We Are Peter Lynch: How to Invest in What You Know

Take a look around, go to a free stock market data website, and get to work.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

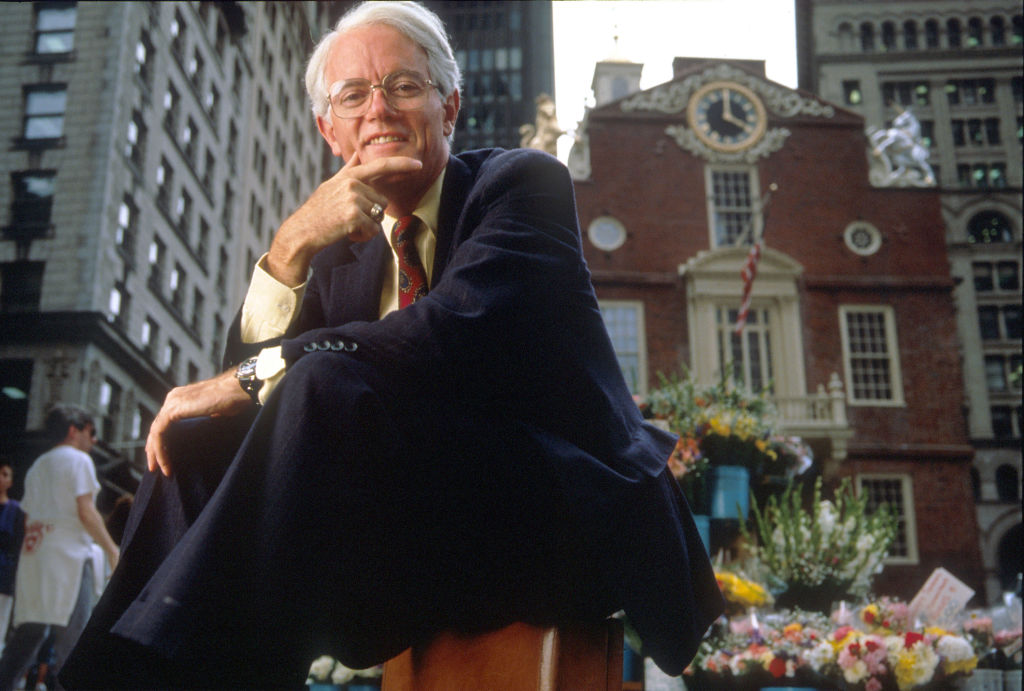

My aunt is the type of person who recognizes "Peter Lynch" as a big Wall Street name without knowing exactly what he did, but she still makes the kinds of stock picks the Fidelity Investments fund manager would favor.

My uncle, a lifetime investor and, during the relevant time frame, the chief financial officer of a publicly traded company, certainly knew all about Peter Lynch's track record at the Magellan Fund from 1977 to 1990.

He was as close to "smart money" as I'd been way back in the summer of 1991, and he was quick to compliment my aunt's decision to buy Nordstrom (JWN) stock earlier that year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It was an intuitive call based on personal shopping behavior, seeing a lot of family, friends and neighbors coast to coast doing the same, and understanding it meant good things for the upscale department store's growth.

"Invest in what you know," indeed.

I assume, based on my uncle's pleasure at JWN's performance for the period in question, that my aunt met the other basic Peter Lynch criterion: "Growth at a reasonable price."

Investing is simple but not easy

Peter Lynch's big idea is that we know more than we think we do and that we probably know more than professional money managers when it comes to buying stocks.

And the fact is, Peter Lynch did it his way and generated an average annual total return of 29.2% from 1977 through 1990, which qualifies him as one of the best mutual fund managers ever.

It's as simple as it is profound.

As Lynch sees it, the major advantage we have is "local knowledge." We can identify good investments in companies and industries we encounter in our daily lives – our jobs, our hobbies, our favorite stores.

It's important that once we've seen a publicly traded company doing good things in the marketplace, gaining popularity and/or delivering quality, that we crunch some numbers to see whether it's well-managed and making money.

We do seek to invest here.

We're looking for a combination of growth, value and stability. Metrics we can use to measure these concepts include price-to-earnings, price-to-sales and debt-to-equity ratios.

Still, simplicity is the thing. "Quantitative analysis," Lynch writes in One Up on Wall Street, "taught me that the things I saw happening at Fidelity couldn't really be happening."

Common sense is really the thing, after all.

Nobody knows anything, not even Peter Lynch. But we can start with our own intuition and then develop a repeatable process on a foundation of observation, common sense and basic math, which is what he did.

Following the advice of a legend and the example of my aunt, I've taken a look around, and I've identified 10 investment opportunities and assessed them for their Peter Lynch qualities.

Data is as of June 13.

Tractor Supply

- Sector: Consumer discretionary

- Industry: Specialty retail

- Market value: $27.3 billion

- Dividend yield: 1.8%

Tractor Supply (TSCO, $51.54) – "your neighborhood rural lifestyle store" – is where I go to get things I need to keep my lawn tractor humming and cutting, mainly oil-change kits and air filters and replacement blades.

