Average Cost of Health Care by Age and US State

Knowing the average cost of health care as you age can help you plan. We've got solutions for how to cover these skyrocketing costs.

Ellen B. Kennedy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you can afford the average cost of health care as you age, you'll be closer to solving one of the thorniest problems in retirement planning.

Unfortunately, the older you get, the crankier your body gets. That means more trips to the doctor, more prescriptions to fill and more money spent on care.

The average monthly cost of health care exceeds $1,300 by the time you're 60. It’s no surprise, then, that 80% of respondents to an RBC Wealth Management survey (PDF) said they’re concerned about funding the cost of health care in retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Health care expenses in retirement rank second after housing costs, according to Western & Southern Financial Group. Given projected Medicare funding shortfalls by the next decade, planning for medical costs will be even more important.

What does health care cost at different ages — and stages of life? To find out, we dove into health expenditure data by age from the nonpartisan Center on Budget and Policy Priorities, the Peterson-KFF Health System Tracker and an analysis by ValuePenguin, a financial information website.

Average cost of health care rises over time

In the big picture, here’s what the numbers tell us.

If you’re 55 and older, you can expect to pay anywhere from 50% more or even double what you would in your 20s, 30s or 40s according to ValuePenguin data that look at average monthly premiums for Silver tier coverage (e.g., moderate monthly premiums and moderate out-of-pocket expenses) purchased on the Affordable Care Act (ACA) marketplace.

If you’re 65 or older, expect to pay even more. A small segment of the population accounts for an oversize share of total health spending each year. That’s one key takeaway from the health spending analysis by Peterson-KFF.

People age 55 and older account for more than half (56%) of total health spending, despite making up just 31% of the U.S. population. according to KFF’s analysis of the Agency for Healthcare Research and Quality’s 2021 Medical Expenditures Panel Survey (MEPS).

“Health spending often increases with age, as we generally have more health conditions and need more care as we grow older,” the study co-authors noted.

A KFF report published in July 2025, titled "Americans' Challenges with Health Care Costs," revealed that just under half (44%) of U.S. adults find it difficult to afford healthcare costs.

Adults who’ve been diagnosed with chronic conditions, such as emphysema, diabetes, heart disease and high blood pressure, have much higher medical costs. Annual out-of-pocket costs, on average, go up for common medical conditions, such as diabetes (plus 27%), heart disease (plus 55%), and high blood pressure (plus 19%), according to new research from T. Rowe Price.

Those with mental health diagnoses such as anxiety and depression also pay more out-of-pocket for care.

Typically, younger people are healthier, have fewer chronic health conditions and, as a result, pay less for health care coverage. Here’s a cost breakdown by age that illustrates how medical bills can rise as people age.

Age | 2025 Cost | 2026 Cost (estimated) |

|---|---|---|

20 | $471 | $571 |

25 | $488 | $591 |

30 | $552 | $668 |

35 | $594 | $719 |

40 | $621 | $752 |

45 | $702 | $850 |

50 | $868 | $1,052 |

55 | $1,084 | $1,313 |

60 | $1,319 | $1,598 |

64 and older | $1,458 | $1,766 |

*Cost for Affordable Care Act (ACA) Marketplace “benchmark” plans in Silver tier coverage, which comes with moderate monthly premiums and moderate out-of-pocket costs.

Source: ValuePenguin

Health care cost components

Age:. “Age is one of several factors insurers use when calculating your health insurance premium,” said Dan Marticio, insurance expert at SmartFinancial, an online insurance marketplace.

For marketplace insurance plans, health insurers also consider these other factors when calculating premiums, according to SmartFinancial.

Location. Premium prices can vary by state and even by city, based on different costs for medical products, prescription drugs and care. See the table below for the average cost in your state. Keep in mind that the average cost of care in your state might be lower or higher for you, depending on your age or other factors.

Tobacco use. Smokers can pay up to 50% more than nonsmokers. You might be able to reduce your insurance rate a year after you quite smoking.

Number of insured. Adding dependents, such as children or a spouse, can increase the cost of health insurance.

Plan category. There are five coverage tiers for Marketplace health care plans, ranging from low-end Bronze to high-end Platinum. There’s also a Catastrophic plan.

The Bronze plans charge the lowest monthly premium but have the highest deductibles and out-of-pocket costs. In contrast, Platinum plans charge the highest premiums but cost you the least out-of-pocket.

