Curious About a QLAC? SECURE 2.0 Act Gives This Annuity a Boost

New legislation raises the amount you can transfer from your rollover IRA to a qualifying longevity annuity contract (QLAC), reducing RMDs and increasing guaranteed lifetime income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The SECURE 2.0 Act of 2022, enacted at the end of December, contains provisions that make it much easier to purchase a pension-like annuity called a QLAC for your retirement income plan. The new legislation allows you to defer more taxes and buy more retirement income from your 401(k), rollover IRA or similar tax-qualified accounts. The maximum QLAC per individual is now $200,000 with no percentage-of-savings limit.

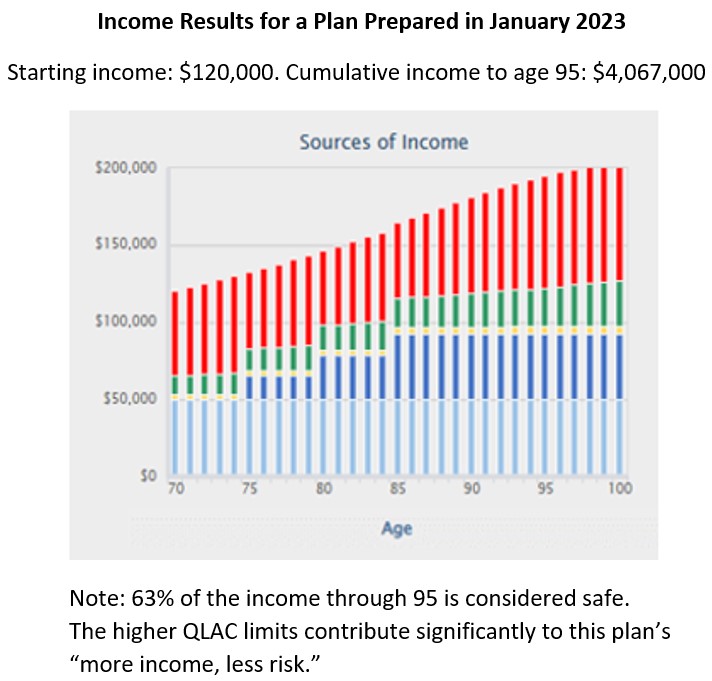

Combine this with the higher annuity payouts due to higher interest rates from these vehicles, and we’re talking about 100% to 250% more income from this source when compared to December 2021. Importantly, QLACs, or qualifying longevity annuity contracts, are offered only by some of the highest-rated insurance companies in the U.S.

What is a QLAC and how does it work?

A QLAC is technically a deferred income annuity purchased by a tax-free transfer of a portion of your tax-qualified accounts generally made after age 55. That transfer, in addition to adding a QLAC to your plan, represents a reduction in your account for the purposes of determining taxable required minimum distributions, or RMDs. So, if you used 25% of a $400,000 qualified account, your $100,000 purchase of a QLAC would reduce your RMDs by 25%. And the income from a QLAC could be deferred until as late as age 85.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While tax deferral to age 85 is nice and has a real economic value, it is also important to think about how you can use the income benefits of that $100,000 investment to improve your retirement. Let me give you two examples:

- A couple, both age 65 with a retirement income plan that’s in good shape, wants to ensure they can pay premiums on their long-term care and life insurance late in retirement. They can use the $100,000 to purchase lifetime income starting at age 85 of $36,000 per year — guaranteed. More than enough to pay the premiums.

- If you’re single but your retirement income plan is a little shaky after the financial upsets of 2022, and you’re concerned about inflation, you can use the QLAC to ladder guaranteed income that starts at age 75 and continues to grow. More about that in the example below.

Background on the SECURE 2.0 Act

Most of the news reporting about SECURE 2.0 has focused on the other parts of the legislation that make it easier for part-time employees and employers to create savings plans, along with an extension to age 73 at which age RMDs must be claimed. It also permits unused 529 accounts to be applied to a Roth account. For an overview of what’s in the legislation, see SECURE 2.0 Act Changes 401(k), IRA, Roth, and Other Retirement Plan Rules.

At the same time, many retirement advisers have been caught unaware of the QLAC provisions. (I’m being generous. Your adviser may not talk about a QLAC or income annuities generally because they don’t have the planning software to provide guidance to customers.)

