax-friendly swtates.

It also has the lowest beer taxes in the nation, a nice perk.

34. Ohio

- Millionaire households: 261,157

- Total households: 4,713,750

- Concentration of millionaires: 5.54%

- Rank: 34 (-1 from last year)

- Median income for all households: $56,111

- Median home value: $151,100

From a resurgent Cleveland to the university city of Columbus to Cincinnati with its touch of the South, Ohio contains multitudes of Midwestern culture.

It also boasts a decent concentration of millionaire households.

More than a quarter-million of Ohio's 4.7 million households have investable assets of at least $1 million. At the same time, median and average home prices are well below national levels. That helps make the cost of living in Ohio cheaper by 11.6%.

As for the better-paying occupations, managers in finance, marketing and information systems are in the top 20 for average salary.

Sadly for its residents, the Buckeye State is among Kiplinger's least tax-friendly states. Housing costs in Ohio are relatively low, but the state's average property tax bill isn't. For a $400,000 home in the state, the owner can expect to pay about $6,564 each year in property taxes. And major state and local taxes are above average, which can add up to a sucker punch for your wallet.

33. Maine

- Millionaire households: 31,993

- Total households: 571,089

- Concentration of millionaires: 5.60%

- Rank: 33 (+1 from last year)

- Median income for all households: $55,602

- Median home value: $197,500

There are fewer than 32,000 millionaire households in Maine – a state in which rich and poor alike face relatively high living costs and taxes.

Largely rural and remote, expenses in the Pine Tree State run about 10% above the national average, according to the Council for Community and Economic Research (C2ER). In the Portland metro area – the state's most populous region – costs are 15% above the national average. Residents pay more for housing and utilities, in particular.

Millionaires and regular folks alike don't catch much of a break when it comes to giving the state government its cut. Although it has been working to lower its income taxes, Maine's lowest rate still is higher than some other states' maximum rate. Indeed, Maine is one of Kiplinger's least tax-friendly states.

For the record, Maine's richest resident is Susan Alfond, according to Forbes. The heir to the Dexter Shoe Company has a net worth of $1.5 billion.

32. Nevada

- Millionaire households: 63,752

- Total households: 1,137,374

- Concentration of millionaires: 5.61%

- Rank: 32 (+3 from last year)

- Median income for all households: $58,646

- Median home value: $292,200

If you need proof that the house always wins, just take a look at Nevada. Median income for all households is below the U.S. level, and yet home prices are well above the national median.

Meanwhile, Sheldon Adelson – CEO of casino operator Las Vegas Sands (LVS) – is the state's richest person with a net worth of $35.7 billion, per Forbes.

But you don't have to go to Las Vegas to rub elbows with the Silver State's millionaires. Gardnerville Ranchos and Elko, Nevada, are among the top 20 small towns with the highest concentration of millionaires in the U.S.

The cost of living in Nevada is 2.5% below the national average, according to the BEA, and residents can catch a break on taxes. As a no-income-tax haven, Nevada is one of Kiplinger's most tax-friendly states.

31. Iowa

- Millionaire households: 73,129

- Total households: 1,280,747

- Concentration of millionaires: 5.71%

- Rank: 31 (+1 from last year)

- Median income for all households: $59,955

- Median home value: $152,000

The farming and food-processing powerhouse of a state has a relatively low cost of living, but Iowa can be tough on residents' wallets when it comes to paying taxes.

Income taxes are on the high end because more than 200 school districts and Appanoose County add their own income taxes on top of the state-level tax. And the average property tax rate in the Hawkeye State is the 12th-highest in the nation.

Easing the sting of taxes a bit is a cost-of-living index that's 10.8% lower than the U.S. average. Obstetricians/gynecologists and orthodontists are the best-paid professions in the state.

Harry Stine, the wealthiest person in Iowa with a net worth of $4.4 billion, made his fortune by licensing corn and soybean seeds to multinationals agribusiness companies such as Monsanto.

30. Kansas

- Millionaire households: 66,406

- Total households: 1,142,371

- Concentration of millionaires: 5.81%

- Rank: 30 (-4 from last year)

- Median income for all households: $58,218

- Median home value: $159,400

Kansas has more than 66,000 millionaire households out of a total of about 1.1 million households, but the state is known more for affordable living than for conspicuous consumption.

Indeed, Salina and Pittsburg, Kansas, are two of the cheapest small towns in America. Statewide, the cost of living in Kansas is 10% cheaper than the national average, helped by much more affordable housing than what the average American pays.

