Stress Test Your Retirement Plan: Because Life Happens

The higher your stress test score, the more likely your retirement plan will hold steady in a crisis.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You can stress test your retirement plan, just as your doctor can challenge your heart function or a bank can run scenarios that might cause it to fail. A retirement plan is only as good as its ability to weather financial storms, such as shocks to the stock market. A good stress test will also forecast whether there’s a risk you could run out of money or you need to course correct to avoid money troubles in retirement.

Financial stress tests, of course, aren’t new. In response to the 2008 financial crisis, the Federal Reserve began stress testing the nation’s biggest banks to see if they had enough capital to absorb losses and keep lending to borrowers during stressful economic conditions.

Performing a stress test on a retirement plan is a way to assess how well a 401(k) and a comprehensive retirement plan, for example, can withstand volatility in the stock market or other financial shocks, such as an economic recession, job loss, exorbitant healthcare or long-term care costs, or periods of high inflation that reduce purchasing power.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What is a stress test of a retirement plan?

“A stress test is an exercise to see how the portfolio withstands different market outcomes,” said Cassandra Rupp, a senior wealth advisor and certified financial planner at Vanguard.

Stress tests are a way to model for an uncertain future that’s impossible to predict. The goal is to run your portfolio through a range of different market and economic scenarios, both good and bad, to see if you’ll still be able to maintain your spending in retirement throughout your lifestyle and have money left at the end of your life.

“We hope that things are going to go really well in retirement,” said Ryan Viktorin, a certified financial planner and VP, financial consultant at Fidelity Investments. “But we have to make sure that the plan and numbers still work given some of the risks that we face.”

Stress tests should consider average market return scenarios as well as below-average returns and bullish above-average returns, says Viktorin. “Most people look at the average market returns over time and think things look pretty rosy,” she added. “But we like to show them what it looks like in a significantly below-average return period.”

The three big unknowns

There are three major uncertainties retirees must consider, says Roger Young, a thought leadership director at T. Rowe Price.

Investment performance and related market volatility are a big one. Earning a lower return than anticipated or suffering portfolio losses at the wrong time can upend a plan. Folded into this category are the sequence of returns risk and similar market challenges.

Longevity, or how long we live, is another. Some people will spend 30 or 40 years in retirement, or more years than they spent working. “Living a long and healthy life is a positive, but it puts potential additional stress on your finances,” said Young.

The third unknown is how much retirees will spend or need to draw from savings, as initial spending projections can change due to unexpected healthcare costs later in life or a spike in inflation. “With stress testing, most people think of the investment side, but you want to think about stress testing across all the uncertainties that are particular to you,” said Young.

How do you stress test your retirement finances?

Financial pros use computer-generated Monte Carlo simulations to stress test retirement plans against many different investment outcomes. “It’s an excellent tool,” said Young. “This financial forecasting method or probability modeling, which runs a retiree’s plan through thousands of different financial simulations and bakes in assumptions like your starting portfolio balance, rates of return on investments, investment time frame, longevity, saving rates, inflation and spending, comes up with a score that projects the probability — or odds — of reaching your financial goals.

However, unlike a basic investment or retirement calculator that allows you to plug in a fixed annual projected return, such as 10%, to determine portfolio balance growth over time, a Monte Carlo analysis takes market volatility into account. Stress testing a retirement portfolio by looking at varying patterns of returns is more realistic and provides better insight into how your plan will fare under the most adverse economic conditions.

