14 Reasons You Might Go Broke in Retirement

Running out of money in retirement is a legitimate fear. But there are steps you can take to avoid that fate – and it’s never too late to start.

About 10,000 baby boomers turn 65 every day and start counting down the minutes to retirement (if they’re not already there). At the same time, they’re also counting their savings – and taking stock of their fears. According to the latest Transamerica Retirement Survey conducted by The Harris Poll in late 2020 and published in November 2021, only 24% of those surveyed were “very confident” they will be able to retire and live comfortably and 42% said their biggest concern was outliving their retirement savings and investments. Social Security, a primary source of retirement income for many, is front of mind to those surveyed: 73% are concerned Social Security will not be there for them when they retire.

It’s time to face your fears, especially in a roller-coaster economy. Before you start your retirement journey, learn more about these common reasons why some retirees run out of money. More importantly, learn what you can do now to avoid that fate.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

You Take All Your Money Out of Stocks

Market volatility is scary for everyone; it can be even more so for retirees. While there's truth to the maxim that retirees should make sure their portfolios have enough income-generating assets, leaping out of stocks because of market lurches is never a good idea. Investors have seen strong gains in recent years, as well as some steep declines.

Retirement experts say you’ll likely need at least some of your savings in stocks throughout retirement for diversification and growth potential. Consider this: Despite market woes in 2018 and at the start of the COVID-19 pandemic, the S&P 500 gained an astounding 195.6% from April 2012 to April 2022. The risk in abandoning stocks is that the spending power of your money in the bank erodes every year with inflation.

“While there is no one-size-fits-all answer for what your stock allocation should be in retirement, for most people, stocks should account for anywhere from 40% to 60% of their portfolio in the years just prior to and after retirement, with the rest invested in bonds and cash,” says Carrie Schwab-Pomerantz, president of the Charles Schwab Foundation and author of The Charles Schwab Guide to Finances After Fifty. “Where you fall on that range depends on your personal tolerance for risk, how much you expect to rely on your portfolio for income, and your anticipated longevity. But the important thing is to have some opportunity for growth that will outpace inflation.”

You Invest Too Much in Stocks

Okay okay, but stocks are risky. "You don't want to have too much in stocks, especially if you're so reliant on that portfolio, because of the volatility of the market," says Schwab-Pomerantz. One route has nearing-retirement investors moving to 60% stocks as you approach retirement, and then trimming back to 40%-50% stocks in early retirement and 20%-30% later in retirement.

“Diversification is critical, too,” says Schwab-Pomerantz. “That means having a mix of small-cap, large-cap and international stocks, as well as a mix of industries and companies within those categories. While diversification doesn’t ensure a profit or eliminate the risk of investment losses, too much of any one stock carries a major risk of its own. Think mutual funds and exchange-traded funds for easy ways to get this diversification.”

Diversification also means investing beyond stocks. For steady sources of retirement income, look into U.S. Treasuries, municipal bonds, corporate bonds and real-estate investment trusts (REITs), to name a few options. Owning gold is another way to diversify your portfolio, as is owning real estate.

You Underestimated Your Life Expectancy

Everyone wants to live a long, happy life. Keeping the “happy” in there depends at least in part on having enough money..

“The good news is that people are living longer than ever before, so it’s widely recommended you plan for at least a 30-year retirement,” says Schwab-Pomerantz. More good news: Americans are starting to get down with that. Most workers polled by Transamerica said they expect to live to age 90.

But are they saving enough? The survey found that the average household earning $100,000 or more had socked away a median $200,000 in retirement accounts. That amount is down slightly from a year earlier, but alone it’s not enough to fund three decades of retirement. Social Security benefits will help, as will a pension if you have one. Downsizing your home and retiring in a cheaper state or city can help, too, as can locking in additional income for life from a deferred income annuity or qualified longevity annuity contract (QLAC).

You Spend Too Much

We all do, before, and probably during, retirement. Studies from the Employee Benefit Research Institute found that 46% of retired households spent more annually in the first two years of retirement than they did just before retiring.

“Ideally you’ve already started preparing a budget prior to entering retirement, but it’s critical to help you understand how to live within your means and not run out of money,” says Schwab-Pomerantz, who offers this simple retirement-budgeting strategy:

- Step 1. Add up your monthly expenses – factor in taxes and extras such as long-term health care;

- Step 2. Separate these expenses into two groups – nondiscretionary (the must haves) and discretionary (the extras);

- Step 3. Tally up all sources of income other than your portfolio, such as Social Security, pensions, salary or real estate.

