How 'Home-Based Planning' Can Address Long-Term Care Costs

Traditional planning for the cost of long-term care doesn't reflect the realities of what the costs are and how they'll be paid.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We’re living longer in retirement, and more of us want to age in place rather than sell the family home. A recent policy paper by AARP listed the goals of the age-in-place population:

- Ensure access to affordable, high-quality long-term services and supports (LTSS) that maximizes the dignity, independence and protection of older adults

- Create age-friendly, livable communities that enable people to age in place and continue as engaged members of their communities

- Support family caregivers

- Provide ample opportunities to generate, save and preserve financial resources

Those goals all seem reasonable and smart. Our focus is around number four — and about planning to preserve resources while meeting retiree objectives.

Let’s start with costs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How much could Boomers pay for LTC costs?

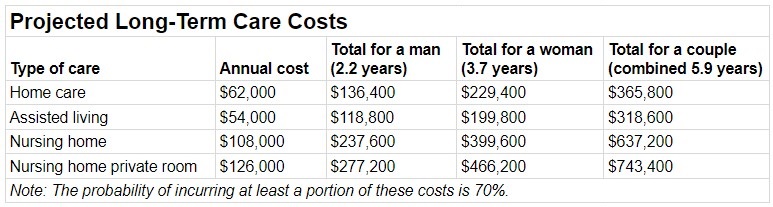

Americans incur more than $400 billion in LTTS costs every year. People over 65 make up the bulk of those who need care at a nursing facility and a larger percentage of those who receive in-home care to assist with daily activities. Home care can cost about $62,000 a year, while care in a facility could be $108,000 to $126,000. Here’s a projection of average costs considering the duration of a stay for a man, a woman and a couple.

At some point, what you are required to pay for long-term health care may outstrip your bank and investment accounts and force you to dip into your hard-earned retirement savings. As you can see, the average cost for a private room in a nursing home for a couple can be as much as $745,000.

Since the probability of incurring at least a portion of these costs is 70%, you need to plan ahead to ensure your financial resources are available when you need them and in a way that you can easily access.

How Boomers plan to pay for long-term care

We have options, including some provided by the government, but in many cases, they require compromises in how to spend our money, or decisions about our lifestyles we would rather not make. From a study that’s about 10 years old, the four most popular options that participants chose for funding LTC were:

- Use personal savings

- Purchase a private long-term care insurance policy

- Spend down savings to qualify for Medicaid

- Sell home and use the proceeds

Others in the study hadn’t even thought about how they would cover LTC costs.

While I’m sure the planning has changed in the interim, I consider these options pretty challenging and, in some cases, life-changing. More recent studies agree that purchasing long-term care insurance at the Boomer’s current age is quite expensive. And with such a large percentage of the population wanting to age in place (a recent AARP survey puts it at more than 75% of adults over 50), selling your home is less appealing.

What is Sally going to do?

Sally, a 70-year-old woman who stands in as our example retiree, is now focused on this issue, and she is wondering about next steps, even with her $1.5 million in retirement savings and $1 million in equity in her home. Sally has done a good job using savings within a plan to meet her retirement goals of income, liquidity and legacy. Now she wants to explore how to address the expense of long-term care within or in addition to that plan.

The thought of spending on average of $375,000 (roughly the average cost of a three-year stay with a private room in a nursing home) is pretty daunting. Here are some options she’s thought about.

- Set aside investments so she can pay for LTC with her personal savings. That would require her to spend less, impacting her lifestyle even during the years that she feels great.

- Buy insurance to pay for long-term care. Like many consumers, Sally didn’t buy long-term care insurance when she was younger. Buying it now will be much more expensive and reduce funds for other expenses.

- Spend down savings to qualify for Medicaid. She has a lot of savings, so this is probably impractical.

- Stay at home and bring in help. Sally wants to age in place for as long as she can. She is a little nervous about the costs for care, along with home modifications — and the need to spend down savings at such a rapid rate.

Is there another option?

What about home-based planning?

Since she’ll be aging in place, she plans to live in her home for a long time and thus considers “home-based planning.” The specific option Sally considers is an approach called HomeEquity2Income (H2I), which combines a home equity conversion mortgage (HECM) with a deferred income annuity called a QLAC. This combination provides both current cash flow and a line of credit through an HECM to reduce or eliminate the necessity to spend her savings on long-term care costs. For more on this, see my article Transform Your Retirement Plan With This Powerful Combo.

