An Expert Guide to How All-Assets Planning Offers a Better Retirement

An "all-asset" retirement planning strategy would integrate housing wealth and annuities with traditional investments to generate more income and liquid savings for retirees. Here's how it works.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The net worth of retirees over the past three decades has tilted steadily toward housing wealth.

A study by the Federal Reserve shows that the share of net worth in primary residences among households headed by people ages 60 to 69 rose from roughly 40% in 1989 to just over 50% by 2022.

For those aged 70 to 79, the share climbed from about 38% to 50% over the same period.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Ideally, the retirement industry would look for solutions that allow retirees to take full advantage of their housing wealth with plans that incorporate all their assets. We know that the wheels of change grind slowly.

The big financial advising companies have to explore new ideas carefully.

The latest "natural language" artificial intelligence programs also lack recognition that the effective use of all assets, like the home, is crucial to retirement planning.

Testing AI and ability to innovate

We wanted to find out whether AI, given the objectives of our target retirees, could also come up with this new all-asset planning approach. The answer after pages of back and forth was a resounding "yes" and "no."

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

Yes, AI programs are a quick study, and if told to narrow the gap between the single-asset and all-asset method, first considering lifetime annuities, they would do that. It took them multiple steps to forget the biases against housing wealth and then to incorporate it into a plan.

They never got all the way. So here, I will lay out an approach that AI and others can study.

The issue seems to be that AI starts with a single asset class and current models. It doesn't care that results would not support the needs in the marketplace in general and an individual retiree in particular.

Our alternative started with new asset classes that we felt belonged in the plan. We then analyzed and integrated the three — and in the process created a new all-asset approach.

Technical analysis has the advantage of removing market emotion and bias. In this case, it also improves results.

The benefit of integrating housing wealth

To demonstrate how integration of a retiree's housing wealth can improve a retirement plan, set out below is a comparison of the "with and without" strategies for a homeowner (male age 67) who has $1 million in IRA savings and $1 million in the value of a house.

Strategy No. 1: A plan that doesn't include housing wealth ('without')

Our sample client's current retirement planning strategy does not take advantage of housing wealth and leaves the house outside retirement planning.

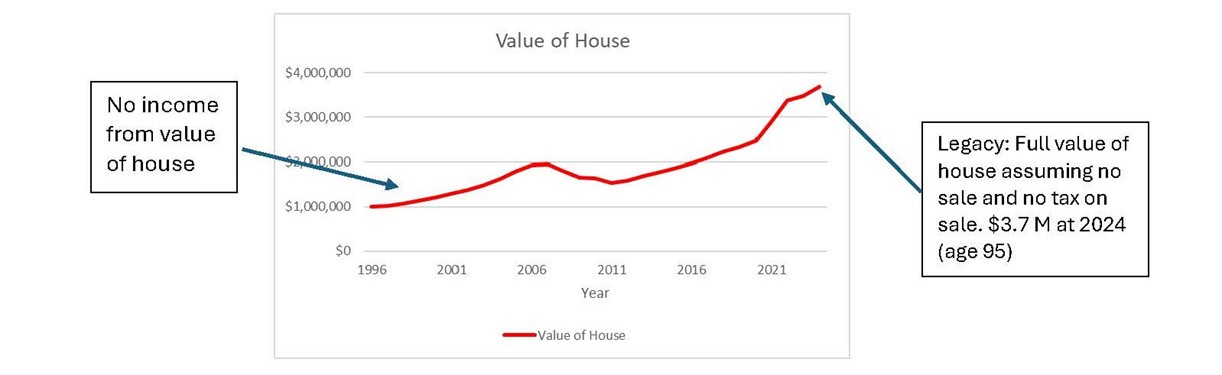

For this homeowner, here's how the value of the house would have appreciated and depreciated over the past 28 years ending June 30, 2025.

The plan with investments as the only asset class generates no additional income or liquid savings from the housing wealth and leaves only the value of the home at passing.