We've also added one of those Bird Buddy feeders to our landscape, and it's an early hit with the local winged community, so we're provisioning for that now too.

It was a revelation when I saw that TSCO has outperformed the S&P 500 by a significant margin – 132.9% to 116.4% since June 2020 – during the five-plus years since we moved from Northern Virginia to the Shenandoah Valley.

What's even more exciting is that the company and the stock are still set up to deliver more growth – there are a lot of folks just like me here and in rural areas of 48 other states.

That's the foundation of a long track record of solid financial performance and operational stability – and dividend growth.

And even at this point in its long-term uptrend, TSCO offers that upside based on expansion and product-line diversification at a reasonable price.

Sherwin-Williams

- Sector: Materials

- Industry: Specialty coatings

- Market value: $84.2 billion

- Dividend yield: 0.9%

Sherwin-Williams (SHW, $335.88) would have us "COVER THE EARTH" with a bucket of its red paint.

Our contractor made a much simpler point when we were preparing to have our metal roof sanded, primed and painted: Its liquid coverings are the best.

Sherwin-Williams, like Tractor Supply, is a big, national chain that employs people who know what life is like in their local communities. It benefits as well from a well-known and respected brand.

And it, too, has a long and stable financial history, with consistent earnings and dividend growth.

This is not a fast-growing disruptor. It's a mature company that continues to generate profits and to make its way amid ever-changing trends.

Sherwin-Williams is solid, consistent – and profitable. It may not sound like much.

But I trust it to preserve the roof over my family's head. And the 28 Wall Street analysts who cover the Dow Jones stock collectively agree SHW is set to Outperform over the next 12 months.

Walmart

- Sector: Consumer staples

- Industry: Wholesale and retail

- Market value: $753.7 billion

- Dividend yield: 1.0%

Walmart (WMT, $94.44) is ubiquitous, yes. That it's familiar to you, me and everyone else does not mean the large-cap stock can't offer growth at a reasonable price.

Walmart and its big boxes of juices and snacks and other fungible stuff is a great convenience for families everywhere – when we were raising our kids in NoVa, for example, and after we downsized to the country too.

There is a gas station, a truck stop, a coffee roastery, a brewery and a drive-in theater along the way, but the Walmart Supercenter almost literally marks the beginning of civilization for us, about eight miles up Route 11 at the edge of town.

Never imagined when we embarked for Lexington and our new "farm to table" lifestyle that we'd rely more than ever on the old big-box retailer.

WMT trades at a high price-to-earnings ratio, but its price-to-sales and debt-to-equity multiples mark it as a well-managed and stable company.

And it's proven a go-to for more and more consumers amid challenging economic conditions – a beacon in a time of tariffs and uncertainty.

Amazon.com

- Sector: Consumer discretionary

- Industry: E-commerce

- Market value: $2.3 trillion

- Dividend yield: N/A

Amazon.com (AMZN, $212.10) is both a digital and a physical connection to the world beyond our 11 acres: There's "Wolf Hall" on PBS through Prime Video, and I bought the three books the series is based on from Bezos's behemoth.

I've picked up all kinds of items other than prestige British TV series and their source material from Amazon.com, including shampoo, sunscreen and floss sticks as well as coffee, hot peppers and a replacement blade spindle assembly for my lawn tractor.

I still remember when I thought it was an online bookstore, before I learned of its founder's SKU-based ambitions. Good for him… convenient for us… great for shareholders.

The truth is, I was into Amazon when we lived in Alexandria too. But I also frequent independent bookstores from Lexington, Virginia, to Portland, Oregon.

Bezos is onto something – this "customer obsession" thing – and his successors are leveraging new technology such as artificial intelligence to extend what seems like a never-ending growth story.

It's highly profitable now, too. I'm in… rather, I'm still in.

Kroger

- Sector: Consumer staples

- Industry: Supermarkets and grocery stores

- Market value: $43.7 billion

- Dividend yield: 2.0%

Kroger (KR, $65.56) is our main grocery store. The company is one of the largest grocery retailers in the U.S., with more than 2,700 stores across a portfolio of about 20 supermarket banners. The one near us in Lexington is a Kroger.

It's right by Cattlemen's Market, the retail outlet for the local Potter family farm and their Buffalo Creek Beef and Herman's Produce, where we go for the best watermelon on the planet.

Competition is tough in the grocery space. Margins are tight as a rule. KR stock looks good on a price-to-earnings and price-to-sales basis, though it does carry a little more debt than the other names here.

Sales and profit are growing, and it is maintaining market share. Meanwhile, not for nothing, KR stock has outperformed the S&P 500 so far in 2025, 8.3% to 2.3%, and has bested the index over the last five years, 126.1% to 112.0%.

PepsiCo

- Sector: Consumer staples

- Industry: Beverages

- Market value: $179.4 billion

- Dividend yield: 4.4%

PepsiCo (PEP, $130.85) does not benefit from the exalted kind of Warren Buffett stock status bestowed on Coca-Cola (KO).

