Should You Skip the Wait and Prepay Your Retirement Dreams?

He bought his retirement home more than a decade before he plans to retire. Was it the right move?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

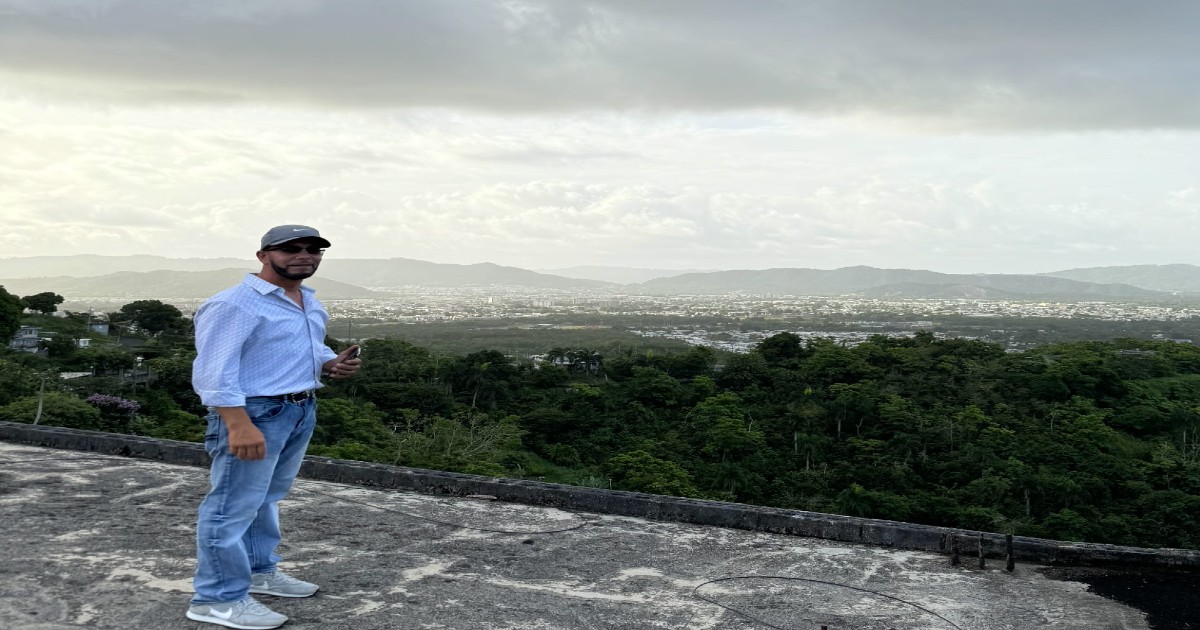

Eric Rivera always knew his retirement would include a house in the mountains of Puerto Rico. So instead of waiting ten or fifteen years until retirement, he went ahead and purchased his dream home while he’s still working.

It doesn’t matter that it means two mortgages. He can still contribute to his 401(k), and although things may be a little tighter, when he does retire, he’ll have two homes that he hopes will have appreciated, along with a plan for where he’ll spend his golden years.

Unconventional? Maybe. After all, the normal trajectory is to save money in a tax-advantaged retirement savings account, retire, and then start your next chapter.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For Rivera, prepaying a portion of his retirement not only gives him peace of mind but presents an opportunity to pass on generational wealth to his two adult children. When he retires, they’ll inherit his current home, and when he passes, his retirement home.

“Even if I’m wrong, you can’t really put a price on that,” said Rivera. “I already know where I want to retire, and that location may not be affordable to me in ten years.”

Eric Rivera on the roof of his "dream home" overlooking the mountains of Puerto Rico.

Prepaying retirement dreams

However, it’s not just retirement homes that people are prepaying.

They are buying new cars as they approach retirement, worrying that they may not get approved for the best financing when they stop collecting a paycheck. Alternatively, they may consider purchasing an RV to encourage themselves to travel the country when they retire, or retrofit their homes pre-retirement to age in place later in life.

Some people are moving into retirement communities long before they stop working, to prepare for the transition into that phase of their lives.

But the question is, from a wealth planning perspective, is that the best approach? Would their money be better served invested elsewhere?

The answer: It depends.

Prepaying retirement is ok if…

Go for it, says Denny Artache, president and CEO of Artache Financial Group, if the purchase meets certain criteria.

To begin with, you need to be able to afford it. If Rivera had purchased the home in Puerto Rico, but as a result, couldn’t afford his first mortgage, Artache would have said, 'Don't do it.'

But Rivera can afford both and plans to have his retirement home paid off before he stops working. At that point, his children will take over his first mortgage, and he’ll live mortgage-free, alleviating a big financial burden in retirement.

“Whenever you look at ‘Should I?,’ ask yourself, ‘can I afford to?'" says Artache. “Don’t go out of your way to finance a pipe dream.”

The cost of financing and depreciation are other things to consider. If your dream is to travel the country in an RV once you retire in five years, and you want to encourage yourself to do it by buying it ahead of time, the cost of ownership comes into play.

If you have to pay interest on a loan to make it a reality now, or if the RV will be worth nothing when you finally use it, you may be better off waiting. You can save more money to avoid financing charges and get a more modern one later on.

Then there’s the investment returns. In the case of Rivera, he purchased real estate that has the potential to appreciate. That may not be true if you prepaid for a boat or RV.

Some people don't care if prepaying a piece of their retirement dream isn’t the smartest financial move; for them, it's about the peace of mind, and that can be priceless.

“If you can afford to have peace of mind, go for it,” says Artache.

Test the waters instead

It’s nice to have a dream and want to prepay for it, but there’s a lot that can go wrong with that, cautions Michael Pumphrey, a wealth advisor at Tanglewood Total Wealth Management.

“One of the big picture things to consider as we guide retirees into the next phase of their life is to have an idea about what retirement might look like, but also that those ideas can change over time,” said Pumphrey.

Rivera may want to live in Puerto Rico now, but who knows if he will still want to in ten years, says Pumphrey. If he changes his mind, he has to deal with trying to sell the property and the potential for losses.

Rather than going all in, Pumphrey advocates a test-the-waters approach in which you take small bites.

“Instead of buying a house in the Caribbean or buying an RV right now, maybe rent an Airbnb or an RV a couple of weeks a year for a few years and see if you like it,” he says. “Even people with these grandiose ideas of how they want to spend all this money decide 'it isn’t for me.'”

Evaluate your reasons for prepaying

Ultimately, your motivation will dictate why you are prepaying your retirement bucket list item. For Rivera, it's a desire to retire to a place he always dreamed of and to pass it on to his kids and maybe grandkids, and he’s ok if it doesn’t make him a fortune.

For someone else, it may be less about legacy and the location and more about spending time with family.

“I always say for people to evaluate really what they value, what's more important to them, and make sure they are prioritizing that in terms of their spending decisions,” said Pumphrey.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.