- Step 4. Subtract your expenses from your income to see what your budget should be.

You Rely on a Single Source of Income

Ninety-four percent of retirees and 86% of workers cite Social Security as the primary source of income in retirement, according to the 2022 Retirement Confidence Survey conducted by the Employee Benefit Research Institute in January. At the same time, many fear Social Security will be reduced or cease to exist by the time they retire. (It won’t.)

However, Social Security alone probably won’t be enough to see you comfortably through retirement. Having multiple income streams is the smartest play for retirees. You want to create a mix: a pension (if you’re among the fortunate few to have one), a 401(k) from your job; your own IRAs, either Roth or traditional; and annuities that can provide either lump sums of cash or steady payouts, depending on the type of annuity you choose.

You Aren't Able to Work

More than half (57%) of boomers surveyed by Transamerica are planning to work beyond when they could begin collecting Social Security benefits (age 62) until when they have to take Social Security (age 70). And for 80% of workers surveyed, they’ll be working in retirement because of financial reasons. Most say they are staying healthy or sharpening their job skills to keep working in their retirement years.

But what if you can’t keep working? Health issues can strike at any time, and changes to your employment status resulting from downsizing, business failures or layoffs are always a risk. And anyone who has attempted to get a new job after age 50 knows, ageism can be a very real obstacle. The Transamerica survey shows many workers do not have a backup plan for retirement income if they are unable to work before their planned retirement.

What to do? Save aggressively, keep an emergency fund and review your insurance – in particular, disability insurance – to ensure your coverage is adequate.

You Get Sick

It’s no secret our health deteriorates as we get older. It’s also no secret that health care is expensive. A report from the Employee Benefit Research Institute shows a 65-year-old man would need to save $142,000 to have a 90% chance of affording his health-care expenses in retirement (excluding long-term care) that aren't covered by Medicare or private insurance. The news is worse for a 65-year-old woman, who would need $159,000. Be sure you're doing all you can to cut health-care costs in retirement by considering supplemental medigap and Medicare Advantage plans and reviewing your options annually.

Should you or a loved one need long-term care, costs skyrocket. According to Genworth Financial, the median cost for adult day health care in the U.S. is $1,690 a month; for a private room in a nursing home, it costs a median of $9,034 a month. Small wonder 41% of workers are concerned about their health in retirement, with 44% worried they’ll need long-term care due to declining health and 42% fearing cognitive decline, dementia and Alzheimer's disease. Premiums can be steep, but look into getting long-term-care insurance to help cover those costs.

You Tap the Wrong Accounts

Let’s hope your younger self was smart enough to build multiple streams of income to tap in retirement. The older, retired you still needs to know which accounts to tap when to minimize taxes and avoid penalties.

As a general rule of thumb, Schwab-Pomerantz recommends going to taxable accounts first to allow your savings in tax-deferred accounts such as traditional IRAs and 401(k)s to compound for as long as possible before being withdrawn and taxed. The most tax-efficient distribution method will depend on the exact composition of your portfolio, your income needs, and your personal situation. A tax advisor can help you customize when and how much to take out from which accounts to extend the life of your portfolio. Just remember that traditional IRAs and 401(k)s funded with pre-tax dollars are subject to required minimum distributions starting at age 70½ or 72, depending on your birthday. Miss an RMD, and you’ll face a stiff penalty.

Additionally, keep in mind that Roth IRAs aren’t subject to RMDs, and there are no deferred taxes to contend with since Roth contributions are made on an after-tax basis. The flexibility of Roths comes in handy in retirement as you try to manage income levels from year to year and keep taxes at a minimum.

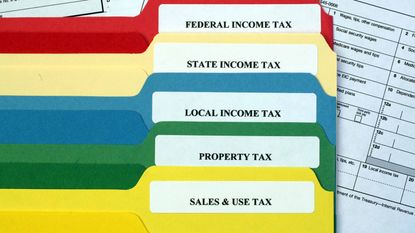

You Don't Consider State Taxes

So let’s say your retirement savings drawdown strategy is in place, primarily based on federal tax rules. But have you considered how state and local taxes will hit your retirement nest egg? Depending on where you live, high state income taxes, state and local sales taxes or property taxes – or a combination of all three – could eat up your hard-earned savings quickly. Twelve states even tax Social Security benefits.