Offsetting that somewhat is the fact that the Sunflower State is not the friendliest place when it comes to taxes. Sales taxes are high (and are applied to groceries), and property taxes are steep, too. Taxes in Kansas aren't kind to retirees either.

Kansas fell four spots in the Phoenix Wealth and Affluent Monitor millionaire rankings this year.

29. Wisconsin

- Millionaire households: 138,283

- Total households: 2,370,721

- Concentration of millionaires: 5.83%

- Rank: 29 (+2 from last year)

- Median income for all households: $60,773

- Median home value: $188,500

Bucolic Wisconsin's 138,283 millionaire households enjoy a relatively affordable cost of living, but taxes in the Badger State can be quite a burden.

Wisconsin ranks among Kiplinger's least tax-friendly states, thanks to high income and property taxes.

Many residents find themselves in the 6.27% income tax bracket, which kicks in on income above only $22,900 for singles and $30,540 for joint filers (2018 brackets). Property taxes for a $400,000 home in the state would run at an estimated $7,695 per year.

On the other hand, the ratio of median income to median home values is very favorable. Income is close to national levels, but house prices are well below. Overall, it's 8.1% cheaper to live in Wisconsin than the country as a whole.

John Menard, Jr., founder of the Menards home improvement chain, is the state's richest resident with a net worth of $18.8 billion.

28. Nebraska

- Millionaire households: 45,130

- Total households: 770,566

- Concentration of millionaires: 5.86%

- Rank: 28 (+2 from last year)

- Median income for all households: $59,566

- Median home value: $161,800

When it comes to lifestyles of the rich and famous in Nebraska, one name immediately comes to mind: Warren Buffett, chairman and CEO of Berkshire Hathaway (BRK.B), is the Cornhusker State's richest – and most famous – resident by a wide margin.

But although the Oracle of Omaha is clearly in a league of his own, Nebraska does have 45,129 other households with at least a million bucks in investable assets.

Regardless of wealth, Nebraskans can take comfort in a cost of living that's 10.5% lower than the national average, according to the BEA. Again, comparatively low home prices lead the way in making the state affordable. Folks also save on utilities and groceries.

When it comes to paying taxes, Nebraska is ranked as "least tax-friendly" by Kiplinger because the average property tax rate is quite high. For a $400,000 home, the state-wide average tax in Nebraska comes to $7,421 per year. That's the eighth-highest property tax amount in Kiplinger's U.S. rankings.

27. Florida

- Millionaire households: 496,971

- Total households: 8,464,598

- Concentration of millionaires: 5.87%

- Rank: 27 (-2 from last year)

- Median income for all households: $55,462

- Median home value: $230,600

Florida's popularity as a retirement destination helps boost its concentration of millionaires. Indeed, an hour's drive north of Walt Disney World, you'll find The Villages, a sprawling retirement haven with a high percentage of affluent residents.

More broadly, median home prices are higher than the national level, while median income is below the national level. Groceries and utilities are a bit pricier in the Sunshine State, but as a whole, Florida is only 0.6% more expensive than the U.S. average.

While there are probably few millionaires in the cockpits of commercial airplanes, airline pilots, co-pilots and flight engineers are among the best-paid workers in the state.

Florida is well-known for its absence of a state income tax, which helps put it into Kiplinger's top 10 most tax-friendly states. Property taxes are in line with the national average, but Florida's gas tax is the 10th-highest state tax on gasoline in the country.

26. Michigan

- Millionaire households: 236,858

- Total households: 3,968,527

- Concentration of millionaires: 5.97%

- Rank: 26 (+2 from last year)

- Median income for all households: $56,697

- Median home value: $162,500

Michigan doesn't have the highest concentration of millionaires in the country, but it is certainly well-stocked with billionaires. The Great Lakes State is home to 11 billionaires, led by Hank & Doug Meijer, whose supermarket empire gives them a net worth of $10.3 billion, according to Forbes.

At the other end of the spectrum, Michigan is home to one of the least expensive places to live in the U.S. The cost of living in Kalamazoo is 21.6% below the U.S. average. Overall, Michigan is 7.6% cheaper than the national average, led by lower prices for houses and groceries.

Unfortunately for millionaires and non-millionaires alike, Michigan is not tax-friendly. It's one of just a handful of U.S. states with a flat tax, but 23 cities levy income taxes as well. And property taxes, particularly in Detroit, are steep.

