10 Ways to Increase Your After-Tax Investment Returns

Your investments could be doing great, but if you’re not minimizing your taxes on them, you’re throwing money out the window. Here are 10 tax-smart ways to optimize your investments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Taxes are a drag. A drag on your investment return, that is. Dividends are taxable, interest income is taxable and capital gains are taxable. Your after-tax investment return – what you keep, not make, on your investment portfolio – could be lower than you think. And with tax rates probably trending higher, now is the time to get planning. After all, portfolio income when added to your other income can push you into a higher tax bracket, trigger an additional investment income tax, or cause Social Security benefits to be taxed.

Here to help are 10 fixes to help increase your after-tax investment return:

1. Use low-turnover mutual funds

Mutual funds report a “turnover ratio.” This is the rate at which a fund manager buys and sells stocks or turnovers a portfolio. The higher the turnover, the greater the likelihood for taxable capital gains distributions at the end of the calendar year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Consider using low turnover funds – lower than 30% – in taxable accounts. High-turnover funds belong in IRAs and 401(k)s where there are no taxes on capital gains.

2. Use index funds in taxable accounts

Index funds, such as the Vanguard Index Funds, have low turnover. There is very little buying and selling, and typically lower capital gains distributions in index funds than active funds. For that reason, index funds are good investments for taxable accounts like a brokerage account.

3. Active indexing helps even more

Active indexing is owning each individual stock in a stock index instead of buying the index mutual fund. It’s like buying all the stocks in the S&P 500 index. You do this to increase the opportunity to harvest losses in the portfolio.

