The '8-Year Rule of Social Security' — A Retirement Rule

The '8-Year Rule of Social Security' holds that it's best to be like Ike — Eisenhower, that is. The five-star general knew a thing or two about good timing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

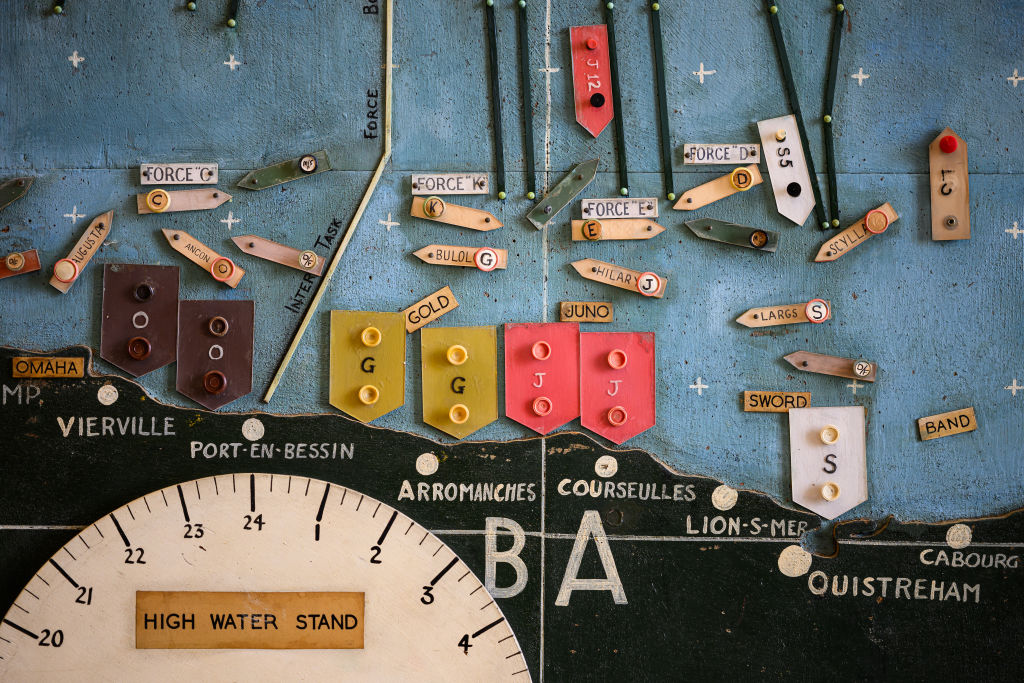

Sometimes, waiting feels like the wrong move. Until it proves to be your best one. For instance, on June 5, 1944, Allied troops were prepared to launch the largest military invasion in history. But when poor weather rolled in, General Dwight D. Eisenhower made the high-stakes decision to delay D-Day by 24 hours, despite enormous pressure to proceed.

That pause changed the course of history.

Sure, the fate of the world doesn’t rest on your decision to file for Social Security. But the quality of your retirement might. And, like Eisenhower’s call, it often comes down to timing.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While retirees draw income from various sources, Social Security remains the most commonly cited. According to the Transamerica Center for Retirement Studies, 91% of retirees expect to rely on it. When you file, anytime between ages 62 and 70, it can mean the difference between a smaller monthly check or a significantly larger one for life.

Think of it as the “8-Year Rule of Social Security,” a strategic window that determines your permanent benefit. Understanding it — and getting the timing right — can be one of the most valuable decisions you make in retirement.

What to know about the '8-year rule of Social Security'

Most people nearing retirement are aware that they can start receiving Social Security as early as age 62 or delay up to age 70. However, fewer people understand the significant impact this eight-year window can have.

Filing at 62 locks in a benefit that’s about 30% lower than what you’d get at full retirement age (generally 66 or 67). On the other hand, waiting until 70 increases your benefit by about 8% for each year you delay, up to about 132% of your full benefit. In dollar terms, if you’re eligible for $1,000 per month at a full retirement age of 66, delaying until 70 would raise your monthly check to $1,320.

Despite the upside, many retirees still claim early. A 2022 Congressional report found that age 62 was the most common age to file, with 29.3% of new retired-worker beneficiaries doing so. The next most popular age was 66 (24.7%), while fewer than 10% waited until age 70.

But the “8-Year rule of Social Security” isn’t just about filing earlier or later, but also understanding how it affects your overall retirement income. Preston Cherry, founder of Concurrent Wealth Management, explains it this way: “Filing at 62 gives you a longer runway, but with smaller checks. Waiting until 70 gives you a larger monthly income, but requires you to bridge the gap. That bridge, how you cover the years between, is where the strategy lives.”

