Retire in Ecuador for an Affordable, Rich Life

When you retire in Ecuador, you'll enjoy one of the world’s most painless visa processes in a country rich with biodiversity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor’s note: "Retire in Ecuador" is part of an ongoing series on retiring abroad. To see all the articles in the series, jump to the end.

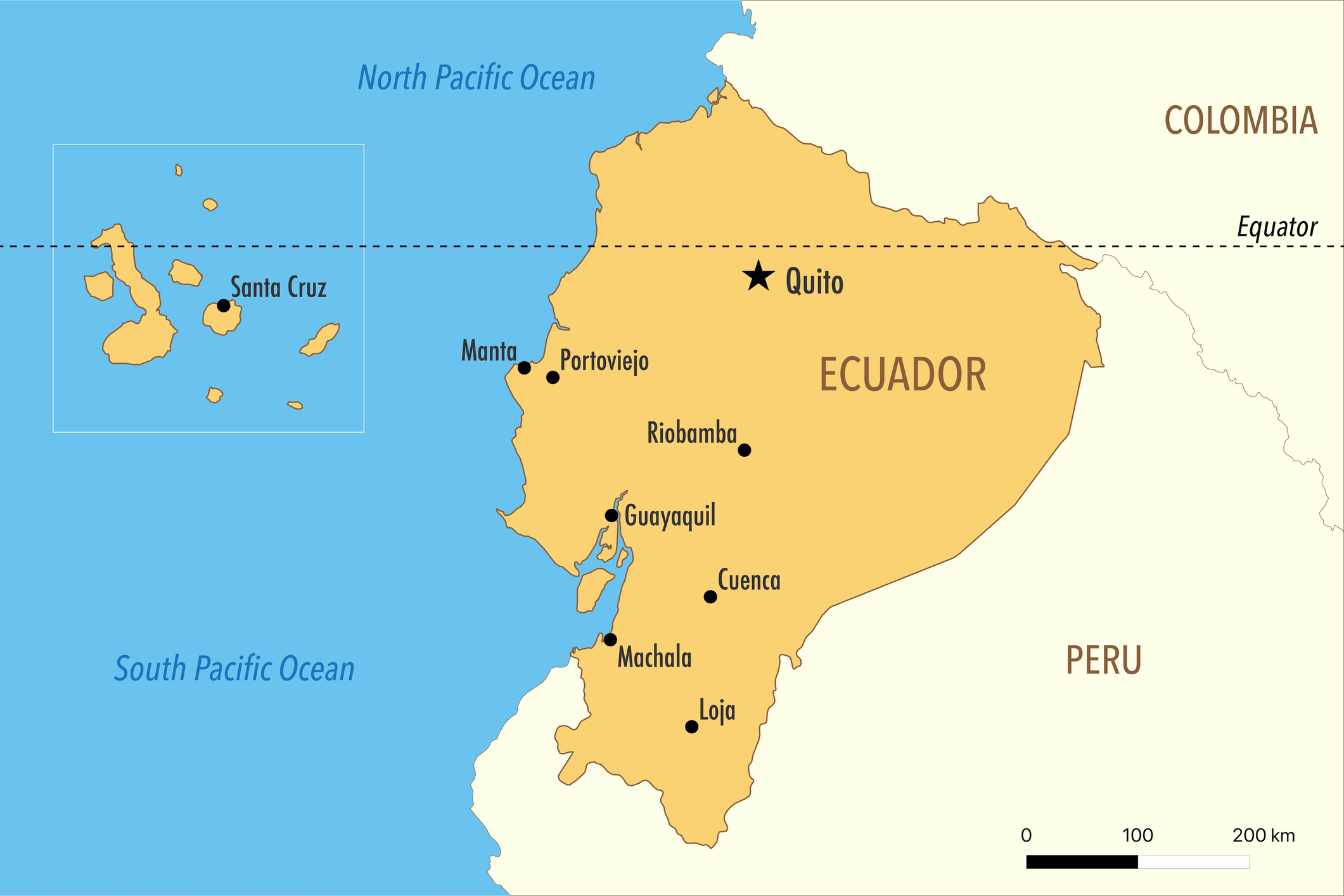

Ecuador, a mushroom-shaped country located toward the top of South America, tucked between Colombia and Peru, is known to expats for two things: its abundance of nature (including the Galapagos Islands) and the ease of its visa process. As European countries clamp down on relocation opportunities, and golden visas grow ever more expensive (e.g., Greece), retirees and soon-to-be retirees are taking a good look at Latin America.

