10 Stocks Warren Buffett Is Selling (And 7 He's Buying)

Berkshire Hathaway CEO Warren Buffett ended 2021 like he started it: selling. But while he unloaded plenty in Q4, he also added a few new interesting stakes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Warren Buffett once again was a net seller of equities in the fourth quarter, slicing, slashing and outright exiting stakes across a series of sectors that have fallen out of his favor. But the Oracle of Omaha did pull off a few interesting buys in Q4, too.

The chairman and CEO of Berkshire Hathaway (BRK.B) continued to pull back on bets in the financial and healthcare sectors, with a particular focus on ridding himself of positions in the pharmaceuticals industry.

On the other side of the ledger, Buffett made incremental additions to holdings with exposure to the housing market, upped a major energy sector bet in a big way, backed another initial public offering (IPO) and even got behind an international motorsport circuit.

We know what the greatest long-term investor of all time has been up to because the U.S. Securities and Exchange Commission requires investment managers with at least $100 million in assets to file a Form 13F quarterly report disclosing changes in share ownership. These documents add an important level of transparency to the stock market and give Buffett-ologists a bead on what the Berkshire chief is thinking.

When Buffett initiates a stake in some company, or adds to an existing one, investors read into that as a vote of confidence. But if he pares his holdings in a stock, it can spark investors to rethink their own investments.

Here's the scorecard for what Warren Buffett was buying and selling during the fourth quarter of 2021, based on Berkshire Hathaway's 13F filed on Feb. 14, 2022, for the period ended Dec. 31, 2021. You can check out the entire list of Buffett stocks here, or continue reading if you're most interested in Buffett's most recent transactions.

And remember: Not all "Warren Buffett stocks" are actually his picks. Some of Berkshire Hathaway's positions are handled by lieutenants Ted Weschler and Todd Combs.

Current share prices are as of Feb. 14, 2022. Holdings data is as of Dec. 31, 2021. Sources: Berkshire Hathaway's SEC Form 13F filed Feb. 14, 2022, for the reporting period ended Dec. 31, 2021; and WhaleWisdom.

Kroger

- Action: Reduced stake

- Shares held: 61,412,910 (-0.01% from Q3 2021)

- Value of stake: $2.8 billion

Warren Buffett reduced Berkshire Hathaway's exposure to one of his more recent favorite stock picks by an immaterial amount in Q4. The holding company shed 350,000 shares, or less than 0.01% of its stake, in supermarket operator Kroger (KR, $45.69).

Buffett first bought Kroger in the fourth quarter of 2019 and quickly built on the position over the following two years. Shares are up by 57% on a price basis since Buffett initiated the position, boosted by the pandemic and operational tailwinds. Once you throw in dividends, the KR position has delivered a 66% total return.

Kroger operates roughly 2,750 retail food stores operating under such banners as Dillons, Ralphs, Harris Teeter and its namesake brand, as well as 1,585 gas stations and even 170 jewelry stores under banners including Fred Meyer Jewelers and Littman Jewelers.

With more than 61 million shares, Berkshire Hathaway is Kroger's third-largest stockholder, holding 8.4% of its shares outstanding. Only BlackRock (10.7%) and Vanguard (9.9%) have larger stakes in the supermarket chain.

It's only a middle-of-the-pack position at just 0.8% of Berkshire's equity portfolio. But the old-economy value play is a natural Buffett stock, right in line with the Oracle's traditional interests.

Mastercard

- Action: Reduced stake

- Shares held: 3,986,648 (-7.0% from Q3 2021)

- Value of stake: $1.4 billion

Mastercard (MA, $374.16) was the idea of lieutenants Todd Combs and/or Ted Weschler (Buffett won't tell). And it has been a mighty successful idea, returning well more than 1,400% since Berkshire established the stake in the first quarter of 2011.

But for a second straight quarter, Berkshire Hathaway lightened its exposure. The holding company reduced its stake by 7% in Q4 to just under 4 million shares. That followed a cut of 6%, or 276,108 shares, in the prior quarter.

Mastercard is a bet on the global growth of digital transactions, and happens to be a Wall Street and hedge fund darling as well. Analysts credit MA's long-term outperformance to its "powerful brand, vast global acceptance network and strong business model." Substantial barriers to entry, thanks to Mastercard's massive scale, global reach, security and data management skills, information intelligence and trust, have also served it well.