25. Arizona

- Millionaire households: 161,014

- Total households: 2,670,859

- Concentration of millionaires: 6.03%

- Rank: 25 (+4 from last year)

- Median income for all households: $59,246

- Median home value: $241,100

More than 6% of Arizona's households have at least $1 million in investable assets. The state also is home to nine billionaires. Ernest Garcia II, who made his fortune in used cars and auto loans, tops the list with a net worth of $6.6 billion.

Part of Arizona's appeal to the wealthy and retirees is that, like Florida, it's one of Kiplinger's most tax-friendly states.

Although the Grand Canyon State does have an income tax, the rates are notably low. If you're a joint filer, you won't hit the top bracket until your income is over $318,000. The tax on gasoline also is one of the country's lowest.

Arizona's median home values are above the national level, but its cost of living remains more than reasonable. The state is 3.5% less expensive than the U.S. as a whole.

Within the state, you're most likely to find millionaires living in the Phoenix-Mesa-Scottsdale metro area. Psychiatrists, dentists and CEOs are among the folks earning the highest salaries.

24. Georgia

- Millionaire households: 239,287

- Total households: 3,940,078

- Concentration of millionaires: 6.07%

- Rank: 24 (+3 from last year)

- Median income for all households: $58,756

- Median home value: $189,900

With a cost of living 7% lower than the national average, a million dollars goes a bit further in the Peach State than elsewhere. Significantly cheaper average home prices drive Georgia's affordability.

But taxes do take their bite.

Georgia's tax brackets mean that many taxpayers will find themselves paying the top marginal rate, which kicks in at just $10,000 of taxable income for married couples filing jointly or $7,000 for individual filers. Sales taxes lean high, and in some areas, groceries are taxed as well. Property taxes are modest. But if you're a retiree, Georgia's taxes aren't nearly so onerous.

The highest concentrations of millionaires are found in the Atlanta and Savannah metro areas. Jim Kennedy, chairman of conglomerate Cox Enterprises, is the state's wealthiest citizen with a net worth of $8.7 billion.

23. North Dakota

- Millionaire households: 20,002

- Total households: 324,512

- Concentration of millionaires: 6.16%

- Rank: 23 (-2 from last year)

- Median income for all households: $63,837

- Median home value: $198,700

The explosion in shale oil drilling has minted many a millionaire in North Dakota over the past decade. Indeed, small towns such as Dickinson and Williston, located in the oil-rich Bakken Formation, have some of the highest concentrations of millionaires in the U.S.

However, it remains to be seen what happens to their ranks amid an historic crash in oil prices. North Dakota, the nation's second-largest oil-producing state after Texas, saw its oil output decline 4.6% from January to February, the most recent available data as of this writing.

North Dakota is one of the nation's tax-friendliest states. The Peace Garden State offers modest sales taxes that favor agriculture, and it has cut income taxes to the point that they barely exist. Property taxes are middle of the road, and the state scores well for fiscal stability, indicating that it will be able to stay tax-friendly in the future.

To top it off, the cost of living is 9.4% lower than the U.S. average, while median income is higher than the national level.

22. Vermont

- Millionaire households: 16,411

- Total households: 260,740

- Concentration of millionaires: 6.29%

- Rank: 22 (+1 from last year)

- Median income for all households: $60,782

- Median home value: $233,100

Tiny Vermont has just 16,411 millionaire households, and the Green Mountain State is one of the tougher states when it comes to taxing millionaires.

Generally speaking, it's a pricey place to live if you're wealthy. Among other policies, income tax rates reach 8.75%. Although sales taxes in Vermont are modest, it's an expensive place to own a home (as well as heat it).

Largely rural and remote, Vermont is a comparatively expensive state in which to live in other ways, too. The state's cost of living is 3% higher than the national average, according to the BEA. By the Council for Community and Economic Research's formula, costs are 14.3% higher in Vermont.

Architectural and engineering managers, CEOs and pharmacists have some of the highest average salaries in the state.

21. Texas

- Millionaire households: 650,216

- Total households: 10,285,623

- Concentration of millionaires: 6.32%

- Rank: 21 (-2 from last year)

- Median income for all households: $60,629

- Median home value: $186,000

Everything is bigger in Texas. No, it doesn't have the highest concentration of millionaires, but in terms of raw numbers, only California has more than the Lone Star State's 650,216 millionaire households.

And then there are all the folks in the 10-figures club. Texas has 56 billionaires among its ranks, led by Alice Walton ($55.1 billion) of Walmart (WMT) fame.