It’s true that short nonstop flights between the U.S. and Ecuador aren’t easy to come by — the four-plus-hour flights from South Florida (Miami and Fort Lauderdale) are the quickest options, but there are also direct flights from Houston and Atlanta. But once you’ve landed in your new home in Ecuador, popular destinations such as Cartagena, Colombia; Lima, Peru; and Costa Rica are right in the neighborhood, so to speak. Ecuador’s charming capital is Quito, and its largest city is Guayaquil. Located 40 miles from the Pacific, frenetic Guayaquil is not a top choice due to safety concerns.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“The big appeal in Ecuador, overall, is the weather,” says Esteban Rivera, principal of Rivera Law Firm, which is located in Minneapolis, Iowa City, and Quito, Ecuador. “We don’t have extreme weather. Even on the coast, it is warm but not over 90 degrees.” He also cites the cost of living — “much cheaper than in the U.S.” — and the warmth and friendliness of the people: “People are very kind to tourists and foreigners.”

“Ecuador is about the size of Colorado, and within that area, it’s a megadiverse country (one of 17 megadiverse countries in the world). You drive for two hours, and you’re in a completely different landscape,” Rivera says. "We have snow-capped mountains, the jungle, and the Amazon River starts in Ecuador. We have beautiful beaches, primary forests and kelp forests. In terms of nature, it is amazing.” Birders will have lots to look at, as Ecuador ranks as number five worldwide in the number of species; a two-and-a-half-hour flight gets you from Quito to the Galapagos Islands, an archipelago that is legendary for its exotic wildlife, like red-footed boobies.

Where to land: best places to live in Ecuador

Like several other Latin American countries, such as Costa Rica, certain Ecuadorian towns are known for their vibrant U.S. expat communities. Rivera immediately mentions Cuenca, and indeed, the highlighted testimonial on the firm’s website was provided by a U.S. expat living in Cuenca. “It’s a city in the highlands, the third-largest city in Ecuador, and it is beautiful,” Rivera says. The city of roughly 600,000 people “has really nice weather,” Rivera adds, along with a robust cultural and social scene of cafes, movie theaters, and museums. Rivera says that a two-bedroom, two-bath condo in Cuenca will set you back around $100,000 to $200,000, depending on how luxurious the building is, and whether it has amenities such as a swimming pool.

Since 1978, Quito has been on UNESCO’s list of World Cultural Heritage Sites, due to its painstakingly preserved historic center. Several of its churches, such as the Basilica of San Francisco and the Church of Santo Domingo, are gorgeously ornate. The Museo de la Ciudad is dedicated to the city’s history, and Quito contains several other notable museums, including the national Museum of Ecuador, one museum housing pre-colonial art, and another focusing on contemporary art. Quito also boasts the largest urban park in South America: Parque Metropolitano Guanguiltagua. The wealthiest expats gravitate to the neighborhoods of Cumbaya and Tumbaco, but the historic center and the modern República del Salvador are also highly desirable.

Rivera says that beachcombers will find everything they need in terms of amenities — movie theaters, restaurants, shopping malls — if they want to settle on the Pacific coastline, but that there isn’t one particular town that stands out as an expat magnet.

Visa and money matters

The range of visa types on offer can be, at first glance, somewhat dizzying, but a retiree can quickly home in on a few appropriate options. Visas based on such financial resources, such as pensions, Social Security income, lump sums, investments — there’s really something for everyone.

Rentista visa

For many retirees, the Rentista visa will be the most suitable option. An individual must demonstrate income from a pension or Social Security of $1,410 a month, which is equal to three times the current minimum wage in Ecuador. That minimum is called the Salario Básico Unificado: $470 per month, but note that the minimum wage is subject to small annual increases (we are citing 2025 numbers). The U.S. dollar is the country’s national currency, so there are no annoying conversions. Given the fact that the average monthly Social Security check is around $2,000, Ecuador earns its reputation as a soft landing for U.S. retiree expats.

