Walmart's Transformative Ways Spark a 100,000% Stock Return

Walmart's strategic store expansion and relentless cost-cutting have catapulted its share price over the years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor's note: This is part 12 of a 13-part series about companies whose shares have amassed 100,000% returns for investors and the path taken to generate such impressive gains over the long term. See below for links to the other stocks in this series.

From its humble beginnings as a small discount store in Rogers, Arkansas, Walmart (WMT) has grown into a global retail powerhouse, transforming the way the world shops.

How did a single store become the largest retailer in the world, with over $600 billion in annual revenue? The answer lies in Walmart's unique approach to expansion and its relentless focus on cost control.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

By strategically opening thousands of stores and mastering supply chain management, Walmart has consistently outperformed its competitors and reshaped the retail landscape.

To truly understand Walmart's success, we must examine these key areas: its aggressive store expansion and improvements in gross margins through cost-effective procurement. Together, these factors reveal the secrets behind Walmart's sustained growth and its ability to dominate the global market.

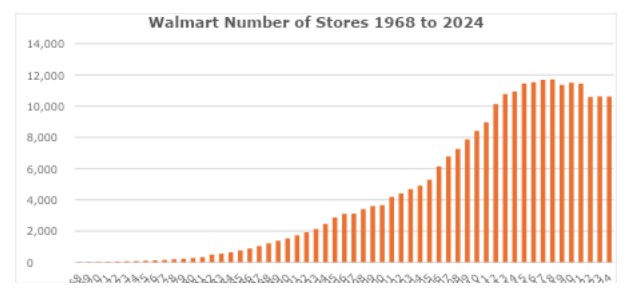

A major driver of Walmart's growth has been its aggressive expansion strategy. In 2000, Walmart operated 3,662 stores worldwide including Supercenters, discount stores, and Sam's Clubs.

By 2023, the number of stores had grown to 10,130. This rapid expansion allowed Walmart to capture a broad customer base across both urban and rural areas.

Looking at sales per store over time provides insights into Walmart's growth strategy.

In 2000, Walmart reported a revenue of approximately $167 billion. Dividing this by its 3,662 stores results in an average sales per store of around $45.6 million.

By 2023, Walmart's revenue had surged to nearly $611 billion. With over 10,623 stores, the average sales per store had risen to approximately $57.5 million. Over time, Walmart's methods allowed it to increase the productivity of each store by 26%.

Improving and maintaining gross margins has also been crucial to Walmart's ability to offer low prices and sustain profitability.

Walmart's massive scale allows it to negotiate better prices with suppliers, driving down the cost of goods sold and enhancing/maintaining gross margins. For a decade, Walmart has been able to keep its gross margin in the range of 24% to 26%.

You could almost say that Walmart is impervious to inflation, and that's one reason shoppers come back to Walmart again and again.

Amazingly, during the peak inflation of 2022, when the rate in the U.S. peaked at 9.1%, Walmart was able to maintain its gross margin at 24.1% that year, only 4% lower than the previous year's gross margin of 25.1%.

And when inflation abated in 2023, Walmart's gross margin was able to bounce back to 26.2%.

The company has leveraged its buying power to source goods at lower prices and invested in technology to enhance inventory management. These efforts have allowed Walmart to reduce the cost of goods sold and maintain its "Everyday Low Price" strategy, attracting price-sensitive customers and driving sales volume.

Despite economic fluctuations and changing market conditions, Walmart's ability to adapt and leverage its massive scale has enabled it to thrive.

As the largest retailer in the world, Walmart continues to shape the retail industry, demonstrating that a well-executed growth strategy and a relentless focus on cost control works.

The formula is still valid, and Walmart likely has more growth to deliver to shareholders.

Note: This content first appeared in Louis Navellier's latest book, The Sacred Truths of Investing: Finding Growth Stocks that Will Make You Rich, which was published by John Wiley & Sons, Inc.

Other 100,000% return stocks

- McDonald's Stock: How Small Changes Have Led to 100,000% Returns

- How Amazon Stock Became a Member of the 100,000% Return Club

- M&A Is Why UnitedHealth Group Stock Is a Member of the 100,000% Return Club

- Sherwin-Williams Is a Sleeper of the 100,000% Return Club

- Dealmaking Drives HEICO Stock's 100,000% Return

- Adobe Stock's Path to a 100,000% Return Is Impressive

- Apple's 100,000% Return Is a Result of Innovation, Brand Loyalty and Buybacks

- Home Depot's Winning Ways Fueled Its 100,000% Return

- It's No Surprise That Berkshire Hathaway's in the 100,000% Return Club

- Nvidia Stock's Been Growing for Years. Just Look At Its 100,000% Return

- Relentless Leadership Drives Oracle Stock's 100,000% Return

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.