The 'Sequence of Returns' Risk Could Shrink Your Retirement Nest Egg

The 'sequence of returns risk' — a sharp decline in stock prices during the early years of retirement — can damage your portfolio. Here's how to prevent it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It’s the nightmare that jolts recent retirees awake at night: after a lifetime of saving in a 401(k) or IRA, the stock market goes into freefall the day they stop working and keeps going down, putting a sizable crack in their retirement nest egg.

It may be challenging to envision a significant market correction, given that the S&P 500 has gained almost 12% in 2025 and small-cap stocks are at a four-year high. Yet anyone who lived through the Great Recession of 2008 or market volatility during the early years of the Covid pandemic knows that a rosy market can quickly turn dark.

The downside of such an ill-timed market downturn would be especially acute for recent retirees who no longer receive paychecks at work and must start withdrawing from their retirement accounts. The one-two punch of selling stocks in the early years of retirement when share prices are declining in value can deplete a retirement nest egg prematurely and put long-term retirement security into question. This bearish scenario can cause even greater financial pain if the downdraft drags on for a year or longer.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“The order and timing of returns matters greatly in determining how long your savings will last and how sustainable your spending plan is,” says Rob Haworth, senior investment strategy director at U.S. Bank Asset Management. “The challenge is, once you start spending (your nest egg), you’re a little more sensitive to market drawdowns.”

What is “sequence of returns risk”?

Wall Street dubs this investment hazard “sequence of returns risk.” In a nutshell, the way the math works is portfolio declines that occur early in retirement can have a much more significant impact on your portfolio. These early losses can severely weaken your 401(k) or IRA’s growth potential and its ability to generate the steady income retirees need throughout life, even if the market eventually recovers.

In fact, the sequence of market returns can determine whether you run out of money in retirement or have money left over to leave to heirs, according to a recent study from U.S. Bank Wealth Management.

A tale of two investors

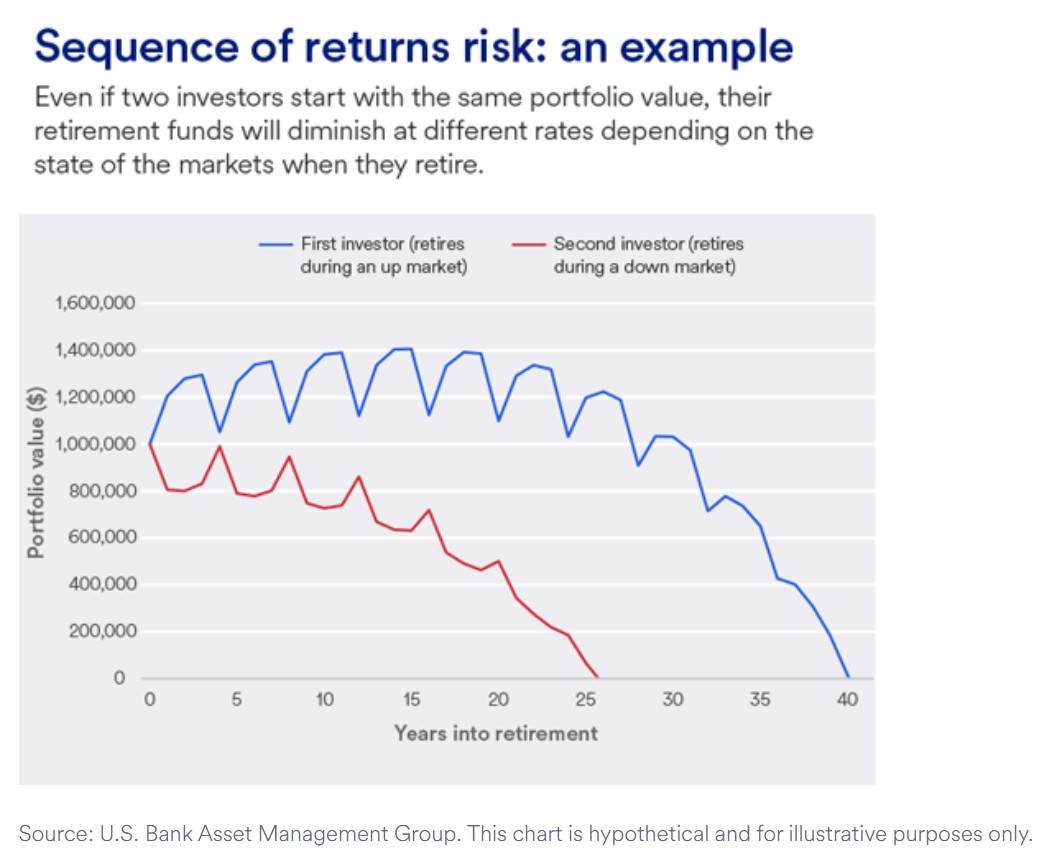

Consider two investors with $1,000,000 in their retirement accounts with plans to withdraw $45,000 per year plus adjustments for inflation in later years. Over the course of their retirements, both portfolios post comparable average annual returns but follow a different year-to-year performance pattern.