MA wasn't a particularly meaningful part of BRK.B's equity portfolio prior to the most recent sales, and it's even less material now. MA accounts for 0.43% of the holding company's total portfolio value, down from 0.51% in Q3.

Shares in Mastercard were essentially unchanged in 2021, lagging the broader market by about 26 percentage points. The spread of COVID-19 greatly curtailed cross-border spending, as well as billings related to travel and entertainment.

The new year has been a different story, however, with MA beating the S&P 500 by a wide margin through the first seven weeks of 2022.

Charter Communications

- Action: Reduced stake

- Shares held: 3,828,941 (-8.0% from Q3 2021)

- Value of stake: $2.5 billion

Charter Communications (CHTR, $608.28) seems to have lost some of its shine for Warren Buffett over the past few years.

The company – which markets cable TV, internet, telephone and other services under the Spectrum brand – is America's second-largest cable operator behind Comcast (CMCSA). It greatly expanded its reach in 2016 when it acquired Time Warner Cable and sister company Bright House Networks.

And yet Buffett slashed BRK.B's stake by another 8% during the fourth quarter of 2021. That followed a cut of nearly 20% in Q3, as well as reductions in 2020 and 2017 as well.

The most recent sale of 371,685 shares leaves Berkshire Hathaway with 2.1% of the cable company's shares outstanding, down from 2.4% at the end of Q3 – though BRK.B remains a top-10 shareholder. The stake was worth $2.5 billion as of Dec. 31, 2021.

Charter now accounts for 0.75% of Berkshire Hathaway's total portfolio value, down from more than 1% in Q3.

Visa

- Action: Reduced stake

- Shares held: 8,297,460 (-13% from Q3 2021)

- Value of stake: $1.8 billion

Like Mastercard, the Visa (V, $225.34) stock pick was the brainchild of either Todd Combs or Ted Weschler. And also like Mastercard, Visa – the world's largest payments processor – is a bet on the global growth of digital transactions.

The stock gets high marks from Wall Street analysts and is a favorite among hedge fund managers and billionaires. And yet Berkshire Hathaway cut its stake in Visa for a second consecutive quarter.

The holding company reduced its Visa exposure by 13%, or 1.3 million shares, in Q4. That followed a cut of 4% in the previous quarter.

Berkshire's remaining stake of 8.3 million shares was worth $1.8 billion as of Dec. 31, and accounted for 0.5% of its total portfolio value. That's down from 0.7% at the end of Q3.

Berkshire Hathaway first bought Visa in the third quarter of 2011, and while he didn't specify whether it was Todd Combs or Ted Weschler, Buffett admitted that it was one of his lieutenants. He also has said that he wishes it was his own stock pick, and that Berkshire had bought even more.

"If I had been as smart as Ted or Todd, I would have (bought Visa)," Buffett told shareholders at the 2018 annual meeting.

Royalty Pharma

- Action: Reduced stake

- Shares held: 8,648,268 (-34% from Q3 2021)

- Value of stake: $344.6 million

Berkshire Hathaway sure changed its mind in a hurry on Royalty Pharma (RPRX, $39.11). After all, the holding company initiated a stake in the company just one quarter ago.

Buffett picked up RPRX in the third quarter, buying 13.1 million shares worth $475.0 million at the time. However, he turned around and slashed the stake by more than a third, dumping 4.5 million shares in Q4.

Buffett has been hot and cold – OK, mostly cold – with his bets in the healthcare sector for the past several quarters, which might help explain the abrupt volte-face.

Royalty Pharma, as the name might indicate, is focused on acquiring biopharmaceutical royalties. It doesn't research or develop drugs – it helps provide capital for the companies that do. Through that model, RPRX has gotten a piece of blockbuster drugs such as AbbVie's (ABBV) Imbruvica, Biogen's (BIIB) Tysabri and Pfizer's (PFE) Xtandi.

To be sure, RPRX was never a significant holding to begin with. It now accounts for just 0.1% of Berkshire Hathaway's equity portfolio, down from 0.16% at the end of Q3.

However, with more than 2.0% of the firm's shares outstanding, BRK.B remains a top-10 stockholder.

Bristol-Myers Squibb

- Action: Reduced stake

- Shares held: 5,202,674 (-76% from Q3 2021)

- Value of stake: $324.4 million

Warren Buffett reversed course on Bristol Myers Squibb (BMY, $59.62) in a big way in the fourth quarter, cutting his company's stake by 76%. Berkshire Hathaway has now sold shares in BMY during every quarter of 2021.

