Forget FIRE: Why ‘FILE’ Is the Smarter Move for Child-Free DINKs

How shifting from "Retiring Early" to "Living Early" allows child-free adults to enjoy their wealth while they’re still young enough to use it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There’s a growing number of people rethinking retirement, not because of Social Security changes or longer lifespans, but because of something far more personal: They don’t have children, and increasingly, they don’t plan to.

In a way, they’re following a path not unlike Simone de Beauvoir and Jean-Paul Sartre, the 20th-century literary power couple that famously chose a child-free life and built a partnership around freedom, intellectual work and self-directed purpose.

Their arrangement was considered unconventional at the time. Today, it reflects a broader reality: More adults are child-free by choice, often due to financial constraints or simply because they want a lifestyle with fewer limitations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Consider that in the past two years, the expense of raising a child has jumped roughly 25% to nearly $300,000, not including college, according to a LendingTree study.

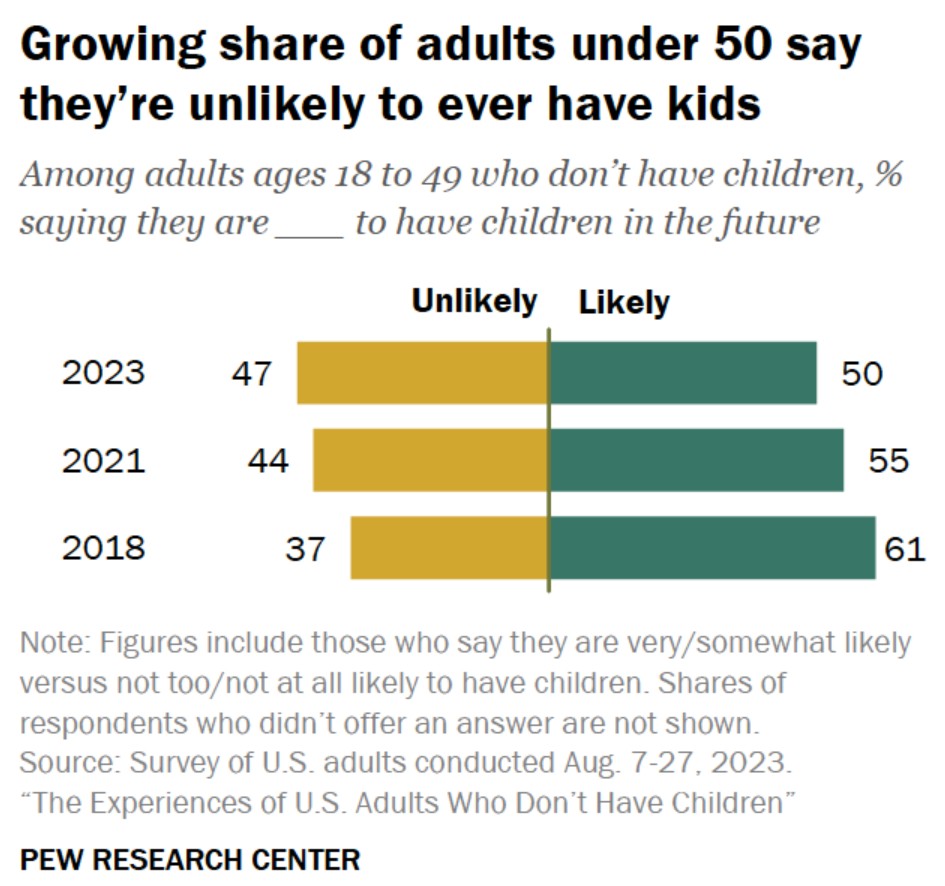

Pew Research finds that the share of U.S. adults under 50 without children who say they’re unlikely ever to have kids rose from 37% in 2018 to 47% in 2023, with more than a third citing cost as a major reason. Yet, the top two reasons were that they "just didn’t want to” and “wanted to focus on other things."

Without waiting for the proverbial birds to leave the nest, many child-free adults are choosing to structure their wealth and work so they can enjoy life sooner. Some look to the FIRE (Financial Independence, Retire Early) movement. Others don’t dream of retiring early or stopping work altogether; instead, they want the freedom to work differently.

