How to Plan for an Early Retirement

Hint: It’s a little different than the usual retirement planning. When you want to retire early, there are a few extra considerations you need to think through.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Dreaming of an early retirement? You’re not alone. In the midst of the pandemic, the number of retirees 55 and older grew by 3.5 million according to the Pew Research Center. But it’s not just those over 50 looking to retire, according to a recent study by Northwestern, millennials are twice as likely to be thinking about early retirement as Gen Zers and three times as likely as Gen Xers.

An early retirement sounds nice, though there are challenges. Consider you may be forgoing additional savings, your Social Security benefits may be impacted if you stop contributing, and with life expectancy increasing over the years, you may have to rely on your savings for longer than if you waited. But if you really want to get serious about early retirement, then I suggest taking a careful, thoughtful approach. After all, you only want to retire once – you will want to get it right the first time.

Here to help get you started are a few suggestions I share with my clients who want to retire early.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Retire with a realistic picture of your income and expenses

Estimating retirement expenses is tricky, given all the unknowns. In my experience, I see retirement spending generally stays about the same in the first few years of retirement. Clients are the most active in this phase, given all the travel and bucket list items they want to accomplish. Spending eventually levels off, and usually declines later in life. Housing, health care, caring for adult children, taxes and travel make up the bulk of the typical retiree’s budget in my experience.

Long-term care expenses are the big whammy, especially if both the husband and wife need care, that could be a game changer. It's best to plan for long-term care earlier in retirement, as there may be more options.