Heck, Texas is so big it not only has two of the smallest towns with the most millionaires in the U.S. – Andrews and Fredericksburg – but it's also home to two of the cheapest U.S. metro areas in which to live. (Those would be Brownsville-Harlingen and McAllen-Edinburg-Mission.)

On average, the cost of living in Texas is 8.5% lower than the U.S. average, according to C2ER. Housing and groceries are particularly affordable.

Texas is a place of extremes when it comes to taxes, too. There's no income tax at all. On the other hand, sales taxes run high, as do property taxes. As befits a place that pumps a lot of oil out of the ground, fuel taxes are low.

20. Oregon

- Millionaire households: 108,858

- Total households: 1,692,389

- Concentration of millionaires: 6.43%

- Rank: 20 (+2 from last year)

- Median income for all households: $63,426

- Median home value: $341,800

The Beaver State's cost of living is 1.1% higher than the U.S. average. That's partly due to a median home value of more than $265,700, which is well above the national average. Median income is higher too, but by a slimmer margin.

Nike (NKE) founder Phil Knight is the state's richest person with a net worth of $38.6 billion. Whether he complains about Oregon's taxes is unknown, but millionaires (and pretty much everyone else) do.

Oregonians face the country's highest income tax bracket. The 9.9% rate is applied to taxable income over $125,000 ($250,000 for married couples filing jointly), and the lowest bracket is already 5%.

Property taxes are on the high side, too.

19. Pennsylvania

- Millionaire households: 328,859

- Total households: 5,109,218

- Concentration of millionaires: 6.44%

- Rank: 19 (+1 from last year)

- Median income for all households: $60,905

- Median home value: $186,000

More than 6.4% of Pennsylvania's 5 million-plus households have investable assets of $1 million or more, excluding the value of real estate, employer-sponsored retirement plans and business partnerships. That puts the state's concentration of millionaires not far off from the national percentage of 6.71%, even as the cost of living in the Keystone State is 2.5% lower than the U.S. average.

Median home values also are below the national level.

Millionaires and other residents deal with some annoyingly high taxes, however. The Keystone State has the second-highest state gas tax in the nation and the sixth-highest state and local cellphone wireless service taxes. An inheritance tax adds to the state's overall tax burden.

The state's tobacco and alcohol taxes take a noticeable bite as well.

18. Rhode Island

- Millionaire households: 28,165

- Total households: 420,830

- Concentration of millionaires: 6.69%

- Rank: 18 (-1 from last year)

- Median income for all households: $64,340

- Median home value: $273,800

When people think about Rhode Island and millionaires, Newport and its grand 19th century mansions naturally come to mind. But today's picture is more pedestrian.

With more than 28,000 millionaire households out of 420,830, Rhode Island has a merely in-line concentration of millionaires. Unhappily, taxes and expenses in the Ocean State are on the high side too.

The cost of living in Rhode Island is a whopping 18.6% higher than the national average, according to C2ER. Partly that's because Rhode Island is expensive for homeowners. In Rhode Island, residents pay an average $1,723 in taxes per $100,000 of assessed home value. The Ocean State's sales taxes lean high (and are above its neighboring states), but the income tax bite is modest.

Private equity macher Jonathan Nelson is the top earner in the state with a net worth of $1.8 billion.

17. Delaware

- Millionaire households: 25,937

- Total households: 371,672

- Concentration of millionaires: 6.98%

- Rank: 17 (-1 from last year)

- Median income for all households: $64,805

- Median home value: $255,300

Well-paid jobs in the finance and insurance industries, as well as the presence of major companies like DuPont (DD) and AstraZeneca (AZN), help fuel an above-average concentration of millionaire households in Delaware.

No billionaires live in the tiny state, however.

Despite a heavy corporate presence, Delaware's cost of living is just 1.8% above the U.S. average. Taxes more than make up for higher prices, however.

The First State is a standout among its East Coast neighbors with no sales tax and low property taxes. But it's worth noting that the city of Wilmington taxes wages of everyone who lives or works there at 1.25%.

16. Utah

- Millionaire households: 71,613

- Total households: 1,016,121

- Concentration of millionaires: 7.05%

- Rank: 16 (+2 from last year)

- Median income for all households: $71,414

- Median home value: $303,300

Utah is the first of our states to cross the 7% plateau for concentration of millionaire households. The numbers get a big lift from Summit Park, a small town with one of the very highest concentrations of millionaires in the country. World-class ski resorts and luxury shopping are the main draw.