The most recent sales amounted to 16.8 million shares, leaving the holding company with a stake worth just $324.4 million as of Dec. 31. That followed a 16% reduction in Q3, when Buffett shed 4.2 million shares in the pharmaceutical giant.

Altogether, the moves represent a 180 for Berkshire Hathaway, which first bought BMY in the third quarter of 2020 and immediately added to the position in Q4.

The moves come as part of a general retreat by Berkshire Hathaway's on bets in the pharmaceutical industry. In the case of BMY, its late 2019 acquisition of biotech giant Celgene was thought to be a big part of Buffett's attraction to the stock. The deal brought in a pair of blockbuster multiple myeloma treatments: Pomalyst and Revlimid, the latter of which also treats mantle cell lymphoma and myelodysplastic syndrome.

A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. But if the past four quarters of selling are any indication, Buffett seems to have reset his expectations for BMY – and the broader sector – going forward.

BMY now accounts for 0.1% of Berkshire Hathaway's portfolio value, down from 0.4% in Q3.

AbbVie

- Action: Reduced stake

- Shares held: 3,033,561 (-78% from Q3 2021)

- Value of stake: $410.7 million

Buffett first bought AbbVie (ABBV, $143.00) during the third quarter of 2020 as part of a wider bet on the pharmaceutical industry. But Berkshire has all but given up on the position, gutting it over the past four consecutive quarters.

The holding company dumped 11.4 million shares, or 78% of its ABBV stake, during the fourth quarter. That followed reductions of 29% in Q3, 10% in Q2 and 10% in Q1. AbbVie now accounts for just 0.1% of Berkshire's equity portfolio, down from 0.5% at the end of the third quarter.

The pharma giant is best known for blockbuster drugs such as Humira and Imbruvica, but analysts are also optimistic about the potential for its cancer-fighting and immunology drugs.

Another thing that puts ABBV among classic Buffett stocks is the biopharma firm's storied dividend history. AbbVie is an S&P 500 Dividend Aristocrat, by virtue of having raised its dividend every year for 50 years. The most recent hike – an 8.5% increase to the quarterly payment to $1.41 per share – was declared in October 2021.

Marsh & McLennan

- Action: Reduced stake

- Shares held: 404,911 (-85% from Q3 2021)

- Value of stake: $70.4 million

Berkshire Hathaway slashed its stake in Marsh McLennan (MMC, $151.71) yet again, this time by a whopping 85% in Q4.

Buffett sold more than a third of the position in Q3 after lightening up on it in Q2. The sales mark a stark reversal from Q4 2020 and Q1 2021, in which Berkshire initiated and then grew its stake in the insurance company.

Berkshire has plenty of insurance exposure in its core operations, of course, including Geico, General Re, MLMIC Insurance and Berkshire Hathaway Specialty Insurance, among others. But up until recently, the industry has never been a major factor in its equity portfolio. In fact, Buffett dumped what little of his Travelers (TRV) stake remained in early 2020.

The wind had changed direction for a couple quarters. Berkshire initiated a 4.2 million-share position in MMC worth just short of half a billion dollars during Q4 2020. It wasn't a major position, at just 0.2% of the total value of Berkshire's equity holdings. But by virtue of another 1 million shares or so purchased in Q1 2021, the stake had increased by 23% in just a few short months.

Cut to today, however, and Berkshire now holds what is essentially just a rump position. Its stake of less than 405,000 shares – worth $70.4 million as of Dec. 31 – accounts for 0.02% of its total portfolio value.

