How Much More Retirement Income Can You Get?

Each investor is unique, so the answer to that isn't as simple as it sounds. Let's take a look at a few different scenarios to see the outcomes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A savvy consultant recently asked me how much more income a Go2Income plan, with its integration of annuity payments and focus on income allocation, could produce as compared to a traditional retirement income plan. Might it be 20% or more?

He recalled my discussion about rules of thumb in Retirement Planning: One Size Doesn’t Fit All. In that article, I pointed out that the Starting Income Percentage (SIP) for a Go2Income plan was 5% — vs. the “4% rule of thumb” many advisers include in their plans. (That extra percentage point, from 4% to 5%, is a 25% gain.)

But I couldn’t give that consultant a definitive answer or a single percentage — because each investor is different. Investors will:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- Bring a unique profile based on age/gender/marital status and savings.

- Have a different set of retirement objectives and tolerance for risk.

- Experience a particular set of market results.

So, while I believe in Go2Income planning, I am ducking the “income advantage” question until we discuss the numbers question in more depth.

It’s Not All About the Numbers

In designing the Go2Income planning method and process, reducing the “risk of ruin” — or running out of money in retirement — is our No. 1 objective. And within that constraint, the method strives to achieve the investor’s legacy objective wherever possible.

Assembling and presenting the numbers so that an investor can understand the plan and what the numbers mean is critically important. Here’s our process:

1. To introduce a plan to an investor, we deliver a “starter” plan focusing on a few key plan results: starting income, annual percentage increase in income to age 85, percentage of safe income and legacy at 95.

2. To present the detail, we use plenty of illustrated graphs to show investors the plan in an easy-to-digest form. Some examples are below.

3. To capture the often-conflicting objectives of income and legacy, we use a “decision table” that helps us compare plans on a more scientific basis.

Set out below are illustrations of these three steps.

1. Simple Definition of Plan

Here’s how we describe a starter Go2Income plan for the investor we often use in our examples (a 70-year-old female with $2 million in retirement savings). Her starting income in the Go2Income plan is $114,000 per year, and it will grow by 2% a year to $135,000 at age 85. About 60% is safe, meaning it’s not coming from the sale of investments. Her legacy at age 95 is $2,730,000 as she reinvests her income in excess of her 5% income goal of $100,000 per year. We’ll use this example for the balance of the article.

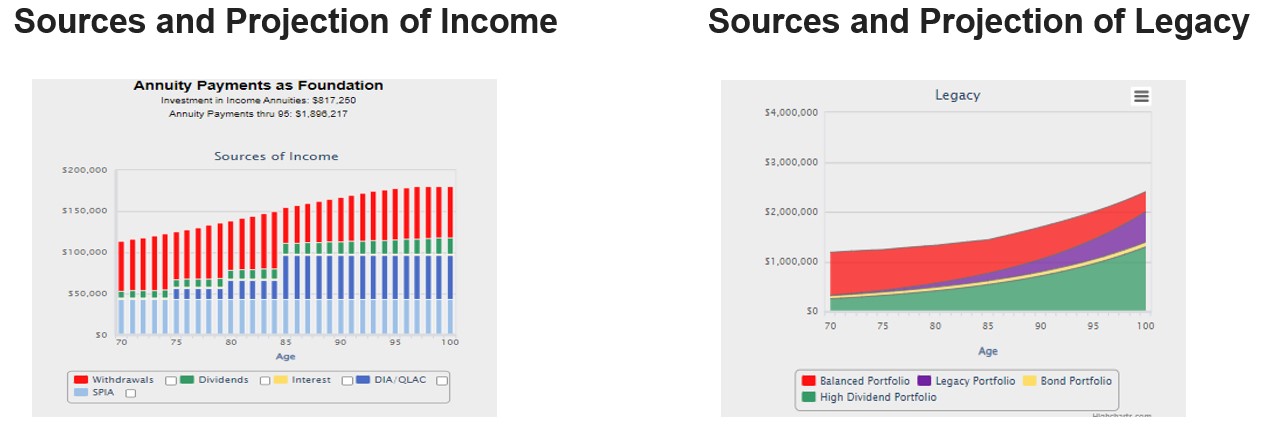

2. Capture Details in Easy-to-Digest Graphs

The projected results of every decision you make can be explained clearly and quickly in a visual way, often with a graph. Such visual aids will also show how unexpected turmoil — inflation, recession — might affect your income stream.

For the case above, here’s how graphs fill in the picture:

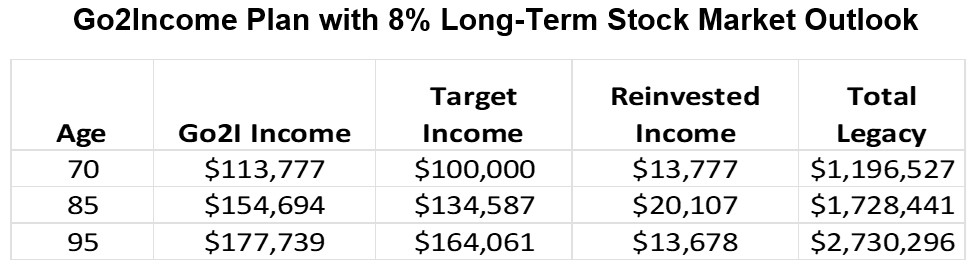

3. Considering Plan Income, Income Goal and Legacy

The above graphs and starter plan information look at income and legacy separately. But how do you achieve both sets of objectives? We had to develop a “decision table” like the one below, which shows the following:

- Income from a Go2Income plan based on a set of planning assumptions.

- Target income set by client; in this case, 5% of savings, growing by 2% a year.

- Excess income available to reinvest, or liquidate if there is a deficit.