That’s a big reason so many people pull up stakes and move to tax-friendly states for retirees such as Florida and Georgia. The nice weather is a draw, to be sure, but so too are incentives such as low or no state taxes on retirement income and generous tax breaks for older homeowners.

Do your research, consider friends and family in the equation and consult our handy State-by-State Guide to Taxes on Retirees.

You Bankroll the Kids or Grandkids

It’s a natural part of raising a family to want to be helpful: You’d like to give your children and grandchildren a leg up by contributing to a down payment on their first home or helping them with tuition bills. But you can’t be the Bank of Mom & Dad forever, particularly if it puts your own financial security at risk.

“One of the most common financial mistakes parents make is funding their child’s education before taking care of their own retirement needs,” says Schwab-Pomerantz. “The point is that you won’t be of much use to your child or anyone else in the future if you can’t take care of yourself. So as long as you’re saving enough for your own retirement, then by all means help your kids with college. But if you’re paying for college at the expense of your own retirement savings, remember that there are many ways to cover the cost of college including financial aid, grants, student loans and scholarships. But there aren’t any scholarships for retirement.”

As for that new house, talk to your kids about their funding options. If they don’t have enough for a traditional 20% down payment on the home of their dreams, they might need to rent a cheaper place or (gasp!) move into your basement until they save enough. Or, they might need to scale back and target a less expensive starter home. Or, they might need to think unconventionally and find a roommate to share housing costs.

You Are Underinsured

Cutting costs in retirement is important, but scrimping on insurance might not be the best place to do it. Adequate health coverage, in particular, is essential to prevent a devastating illness or injury from wiping out your nest egg.

Medicare Part A, which covers hospital services, is a good start. It’s free to most retirees starting at age 65. But you’ll need to pay extra for Medicare Part B (doctor visits and outpatient services) and Part D (prescription drugs). Even then, you’ll probably want a supplemental medigap policy to help cover deductibles, copayments and such. You don’t need Part B and may not need Part D under Medicare Advantage. "Medicare is very complex, and it's more expensive than people realize," says Schwab-Pomerantz. "So it definitely needs to be part of the budgeting process."

Medicare is designed to cover most of your retirement health care expenses, but like private insurance, there’s out-of-pocket costs from premiums, deductibles and co-pays, and it won’t cover everything. For example, Medicare isn’t designed to cover long-term care costs.

And don't forget about other forms of insurance. As you age, your chances of having accidents both at home and on the road increase. In fact, according to the Insurance Institute for Highway Safety, the rate of fatal car accidents starts to skyrocket once drivers hit age 75. Beyond your own medical expenses, all it can take is a single adverse ruling in an accident-related lawsuit to drain your retirement savings. Review the liability coverage that you already have through your auto and home policies. If it’s not sufficient, either bump up the limits or invest in a separate umbrella liability policy that will kick in once your primary insurance maxes out.

You Get Scammed

Retirees are particularly vulnerable to scams. The FBI notes that older adults are prime targets for criminals because of their presumed wealth, relatively trusting nature and typical unwillingness to report these crimes. “People who grew up in the 1930s, 1940s, and 1950s were generally raised to be polite and trusting,” according to an FBI report. “Con artists exploit these traits, knowing that it is difficult or impossible for these individuals to say ‘no’ or just hang up the telephone.”

Even worse, the perpetrators may be closer than you think. According to a study from MetLife and the National Committee for the Prevention of Elder Abuse, an estimated 1 million seniors lose $2.6 billion a year due to financial abuse—and family members and caregivers are the perpetrators 55% of the time.

Common retirement scams to watch out for often involve impostors pretending to be Social Security, Medicare or IRS officials. The absolute best way to deal with fraudsters who call you out of the blue demanding personal information or immediate payment? Hang up. “Medicare is not going to call you. Social Security is not going to call you,” says Kathy Stokes, a fraud expert at AARP. “The IRS will reach out to you many times by mail if you have back taxes as an issue before you would get a phone call.”

You Borrowed From Your Retirement Savings

Many people in a middle-age cash crunch saw an easy way to pay down credit cards by borrowing from our employer-sponsored retirement plans. After all, retirement was decades away and the money (our money) was just sitting there. Right?

But borrowing from your 401(k) is an all-too-common mistake you’ll regret in retirement. According to Transamerica, about one-third of workers have taken some form of loan, early withdrawal or hardship withdrawal from a 401(k) or similar plan.