As for taxes, millionaires could do better, but then, they could also do worse.

The Beehive State runs a flat tax system. However, the loss of the federal personal exemption due to the new tax law means that many Utahns, particularly those with multiple dependents, will pay higher state taxes than before.

Property taxes are low and sales taxes average. A strong score on fiscal stability indicates the Beehive State is likely to be able to keep things average.

Gail Miller, with $1.7 billion stemming originally from car dealerships, is the state's wealthiest person. The cost of living is 3.4% lower than the national average, according to the BEA.

Law professors and podiatrists crack the top 10 jobs with the highest average salaries.

15. Illinois

- Millionaire households: 346,873

- Total households: 4,865,837

- Concentration of millionaires: 7.13%

- Rank: 15 (Unchanged from last year)

- Median income for all households: $65,030

- Median home value: $203,400

Illinois has a higher concentration of millionaires than the national average, and a million bucks goes a bit farther in the Prairie State than it does in much of the rest of the country.

The cost of living for Illinois is 1.9% below the U.S. average, but taxes can take quite a toll. Indeed, Illinois is one of Kiplinger's top 10 least tax-friendly states. Illinois' economic woes are one reason why it makes the list; it's 50th in the latest ranking of states' fiscal health by the Mercatus Center at George Mason University – and residents are paying the price with higher taxes.

Property taxes in Illinois are high, as are sales taxes. In some municipalities, combined state and local sales taxes exceed 10%. Most states exempt food and drugs from their sales tax, but that's not the case in Illinois.

The state's wealthiest resident is Citadel hedge-fund honcho Ken Griffin. He's reportedly worth $12.6 billion.

14. Minnesota

- Millionaire households: 167,206

- Total households: 2,250,486

- Concentration of millionaires: 7.43%

- Rank: 14 (Unchanged from last year)

- Median income for all households: $70,315

- Median home value: $235,400

Minnesota is loaded with giant companies. UnitedHealth Group (UNH), 3M (MMM), Target (TGT) and General Mills (GIS) are just a few of the major firms headquartered there. They help drive an economy that supports more than 167,000 millionaire households.

Although Minnesota affords residents a cost of living that's 2.5% below the national average, median home value (and median income) easily top national levels.

Less sunny is the fact that the North Star State hits hard with income tax. It added a new top income tax rate of 9.85% in 2013. But what makes Minnesota really stand out is that its lowest income tax rate is 5.35%.

Property taxes are on the high side, too.

Given the number of major corporation headquarters, it should come as no surprise that CEOs have some of the highest average salaries. And one of them – Glen Taylor, CEO of printing firm Taylor Corp. – is the richest of them all, with a net worth of $3.1 billion.

13. Colorado

- Millionaire households: 170,223

- Total households: 2,275,868

- Concentration of millionaires: 7.48%

- Rank: 13 (Unchanged from last year)

- Median income for all households: $71,953

- Median home value: $373,300

Colorado has a relatively high concentration of millionaire households partly because it's an outdoor recreational paradise.

The small town of Edwards, for example, is bristling with millionaires thanks to nearby world-class ski resorts such as Vail and Beaver Creek. Breckenridge, Glenwood Springs and Boulder punch well above their weights in the millionaire rankings as well.

Both median income and home value are well above national averages in Colorado, as is the cost of living, albeit only by 1.9%.

Property taxes are quite low, but sales taxes take a toll. The Centennial State has a flat tax: If you have federal taxable income, the rate is 4.63%. The state levy for sales tax is 2.9%, but localities can add as much as 8.30%. The average combined rate is 7.63%, according to the Tax Foundation.

Philip Anschutz – a mogul whose interests span oil, railroads, telecom, real estate and entertainment – tops the state's rich list with a net worth of $11.6 billion

12. New York

- Millionaire households: 570,456

- Total households: 7,584,043

- Concentration of millionaires: 7.52%

- Rank: 12 (Unchanged from last year)

- Median income for all households: $67,844

- Median home value: $325,500

New York State has the third-most millionaire households in raw numbers after California and Texas. They're disproportionately located in the greater New York City area, however, where a million bucks doesn't go that far.

Manhattan and Brooklyn are the first- and fourth-most expensive places to live in the country at a whopping 145.7% above the U.S. average.

Taxes can be brutal, too. The Empire State's average sales tax rate is the 10th-highest in the country. The average property tax on a $400,000 home in New York is about $7,246, which is the fourth-highest average in the country.