But I enjoy a seven-ounce real sugar "Soda Shop" Pepsi and multiple handfuls of roasted unsalted almonds every weekday afternoon for a pick-me-up.

And Pepsi-Cola Bottling Company of Central Virginia is a family-owned franchise headquartered not 50 miles up Interstate 81 or Route 11 in Weyers Cave.

That PepsiCo is a stable, high-cash-generating company with a strong brand and a stable of other strong brands, plus a history of rewarding shareholders with dividends, is why it's recommended as a Peter Lynch stock.

Indeed, Pepsi has raised its dividend for 53 straight years. And it still can reinvest in growth and support share buybacks too.

What's more, PEP stock trades at a price-to-earnings ratio of 19.2, which makes it a better value right now than KO stock at 28.4.

Hershey

- Sector: Consumer staples

- Industry: Specialty foods

- Market value: $34.3 billion

- Dividend yield: 3.2%

Hershey (HSY, $169.12) is a Pennsylvania icon – in fact, my wife, who grew up in Philadelphia, has an aunt who worked at the chocolate factory in Hershey for decades.

Also, Hershey Chocolate of Virginia is the second-largest Hershey factory in the U.S. For more than 40 years, it's been one of the largest employers in the Shenandoah Valley, with about 1,500 of our neighbors working about 30 miles from us in Stuarts Draft.

And these days, I eat two (or four) Hershey's Nuggets with almonds and chase them with a couple of shots of Shenandoah Valley milk almost every night.

HSY stock is a challenging proposition. Growth is slowing. Cocoa prices are rising. Seventeen of the 25 Wall Street analysts who cover it rate the consumer staples stock Hold.

At a little more than 20 times earnings and with a dividend yield above 3%, though, PEP represents decent value and generates good income.

Pilgrim's Pride

- Sector: Consumer staples

- Industry: Meat products

- Market value: $10.9 billion

- Dividend yield: N/A

Pilgrim's Pride (PPC, $46.14) is one of the top three or four chicken producers in the world, up there with Tyson Foods (TSN) and privately held Cargill and Perdue Farms.

It's a major player in the U.S., Puerto Rico, Mexico and Europe.

And it has multiple locations in the Shenandoah Valley, including a major plant in Timberville and local headquarters in Broadway.

PPC stock is downright cheap at these levels, trading at 9.1 times sales and just 0.6 times sales. Debt-to-equity is 1.0, reasonable.

Nobody really knows "Pilgrim's Pride," though surely plenty of folks around these parts are glad for its contribution to the local economy. And the business is not hard to understand: It produces and distributes chicken, pork and prepared foods.

During the volatile start to 2025, PPC stock has outperformed the S&P 500 by a substantial margin – 14.2% vs 2.3%. Its five-year performance is even more impressive – 185.7% vs. 112.0%.

Strong fundamentals… stable operations… easily understood… sounds like a Peter Lynch stock to me.

F & M Bank

- Sector: Financials

- Industry: Regional banks

- Market value: $74.8 million

- Dividend yield: 5%

F & M Bank (FMBM, $21.00) and its stock price are probably the highest-quality economic indicator there is for the Shenandoah Valley.

Founded in 1908, FMBM is the only publicly traded organization based in Rockingham County. And it's a traditional bank, providing basic account and lending services to the predominantly agriculture-based local economy.

It's small, with a market capitalization of about $75 million. But it pays, with a dividend yield of about 5%.

Not a single Wall Street analyst covers it, not a surprise given its minuscule market cap. And its appeal is certainly supremely local.

But at just 8.6 times earnings vs a regional bank average north of 11.0, FMBM represents good value.

And that dividend yield is attractive. This is not a stock you trade. This is the kind of stock you buy with the long term and a bigger picture in mind.

Wells Fargo

- Sector: Financials

- Industry: Banking

- Market value: $235.5 billion

- Dividend yield: 2.2%

Wells Fargo (WFC, $72.36) is the Too Big to Fail alternative in Lexington – WFC is literally about 3,000 times as large as FMBM in market cap terms – and we also happen to have accounts there.

The branch is located across the street from our cheese lady's shop, and she only takes cash or checks, so we use the ATM often.

WFC stock is trading at a price-to-earnings ratio of 12.9 compared to a five-year average of 22.7 and vs 13.1 for Bank of America (BAC) and 13.0 for JPMorgan Chase (JPM).

Wells Fargo is an established, profitable company with a reasonable valuation. Fair to say not many of us really know what happens all day, every day inside the biggest of the big banks.

But, intuitively, we probably get what they're trying to do and, after the experience of the Global Financial Crisis/Great Recession in 2008-09, appreciate their position in the broader economy.

Even if you don't have a specific interest in them, ownership or otherwise, they have an interest in all of us.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Dittman is the former managing editor and chief investment strategist of Utility Forecaster, which was named one of "10 investment newsletters to read besides Buffett's" in 2015. A graduate of the University of California, San Diego, and the Villanova University School of Law, and a former stockbroker, David has been working in financial media for more than 20 years.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.