That approach is increasingly known as FILE (Financial Independence, Live Early), an acronym far more vibrant than it sounds and unrelated to taxes or office supplies. It's gained momentum as remote work enables digital nomadism, geo-arbitrage or nontraditional lifestyles such as RV living. The premise is to build financial stability, not to quit working, but to use your resources to shape a more meaningful and enjoyable life today.

That raises a question more people are asking themselves: Do you want to retire, or would you rather have a life you enjoy sooner? If retirement isn’t the goal, FILE might be the better path.

What exactly is FILE, or child-free retirement planning?

Retirement is traditionally viewed as an on-off switch: You work full-time, then one day you stop. Financial planning, in that model, revolves around saving enough to flip that switch safely.

That’s not what all workers want. The 2025 EBRI Retirement Confidence Survey (PDF) finds that about half of workers expect to retire gradually rather than abruptly, suggesting many prefer a phased transition rather than a hard stop.

FILE embraces that preference. It treats work as a continuum rather than a finish line, aiming to adjust your intensity, schedule and type of work so you can support more of the life you want now, not decades from now.

"Living early" might mean earning less for a time or slowing your savings rate, but with the goal of a more balanced life in the years when you’re healthiest and most active. As Joseph Piszczor, CFP® and founder of Washington Family Wealth, explained, "FILE planning tends to emphasize resilience and optionality over legacy-driven goals."

The FILE strategy generally involves building a sizeable nest egg, then shifting into a desired role, such as nonprofit work or a long-delayed creative pursuit. You could say it resembles other planning strategies, such as Barista FIRE or Slow FI. That is, building enough wealth up front to create flexibility while continuing to work until retirement at a pace and in a role that feels sustainable and aligned with personal goals.

How FILE works in practice

Imagine someone like Jane, a fictional but realistic example of a FILE lifestyle. After years of 60-hour workweeks as a Fortune 500 executive, she shifts into a flexible online business. She now works about 25 hours a week — never before 10 a.m., never on Fridays — and some months she and her partner spend a few weeks living in another state or country.

Not having children doesn’t make someone wealthy, but it can remove major lifetime expenses and open flexibility in career choices, travel, where you live and timing of big decisions. That can mean the "enough" number — the level of savings needed to reach work-optional status — can appear earlier for child-free households.

As Piszczor puts it, "Child-free households often don’t need to earmark capital for dependents or education, which can lower long-term required savings."

FILE might offer lifestyle flexibility, but it still relies on disciplined financial habits. Clear budgeting and reducing debt help widen your options, while thoughtful saving and investing before cutting back hours create the financial breathing room needed to work differently without jeopardizing long-term security.

Account selection also matters. "FILE strategies hinge on liquidity and access," Piszczor says. "Skipping employer matches to stay flexible is usually a mistake. Those matches materially boost savings and can still align with FILE when paired with Roth conversions or taxable strategies.”

He says FILE-oriented savers might consider blending taxable brokerage accounts with Roth accounts so they can access funds before traditional retirement ages without penalties.

The risks and realities of FILE

While FILE offers a more flexible lifestyle, Piszczor notes that "flexibility comes with tradeoffs. Many still want to support extended family, plan for their future care needs or self-insure risks that parents sometimes share across generations." In other words, such as any financial strategy, FILE has its own set of potential risks and drawbacks.

Health care is one of the biggest hurdles. Moving to part-time work or freelancing typically means losing employer-sponsored insurance. Until Medicare begins at age 65, individuals must rely on the ACA marketplace or private coverage, and premiums can be significant. This alone can delay or complicate a move toward reduced hours.

For child-free adults, longevity planning carries additional weight. Without adult children to rely on, long-term care becomes a more personal responsibility. That might involve extra savings for later life, considering long-term care insurance or hybrid policies, or arranging caregiving support with trusted friends or extended family.

Income variability is another factor. Someone who scales down at 50 might assume they can scale back up later if needed, but the data tell a different story. According to the EBRI (PDF), roughly 75% of workers expect to work for pay in retirement, yet only about a third of retirees do — often because of health issues, caregiving responsibilities or a lack of available jobs.

Piszczor emphasizes that “successful FILE planning requires scenario modeling and stress-testing irregular income.” But perhaps most important, he says, is the mindset shift from “retire early” to “design work to fit life.”

Simone de Beauvoir once wrote, “Change your life today. Don’t gamble on the future.” For more workers, especially those without children, that sentiment is becoming the foundation not just of personal philosophy but of financial planning.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.