But wait, there's more. New York City and Yonkers impose their own income taxes, and there's a commuter tax for self-employed people working in and around New York City.

Needless to say, New York's taxes are tough on retirees too.

Michael Bloomberg, founder of the financial data company that bears his name and erstwhile presidential candidate, is the state's richest person at a net worth of $60.1 billion. Financial managers are among the highest paid professionals in the state.

11. Washington

- Millionaire households: 233,155

- Total households: 2,971,172

- Concentration of millionaires: 7.85%

- Rank: 11 (Unchanged from last year)

- Median income for all households: $74,073

- Median home value: $373,100

Although Washington is home to the two richest people in the world – Amazon.com (AMZN) honcho Jeff Bezos and Microsoft (MSFT) co-founder Bill Gates – the state's well-to-do live closer to Earth. Seattle, which is one of America's fastest-growing cities, also is one of the most expensive.

The cost of living in Washington is 7.8% higher than the national average, according to the BEA. Housing, in particular, is pricey. Median home value is a whopping 62% higher than the national level, but median income is less just 20% greater.

As much as Seattle is associated with Washington State, millionaires also can be found outside the Emerald City that Bezos and Gates call home. Tiny Oak Harbor, Washington, has one of the highest concentrations of millionaires of any small town in America.

Washington is one of Kiplinger's most tax-friendly states because it doesn't have an income tax. The flip side is, the burden of other state and local taxes in the Evergreen State is heavier. The Tax Foundation's average combined state and local sales tax rate for Washington is the fourth-highest in the country, as is its gas tax.

10. Alaska

- Millionaire households: 22,302

- Total households: 272,739

- Concentration of millionaires: 8.18%

- Rank: 10 (-1 from last year)

- Median income for all households: $74,346

- Median home value: $276,100

Oil wealth is what gives Alaska its high percentage of millionaires. Indeed, Juneau, the state capital, has the third-highest concentration of millionaire households among the country's "micro" areas.

The downside is that folks there need higher incomes; everything costs more in Alaska because it's so remote. For example, groceries alone cost 39% more in Juneau. Overall, the cost of living in the Last Frontier is 24.4% higher than the national average.

On the other hand, Alaska is among the most tax-friendly states in the country. State income tax doesn't exist; in fact, the government actually pays residents. Alaska gives each legal resident who has lived in the state for a full year an annual "Permanent Fund Dividend." The 2019 dividend was $1,606. (The highest payment ever was $2,072 in 2015.)

The centrality of the oil industry to Alaska's economy helps make petroleum engineers and chemical engineers some of the best-paid professionals in the state.

9. Virginia

- Millionaire households: 272,103

- Total households: 3,272,722

- Concentration of millionaires: 8.31%

- Rank: 9 (+1 from last year)

- Median income for all households: $72,577

- Median home value: $281,700

Virginia's high concentration of millionaires is largely driven by Washington, D.C., and its close-in suburbs such as Arlington and McLean. The greater D.C. area is a magnet for the highly educated seeking high-powered jobs.

Although Virginia's D.C. suburbs are among the more expensive places to live in the U.S., the state as a whole isn't unaffordable. Virginia's cost of living is only 2% higher than the national average.

Jacqueline Mars, heir to the Mars candy fortune, is the state's wealthiest resident with a net worth of $27.4 billion, per Forbes.

The Old Dominion has middle-of-the-road income taxes and relatively low property taxes. Note that while the sales tax is modest, groceries are taxed, albeit at a lower rate.

8. New Hampshire

- Millionaire households: 45,758

- Total households: 539,929

- Concentration of millionaires: 8.47%

- Rank: 8 (-1 from last year)

- Median income for all households: $74,991

- Median home value: $270,000

New Hampshire's high concentration of millionaires hinges on Concord and Laconia. In the former case, the state capital is home to a horde of state, county, local and federal agencies – and the law firms and professional agencies that support them. Laconia and the state's famed Lakes Region benefits from its popularity as a tourism hub.

Like Tennessee, New Hampshire has a very limited income tax that only applies to dividend and interest income. There's no sales tax in the Granite State, either. New Hampshire residents also don't pay too much state tax at the pump.

Although N.H. is a relatively tax-friendly state – especially for retirees – the high concentration of millionaires contributes to relatively high living costs. Expenses in the Granite State run 6% above the U.S. average.