Taking a loan from your 401(k) can severely inhibit the growth of your retirement nest egg and have lasting consequences. Not only is the money you borrowed not earning interest in your account, but you’ve also stopped making new contributions as you try to pay down your debt. And, of course, no new contributions means no matching contributions from your employer.

You Have No Emergency Savings

Building emergency savings isn’t just for wage earners. A single home or auto repair – say, you need to replace your roof or get a new transmission – can strike a devastating blow to the budgets of fixed-income retirees who don’t have money set aside for just such calamities.

Unfortunately, quite a few baby boomers are members of the no-emergency-savings club (or have very little saved). According to the Transamerica survey, the median savings in workers’ emergency savings was only $5,000; 31% of boomers said they had less than $5,000 in their emergency savings (a Bankrate survey found 25% of boomers have no cash whatsoever put away for emergencies).

Review your budget, and reduce spending temporarily, so you can slowly build up your emergency fund. Six months’ worth of living expenses is generally recommended, but three-plus months should be adequate for many retirees.

Bob was Senior Editor at Kiplinger.com for seven years and is now a contributor to the website. He has more than 40 years of experience in online, print and visual journalism. Bob has worked as an award-winning writer and editor in the Washington, D.C., market as well as at news organizations in New York, Michigan and California. Bob joined Kiplinger in 2016, bringing a wealth of expertise covering retail, entertainment, and money-saving trends and topics. He was one of the first journalists at a daily news organization to aggressively cover retail as a specialty and has been lauded in the retail industry for his expertise. Bob has also been an adjunct and associate professor of print, online and visual journalism at Syracuse University and Ithaca College. He has a master’s degree from Syracuse University’s S.I. Newhouse School of Public Communications and a bachelor’s degree in communications and theater from Hope College.

-

How to Help Your Kids Without Ruining Your Retirement

How to Help Your Kids Without Ruining Your RetirementHere are some general considerations to ensure the gift of assets to your kids will not negatively affect your financial future.

By Mario Hernandez Published

-

AI to Power the Next Generation of Robots

AI to Power the Next Generation of RobotsThe Kiplinger Letter There's increasing buzz that the tech behind ChatGPT will make future industrial and humanoid robots far more capable.

By John Miley Published

-

7 Things Medicare Doesn’t Cover

7 Things Medicare Doesn’t CoverHealthy Living on a Budget Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. But Medicare Advantage has problems, too.

By Donna LeValley Last updated

-

7 Best Stocks to Gift Your Grandchildren

7 Best Stocks to Gift Your GrandchildrenThe best stocks to give your grandchildren have certain qualities in common.

By Dan Burrows Last updated

-

10 Things You Need to Know About Retiring to Florida

10 Things You Need to Know About Retiring to FloridaMaking Your Money Last If Florida is part of your retirement plan, we offer up a few tips to help you find your way.

By Bob Niedt Last updated

-

Investors Nearing Retirement Show Patience With Markets

Investors Nearing Retirement Show Patience With MarketsDespite last year’s upheaval, many investors are sticking with long-term plans and tightening their budgets instead of moving money out of stocks and bonds.

By Matthew Sommer, Ph.D. CFA® Published

-

What the Markets’ New Tailwinds Could Look Like in 2023

What the Markets’ New Tailwinds Could Look Like in 2023Historically, the markets bounce back nicely after sharp declines, so focusing on historically high-quality companies trading at today’s lower valuations could be a good recovery strategy.

By Don Calcagni, CFP® Published

-

Annuities: 10 Things You Should Know

Annuities: 10 Things You Should KnowLove ’em or hate ’em, annuities are back. And as always, there's plenty you should know before getting an annuity for yourself.

By David Rodeck Published

-

The Biggest 401(k) Funds Ranked

The Biggest 401(k) Funds RankedUse Kiplinger's guide to 401(k) funds to boost the performance of your retirement portfolio. We analyze them and rate each one “buy,” “sell” or “hold.”.

By Nellie S. Huang Published

-

Auto-Callable Yield Notes Are the Income Stream Nobody’s Talking About

Auto-Callable Yield Notes Are the Income Stream Nobody’s Talking AboutAuto-callable yield notes, or ACYNs, let investors diversify their investments and fortify their retirement income when stocks and bonds are letting them down.

By Adam J. Bruno, Certified Financial Fiduciary® Published