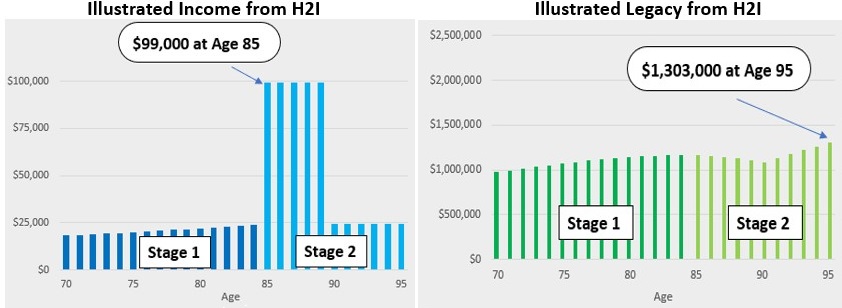

To illustrate, here’s how H2I measures up for Sally when she uses $200,000 from her rollover IRA savings to purchase a QLAC, establishes an HECM line of credit of $330,000 against the equity in her home and funds $75,000 per year in LTC costs from 85 to 89 only from H2I — not from her retirement savings.

In summary, this is what H2I does as measured against her personal objectives:

- Don’t run out of money: $20,000 additional income at start and continuing for life

- Grow income each year: 2%-per-year increase until age 85

- Lower income taxes: Income tax-free until age 85

- Cover unfunded expenses: $75,000 per year in LTC costs from 85 to 89

- Leave a meaningful legacy: $1.3 million

Now let’s address her retirement savings and plan for retirement income.

What about drawing down only from an HECM?

While the coverage of $375,000 in LTC costs is pretty nice, couldn’t Sally have done the same thing without transferring $200,000 from her savings to purchase QLAC and simply draw down from HECM?

Here is our response:

- Sally got more than the LTC costs covered, as H2I also provided tax-favored income starting at $20,000 and continuing for life.

- Sally still passed along a legacy of over $1.3 million just from H2I.

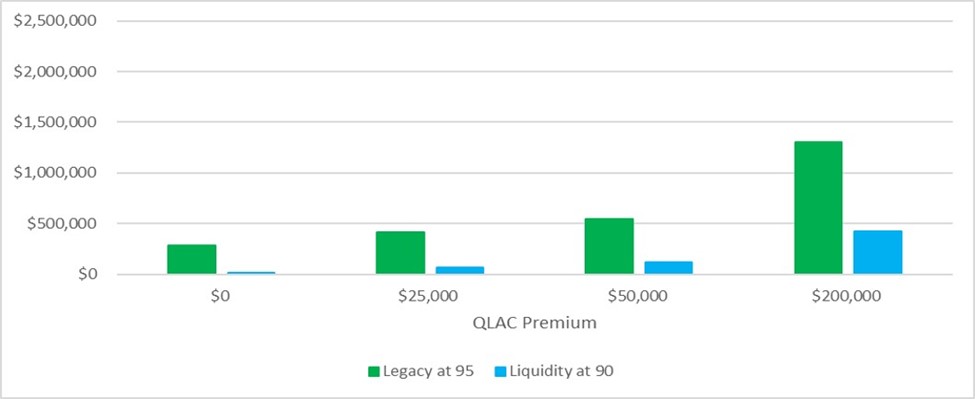

With only, say, a $50,000 QLAC premium, her legacy at 85 would be reduced by more than half, and her liquidity would be wiped out at age 90. With no QLAC, her legacy is reduced by 75%, and liquidity again is gone by age 90. What the chart below shows is that within the statutory limits, the maximum funding of a QLAC makes sense.

Making up the difference in her retirement income plan

What about the transfer of $200,000 from her rollover IRA savings? While the analysis requires you to take a hard look at what Sally is doing with her retirement savings, here are a few points to consider:

- She’s deferring taxable RMDs (required minimum distributions) to age 85 — and creating tax-free income from HECM.

- With the substitution of immediate income annuities for a portion of her fixed income portfolio, she can replicate or exceed her original income even with the $200,000 outflow.

- With greater safe income, she can increase her allocation to equities.

Conclusions for Boomers who want to age in place

- LTC insurance purchased by Boomers is costly and, where possible, should be used to fund “catastrophic” large-amount LTC costs.

- There will be other costs for age-in-place Boomers beyond care-related payments.

- You can minimize the drain on retirement savings to cover LTC costs, unless you’re OK going on Medicaid.

We’ve taken you through the steps to address the costs of long-term care with a H2I plan, based on your own assets and needs. Visit Go2Income Personal Planning to start a plan risk-free. One of our analysts can help you make adjustments as you build a plan that gives you lifetime income, greater liquidity — and a clear path to paying long-term care costs.

Related Content

- Things Change: Is It Time to Update Your Retirement Plan?

- How Your Home Can Fill Gaps in Your Retirement Plan

- A Roth Conversion Alternative That Addresses Long-Term Care

- New Payroll Tax Targets Long-Term Care Expenses

- Four Tax-Friendly Ways to Pay for Long-Term Care Insurance

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.