The Rule of the Shrinking Dollar in Retirement

Alas, we must all follow the rule of the shrinking dollar once we hit retirement. Here's how to hold onto your hard-earned money in many years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Benjamin Franklin famously wrote in a letter, “In this world nothing can be said to be certain, except death and taxes.”

Little did he anticipate a third certainty that behaves like both: inflation. It creeps in slowly, yet hits with lasting consequences, especially in retirement.

Consider that 64% of Americans say they fear running out of money in retirement more than death itself, according to an Allianz Life survey. While many factors feed that fear, rising prices are the biggest culprit. More than half (54%) of those surveyed said inflation is what keeps them up at night.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Inflation is the silent killer of retirement,” says Will Kellar, CFP® and managing partner at Human Investing. “Left unchecked, it steadily erodes purchasing power and can derail even well-funded plans.”

This is the essence of the retirement rule of the shrinking dollar, a reminder that how you plan, spend and invest can either slow the erosion of your purchasing power — or speed it up. The steps to navigate it touch nearly every part of your financial life, from your portfolio to your grocery bill.

Why the 'rule of the shrinking dollar' matters most in retirement

If you wonder why McDonald’s no longer has a dollar menu, the answer is inflation. Yet, a modest level of inflation is considered normal and even necessary for a healthy, growing economy.

However, when inflation becomes unpredictable or rises too quickly, it chips away at purchasing power and creates economic uncertainty. That’s especially problematic for retirees, who often live on a relatively fixed income.

Even moderate inflation can take a toll. For example, if you need $60,000 a year to live comfortably today, that same lifestyle could cost more than $108,000 in 25 years with just 2.5% annual inflation.

“The biggest mistake is pretending inflation can’t be planned for,” says Melissa Caro, CFP® and founder of My Retirement Network. “You don’t need to predict the exact number; you just need to budget for it. And if you end up overestimating, you’ve built yourself some breathing room.”

Caro says planning needs to happen in two key areas: “Your investments have to grow enough to cover rising costs, and your spending plan has to be flexible.”

Fighting inflation in your portfolio

Inflation doesn’t just raise prices; it also reduces the real return on your investments. In other words, without proper planning, your portfolio’s ability to support your retirement lifestyle might decline over time.

“Going too conservative too early can backfire,” cautions Caro.

How do you guard against that when the common advice in retirement is to play it safe?

“The best defense is a diversified portfolio that includes an appropriate allocation to stocks,” says Kellar. “While equities bring short-term volatility, they’ve never experienced a total and permanent loss. In fact, over the long run, they’ve been the most reliable hedge against rising costs.”

