Microsoft Buys Activision With One Eye on the Cloud

MSFT’s $68.7 billion deal for ATVI brings the tech giant a library of A+ titles … and another way to leverage its cloud heft.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Long-suffering shareholders — not to mention canny value investors — were rewarded for their patience in Activision Blizzard (ATVI, $65.39) Tuesday when Microsoft (MSFT, $310.20) agreed to pay $68.7 billion, or $95 a share in cash, for the troubled video game publisher.

After all, ATVI, the developer of global hits such as World of Warcraft and the Call of Duty franchise, had an annus horribilis in 2021.

Allegations of sexual harassment, litigation, a torrent of bad press and calls for CEO Bobby Kotick to step down would have been trouble enough. Tough year-over-year comparisons against 2020's pandemic-fueled growth only made matters worse.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Shares in Activision Blizzard, which closed at an all-time high of $115.82 in February, lost 28% last year. That lagged the tech-heavy Nasdaq Composite by nearly 50 percentage points.

Shares naturally popped on the Microsoft news – a deal in which the software titan is paying a premium of roughly 30% to the video game maker's Friday closing price. ATVI stock was up more than 25% as of midday Tuesday. (U.S. markets were closed Monday in observance of Martin Luther King Jr. Day.)

Some newer ATVI shareholders will close out their investment with losses, but longer-term holders will go out with a smile.

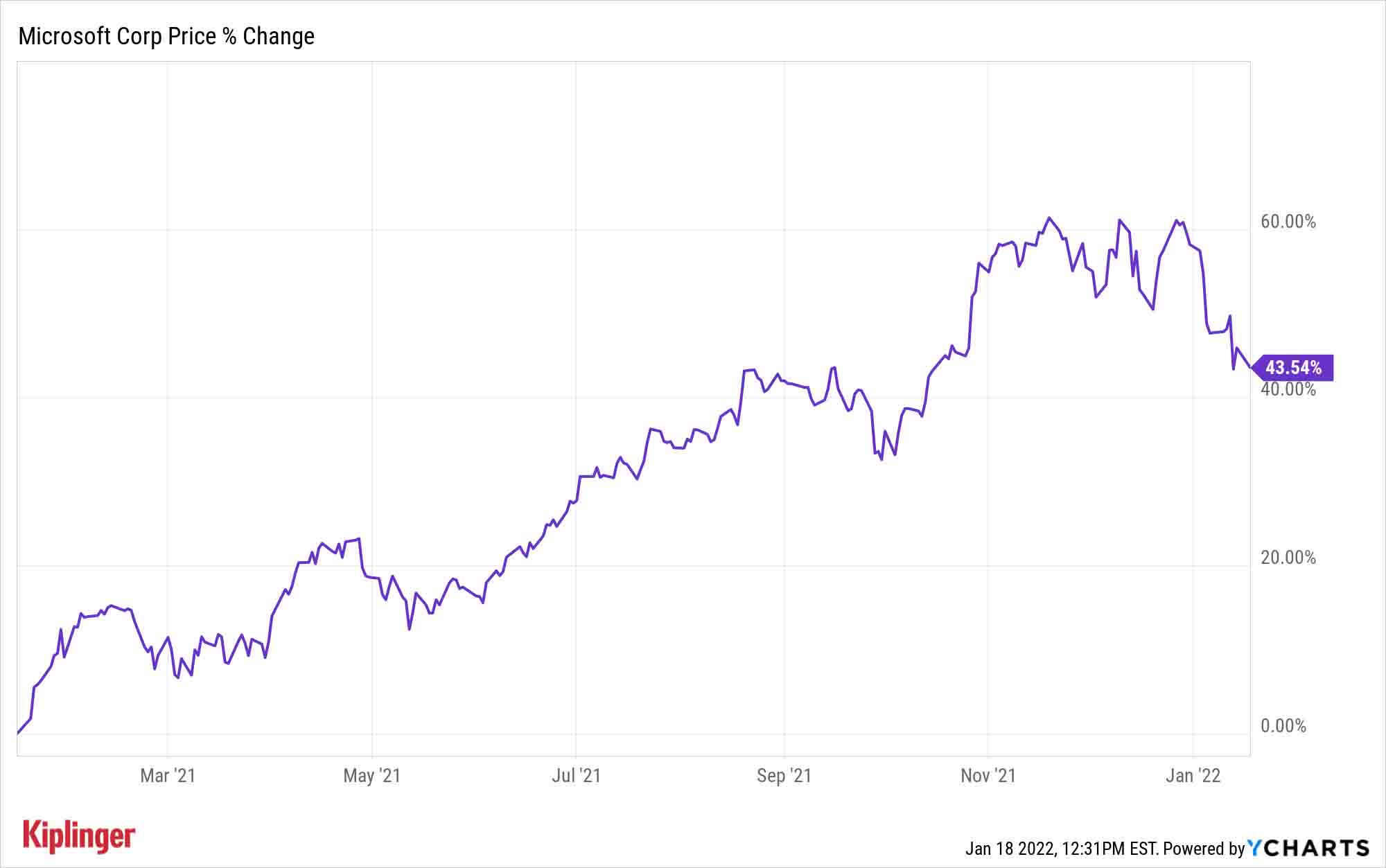

MSFT shares were slightly lower Tuesday, but Microsoft shareholders should like this arrangement for the long run. The acquisition unites Activision’s considerable talents for content production and distribution with MSFT's Xbox console and subscription-based gaming business.

It's the largest deal in dollar terms in Microsoft's history, and comes as the emergent metaverse and other industry trends are forecast to deliver outsized industry growth for years to come.

Why Microsoft Bought Activision Blizzard

The global gaming market is projected to expand to $546.0 billion in 2028 from $229.2 billion last year, or a compound annual growth rate of 13.2%, according to data from market researcher Fortune Business Insights.

Not only does the deal create the world's third-largest video game company, but — perhaps more importantly — it gives MSFT another way to leverage its behemoth of a cloud-based services business.

Indeed, gaming's future as a cloud-based product was one of the reasons behind Cambiar Investors' interest in Activision Blizzard, says Chief Investment Officer Brian Barish.

Cambiar, a Denver-based active value manager with $8.1 billion in assets under management, initiated stakes in ATVI in the fourth quarter. The video game publisher accounts for 2% to 2.5% of the funds that own it; namely, Cambiar Opportunity Fund (CAMOX) and Cambiar Aggressive Value Fund (CAMAX).

Barish saw value in a stock beaten down by scandal, negative press and difficult year-over-year comparisons — especially one that was trading at just around 13 times free cash flow.

"The conclusion at the time of purchase was there was some component of 'inevitability' that the management suite drama would conclude in some constructive fashion, along with scarcity value for a major video game studio," Barish says.

And make no mistake: That scarcity value is key at a time when major cloud companies such as Amazon.com (AMZN), Google parent Alphabet (GOOGL) and Microsoft all have designs on the space.

"Eventually we expect video games to become a cloud-based product (as compared to console based), and more content to throw at the customer should expedite this process," Barish adds.

That's the strategic rationale behind Microsoft’s deal for Activision, Barish surmises. "The migration will take a lot of time, however," he cautions.

Bottom Line

It appears investors in ATVI can put the drama surrounding the C-Suite and the stock behind them. MSFT, meanwhile, looks to have made a bold strategic acquisition in a massive and fast-growing industry.

And as for investors in other video game studios? Does the MSFT-ATVI marriage make those assets more valuable?

"Possibly," Barish says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.