Investor one benefits from three straight years of positive returns (+25% in year one, +10% in year two, and +5% in year three) at the start of retirement. This investor, however, suffers a 15% decline in year four.

Investor two starts off retirement in a down market with declines of 15% in year one, followed by gains of 5%, 10%, and 25% in three subsequent years.

Both investors have identical performance in the remaining years of retirement.

The outcomes, though, are quite different.

The first investor benefits from up markets in the initial retirement years, which allows the portfolio to grow despite taking distributions to pay bills. The strong market early in retirement allows the investor’s nest egg “to generate the desired amount of income for 40 years,” the hypothetical study found.

Unfortunately, the second investor, who retired in a year when markets were down, did not have such a rosy outcome. That one year of decline resulted in a significant loss of portfolio value with lasting consequences. Selling assets into a down market meant the portfolio didn’t have enough time to fully recover, significantly damaging the investor’s long-term strategy. This investor ran out of money after 25 years, the study found.

It's clear that withdrawing from retirement accounts in down markets has lasting implications for savers.

“It puts your retirement plan a little more at risk,” says Haworth.

How sequence of returns risk could damage your 401(k)

Let’s say you have $1,000,000 in your 401(k), and you plan on 4%, or $40,000, annual withdrawals, but in your first year of retirement, the market is down 10%. Your $1 million nest egg will quickly be trimmed to $860,000 due to the down market, far less than the $960,000 you’d be left with even if the market is flat.

The downside is two-fold. First, you’ll have to sell more shares to generate the income you need to pay bills in retirement than you would if stocks were in rally mode. Secondly, you’ll have fewer assets left in your account to benefit from the eventual recovery. “Once assets are spent, those assets can no longer generate the growth necessary to last through retirement,” says Haworth.

Of course, stock declines later in retirement have a smaller impact on your portfolio. Why? Your portfolio has had more years to benefit from compounding (or gains earned on the remaining principal and prior gains). Plus, you have fewer years of longevity remaining, which reduces the chance you’ll run out of money.

And while the sequence of returns risk hits retirees hardest when the stock market suffers losses for more than a year, that’s rare. Going back to the Great Depression in 1929, there have been only four periods when the broad U.S. stock market has posted negative returns two calendar years in a row.

Ways to minimize the sequence of returns risk

The goal is to develop a strategy that avoids having to draw down principal in down markets at the beginning of retirement.

Haworth recommends the so-called “bucket approach, which sets aside a portion of your money for short-term needs and later phases of retirement.

The bucket strategy

The first bucket is a so-called “liquidity” bucket to meet your short-term cash needs in retirement, such as paying the mortgage and cable bill and buying groceries. This money should be parked in safe investments, such as high-yield savings accounts, CDs, and short-term bond funds, which have minimal exposure to market fluctuations. “Let the market recover before you start taking withdrawals from the volatile piece of your portfolio,” says wealth advisor Jim Elios, founder and CEO of Elios Financial Group.

Having one to two years of cash on hand should help you avoid tapping depressed assets even in prolonged downturns.

“This money is meant to be that cozy safety blanket that’s there for you when you need it,” says Haworth. With cash earning 4% or more these days, it’s also a way to earn some income while the money is sitting idle, adds Haworth.

Bucket number two should address short- to medium-term savings goals and can be invested in a diversified portfolio of stocks and bonds, such as a 60/40 stock-to-bond portfolio. It is not advisable to be 100% invested in stocks, as a big market drop early in retirement might make it too hard to recover from.

“Diversification is very important,” says Haworth. A 50/50 stock/bond mix, for example, means if the stock market is down 10%, your portfolio might only be down around 5%. Those smaller losses add more resilience to your spending plan, as your nest egg will suffer smaller losses. In short, this bucket should include a diverse range of asset classes in the portfolio, allowing you to identify an asset that has increased in value and opt to sell it if desired, rather than being forced to liquidate assets that have decreased in value.

“If you have the flexibility to do so, definitely take withdrawals from the asset classes that have held up, and delay withdrawals from the declining stock portion of your portfolio,” says Elios.

Your final bucket can be investments with long-term growth potential in mind that have the time to ride out any market storms.

Reduce your distributions

Another way to mitigate the sequence of returns risk if you must tap your portfolio for income is to reduce the size of your annual distributions. If you had planned on a 4% annual withdrawal rate, you might dial that back to 3%. Another strategy is to take withdrawals from funds in your retirement account that are in the green.

Fold the risk into your retirement plan

Evaluating how the sequence of returns risk could impact your retirement security should always be part of your broader financial plan, says Nick Bour, founder and CEO of Inspire Wealth.

“You should absolutely look at how it could impact your investments going into retirement,” says Bour. Ask yourself, “Should I be looking at a more conservative asset allocation as I enter my first phase of retirement and not be hurt negatively (by a market downturn)?”

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.