- Legacy from the Go2Income plan together with the value of reinvested or liquidated income.

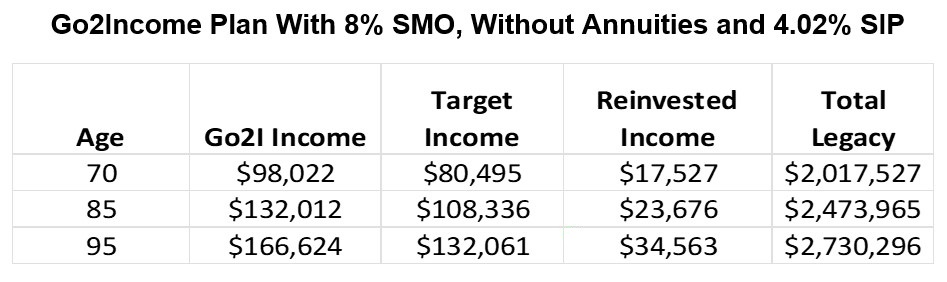

Here’s our decision table for the plan adopted by the investor based on an 8% long-term stock market return (after fees) and other standard assumptions.

This plan seems to work out, since our investor is meeting her target income and reaching a legacy in excess of her initial savings, but that’s not true in every situation. Let’s use our decision table tool to answer the most frequently asked and fundamental questions.

Frequent Questions About the Plan

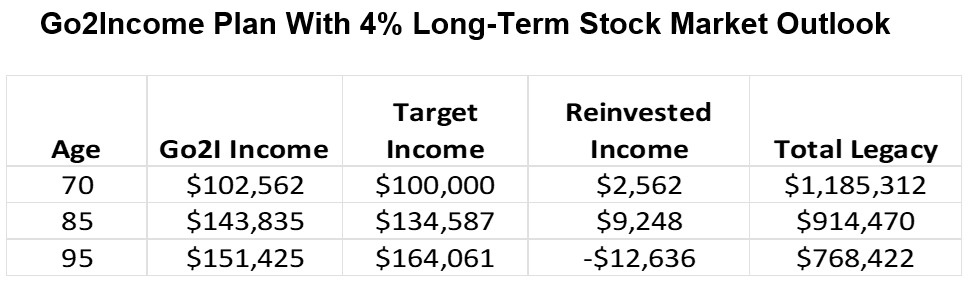

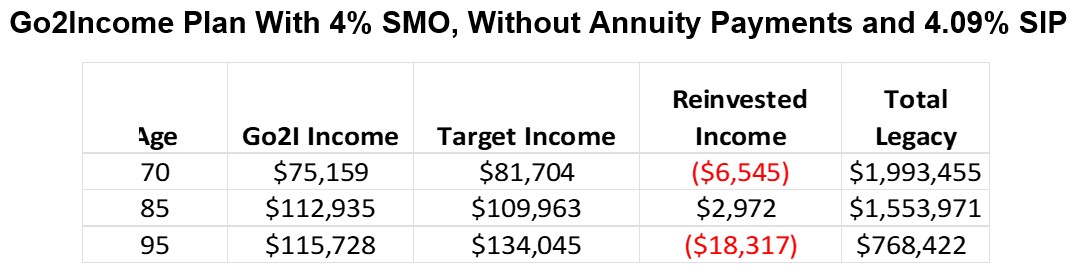

Q: What if the market doesn’t achieve a long-term 8% stock market return and does only 4% over the long term?

Using this same set of measures, the plan illustrated below still meets the income objective, but delivers a lower legacy at 95 of $768,000. Under Go2Income, most of the market underperformance has been pushed to the kids or grandkids.

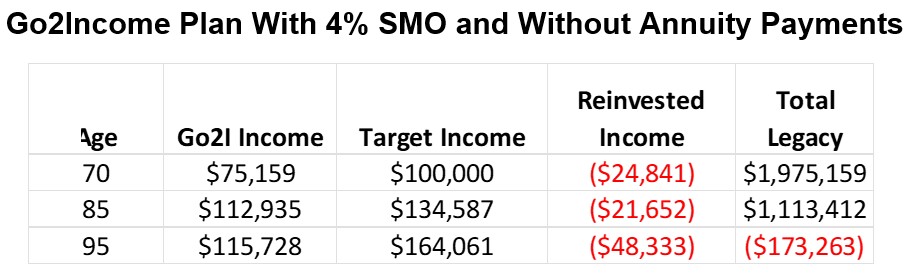

Q: What if I get rid of annuity payments and achieve the same 4% long-term performance?

Rather than ending with $768,000, the legacy portion of this plan runs out of money by age 92 — primarily because there’s no source of income, like annuity payments, that is unaffected by the market.

That’s not a satisfactory result.

What’s the percentage advantage “number” for these two scenarios?

Getting back to the consultant’s question, our analysis does show a large bump in the income goal while meeting a long-term legacy objective by using Go2Income.

Here’s the way I would describe that increase:

If you believe in a long-term return on the stock market of 4%, but don’t want to include annuity payments, then to match the Go2I legacy at 95 (and to avoid running out of money), you’ll have to lower your goal from 5.00% to 4.09%.

If you believe in a long-term return on the stock market of 8% and want to eliminate annuity payments, then to match the Go2Income plan’s legacy at 95, you’ll have to lower your goal from 5.00% to 4.02%.

Depending on how you look at it, adding annuity payments and using the decision table, there’s a 22% to 25% increase in income.

That’s impressive. And although your situation will be different, a Go2Income plan is designed to create more income and long-term legacy. For everyone.

When you are ready to discuss a retirement income plan that allows you to enjoy the rest of your life without big money worries, go to our landing page, answer a few simple questions and begin to create your plan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.