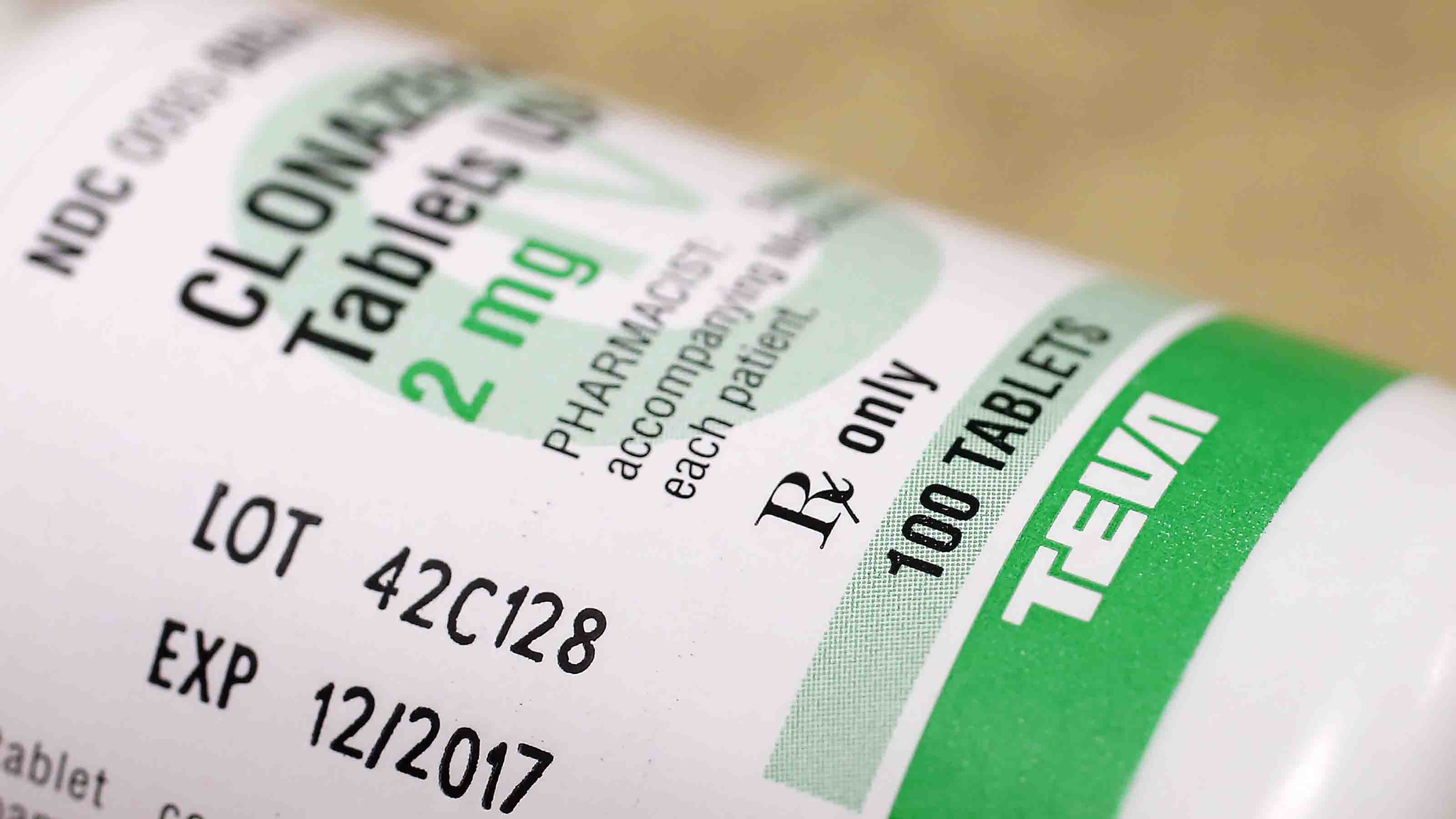

Teva Pharmaceutical

- Action: Exited stake

- Shares sold: 42,789,295

- Value of stake: $0

Berkshire Hathaway is out of the Teva Pharmaceutical (TEVA, $8.52) business, having sold the entirety of its stake – or 42,789,295 shares – in the firm.

The move comes amid Buffett's general multi-quarter retreat from bets across the healthcare sector.

During the fourth quarter of 2017, Berkshire initiated a stake in the Israel-based drug manufacturer, which was out of the market's favor at the time. A bloated balance sheet, mass layoffs and the looming expiration of drug patents had short sellers circling the stock. Needless to say, TEVA's valuation was depressed. Buffett apparently saw a bargain to be had.

Cheap? Yes. Value? Apparently not. The turnaround never materialized, leaving Teva's stock down roughly 75% over the past five years. This one looks like a bet Warren Buffett wishes he could take back.

Sirius XM Holdings

- Action: Exited stake

- Shares sold: 43,658,800

- Value of stake: $0

Berkshire technically had three different investments in satellite-radio leader Sirius XM Holdings (SIRI, $6.17) as of Q3 2021. Not only did it hold a slug of SIRI shares – it also had positions via two different tracking stocks: Liberty Sirius XM Group Series A (LSXMA) and Liberty Sirius XM Group Series C (LSXMK) tracking stock.

At least these convoluted holdings gained a little clarity in Q4.

