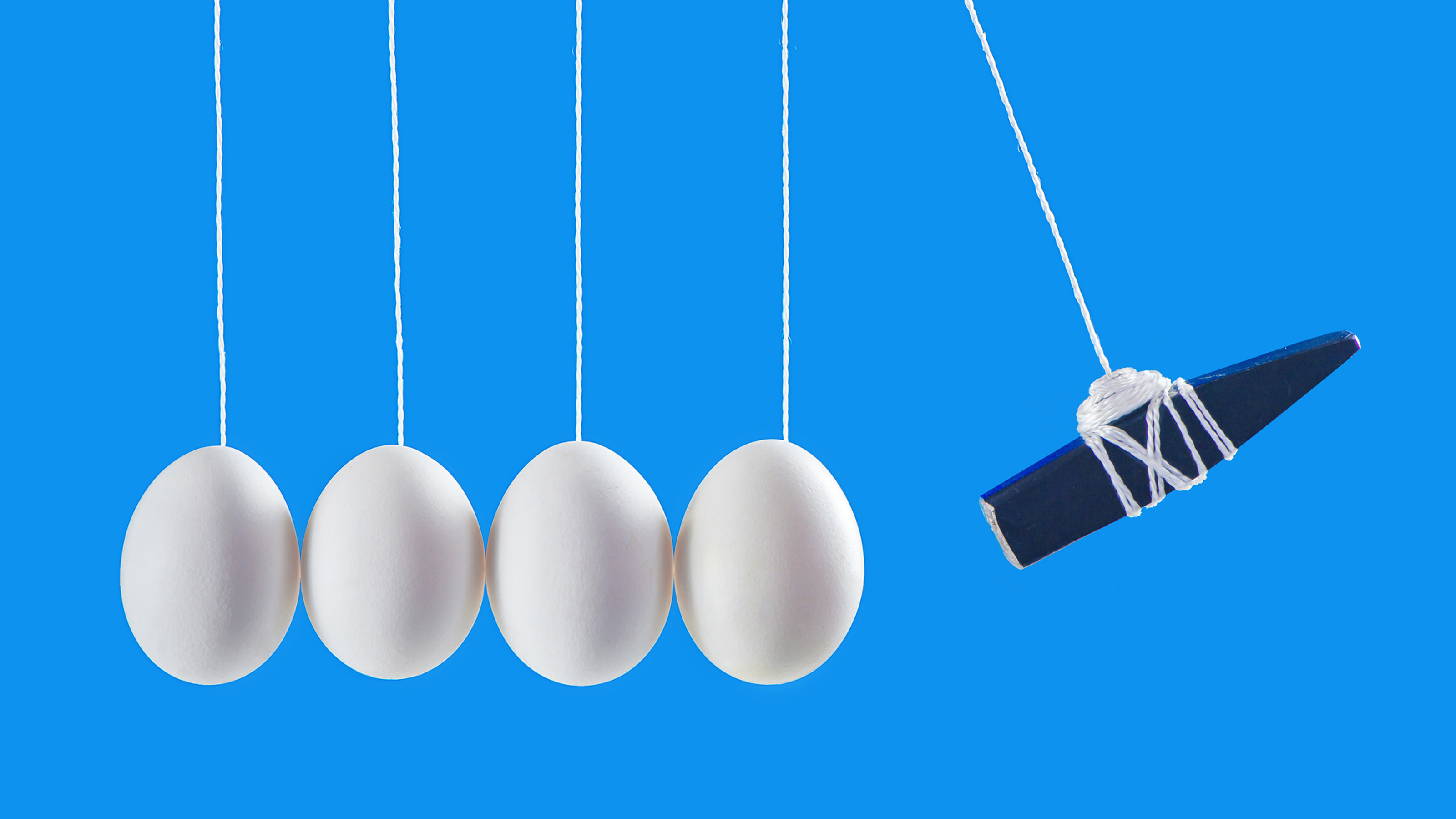

How Exactly Do You Stress-Test Your Financial Plan?