So, could the homeowner manage to meet both housing costs and, say, long-term care expenses without downsizing? Note that the downsizing cost could be several hundred thousand dollars for our retiree, possibly coming at a time of extreme stress.

Strategy No. 2: Housing wealth as part of the plan ('with')

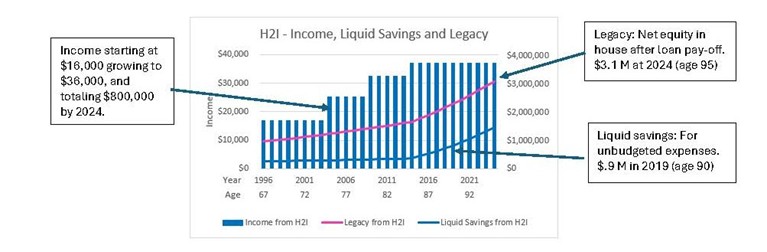

Contrast the results above to the retiree who used the all-asset planning strategy to generate more income and liquid savings.

He unlocked housing wealth with a HECM (home equity conversion mortgage):

- That delivered an immediate $330,000 line of credit

- He's able to take modest tax-free HECM drawdowns until age 84

He also used $200,000 from his IRA account to purchase a QLAC (qualifying longevity annuity contract) and a ladder of lifetime income:

- He can use a portion of the income for budgeted expenses as an inflation hedge

- He can use the rest of the income to pay down the HECM loan balance starting at age 85

Note: Example is for a man, 67, starting in 1996. Based on current annuity pricing and average historical interest rates and property growth rates. Assumes $1 million value of house and $200,000 from IRA savings to purchase QLAC.

Greater security enables higher allocation of portfolio to stocks

Without the income and liquidity from an all-asset combination, the allocation to stocks in the "without" strategy will be conservative and follow the usual model of 100 minus age, or an allocation of 30% (rounded) to stocks.

So, the "without" plan is to invest $1 million in a portfolio of stocks and bonds and allocate $300,000 to stocks and $700,000 to fixed income.

With the benefit of income and liquid savings provided by an all-asset plan, however, the allocation to stocks can be slightly more aggressive.

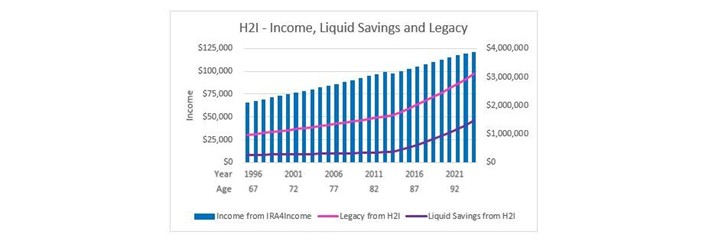

In our example, it's 65% of the investment portfolio to stocks. So, the "with" plan is to invest $800,000 from the IRA, split between a balanced investment portfolio and an immediate annuity as follows:

- $640,000 to portfolio, with $416,000 (65%) to stocks and $224,000 (35%) to fixed income investments

- $160,000 to immediate annuity

Here is a graph of the total income, together with liquid savings and legacy for the all-asset retirement plan — or what we call the IRA4Income:

