For Longevity Protection, Consider a QLAC

A qualifying longevity annuity contract, or QLAC, can help you define a better retirement for yourself by providing guaranteed lifetime income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Please consider two new terms you should know in retirement:

- Longevity protection. The steps you can take to ensure that the money you thoughtfully saved and carefully grew during your working years doesn’t run out before you do, no matter how long you live.

- Qualifying longevity annuity contract. Commonly called a QLAC, this type of deferred income annuity funded out of your rollover IRA account provides guaranteed lifetime income starting at an age you select but no later than 85.

I’m not trying to turn you into an actuary or pension specialist, but an understanding of those terms can make a huge, positive difference in your plan for retirement income and your peace of mind.

Planning for a long life

Living too short a life is unfortunate and sad. So is living so long you outlast your savings. However, while we can’t say with certainty how long we will live, we can prepare ourselves if we are surprised by living beyond our life expectancy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A poll conducted by the Global Financial Literacy Excellence Center with the research organization TIAA Institute, showed that most of us aren’t thinking enough about how long we might live and the new set of late-in-life expenses. More women are well-versed in the details of longevity than men, the poll shows. Financial literacy follows the same trend.

For the basics, if you’re like our sample 70-year-old female retiree, according to certain actuarial models your life expectancy is 89 if you’re in good health; it’s 87 for a man. Remember this factoid: 50% of you will live beyond life expectancy.

Most of us will be able to count on Social Security — and it’s a lifetime benefit. Will benefits be cut when, without governmental intervention, the Social Security program becomes insolvent in or around 2033? Only Congress can tell. And what percentage of your budget is covered by Social Security?

Retirement income alternatives

Traditional retirement income planning, using only investments, predicts how long your savings will last based on probabilities. Certainty is better when faced with these life risks. In other words, you need planning that allows you or your adviser to bring in longevity protection, and while the government isn’t always the first place we look for solutions, a QLAC, which Congress approved and recently expanded, addresses longevity protection with guaranteed income starting later in life.

As I wrote in my article Curious About a QLAC? SECURE 2.0 Act Gives This Annuity a Boost, “A QLAC is technically a deferred income annuity purchased by a tax-free transfer of a portion of your tax-qualified accounts generally made after age 55. That transfer, in addition to adding a QLAC to your plan, represents a reduction in your account for the purposes of determining taxable required minimum distributions, or RMDs. So, if you used 25% of a $400,000 qualified account, your $100,000 purchase of a QLAC would immediately reduce your RMDs by 25%. And the income from a QLAC could be deferred until as late as age 85.”

Sounds a little technical, but the easier version is that you can spend up to $200,000 from your pre-tax accounts like a 401(k) to buy a QLAC, which will defer RMDs on that amount. At the same time, income payments will begin at an age you decide — no later than 85.

QLAC recipients can use the money for whatever they choose, including a trip to Paris or season box seats to their favorite NFL team. But often they spend it on late-in-life health care or housing costs that otherwise might force them to move out of their long-term homes.

How it works

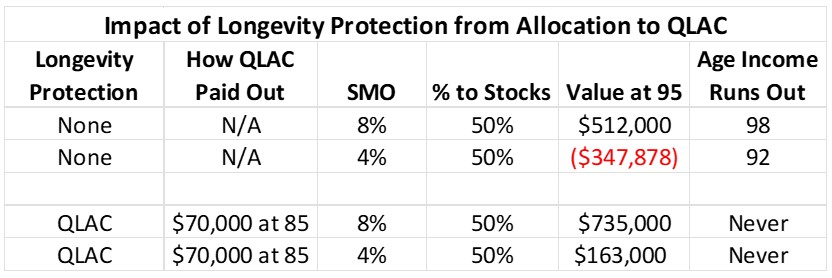

Providing longevity protection through a QLAC can minimize and even eliminate the risks of running out of money.

Let’s use the Go2Income planning tool and some standard assumptions to measure the risks and rewards. To simplify that analysis, we’ll use our sample investor, Sally, age 70, with $1 million of retirement savings in a rollover IRA account. She understands that she can and must do better than the 4% rule (or $40,000 per year) and instead is targeting 6%, or $60,000 per year, growing at 2% a year until age 85. That additional income of $20,000 and growing can make a big difference in her plan — provided it lasts a lifetime.

She orders two Go2Income plans with only investment portfolios and a 50/50 split between stocks and bonds. It’s a little aggressive, but she needs that to meet her ambitious goal of $60,000 annually. Her first plan assumes a long-term return in the stock market of 8%, and she ends with $512,000 at age 95. So far so good. Then she tests her second plan at a lower rate of return of 4%, which has occurred over long periods, about 10% of the time. In this case, her savings run out at age 92. Of course, the years before the run-out will be a time of high anxiety.

Now Sally tests the investment of $200,000 from her rollover IRA savings to purchase a QLAC. She runs the same two stock market scenarios and learns that a QLAC keeps the plan going for life. At an 8% stock market return, her plan is worth $735,000; at 4%, her plan has not run out of money — and she has $70,000 of guaranteed income for the rest of her life coming from a QLAC.

Here is a summary of the results:

Convinced of the efficacy of longevity insurance and QLAC, she tested different options to deploy the QLAC in her plan: (a) laddered QLAC income — reduces longevity protection but acts as an income inflation hedge; or (b) beneficiary protection — reduces late-in-life longevity protection in return for protecting her beneficiary in case of early passing. Visit our QLAC calculator to get a free quote to evaluate these options.

Other forms of income that suggest a need for longevity protection

The important part is to have a tool, like Go2Income, that can provide a fair and objective analysis of the advantages and disadvantages of QLAC or other options. While you’re at it, here are some other income streams that might need protection:

- Rental property that will be sold

- A 10- to 15-year payout from a business or investment

And probably the biggest — drawdowns from the equity in your home. In the next article, we will discuss how by using a home equity conversion mortgage (HECM), also known as a reverse mortgage, you can generate additional tax-free cash flow to 85 and substantial liquidity after 85. A QLAC is what makes it work.

Whether you consider a QLAC as a stand-alone improvement to your retirement, or integrated within Go2Income, order a complimentary Go2Income plan to help you find the best, most efficient plan for your income future.

Related Content

- How to Fix Social Security and What to Do While We Wait

- A Challenging Retirement Plan Mission: Not Impossible

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

- Annuity Payments Are 30% to 60% Higher: Time to Reconsider

- Don’t Bet Your Retirement on Stocks: Follow These Four Tips

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.