Rules in the 2019 legislation that created the original SECURE Act (stands for Setting Every Community Up for Retirement Enhancement) limited the tax-deferred investments into a QLAC to $125,000, (with adjustments for inflation) or 25% of the account if lower. As mentioned above, the new rules allow up to $200,000 of tax-benefitted savings toward a QLAC, and the percentage-of-savings requirement has been removed.

Another benefit is included in the SECURE 2.0 Act: You can now include a “return of premium” feature in your QLAC so that the purchase amount, less any payouts, goes to a beneficiary at your passing.

What the higher QLAC limits could mean to you

QLAC investors at the legislative maximum get two simultaneous tax benefits: $200,000 is excluded from the RMD test, and the QLAC income can be deferred to later in retirement. Together with income from the balance of qualified savings and Social Security, the retiree can more easily meet income needs for life, while creating liquidity for other needs late in retirement.

To demonstrate, if in December 2021 a male aged 70 used $135,000 (the 2021 maximum) to purchase a QLAC, it would have paid income of $38,000 at age 85. Now, just a little more than a year later, you could purchase income of $75,000 a year. That’s because of the increase in the QLAC maximum to $200,000 a year combined with the higher interest-rate-based payout. (You can get a personalized quote that shows how a QLAC could work for you.)

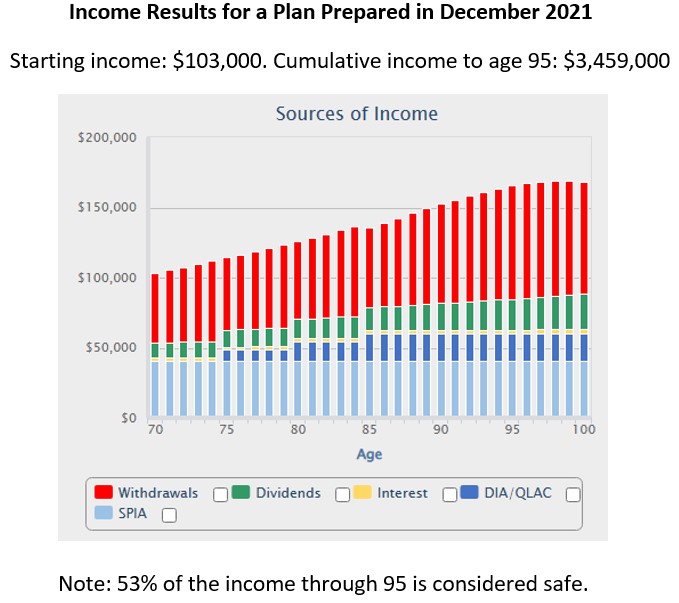

For that same 70-year-old male, the examples below show similar improvement with a Go2Income Plan for Retirement Income that utilizes dividends, interest payments, IRA withdrawals and annuity payments. (For more information, see For Sustainable Retirement Income, You Need These 5 Building Blocks.)

Another view of the QLAC

Mark Iwry is a former Treasury Department official who helped create QLAC during the Obama administration, and he also consulted on the expansion of QLAC provisions in SECURE 2.0. He told the Retirement Income Journal that QLACs can especially benefit women, who are the most likely to live into their 90s.

“The combination of mortality pooling and predictable investment for 15 to 20 years produces a meaningful add-on to Social Security income starting at 80 or 85,” Iwry told the online journal. “Never mind that Homer (Simpson) thinks all those beers and cheeseburgers mean he’ll never live past 80. The QLAC is for Marge.”

Whether you’re male, female or a couple, a QLAC is a financial instrument that should be considered.

For a specific look at the changes a QLAC could make in your own retirement, visit Go2Income for a complimentary Plan for Retirement Income. This funny-sounding idea that was just expanded through legislation is something you should consider.

related content

- Even After a Year Like 2022, Your Retirement Income Plan Can Stay on Course

- Finding Peace of Mind With Your Retirement Income

- How Much More Retirement Income Can You Get?

- Don’t Bet Your Retirement on Stocks: Follow These Four Tips

- Can AI Plan Your Retirement Better Than I Can?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.