Buffett exited his stake in SIRI – which the holding company initiated during Q4 2016 – selling all of Berkshire Hathaway's 43.7 million shares. Thus, all of Berkshire's exposure to Sirius XM is now through Liberty-connected tracking stocks.

RH

- Action: Added to stake

- Shares held: 1,816,547 (+1.0% from Q3 2021)

- Value of stake: $973.6 million

In Q4, Warren Buffett topped off BRK.B's stake in RH (RH, $408.62), which many readers know as Restoration Hardware.

The holding company upped its position by 1%, or 24,580 shares. Berkshire's total holdings of more than 1.8 million shares were worth more than $973 million as of Dec. 31. Berkshire, which was already positioned in home furnishings retail via its Nebraska Furniture Mart subsidiary, initiated the RH position Q3 2019.

RH operates 104 retail and outlet stores across the U.S. and Canada. It also owns Waterworks, a high-end bath-and-kitchen retailer with 14 showrooms.

While brick-and-mortar retailers have struggled mightily over the past few years thanks in part to the rise of e-commerce, RH has found success catering to the upper crust. And that success continued throughout the COVID pandemic as Americans, forced to work from home, decided to spend on improving their environs.

It's hard to tell whether this was an Oracle of Omaha buy, or a project of one of his lieutenants, Ted Weschler or Todd Combs. Buffett has been mostly mum on RH. Still, the stake fits broadly with the Oracle's worldview. Buffett stocks tend to be bets on America's growth, which certainly includes housing-related industries.

With 8.5% of RH's shares outstanding, Berkshire Hathaway is the company's third-largest stockholder.

Floor & Decor Holdings

- Action: Added to stake

- Shares held: 843,709 (+3% from Q3 2021)

- Value of stake: $109.7 million

Warren Buffett added 3% to Berkshire Hathaway's stake in Floor & Decor Holdings (FND, $104.85) in Q4, after initiating the position during the previous quarter.

The investment is very much in keeping with some of his other investments in home retail. Floor & Decor sells hard surface flooring and related accessories primarily through 133 company-operated warehouse store formats.

Buffett bought another 26,846 shares in the company to raise BRK.B's total position to nearly 844,000 shares.

True, it's basically still an immaterial holding, comprising just 0.03% of the portfolio. (For context, BRK.B's top 10 stocks account for nearly 90% of its portfolio value.)

But FND still fits nicely with some of Buffett's other holdings and investments. As we just said, Berkshire has also been building a position in homegoods retailer RH – formerly known as Restoration Hardware – since the third quarter of 2019. And Buffett has made no secret of his love for Berkshire Hathaway's wholly owned subsidiary Nebraska Furniture Mart.

Floor & Decor thus appears to be a way to play the housing market, albeit with a somewhat oblique, Buffett-style angle.

Chevron

- Action: Added to stake

- Shares held: 38,245,036 (+33% from Q3 2021)

- Value of stake: $4.5 billion

It has been nearly impossible to get a bead on Buffett & Co.'s holdings in the energy sector over the past couple years.

Consider some of Uncle Warren's moves:

- Q4 2019: Sold off most of his Phillips 66 (PSX) position, but added more than 150% to his Occidental Petroleum (OXY) stake, and nearly 40% to a Suncor (SU) stake.

- Q1 2020: Fully exited Phillips 66.

- Q2 2020: Bailed out of his Occidental position, but upped Suncor by 28%.

- Q4 2020: Initiated a position in Chevron (CVX, $136.67), but dropped more than a quarter of the Suncor position.

- Q1 2021: Exited Suncor, sold more than half the Chevron position.

And now, after making another small trim to CVX during the second quarter of 2020 year, Buffett has come back and added a total of roughly 39 million shares over the past two quarters.

Berkshire upped its Chevron stake by 33% in the fourth quarter, adding more than 9.5 million shares. That followed a 24% increase, or nearly 29 million shares, in Q3.

Buffett now holds a total of more than 38 million shares in the energy supermajor, worth $4.5 billion. The stock, a component of the Dow Jones Industrial Average, has delivered a total return of 58% over the past 52 weeks, thanks to soaring crude oil prices.

Liberty Sirius XM Group, Series A

- Action: Added to stake

- Shares held: 20,207,680 (+35% from Q3 2021)

- Value of stake: $1.0 billion

There's not really much to say as it pertains to Liberty Sirius XM Group, Series A (LSXMA).