7. California

- Millionaire households: 1,147,251

- Total households: 13,477,890

- Concentration of millionaires: 8.51%

- Rank: 7 (+1 from last year)

- Median income for all households: $75,277

- Median home value: $546,800

The Golden State is home to the most millionaires in the nation, at more than 1 million households, and claims four of the top 10 metro areas with the highest concentrations of millionaires.

California boasts numerous metro areas – including Napa, San Francisco, San Jose and Oxnard – that are loaded with wealth. In the Los Angeles-Long Beach-Anaheim metro, more than 360,000 households have at least $1 million in investable assets.

It almost goes without saying that California is a pricey place to live. The cost of living is 24.7% higher than the U.S. average, according to C2ER.

But the tax situation is far more friendly than many people think. California's reputation as a high-tax destination is built in part on how aggressively it goes after big earners, with a 13.3% tax rate that kicks in at $1 million (for single filers) of taxable income. But for more modest incomes, the impact is far milder. Property taxes are low, too.

Still, Californians pay high sales taxes, as well as high fuel taxes on all that driving they have to do.

Larry Ellison, founder of Oracle (ORCL), is the state's richest person with a net worth of $66.7 billion.

6. District of Columbia

- Millionaire households: 29,506

- Total households: 323,410

- Concentration of millionaires: 9.12%

- Rank: 6 (-4 from last year)

- Median income for all households: $85,203

- Median home value: $617,900

Washington, D.C., has one of the highest concentration of millionaires in the country thanks to its position as the nation's capital.

Although the District of Columbia is a magnet for the highly educated seeking high-powered jobs, the downside is that you need a hefty paycheck to live there.

The cost of living is 48% higher than what the average American pays. And rents and mortgages are closing in on triple the national average, making D.C. one of the most expensive cities in the U.S.

Although property and sales taxes are unexceptional, the District of Columbia takes a huge bite of income. Taxable income over $40,000 is taxed at a steep 6.5% tax rate (the top rate of 8.95% is reserved for taxable income over $1,000,000).

5. Hawaii

- Millionaire households: 44,383

- Total households: 482,601

- Rank: 5 (+1 from last year)

- Concentration of millionaires: 9.20%

- Median income for all households: $80,212

- Median home value: $631,700

It should come as no surprise that a tropical paradise would be a magnet for millionaires. Kapaa, on Hawaii's fourth-largest island of Kauai, and Honolulu have two of the highest concentrations of millionaire households in the U.S.

But paradise doesn't come cheap. Blame Hawaii's remoteness, making pretty much everything more expensive than it would be on the mainland. The cost of living in the Aloha State is 23.3% higher than the national average. Taxes are rough, too. The top tax bracket is an eye-popping 11%.

Seniors, however, catch a break. Hawaii exempts Social Security benefits as well as most pension income from state income taxes. Another ray of sunshine: Property taxes as a percentage of home value are the lowest in the U.S.

Ebay (EBAY) founder Pierre Omidyar, with a net worth of $15.3 billion, is the state's wealthiest person.

4. Massachusetts

- Millionaire households: 254,201

- Total households: 2,710,577

- Concentration of millionaires: 9.38%

- Rank: 4 (+1 from last year)

- Median income for all households: $79,835

- Median home value: $400,700

From the greater Boston area to the tip of Cape Cod, Massachusetts has more than its fair share of millionaire households.

With its unparalleled collection of universities, hospitals, historical sites, and tech and biotech employers, Boston is a center of wealth, as well as one of the priciest cities in the U.S. On the smaller side of things, Barnstable Town and Vineyard Haven (Martha's Vineyard) have some of the highest concentrations of millionaires in the country.

No wonder Massachusetts has a cost of living 22% higher than the national average, according to C2ER.

However, while the Bay State gets dubbed "Taxachusetts," it's perhaps a little exaggerative. Taxes aren't overly onerous, at least compared to many of its New England neighbors.

Abigail Johnson, CEO and chairwoman of Boston-based Fidelity Investments, is the state's wealthiest resident with a net worth of $14.1 billion.

3. Connecticut

- Millionaire households: 130,291

- Total households: 1,380,296

- Concentration of millionaires: 9.44%

- Rank: 3 (Unchanged from last year)

- Median income for all households: $76,348

- Median home value: $277,400

Connecticut's Stamford metro area, which includes Norwalk and Bridgeport, has the fourth-highest concentration of millionaires in the U.S. Some are wealthy commuters who make their livings in the Big Apple. Others made their fortunes closer to home. The southwest corner of the state is the base for many hedge funds and prominent public companies.

