Home Depot's Winning Ways Fueled Its 100,000% Return

Home Depot's wide moat leaves little room for competition – and shareholders have profited as a result.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Editor's note: This is part eight of a 13-part series about companies whose shares have amassed 100,000% returns for investors and the path taken to generate such impressive gains over the long term. See below for links to the other stocks in this series.

Home Depot (HD) may be the winning-est stock of all time. If you invested $1,000 in 1981, your investment would have been worth more than $11 million by the end of 2023, for a return of 1,100,000%. As of this writing midway through 2024, your $1,000 would be worth $12.5 million.

In the chapter in my book titled "Buy Monopoly Stocks," we cover Home Depot in great detail. One of the foundational ideas is that Home Depot built scale so massive that it presents a moat no competitor can breach.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Yes, there is Lowe's (LOW) and it is a formidable competitor – and its shareholders have done well, earning a return of more than 53,000% from 1980 through this writing.

A more jaded commentator might remark that Lowe's is a useful foil for Home Depot because it keeps the antitrust regulators at bay even though Home Depot has amassed monopoly powers.

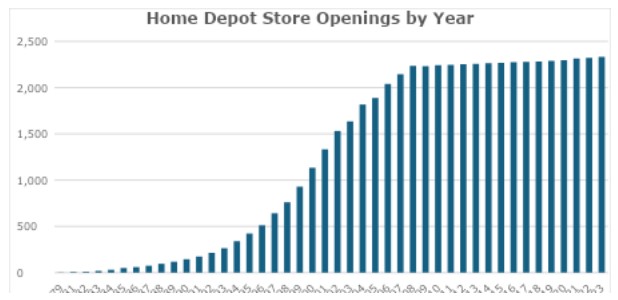

So, Home Depot has not knocked out the competitors so much as it has struck the right balance of competition that has allowed a monopolistic scenario to exist. Evidence that Home Depot has achieved this stasis is that it has leveled off its store openings. It no longer needs to expand geographically. The graph shown below tells the story.

The question that we will address here is: What has Home Depot done now that it has built its moat that consists of about 2,300 stores in all of the markets it needs to be in?

In short, Home Depot has dramatically increased the sales that it generates from each of its locations. For instance, in 2005, Home Depot had 1,890 stores and revenues of $73 billion, for sales per store of about $39 million. At the end of 2023, with 2,335 stores and sales of about $157 billion, sales per store are $67 million, an increase of 71.8%. Wow.

A closer look at Home Depot's financial statements shows what it did with increased revenues to increase its profitability. Notably, the gross profit margin for Home Depot has held steady at about 32% for the past 20 years. This indicates that it is not earning more profits by raising prices on consumers, and this keeps consumers coming back (which gives a boost to same-store sales growth).

Where Home Depot has made enormous strides is in managing its operating costs. That is, once the customer comes through the door, they will experience great prices, but Home Depot has dramatically reduced the cost of servicing that customer. Specifically, the low point for Home Depot’s operating margin was 7.5% in 2009. In 2023, the operating margin was 14.2%. Over time, Home Depot has nearly doubled the profitability it earns on each customer.

All this translates into a stellar bottom line in terms of total net income, but when converted to earnings per share, Home Depot has turbocharged the growth by reducing the number of shares outstanding from 2.2 billion in 2004 to just 993 million in 2023.

That is why total earnings have grown at an average annual rate of almost 6% percent, while the earnings per share have grown at a much higher rate – from $2.27 in 2004 to $15.16 in 2023, for an average annual growth of nearly 10%. This is nearly twice the rate of total net income.

While growth in total net income is important, it's growth in earnings per share that drives stock prices.

Parenthetically, it's growth in earnings per share that drives growth in the dividend too. Since 2004, Home Depot's dividend has grown from 33 cents to $8.36, for an average annual growth of more than 17%. This is an almost unheard-of number and, along with sales and earnings growth, has driven Home Depot stock into the stratosphere.

Note: This content first appeared in Louis Navellier's latest book, The Sacred Truths of Investing: Finding Growth Stocks that Will Make You Rich, which was published by John Wiley & Sons, Inc.

Other 100,000% return stocks

- McDonald's Stock: How Small Changes Have Led to 100,000% Returns

- How Amazon Stock Became a Member of the 100,000% Return Club

- M&A Is Why UnitedHealth Group Stock Is a Member of the 100,000% Return Club

- Sherwin-Williams Is a Sleeper of the 100,000% Return Club

- Dealmaking Drives HEICO Stock's 100,000% Return

- Adobe Stock's Path to a 100,000% Return Is Impressive

- Apple's 100,000% Return Is a Result of Innovation, Brand Loyalty and Buybacks

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.