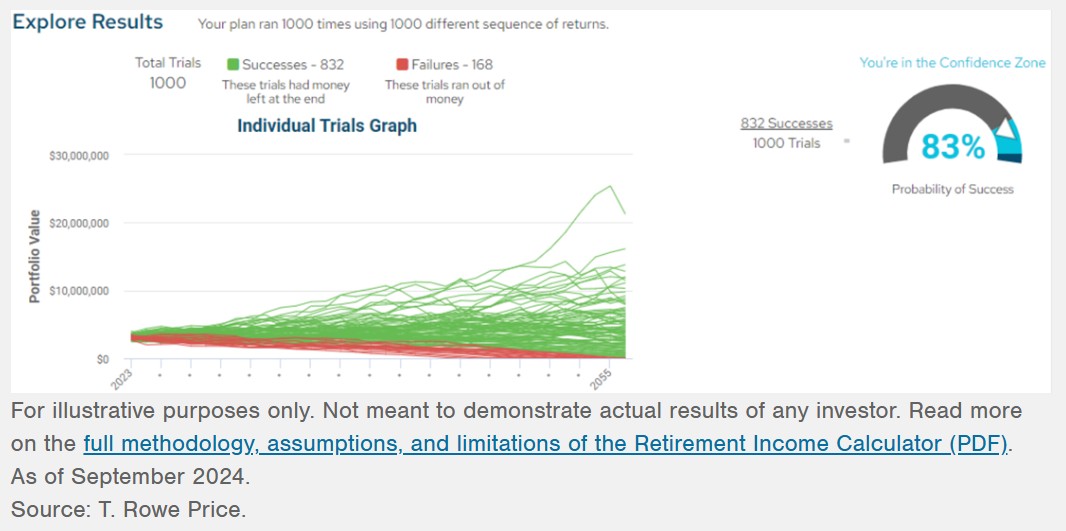

The results of Monte Carlo simulations are expressed numerically from 0 to 99. Let’s say after running 1,000 different simulations using your current plan assumptions, 750 point to a positive outcome of never running out of money and 250 simulations indicate you will fall short and run out of money. The Monte Carlo simulation score of 75 indicates that you have a 75% chance of meeting your retirement goal.

Most financial professionals prefer probability of success scores of 85% or above, but the higher the odds of success, the more wiggle room you have if your situation changes over time. “If their (odds of reaching their goal is) 70% and 84%, we consider that slightly off course,” said Rupp. “If they’re under 69%, we consider that off course.”

When running simulations for clients, Vanguard assumes a life expectancy of 100. “We want the longest time horizon,” said Rupp. No one knows for sure when they will pass, so it’s important to plan for longevity.

A Monte Carlo simulation, for example, can help you answer questions, such as, “What is the probability of running out of funds by age 85?” If the odds of that negative outcome are too high, the Monte Carlo simulation can help you modify your plan for success. For example, it could determine how much more money you need to invest each month to bring your risk score to a more acceptable level.

For most people, working with a financial adviser who specializes in retirement planning is probably the easiest way to stress test their portfolio.

Here is an illustration of 1,000 simulations and a related confidence score from T. Rowe Price.

How to improve your score

A recent white paper from T. Rowe Price illustrates how to improve what the mutual fund dubs your retirement "confidence score." In a hypothetical example, a 56-year-old named Lee thinks he’s in good shape to retire at age 65. Despite a $100,000 salary and $500,000 saved for retirement in a moderate risk portfolio of 60% stocks, and annual savings of 10%, Lee’s confidence score, or odds of success, is only 68%.

But a few tweaks put Lee back in much better shape. His decision to increase his annual retirement contributions to 15% of his pay boosts his probability of success to 76%. He also opts to reduce his spending in retirement by 6%, which boosts his confidence score to a much more attractive 84%. So, by simply boosting savings and cutting spending, Lee was able to get back into what T. Rowe Price dubs the “confidence zone.”

If your score is on the low side, you can pull levers to boost your odds of retirement success, says T. Rowe Price’s Young. You can always reduce your spending in retirement, save more, postpone retirement, or boost the stock exposure in your asset allocation.

Young adds that many people focus too much on having a near 100% probability of success. But that often comes at an expense. “I mean you’re sacrificing,” said Young. “You could be doing other things with your money during your life to make your life better. Consider accepting a slightly lower probability of success and enjoying your retirement a little more.”

Other forecasting methods or DIY stress tests to consider

If you are not working with a financial adviser who can run a Monte Carlo simulation for you, a simple back-of-the-envelope analysis may give you a general sense of your retirement's security. Take a look at what percent of your expenses are covered by guaranteed income, says Viktorin. If you can cover all your expenses with guaranteed income like Social Security or a pension without having to tap your investment portfolio, your odds of success are good.

Another basic forecasting method is to assume a constant rate of return (such as 8%) for your account balance over time to estimate future portfolio value. For example, if you have $250,000 saved now and the future value over 20 years swells to $750,000 and you estimate that that’s the number you’ll need to save to retire comfortably, you have a baseline to follow.

You can also plug in annual return estimates that look at a base-case, best-case, and worst-case scenario to determine if your plan can get you to the finish line under the worst economic and market scenario.

Stress testing your retirement account isn’t a one-and-done process, adds Viktorin. Things change. So, it’s important to update your ability to withstand market stress if your personal financial situation changes.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.