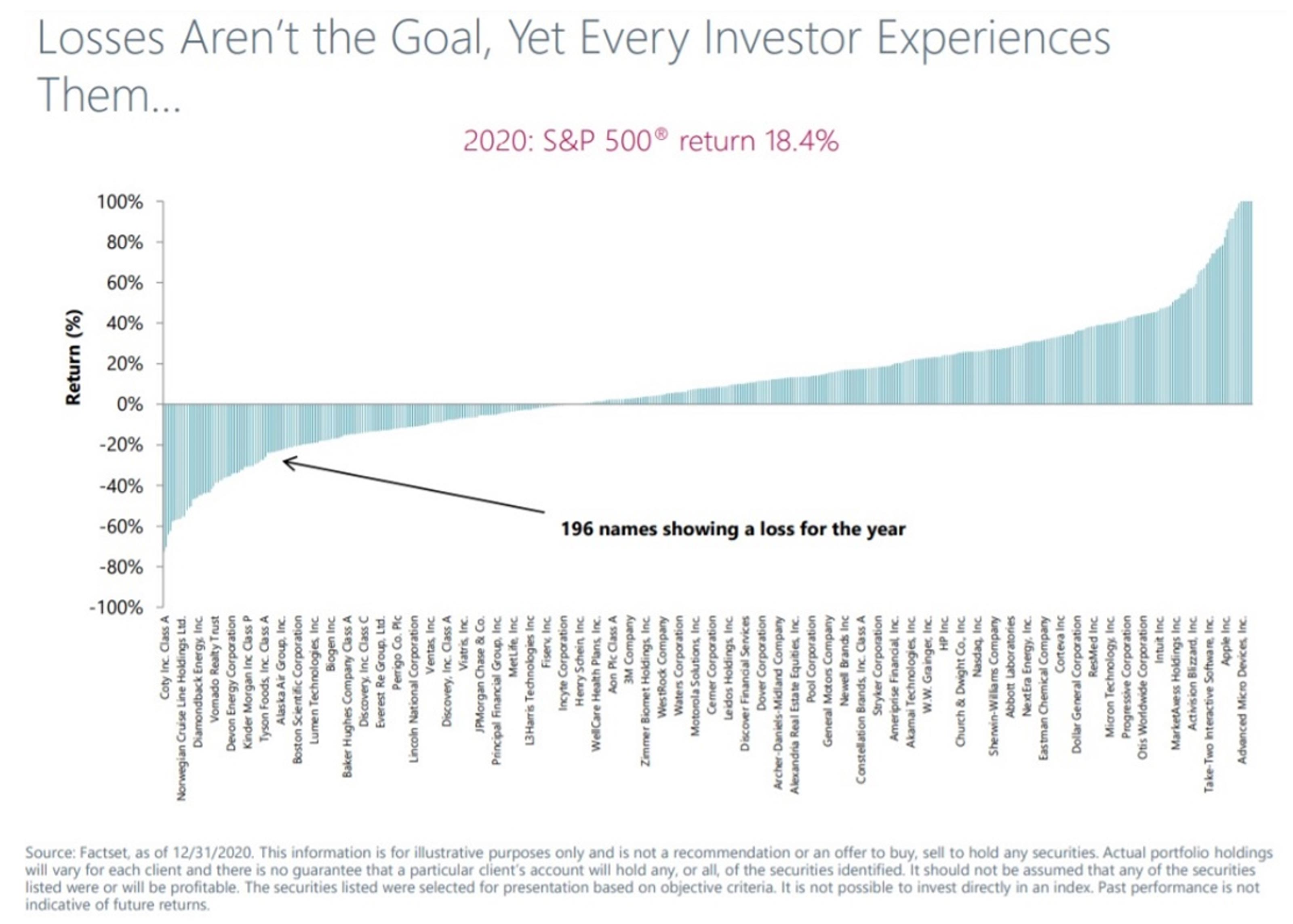

In 2020 the S&P 500 Index finished positive for the year, yet there were 196 stocks in the index that had a loss (See Figure 1). In that year, any one of the 196 stocks could have been sold at a loss to offset a gain elsewhere in the portfolio. You can’t do that if you own an index mutual fund, such as the Vanguard S&P 500 Index.

When you invest in an index mutual fund, you lose the opportunity to harvest losses from the underlying stocks. In that strategy, losses are used to reduce your gains. The less you pay in taxable gains the more money you keep invested. Excess losses are carried forward indefinitely on your federal tax return. This is extremely important for those who may have to sell an asset in the future to provide income. Your future self will thank you for banking those losses.

Managing 500 stocks is a lot for an individual investor. I use two or three institutional money managers for my clients, or you can consider building your own index fund.

Figure 1: Owning individual issues of stock create more opportunities for tax-loss harvesting than owning a single index mutual fund.

4. Look to tax-managed mutual funds for help

Tax-managed mutual funds are mutual funds available to retail investors. The difference between a tax-managed and regular mutual fund is a tax-managed fund actively employs various tax saving strategies. The manager may have a low-turnover strategy to reduce capital gains. He or she may also use tax-loss harvesting – offsetting gains with losses. Tax-managed funds are best held in taxable accounts and can help lower the taxes on your portfolio income.

5. Max out tax-friendly accounts

If you have a high-deductible plan through work, a health-savings account (HSA) is a tax-friendly place to save. The same for cash value life insurance. If you can contribute the max to your 401(k) or IRA, but still are looking for additional tax-deferral, consider making after-tax contributions if your plan allows. Some 401(k)s can take additional after-tax 401(k) contributions – beyond the regular and Roth. There is no deduction upfront, but the earnings are not taxed.

The nice thing too is you may be able to convert your after-tax contributions to a Roth 401(k). You will have to check with your 401(k) administrator. Qualified distributions from a Roth 401(k) are tax-free. The earnings are taxable upon conversion. My recent blog post explains this strategy in greater detail: The “Mega-backdoor Roth.”

6. Consider a no-load variable annuity as an option

All variable annuities allow for tax deferral. The capital gains and interest income are reinvested in the annuity. I prefer a no-load variable annuity, which can have lower costs than a traditional variable annuity. Be aware, upon withdrawal from any annuity, the gains are taxed as ordinary income. That is a trade-off you’ll have to balance – swapping capital gains today if you invested in a brokerage account vs. tax-deferral and ordinary income tax in the future.

You will have to defer long enough with a no-load annuity to make the compounding work you. For my clients, I routinely shop around for a no-load variable annuity that offers the best mix of mutual funds and lowest fees.

7. Be smart about where you hold high-yield bonds

The next three tips involve “asset-location” or holding the right investment in the right account. Kiplinger’s Nellie Huang had a good article about this in June, citing “not all bonds should be held in taxable accounts.” I cringe when I see an investor own a high-yield savings bond in a taxable account. All that high yield is eaten up by ordinary income tax rates. High-yield fixed income belongs in an IRA, 401(k) or no-load variable annuity.

8. Take a look at REITs

REITs (real estate investment trusts) are great for income, some paying a 4%-6% yield. That yield may or may not be taxable. Some private REITs pay back their yield as a return of capital and have other expenses, such as depreciation, which they pass onto investors, reducing the tax liability. Whereas with publicly traded REITs, like the Vanguard Real Estate Index Fund, the yield is ordinary income.

If the REIT you own pays all ordinary income, it is best to own it in a retirement account to avoid the ordinary income tax.