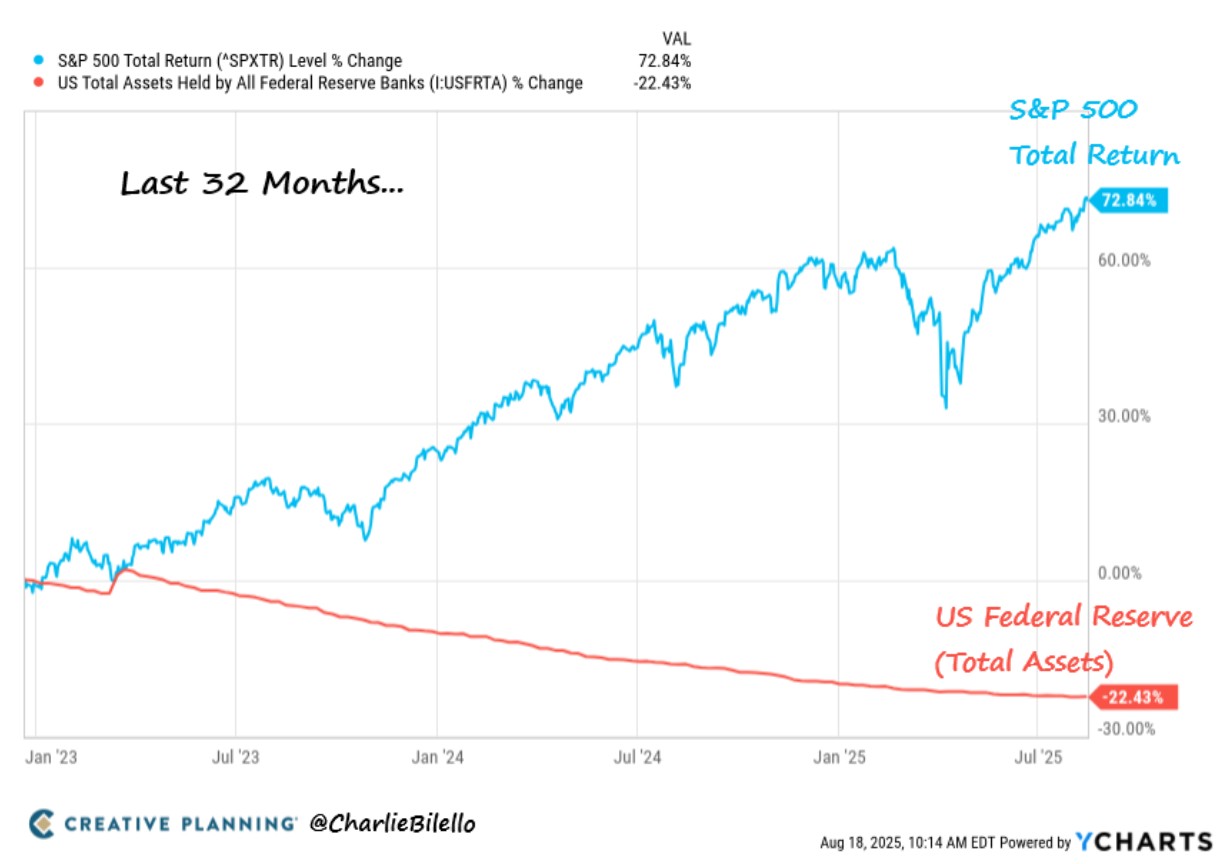

For example, analyst Charlie Bilello found that in the last 30 years, inflation cut the value of a dollar in half. During that time, the S&P 500 delivered an after-inflation gain of 870%.

Kellar adds: “Pairing equities with inflation-protected bonds and cash reserves gives retirees both staying power and flexibility.”

Where your investment funds are located matters, too. Mark Stancato, CFP® and founder of VIP Wealth Advisors, recommends taking advantage of tax diversification.

“Having both Roth and pre-tax accounts gives retirees flexibility to adjust withdrawals in high-inflation years without blowing up their tax bracket,” he says.

Retirement's biggest inflationary threat: health care

As we age, we tend to spend more on health care, which, unfortunately, is one of the most inflation-prone expenses in retirement. Medical costs routinely outpace overall inflation, making them a critical line item to plan for.

A report from the Center for Retirement Research at Boston College found that 12% of the median retiree’s total income went to medical expenses. For many, about 25% of their Social Security benefits were consumed by health care costs alone.

“Health care is the standout as far as vulnerability. It almost always rises faster than general inflation and needs to be modeled separately,” says Caro.

Kellar agrees, noting: “While overall inflation has averaged around 3%, health care has risen closer to 5%, a gap that compounds dramatically over a 20-to-30-year retirement.”

To combat this, Kellar recommends tools such as Health Savings Accounts (HSAs), which offer a rare triple tax advantage: Contributions reduce taxable income, grow tax-deferred and can be withdrawn tax-free for eligible medical expenses.

Flexible spending to navigate fluctuating prices

While some rising costs are expected, others can catch retirees off guard. Take, for example, the recent spike in egg prices, which jumped more than 350% per dozen at one point in 2025 compared with the same period last year.

That’s why financial experts emphasize the importance of flexibility.

“A 30-year retirement is like running three very different marathons back-to-back,” says Stancato. He suggests following dynamic spending rules. That could mean adjusting discretionary categories, such as travel or dining out, based on market performance or inflation levels, while keeping essential expenses covered.

Kellar calls this a “tiered spending plan.” He advises: “Cover your must-have essentials first, then add flexible layers for discretionary expenses like hobbies or vacations. That way, if inflation runs hotter than expected, you can make changes without jeopardizing your quality of life.”

Don’t assume all costs will drop in retirement either. “Even if the mortgage is paid off, housing costs remain a big pressure point,” says Caro. “Property taxes, insurance and maintenance don’t stand still.”