State | 2025 | 2026 | Percent Change |

National | $621 | $752 | 21% |

Alabama | $564 | $691 | 23% |

Alaska | $1,088 | $1,037 | -5% |

Arizona | $529 | $685 | 29% |

Arkansas | $494 | $823 | 67% |

California | $656 | $728 | 11% |

Colorado | $554 | $703 | 27% |

Connecticut | $708 | $859 | 21% |

Delaware | $578 | $759 | 31% |

Florida | $647 | $859 | 33% |

Georgia | $553 | $729 | 32% |

Hawaii | $523 | $583 | 11% |

Idaho | $490 | $537 | 10% |

Illinois | $684 | $888 | 30% |

Indiana | $432 | $558 | 29% |

Iowa | $507 | $624 | 23% |

Kansas | $642 | $787 | 23% |

Kentucky | $538 | $662 | 23% |

Louisiana | $654 | $827 | 26% |

Maine | $623 | $771 | 24% |

Maryland | $412 | $480 | 16% |

Massachusetts | $661 | $725 | 10% |

Michigan | $561 | $719 | 28% |

Minnesota | $451 | $556 | 23% |

Mississippi | $533 | $756 | 42% |

Missouri | $616 | $742 | 20% |

Montana | $636 | $763 | 20% |

Nebraska | $743 | $960 | 29% |

Nevada | $592 | $792 | 34% |

New Hampshire | $373 | $491 | 32% |

New Jersey | $583 | $669 | 15% |

New Mexico | $635 | $800 | 26% |

New York | $1,038 | $1,090 | 5% |

North Carolina | $664 | $800 | 21% |

North Dakota | $627 | $700 | 12% |

Ohio | $536 | $635 | 18% |

Oklahoma | $603 | $739 | 23% |

Oregon | $610 | $643 | 5% |

Pennsylvania | $610 | $750 | 23% |

Rhode Island | $477 | $589 | 23% |

South Carolina | $538 | $657 | 22% |

South Dakota | $690 | $734 | 6% |

Tennessee | $558 | $775 | 39% |

Texas | $610 | $826 | 35% |

Utah | $675 | $821 | 22% |

Vermont | $1,157 | $1,224 | 6% |

Virginia | $421 | $514 | 22% |

Washington | $543 | $761 | 40% |

Washington, D.C. | $573 | $618 | 8% |

West Virginia | $955 | $1,093 | 14% |

Wisconsin | $608 | $722 | 19% |

Wyoming | $895 | $1,119 | 25% |

*Your cost might be lower or higher, depending on your age or other factors. Source: ValuePenguin

How to cope with the cost of health care in retirement

The high cost of health care in retirement can be daunting. A 65-year-old who retired in 2025 can expect to spend $172,500 on health care throughout retirement, according to 2025 Fidelity Investments’ latest Retiree Health Care Cost Estimate report.

“Year after year, so many Americans underestimate how much they’ll need to save to cover health care costs in retirement,” said Shams Talib, head of Fidelity Workplace Consulting. The uncertainty surrounding one’s health trajectory, rising premiums and hard-to-predict out-of-pocket costs are the major reasons why many people stress about medical care and costs.

Get some perspective

T. Rowe Price research suggests it’s a mistake to view health care expenses in retirement as one giant lump sum amount. Despite these so-called big, scary numbers, nobody pays for health care all at once. It makes more sense to view medical costs as an ongoing budget.

“(Medical expenses) are spread out over many years,” Stuart Ritter, vice president, insights director at T. Rowe Price, wrote in a piece aimed at financial advisers titled, “What Your Clients Need to Know About Health Care Costs in Retirement."

“(Our research shows that) health care is far more financially manageable than it’s made out to be,” Ritter said. What makes planning a bit easier is the fact that policy premiums, which account for 73% of health care expenses, are predictable fixed costs that retirees can plan for and pay from monthly income, according to T. Rowe Price.

The more unpredictable expenses, which are more challenging to plan for, such as out-of-pocket expenses, account for just 27% of overall medical costs.

Severe health care 'shocks' are rare

What’s more, despite the pervasive fear of so-called health care “shocks,” or large, unexpected costs that arise due to an illness, causing financial ruin, only a small percentage of retirees experience such a destructive financial hit.

Only 10.9% of retirees experienced an increase in medical costs from $2,000 to $5,000 over a two-year period, according to T. Rowe Price research (PDF). Just 2% experienced an increase of $25,000 or more over a 24-month span.

How to plan for your future cost of health care

Like any financial goal, paying for health care costs requires planning. RBC Wealth Management (PDF) advises younger savers with time on their side to create a long-term investment plan to help cover the costs later in life.

Look to your employer

Workers should take advantage of workplace wellness programs, which can help reduce the cost of health care as they age. It's also prudent to choose the right health care plan that offers the best mix of coverage and cost.

Plan for significant ACA premium increases next year

For anyone not on Medicare or employer-sponsored insurance, the big question is whether Congress will extend a subsidy (enhanced premium tax credit) for ACA Marketplace plans. Without such help, an average premium will more than double. These changes could hit older Americans particularly hard.

For example, a 60-year-old couple with an annual income of $85,000 currently paid an average of $7,225 for ACA Marketplace insurance in 2025, according to the Center on Budget and Policy Priorities. Without existing subsidies, that same couple's premium in 2026 would be $31,762, an increase of 340%.

Think Roth

Investing in a Roth 401(k) is another savings vehicle to consider, as you can withdraw your retirement savings tax-free, freeing up additional dollars to fund health care in retirement. Consider converting a traditional 401(k) into a Roth 401(k); you can convert all or part of your traditional 401(k), and you can stagger conversions to lower your taxable income in the years you convert.

Invest in HSAs for the long-term

Using tax-friendly health savings accounts (HSAs), which offer pre-tax contributions, tax-free investment growth, and tax-free withdrawals for qualified health care, can also be advantageous and reduce the onerous impact of high medical costs in your golden years. You can even use your HSA to pay for Medicare premiums.