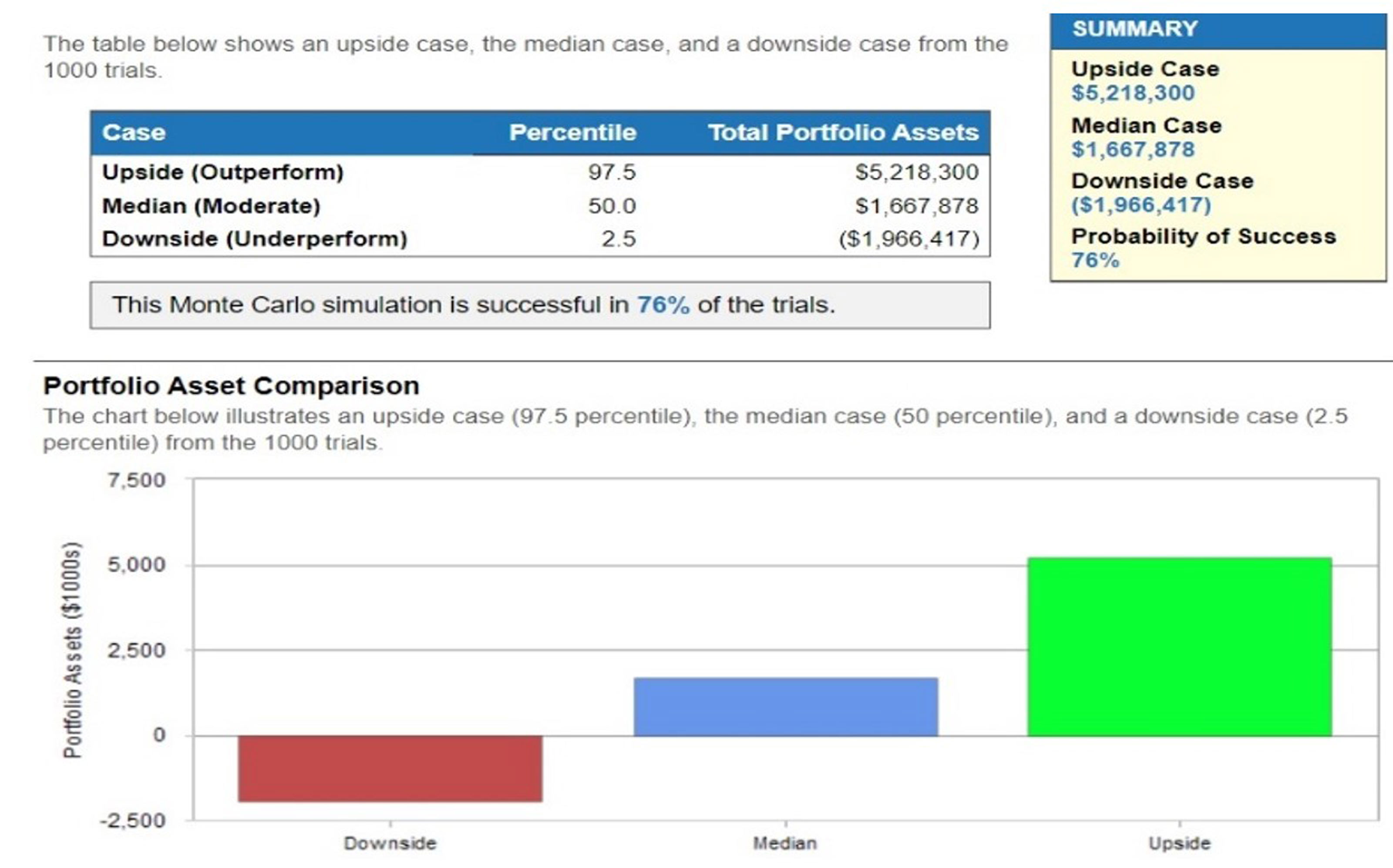

If you estimate your retirement expenses will be roughly 75%-80% of your pre-retirement expenses, you need to determine whether the income derived from your 401(k), 403(b), pension, Social Security or other sources can generate that. I suggest running retirement projections at varying rates of investment return or playing with the inflation rates to stress test your situation. Figure 1 is an example of the planning software we use, which can show 1,000 random return sequences.

Figure 1: Sample Monte Carlo analysis showing the probability of retirement success using 1,000 random iterations of investment returns.

As for spending, we can’t control all retirement expenses, but we can control some of them. The thought of downsizing may have crossed your mind. I find most retirees hold off on downsizing, as they are too attached to the house or the neighborhood. But downsizing can certainly help keep the expenses down. You may be able to lose one or more cars (and the insurance that goes with them) and live in a neighborhood with extensive, efficient public transit. Ditching landlines and premium cable TV (or maybe all cable TV) can bring more savings.

If you can’t produce enough income from your savings or other retirement sources, there may be other options, such as working part-time, using the equity in your house, or delaying retirement a little bit longer. Working with a professional may uncover other ways to save on expenses or generate more portfolio income.

2. Make the most of your savings

If you want to retire early, it’s essential you maximize your savings now. If your cash flow permits, maxing out the workplace retirement accounts – especially if your employer offers a match – is a smart idea. I especially love the Health Savings Account. The triple tax play is hard to beat on an HSA:

- Pre-tax contributions

- Tax deferral

- Tax-free withdrawals for qualified medical expenses

Also, how you are you saving in your 401(k) – pre-tax, Roth or after-tax? Have you made substantial pre-tax contributions? If so, maybe switching to a Roth going forward can make sense. You will lose the current tax-deduction, but qualified Roth withdraws are tax-free. Tax-free withdraws can help keep your future retirement tax rate down.

3. Retire with the idea that you’ll live to be 100

With recent advances in health care, you might become a centenarian. That means your income streams may need to last 20, 30, 40 or even 50 years. Any income streams that you have today may need to be supplemented or adjusted due to unforeseen needs and inflation.

Many new retirees make the mistake of withdrawing income at too high a rate in the first few years after leaving work. They have a lot of fun early on, only to discover, that their retirement nest egg is shrinking fast because they are spending more than their portfolios can earn back.

Additionally, you may also have to pay for health insurance if you retire before age 65. All of this may point you in the direction of part-time employment rather than total retirement.

4. Retire with purpose

Leaving work behind can be exhilarating. But after the first few months, you may ask yourself, “Now what?” Early retirement is better with a plan for purposeful and meaningful living regardless of your finances.

I suggest you start thinking of your retirement purpose. Without a purpose you may start to drift or worse, start to miss the work! In my experience, those clients who retired with a purpose – a general idea of how they will spend their time – were the ones who ultimately thrived.

With that in mind, here are some key question to ask:

- What do you absolutely need to accomplish? If you could only get four or five things done in retirement, what would they be? Answering this question might lead you to compile a short list of life goals.

- What would revitalize you? Some people retire with no particular goals at all. Others are simply burnt out. After weeks or months of rest and relaxation, ambition inevitably returns. How will you channel this new energy? What sparks your fire? Start thinking of how you will spend the next phase of your life; we all need a reason to get up in the morning.

How are you preparing for retirement?

This is the most important question of all. You have to be honest with yourself. Early retirement is not a decision to take lightly. There’s no guarantee you’ll be able to get back into the workforce later if it doesn’t work out. But this doesn’t mean it’s not impossible. It may only mean you have to plan better. Run the numbers, stress the scenarios, plan to live long, and have a purpose.

These are only some of the many planning tips. You may have to plan for Social Security differently. Or you may have to decide how best to take a pension. You may have to invest differently too. If you have to plan for a longer retirement, does that mean you need greater growth to outpace inflation? That depends. Proper planning and modeling can help.

There are also costs many retirees don't consider like long-term care, taxes on retirement accounts, and inflation to name a few. I suggest talking to your friends, mentors, other retirees, and a financial professional, people who have been there done that. They may help broaden your perspective.

I also suggest having a financial plan. A financial plan gives you a reality check on your goals, can help prepare you for the unexpected, and ultimately get you closer to where you want to be.

For a complimentary conversation about your retirement or explore how a financial plan can help, please feel free to schedule a call here: https://michaelaloi.com/

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.