The 90+ Rule of Retirement: Live Long and Prosper

What good is living longer if your money doesn’t last long enough to enjoy it?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

What good is a pension if you don’t live long enough to enjoy it? When Germany introduced the world’s first old-age social insurance program in 1889, the retirement age was set at 70. The problem? Life expectancy at the time was around 40, so many people never reached retirement at all.

Today, we face the opposite problem. What good is living longer if your money doesn’t last long enough to enjoy it?

Although Americans feel more optimistic about retirement, one of their top concerns is the possibility of living longer than expected, according to a survey by Natixis Investment Managers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

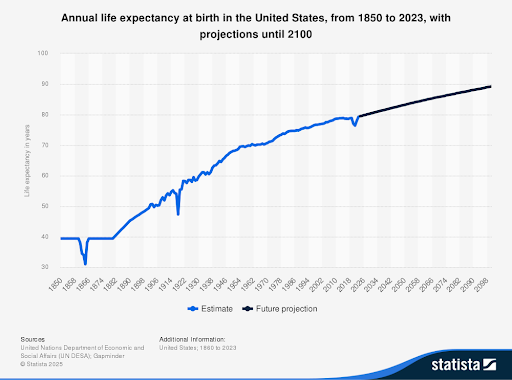

Since 1850, life expectancy at birth in the U.S. has doubled from 39.4 years to 79.6 years in 2023. And UN projections estimate it will climb by another nine years by the end of the century.

Advances in medicine, from AI-powered diagnostics to GLP-1 drugs, could stretch lifespans even further. It’s why many financial professionals now urge clients to ditch outdated assumptions and consider the possibility of living well past 90 — because you just might.

Enter the 90+ rule of retirement: From how you invest to when you claim Social Security, every major retirement move should be made with the expectation that you could live into your 90s or beyond.

With the big 9-0 in mind, here’s how to position your finances, lifestyle and expectations for the long haul.

Extend your career (even just a little bit)

One of the most effective ways to prepare for a longer life is also one of the simplest: work a little longer, if you’re able and willing.

Even just a few extra months can make a surprising difference. A 2018 study found that working just three to six months longer can boost retirement income as much as increasing retirement contributions by 1% annually over 30 years.

And the benefits go beyond your wallet.

“Continuing to work provides intellectual and physical activity, which is very important to healthy longevity,” says David Haas, CFP® and owner of Cereus Financial Advisors. In fact, several studies have linked working past traditional retirement age to better health and, yes, even longer lifespans.

Plan for rising costs, not just reduced spending

Many retirees assume they’ll naturally spend less as they age, but that’s not always how it works.

“Contrary to popular belief, many retirees maintain or even increase their spending post-retirement,” says David Rosenstrock, director of financial planning and investments at Wharton Wealth Planning.

The real challenge isn’t always lifestyle creep; it’s shrinking dollars. “Retirees need to consider how inflation will impact their expenses over time,” Rosenstrock explains. “While some costs may stay stable, others, like housing, healthcare and travel, are especially vulnerable to inflationary pressures.”

Invest for the long haul and withdraw wisely

One of the best defenses against inflation is growth within your portfolio. “That’s why you need stocks in your portfolio,” says Haas. “The stock market is an excellent long-term inflation hedge because the value of company earnings – what stock prices are based on – tends to rise with inflation.”

But investing in retirement is a balancing act. For many retirees, “it makes sense to lower the risk level and focus on investments that provide steady and reliable income,” says Bobbi Rebell, CFP® and consumer finance expert at CardRates.com.

How you draw from your portfolio matters just as much as how you build it. “A flexible withdrawal strategy that allows you to dial spending down during market downturns can add decades to portfolio longevity,” says Joe Petry, CFP® and founder of Mayfair Financial.

Build a resilient income plan

To make it through your 90s, experts emphasize the need for a dependable stream of income. Ideally, from multiple sources.