Keep in mind that HSA contribution limits have risen steadily. In 2025, single plans can contribute up $4,300 and family coverage can save $8,550 in an HSA. Individuals 55 and older can contribute an additional $1,000. Before you go whole hog on HSAs, look for hidden costs such as fees and yields.

Don't forget long-term care

Finally, think about how you might pay for long-term care. You might think you'll never need it, but government data show that about 70% of older adults require long-term care.

In addition to some of the strategies mentioned above, long-term care insurance and annuities might help fund long-term care needs. Both these options have downsides, so research them carefully.

Medicare premiums will also increase in 2026

Medicare Part B costs are expected to rise more than 11% in 2026. Moreover, if you're 63 or older, remember to account for the IRMAA two-year rule.

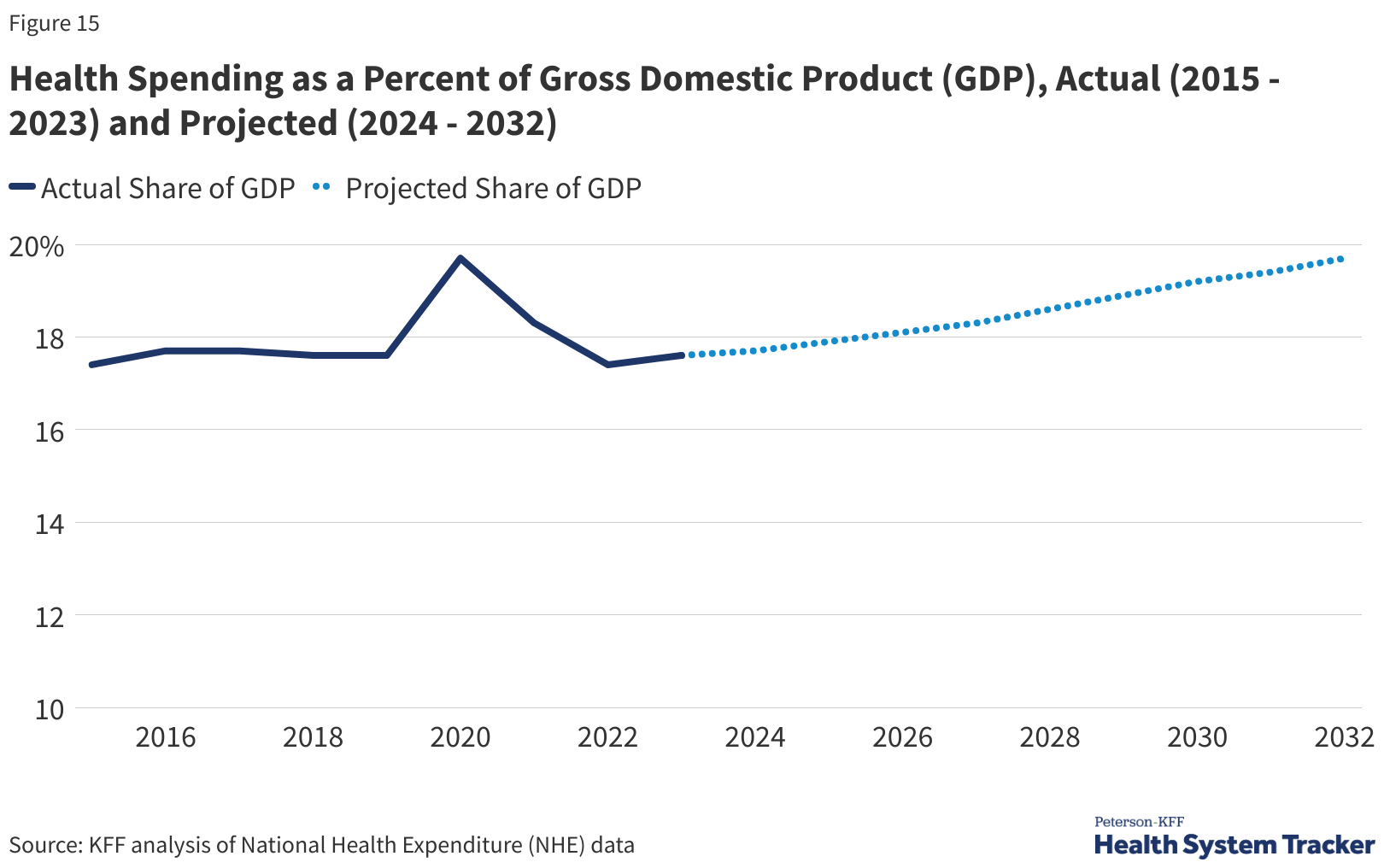

Health care cost forecast to 2032

Health care is projected to remain a drag on U.S. GDP over the next decade, according to KFF. In addition to an aging population, these costs are rising due to the increasing use of GLP-1 drugs such as Ozempic, new cancer drugs and price increases that outpace inflation.

In other words, as health care costs the U.S. a greater share of its GDP over time, the government will be less able or likely to help consumers.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.