Moving to cheaper climates

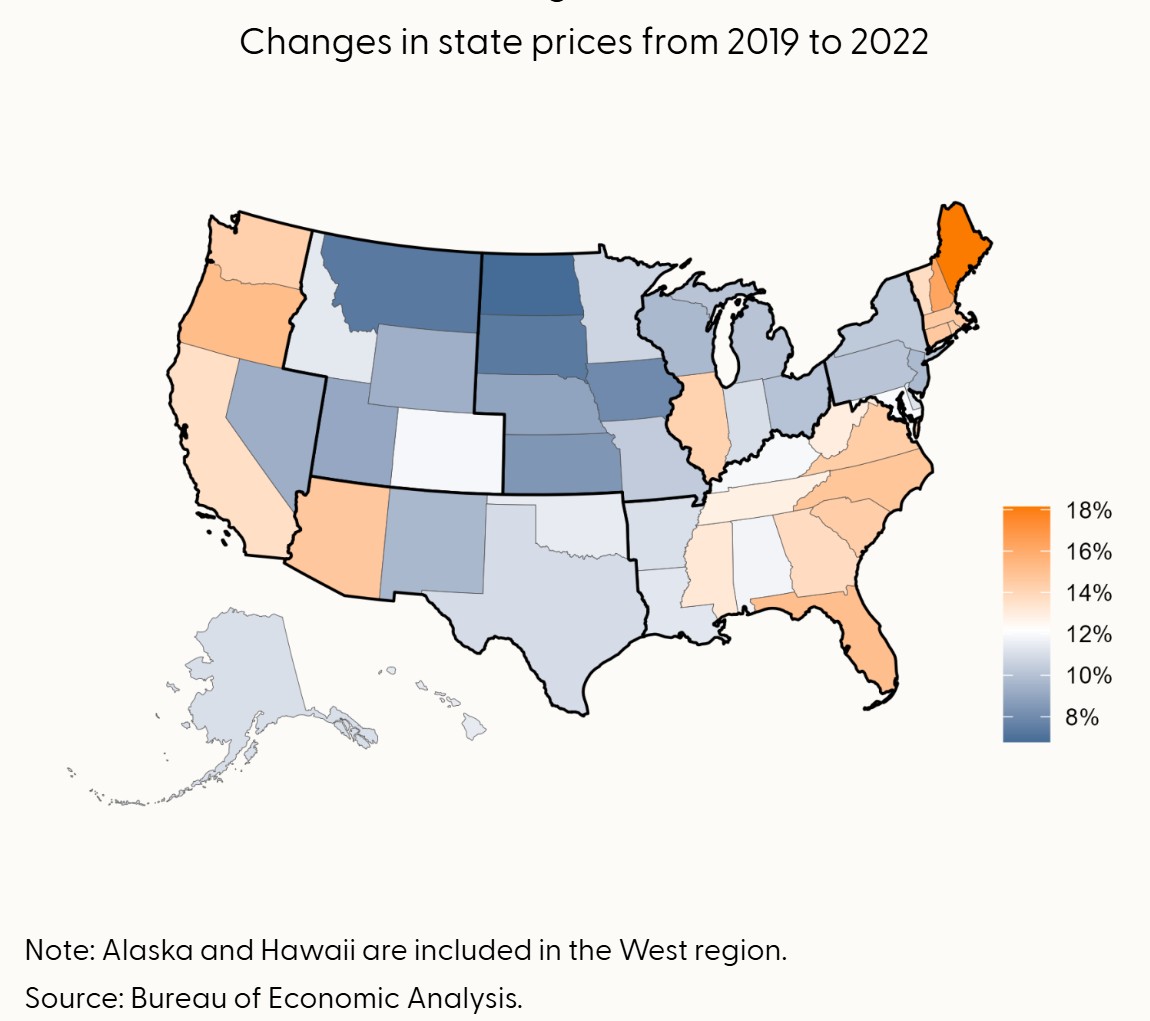

Inflation isn’t uniform. It varies from state to state due to factors such as local taxes, climate-driven consumption patterns and transportation costs. That means where you live can have a big impact on how far your retirement dollars stretch.

This was most apparent during the COVID pandemic, as prices fluctuated widely around the U.S., according to research by the Federal Reserve Bank of San Francisco.

That’s why more people are increasingly “choosing ‘geographic arbitrage,’ relocating to lower-cost states or even countries for part of the year,” says Stancato.

Popular retirement destinations abroad, including Thailand, Malaysia, Ecuador, Colombia, Mexico and Portugal, can offer major savings on housing, health care and everyday expenses compared with the U.S.

Still, it doesn’t always pay to let inflation dictate your ZIP code. “Inflation-proofing isn’t about hiding from rising prices, it’s about building flexibility into both your portfolio and your life,” Stancato adds.

We might not be able to avoid death, taxes or the effects of a shrinking dollar. But we can adapt. As Franklin wisely put it: “Energy and persistence conquer all things.”

Read More Retirement Rules

- The '120 Minus You Rule' of Retirement

- The Retirement Rule of $1 More

- The 'First Year of Retirement' Rule

- The Y Rule of Retirement: Why Men Need to Plan Differently

- The Rule of 240 Paychecks in Retirement

- The 'Die With Zero' Rule of Retirement

- The '8-Year Rule of Social Security' — A Retirement Rule

- The Kevin Bacon Rule of Retirement

- The Rule of Retirement Inversion

- The Rule of 1,000 Hours in Retirement

- The 'Second Law' of Retirement Rules

- The Rule of Four Futures

- The Rule of $1,000: Is This Retirement Rule Right for You?

- The Rule of 55: One Way to Fund Early Retirement

- The 80% Rule of Retirement: Should This Rule be Retired?

- The 4% Rule for Retirement Withdrawals Gets a Closer Look

- The Rule of 25 for Retirement Planning: How Much Do You Need to Save?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.