9. Find the best spot for your dividend-paying investments

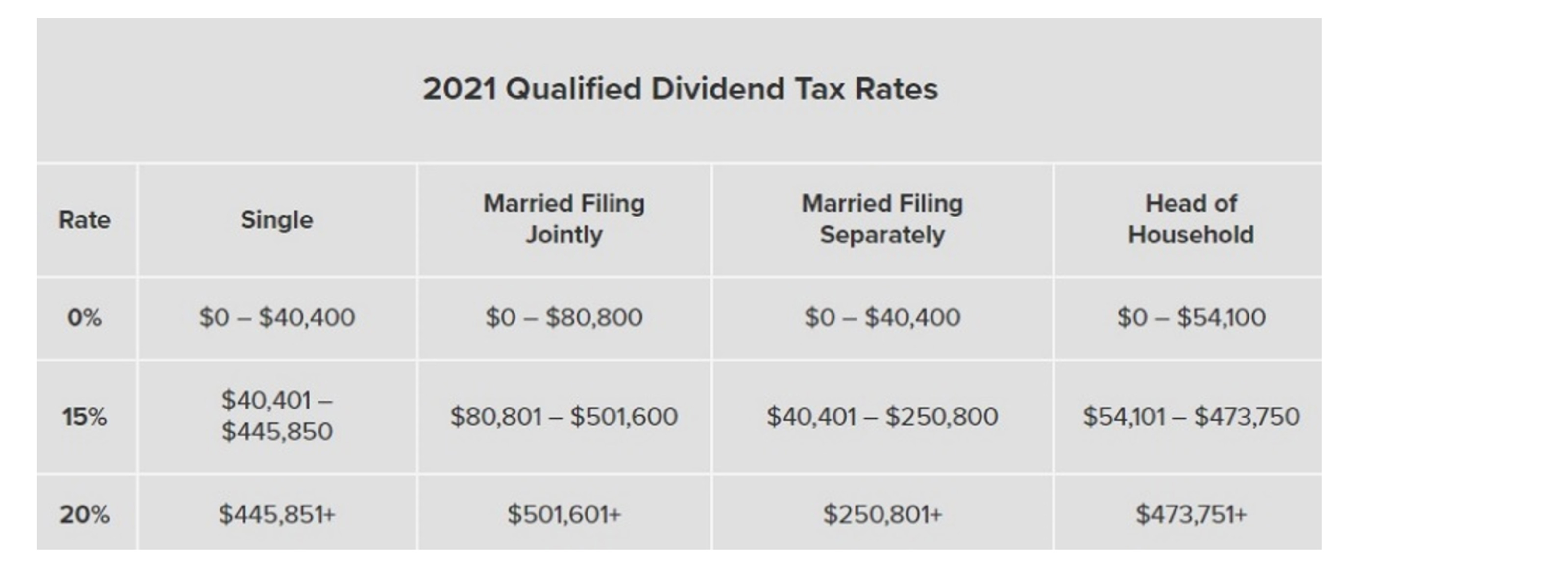

When it comes to stocks, bonds and mutual funds, the qualified dividends they generate are taxable, but at preferential rates. (See Figure 2.) Ideally, you want to own dividend-paying stocks in retirement accounts or in a no-load variable annuity to avoid the tax.

Figure 2: Tax rates on Qualified Dividends are different than ordinary income tax rates

Sometimes it comes down to asset location. If a client has stocks and bonds, I may recommend owning all the dividend-paying stocks in a taxable brokerage account, given the preferential tax treatment. We could then allocate all our fixed income to retirement accounts, so the yield is not taxed.

10. Consider owning ETFs instead of mutual funds

ETFs (exchange-traded mutual funds) have the upper hand versus traditional mutual funds when it comes to taxes. It has to do with the way ETFs redeem, or sell, their shares. If you own an ETF and go to sell, another individual investor buys your shares. If you sell a mutual fund, the manager redeems stock to pay you for your shares. This can cause a capital gain distribution, which is taxable.

Granted, this is less the case with an index mutual fund, but from a tax perspective, ETFs generally are more tax efficient. There is much more to know about ETFs, please consult a qualified professional or use the Kiplinger ETF tool, The Kiplinger ETF 20.

As with many things in life, you can only control what you can control. You can’t control whether tax rates rise, but you can control how and where you own certain investments. Remember:

- High-yield, high-income, high-turnover mutual funds are better off in non-taxable accounts, such as IRAs, 401(k)s, and no-load variable annuities.

- Try to max out your 401(k) or IRA contributions.

- Consider making after-tax contributions to your 401(k) if the plan allows.

- Have an active tax-loss harvesting strategy, like using an active index to build up losses to offset against future gains.

- Use ETFs in taxable accounts to cut down on capital gains distributions.

- Review your asset allocation, and consider owning all your dividend-paying stocks in taxable accounts and fixed income in retirement accounts.

But before you make any wholesale changes to your investment approach, you should consult with a qualified professional, or email me to discuss your options. You may be able to control a lot more than you think!

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.