Torrington, the largest town in Litchfield County – which has long been a popular retreat for Manhattan's wealthy and chic looking for a remote, mountainous getaway – also has more than its fair share of the well-to-do.

The cost of living in the Nutmeg State is 19% greater than the national average. And high taxes don't help matters.

About the only bright spot in Connecticut's tax picture is that localities can't add to the Constitution State's 6.35% sales tax. Real estate taxes are the fourth-highest in the country, and the state has not only a gift tax, but a luxury tax.

Ray Dalio, founder of hedge fund Bridgewater Associates, tops the state's rich list with a net worth estimated at $18 billion.

2. Maryland

- Millionaire households: 221,189

- Total households: 2,274,491

- Concentration of millionaires: 9.72%

- Rank: 2 (+2 from last year)

- Median income for all households: $83,242

- Median home value: $324,800

Year after year, the Old Line State routinely has one of the highest concentrations of millionaire households of any state in the union.

As with Virginia, that's partly thanks to its Washington, D.C., suburbs, but the pull of the nation's capital can't take all the credit. The California-Lexington Park metro area also has one of the country's highest concentrations of millionaires. Tiny Easton, Maryland, on the Eastern Shore of Chesapeake Bay, punches well above its weight when it comes to millionaire households, too.

Steep local income levies make Maryland a decidedly tax-unfriendly state. Maryland's 23 counties and Baltimore City have income taxes ranging from 1.75% to 3.20% of taxable income – on top of the state's take. Maryland's real estate taxes are middle of the road, and sales taxes are 6%.

Naturally, Maryland also is one of the most expensive places to live, with a cost of living 18.8% greater than the national average.

Computer and information systems management is one of the best-paying jobs in the state. Stephen Bisciotti, owner of the NFL's Baltimore Ravens, is the state's richest citizen with a net worth of $4.4 billion.

1. New Jersey

- Millionaire households: 323,443

- Total households: 3,312,916

- Concentration of millionaires: 9.76%

- Rank: 1 (Unchanged from last year)

- Median income for all households: $81,740

- Median home value: $344,000

For the second year in a row, New Jersey is the top spot for millionaires per capita in the U.S.

Like Connecticut, New Jersey has a high concentration of millionaires largely thanks to its proximity to New York City. But not all of New Jersey's millionaires are clustered near the Big Apple. Farther south, the state capital of Trenton – and its metro area that includes tony Princeton – has plenty of millionaires, as well. Athletes and sports competitors, surgeons and CEOs are among the state's best-paid residents.

Also like Connecticut, the Garden State is pricey and taxes are high. N.J.'s cost of living is 13.4% higher than the U.S. average, according to C2ER.

Although New Jersey gives residents a break on income taxes, it brings the hammer down when they buy a home. New Jersey's property taxes are the highest in America. And as any East Coast traveler can tell you, New Jersey is no longer a place where you can hop off an exit and buy cheap gas. The state's gas tax is now the 11th-highest in the country.

John Overdeck, founder of Two Sigma Investments hedge fund, is the wealthiest person in N.J. with a net worth of $6.1 billion, according to Forbes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market Today

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market TodayMarkets follow through on Friday's reversal rally with even bigger moves on Monday.

-

Dow Erases 717-Point Gain to End Lower: Stock Market Today

Dow Erases 717-Point Gain to End Lower: Stock Market TodayThe main indexes started the day with solid gains, but worries of an AI bubble weighed on stocks into the close.

-

Coulda, Woulda, Shoulda: Are These 5 Stocks Too Overvalued to Buy Now?

Coulda, Woulda, Shoulda: Are These 5 Stocks Too Overvalued to Buy Now?Investors worried about missing the boat on overvalued stocks need not fret. These five names, while expensive, are still seeing lots of love from analysts.

-

S&P 500 Extends Losing Streak Ahead of Powell Speech: Stock Market Today

S&P 500 Extends Losing Streak Ahead of Powell Speech: Stock Market TodayStocks continued to struggle ahead of Fed Chair Powell's Friday morning speech at Jackson Hole.

-

Stocks Struggle Ahead of Busy Fed Week: Stock Market Today

Stocks Struggle Ahead of Busy Fed Week: Stock Market TodayThe minutes from the July Fed meeting will be released Wednesday, while Chair Powell will deliver a key speech at Jackson Hole on Friday.

-

Dow Hits New Intraday High: Stock Market Today

Dow Hits New Intraday High: Stock Market TodayValue-hunters with big stakes in a particular component kept one of the main U.S. equity indexes in positive territory.