“Diversification of income sources will bring peace of mind,” says Rebell. That could include Social Security, retirement accounts, savings, dividends, rental income, annuities, part-time work – you name it. The idea is to avoid relying too heavily on a single source, especially one that is vulnerable to market swings.

When it comes to guaranteed income, advisor and CFP® Catherine Valega of Green Bee Advisory says annuities deserve consideration: “Annuities can play an important role, and there are new ‘longevity’ contracts and solutions to explore.” Longevity annuities, in particular, start payouts later in life – often between 75 and 85 — making them a potential backstop against outliving your savings.

Still, these products aren’t one-size-fits-all. Carla Adams, CFP® and founder of Ametrine Wealth, cautions that annuities “can be expensive, complex, and hard to unwind, which limits flexibility.” In other words, buyer beware.

Delay Social Security for a bigger payoff

Gallup’s research on retirement income sources finds that Social Security is the most important major income source for retirees. And the longer you expect to live, the more valuable it can be to delay your benefit.

“One of the most powerful levers is delaying Social Security until age 70, especially for the higher earner in a married couple,” says Adams.

Each year you delay beyond your full retirement age (typically 66–67), your monthly benefit grows by about 8%, not including annual cost-of-living adjustments (COLAs). That growth is permanent and can add up significantly over time.

For example, Adams says a $2,000 monthly benefit at age 67 could grow to roughly $2,480 by delaying Social Security until age 70. For someone who lives into their 90s, that extra $480 a month (along with COLAs) could mean tens of thousands of dollars in additional lifetime income.

Don't just plan for retirement, plan for care

If you live long enough, research suggests the need for care isn’t a matter of if – it’s when. Roughly 70% of people turning 65 today will need some form of long-term care during their lifetime, according to the U.S. Department of Health and Human Services.

“It often makes sense to earmark money specifically for healthcare,” says Rebell. She also encourages retirees to “have a clear understanding of what Medicare does and doesn’t cover, including long-term care.”

“If you are wealthy enough, that plan could be hiring outside help in your home,” says Haas. “Or it could mean moving into an assisted living facility where you get help with meals and care.”

For those who may not be able to self-fund that level of care, long-term care insurance might be worth exploring. Valega says a policy can “protect some assets and provide the resources to allow you the type of care you deserve.”

Remember, health is wealth, especially in your 90s

“Money alone doesn’t carry you through a 90s-long life,” declares Petry. “The happiest long-lived retirees are those who invest not just in markets but in meaning — maintaining purpose, community and health.”

Hence, planning for longevity shouldn’t stop at finances. Petry recommends preparing for the logistical realities of aging, from housing transitions to nurturing social connections. Financial security can fund a long life, he says, but it’s emotional resilience and lifestyle design that make it worth living.

And don’t just think about life in your 90s. Think beyond it. As Rebell notes: “A 90-year-old could live another decade or more! Moreover, they may want to leave a substantial financial legacy to their heirs, so it is important to be intentional and not just ‘run down the clock’ on their money.”

Ultimately, the 90+ rule of retirement isn’t just about simply trying to make your money last. It’s about making your life — however long it lasts — rich in every way that matters.

Read More Retirement Rules

- The Rule of the Shrinking Dollar in Retirement

- The '120 Minus You Rule' of Retirement

- The Retirement Rule of $1 More

- The 'First Year of Retirement' Rule

- The Y Rule of Retirement: Why Men Need to Plan Differently

- The Rule of 240 Paychecks in Retirement

- The 'Die With Zero' Rule of Retirement

- The '8-Year Rule of Social Security' — A Retirement Rule

- The Kevin Bacon Rule of Retirement

- The Rule of Retirement Inversion

- The Rule of 1,000 Hours in Retirement

- The Rule of $1,000: Is This Retirement Rule Right for You?

- The Rule of 55: One Way to Fund Early Retirement

- The 80% Rule of Retirement: Should This Rule be Retired?

- The 4% Rule for Retirement Withdrawals Gets a Closer Look

- The Rule of 25 for Retirement Planning: How Much Do You Need to Save?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.