Lump sum visa deals

However, for those who are not collecting a pension, or are deferring Social Security, yet still want to retire in Ecuador, the country offers several lump sum deals. These deals are all based on a minimum handover of 100 times the current minimum wage, for a total of $47,000.

For the Fideicomiso en Efectivo program, an individual must deposit a minimum of $47,000 in cash into a trust, in an Ecuadorian bank. Similarly, for the Inversionista en póliza visa, the person must invest a minimum of $47,000 in an annuity contract.

For the Inversionista en bien raiz visa, an expat must invest a minimum of $47,000 in a real estate asset. Those who have researched golden visas in Europe will be familiar with this requirement: Purchase a home, and you’ve fulfilled the requirement. “If they buy a house or a condo,” Rivera says, “usually the price will be enough” to fulfill the requirement.

Other visa options

A less utilized path — Inversionista en acciones — involves investing $47,000 in shares of a corporation. Other options involve visas afforded to religious workers and permanent employees of an Ecuadorean company — paths not especially relevant to retirees; Familia visas for those who have an Ecuadorian citizen parent, child, sibling, or common law marriage partner; and one surprising path, for people who simply hold a college degree, called a Profesional visa.

“Most people who apply for these visas provide a Social Security letter, showing that they collect at least $1,410 a month,” Rivera says. But barring that, “the most common thing that my clients do, if they have a college degree, is the 'Profesional' visa, but if they don’t have a college degree, they do a real estate investment or the trust investment.” There is no funding, deposit, or proof of income required to secure a Professional visa, but one must have their documents in order: a diploma, transcripts, and proof that the degree was earned in person and not online.

How to get started

One need not be in Ecuador to apply for a visa, and of all the options, Rivera says that the Rentista visa will probably be processed the quickest. He says that for those who want to explore the country, the country’s 90-day tourist visa offers plenty of time to lock things in: “Usually within those 90 days, I can obtain the visa. I have a bilingual team in Ecuador, and they will process everything.” After 21 months in-country, you can apply for a Permanent Residency Visa (PRV).

Finally, Rivera says that private health care in Ecuador is of high quality, and he mentions that both of his parents are doctors who work in an excellent hospital. Health insurance is mandatory in Ecuador, and Rivera says that one of his clients, a 65-year-old man, pays around $150 per month.

Living in Ecuador: The takeaway

Ecuador boasts colonial charm, but with modern conveniences. That said, you’re never far from the splendor of diverse natural ecosystems.

Established expat communities, particularly in Cuenca and Quito, help to make relocation seamless, as does the low cost of living, and the menu of visa options for retirees, which seems created to accommodate nearly every preference and financial situation.

More on where to retire abroad

- Retire in Japan: It Ain’t Easy, Unless You’re Special

- Retire in Malaysia for Affordable Luxury

- Retire in Finland and Live the Nordic Dream

- Retire in Malta for Quiet Coastal Perfection

- Retire in New Zealand for Lush Landscapes and a Relaxed Vibe

- Retire in Italy for Culture and Beauty

- Retire in Greece for Relaxed Living With a Cinematic Backdrop

- Retire in Thailand Where 'The White Lotus' Was Filmed

- Retire in Mexico: Get a Lower Cost of Living Near the US

- Where to Retire: Living in Portugal as a US Retiree

- Where to Retire: Living in the Dominican Republic

- Where to Retire: Living in Panama Offers Stability and Charm

- Where to Retire: Living in Brazil Is More Than Carnival, Coffee and Copacabana

- Where to Retire 2025: Puerto Rico

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Drew Limsky joined Kiplinger Digital as a freelance retirement writer because he believes that every day offers opportunities to make better financial decisions, and that it’s never too late to learn how to enhance your financial position and lifestyle. Drew is the former editor of Lexus magazine, Cadillac magazine, South Florida Business & Wealth, Business Jet Traveler, Interiors South Florida, and Mariner (for Holland America). Drew’s writing credits include The Wall Street Journal, New York Times, LA Times, Washington Post, Boston Globe, Yahoo, Worth, AD, Robb Report, Metropolis, Men’s Journal, and Business Insider. An Emory grad, Drew earned his JD and PhD at NYU, and lives in Miami Beach, Brooklyn, and Cape Cod.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.