Why timing isn't just about the math

Yes, delaying your benefit results in a bigger monthly check, but that doesn’t always translate into the highest lifetime payout. If you don’t expect to live very long due to health concerns or family history, claiming earlier could make more financial sense.

“It is difficult to provide a rule of thumb since individuals’ situations are so different,” says certified financial planner Clark Randall, director of financial planning at Creekmur Wealth Advisors. “Having said that, there is a general trend that the longer one’s life expectancy, the later he or she should file for Social Security, all things being equal.”

Elizabeth Scheiderer, principal and financial advisor at Signal Tree Financial Partners, puts it more directly: “If you need the cash flow and are retired, then collecting at 62 is the ‘easy’ button. Other than that, it gets complicated.”

And it does get complicated. Timing affects more than just your benefit amount — it also influences tax planning, spousal benefits and how other income sources are coordinated. “Can we use brokerage assets or Roth dollars to cover the gap in a tax-smart way?” asks Cherry. “Will delaying Social Security reduce the chance of big RMDs later or help avoid IRMAA surcharges? Does the break-even age line up with realistic health and longevity expectations?”

Your break-even age is the point at which the total value of delayed, higher payments exceeds the total value of earlier, smaller payments. It’s a key factor in the decision, especially when considering longevity and cash-flow needs.

Plans are worthless, but planning is everything. - Dwight D. Eisenhower

Working longer may also affect your filing decision. Randall points out that “claiming prior to full retirement age while still working will cost $1 of benefit for each $2 of earned income over $23,400 in 2025.” There’s also the Medicare impact, as higher income today could push you into IRMAA territory later, increasing your future Part B premiums.

“There’s a lot of noise out there,” Cherry adds. “Some say, ‘You should always wait until 70.’ Others say, ‘Only take it at 62 if you’re desperate.’ Neither is completely right, and that mindset puts unnecessary pressure on people. We need to normalize choosing what’s best for the individual, not what sounds smartest on paper or what someone heard incorrectly on a podcast.”

President Dwight D. Eisenhower at the United Nations.

How to make the most of the eight-year rule

The biggest mistake people make isn’t necessarily filing too early or too late; it’s making the decision in a vacuum. In fact, 53% of Americans report having limited knowledge of Social Security or how it fits into their retirement plan, according to a survey by Allianz Life.

Financial advisors emphasize that Social Security shouldn’t be treated as a standalone choice. It’s a crucial component of your overall retirement strategy.

That’s especially true for married couples. Scheiderer notes that “If you are married, having one spouse collect early and one collect at 70 can ‘hedge’ the decision.” Planning for spousal and survivor benefits can have ripple effects on your household income for decades. When one spouse passes away, the lower of the two benefits disappears, so delaying the higher earner’s claim can make sense for long-term security.

For those who’ve already filed but are second-guessing it, there are “do-over” options. If you claimed early, you can potentially suspend benefits once you reach full retirement age to allow them to grow again. And if you filed within the last 12 months, you can withdraw your application and repay benefits, essentially resetting your claim.

Ultimately, the best way to make the most of the "8-Year Rule of Social Security" is to be intentional. Understand the trade-offs, plan your cash flow, and factor in your health, taxes and partner’s benefits. And then, like Eisenhower, accept the weight of your decision.

Because, as Scheiderer reminds us, “The only certainty is you may never know if you made the right decision. If we had a crystal ball on life expectancy, you would know the exact month you should start to collect. If only!”

We curate the most important retirement news, tips and lifestyle hacks so you don’t have to. Subscribe to our free, twice-weekly newsletter, Retirement Tips.

More Retirement Rules

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.When your heart says "yes" but your wallet says "no," there is still a way forward. Here's what financial pros say.

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Quiz: Do You Know How to Maximize Your Social Security Check?

Quiz: Do You Know How to Maximize Your Social Security Check?Quiz Test your knowledge of Social Security delayed retirement credits with our quick quiz.

-

Private Capital Wants In on Your Retirement Account

Private Capital Wants In on Your Retirement AccountDoes offering private capital in 401(k)s represent an exciting new investment opportunity for "the little guy," or an opaque and expensive Wall Street product?

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.

-

Fix Your Mix: How to Derisk Your Portfolio Before Retirement

Fix Your Mix: How to Derisk Your Portfolio Before RetirementIn the run-up to retirement, your asset allocation needs to match your risk tolerance without eliminating potential for growth. Here's how to find the right mix.

-

I Thought My Retirement Was Set — Until I Answered These 3 Questions

I Thought My Retirement Was Set — Until I Answered These 3 QuestionsI'm a retirement writer. Three deceptively simple questions helped me focus my retirement and life priorities.