Buffett has been involved with the Sirius XM tracking stock since the second quarter of 2016, and has been one of the stock's largest shareholders for some time. He added to that stake in a big way during Q4 2021, packing on more than 5.4 million shares, or 35%.

The most curious thing about the move is that it came during the same quarter Berkshire exited its position in Sirius XM's common shares.

So clearly, Buffett still wants to be involved with the world's top satellite radio provider. He apparently has just finally decided that the Liberty-tethered tracking shares are a more ideal way of doing so.

Formula One Group

- Action: New stake

- Shares held: 2,118,746

- Value of stake: $134.0 million

Berkshire Hathaway initiated a miniscule stake in Formula One Group (FWONK, $62.29) in Q4. The purchase of 2.1 million shares, worth $134 million, represent 0.04% of the holding company's equity portfolio.

FWONK holds commercial rights for the Formula One world championship – a nine-month long motor race-based competition in which teams compete for the constructors' championship and drivers compete for the drivers' championship.

Formula One Group also is a subsidiary of John Malone's Liberty Media Corporation, making FWONK yet another of several Berkshire investments tied to the billionaire businessman.

Activision Blizzard

- Action: New stake

- Shares held: 14,658,121

- Value of stake: $975.2 million

Berkshire Hathaway initiated a stake in video game publisher Activision Blizzard (ATVI, $81.50) during the fourth quarter.

Great timing.

In mid-January, Microsoft (MSFT) agreed to pay $68.7 billion, or $95 a share in cash, for the troubled video game publisher. At the time the deal was announced, the software titan was paying a premium of roughly 30% to the video game maker's most recent closing price.

BRK.B, however, bought more than 14.6 million shares in ATVI – worth $975.2 million as of Dec. 31 – during the fourth quarter at an estimated average price of $66.53 per share. That means Buffett likely made a quick 43% profit in very short order.

As we noted at the time, long-suffering shareholders — not to mention canny value investors — were rewarded for their patience in Activision Blizzard, which had a terrible 2021.

The developer of global hits such as World of Warcraft and the Call of Duty franchise saw its stock plunge amid allegations of sexual harassment, litigation, torrents of bad press and calls for CEO Bobby Kotick to step down. The company also faced tough year-over-year comparisons against 2020's pandemic-fueled growth.

Credit to Buffett or his lieutenants for buying a beaten-down stock on the cheap. Although at just 0.3% of Berkshire Hathaway's portfolio, the ATVI bet can't move the needle all that much.

Nu Holdings

- Action: New stake

- Shares held: 107,118,784

- Value of stake: $1.0 billion

Buffett-backed Nu Holdings (NU, $8.68) went public late last year, giving Berkshire Hathaway a stake worth $1 billion as of Dec. 31.

The Brazilian financial technology company, which offers digital banking services to 48 million customers in Latin America, was one of the largest initial public offerings (IPOs) of 2021. The fintech's hook is that most retail banks in Brazil charge extremely high fees while offering poor customer service to boot.

The chairman and CEO of Berkshire Hathaway, for the record, has never been a fan of IPOs. He's said so, on the record, and has notably turned up his nose at some of the most heavily hyped stock market debuts.

But that didn't scare him away from NU, the second widely touted IPO he's backed in the past two years. Berkshire Hathaway backed Snowflake's (SNOW) blockbuster IPO when the cloud infrastructure unicorn hit the public market in fall 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

What Made Warren Buffett's Career So Remarkable

What Made Warren Buffett's Career So RemarkableWhat made the ‘Oracle of Omaha’ great, and who could be next as king or queen of investing?

-

Risk Is On Again, Dow Jumps 381 Points: Stock Market Today

Risk Is On Again, Dow Jumps 381 Points: Stock Market TodayThe stock market started the week strong on signs the government shutdown could soon be over.

-

With Buffett Retiring, Should You Invest in a Berkshire Copycat?

With Buffett Retiring, Should You Invest in a Berkshire Copycat?Warren Buffett will step down at the end of this year. Should you explore one of a handful of Berkshire Hathaway clones or copycat funds?

-

Stocks at New Highs as Shutdown Drags On: Stock Market Today

Stocks at New Highs as Shutdown Drags On: Stock Market TodayThe Nasdaq Composite, S&P 500 and Dow Jones Industrial Average all notched new record closes Thursday as tech stocks gained.

-

Stocks Slide to Start September: Stock Market Today

Stocks Slide to Start September: Stock Market TodaySeasonal trends suggest tough times for the stock market as we round into the end of the third quarter.