Advantages over investment-only single asset class planning

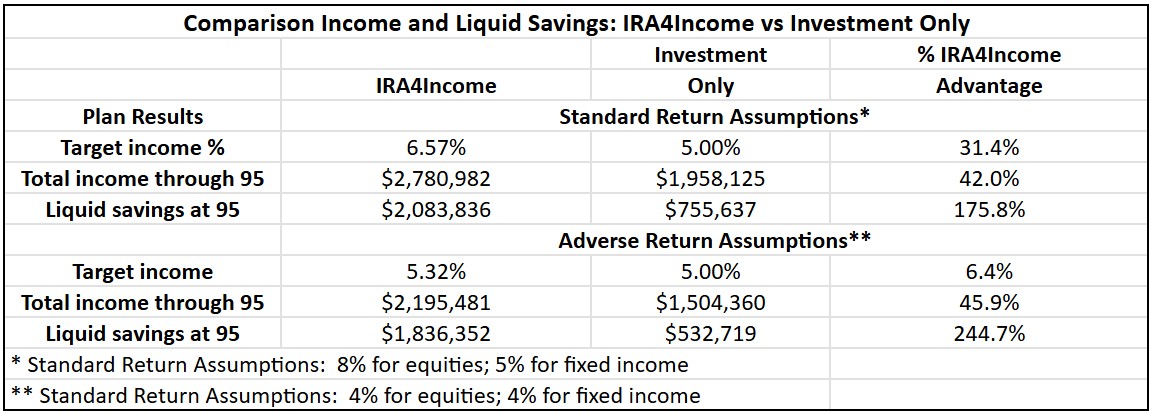

Set out below is a comparison of the results for the "with" and "without" retirement plans, assuming standard returns of 8% for equities and 5% for fixed income, and adverse returns of 4% for both equities and fixed income.

As you can see, this homeowner builds more income ($700,000 to $800,000 more) and more liquid savings (over $1.3 million more) from his IRA4Income plan.

With the liquid savings made up of both the IRA account value and the HECM line of credit, he should be able to pay for long-term health care if needed.

If he stays healthy, he can spend the additional income or reinvest and build even more savings.

Use favorable economics to meet other objectives

While the starting point for evaluating IRA4Income is the increase in income and liquid savings, there are individuals who can use other sources of income — e.g., interest and dividends, Social Security, pensions and other annuities — to meet additional objectives.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

A possible objective for them might be to maximize the legacy left to children, grandchildren or a favorite charity.

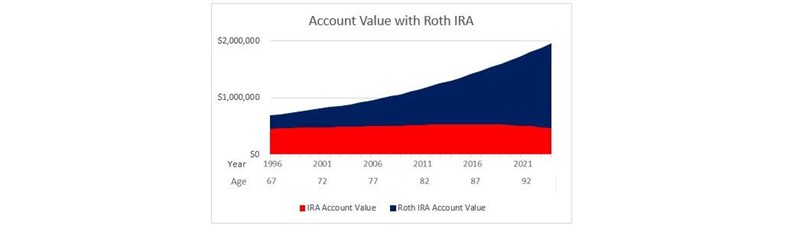

One way to accomplish this is by taking advantage of a Roth conversion, where rollover IRA funds are transferred to a Roth IRA. A tax is paid at the time of conversion, but taxes are eliminated on the future growth of the Roth account.

Here's a way to accomplish this with IRA4Income:

- Elect a lower income target (e.g., 5.0% instead of 6.5%)

- Reduce rollover IRA amount to $775,000, leaving $225,000 for the Roth conversion

- Pay taxes on the conversion using Roth funds or other income

- Grow the Roth tax-free in a balanced portfolio

- Rollover IRA + Roth account value at age 90: $1.6 million

Set out below is a projection of the combined account value of the rollover and Roth IRA, $1.6 million at our investor's passing at age 90 — or more than seven times the original Roth conversion of $225,000.

In addition, the ongoing tax benefits of this strategy are significant, with about half the required minimum distribution (RMD) from the rollover IRA account. (This takes into account untaxed future growth and distributions from the account.)

Input your numbers here and find out how your retirement could benefit by combining all your assets. We think you will find that the plan built on needs and resources can provide more income, legacy and liquidity than keeping the house outside the retirement plan and then being forced to sell the home to pay for higher living costs or unplanned expenses. It helps protect the consumer while leaving heirs with a substantial financial legacy.

Related Content

- This HECM-QLAC Power Move Can Unlock Guaranteed Retirement Income

- For a Richer Retirement, Follow These Five Golden Rules

- What the HECM? Combine It With a QLAC and See What Happens

- Transform Your Retirement Plan With This Powerful Combo

- How Combining Your Home Equity and IRA Can Supercharge Your Retirement

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.