Some tasks are not good for DIYers, and stress-testing your portfolio is probably one of them. Because individuals don’t have access to the same tools that pros do, they are somewhat hamstrung. But they can get a leg up by laying the groundwork themselves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you’ve been investing for some time, you most likely have a plan in place. Of course, these plans will vary depending on your specific goals, age and risk tolerance. But the essential consideration is that some sort of attainable goal, as well as a plan on how to reach that goal, is common to most investors.

Along with that, however, comes a fatal flaw that is seen far too often: These plans are made in a vacuum. You may think, if I continue earning my current salary, putting 10% in savings, and investing another 25%, then everything will turn out fine. Unfortunately, nothing happens in a vacuum — least of all in the world of investing.

The fact is that the circumstances in which you made your plan will most certainly change. Income can fluctuate (either expectedly or unexpectedly), interest rates change, inflation rises or drops, economies experience recessions, and industries crash.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This means that our immediate cash needs and the risks associated with certain investments can significantly fluctuate, too. The way they impact our long-term financial plan is vital.

None of us can predict how the future will unfold. However, we can approximate what would happen to our portfolio if some of those initial factors were to change. The basic idea isn’t too complicated: If your primary source of income sharply decreases, will your limited savings require you to liquidate long-term investments to generate short-term cash flow, thereby throwing your entire retirement plan off course?

These are the occurrences we wish to avoid — and stress-testing our financial plan helps us do just that.

In practice, this process requires a vast amount of knowledge and expertise. Most investors turn to financial advisers to help with such a task. Whether you’re seeking to conduct this yourself, or plan to turn to a trusted adviser, the following will provide a head-start either way.

Stress-Testing Your Portfolio: Considerations

The first and most crucial aspect of a stress test is to start with a budget. Calculating your budget will allow you to forecast cash needs over time.

Understanding your cash needs — which are specific to your income, financial goals and lifestyle — allows you to recognize the most important aspect of successfully managing a financial plan over time: Your goal isn’t just about growing your assets; it’s about managing liquidity.

Life happens — and we all eventually run into unexpected cash needs. The last thing you want to do in such a situation is liquidate a long-term investment to satisfy short-term cash flow needs. This will not only divert your long-term financial plan, but you’ll likely incur added immediate expenses through capital gains taxes.

When most investors think of their financial plan, they think long-term. And that’s great — but everyone needs to be prepared for a rainy day in the immediate future. The key to finding this balance between a long-term vision and the immediate future boils down to liquidity management, which all starts with defining a budget.

If your budget isn’t clearly defined, then you’ve already botched your stress-test.

So, once you nail down a budget and projected cash flow, the focus then shifts to your portfolio. This is where things get a little tricky. Most portfolios are built using tools that only professional money managers can access. This is why it’s always best to utilize a financial adviser.

Above all, there are two primary concepts at play in your stress-test: asset appreciation and after-tax cash flow expectations. This is very similar to the strategies behind many large endowment fund managers — but just on a micro-scale.

In action, this typically involves examining risk-ratios to calculate expected returns and volatility from modern portfolio theory. The obvious goal is to maintain the lowest risk ratio for the highest expected value. A key component is maintaining balance between risk and reward, and one way in which this is done is through the Sharpe Ratio.

To put it simply, the Sharpe Ratio adjusts the expected return of an investment based on its risk. Let’s say Jerome and Sarah are both traveling from point A to point B. Jerome takes his car, averaging a modest 45 mph. Sarah takes her motorcycle, averaging 75 mph. Of course, Sarah reaches point B first. But — she also incurred much more risk than Jerome — despite the fact that they both reached the same destination.

Was the risk that Sarah took worth the benefit of arriving early? Of course, the level of risk you’re willing to assume will vary based on your unique situation, but this is the sort of insight that the Sharpe Ratio aims to illuminate.

Then, there are some stressors that need to be thrown into the mix. The most important of which should be a loss of primary income. Many experts suggest having three to six months of your salary readily accessible as cash in a savings or brokerage account. All too often however, this simply isn’t enough. More conservative savers aim for a figure closer to 12 months. Again, we see how starting with a budget — to determine monthly expenses and manage short-term cash flow needs — plays a crucial role.

For most people, the end goal of this entire process is adequately preparing for your retirement — so that you can indeed retire on time. For various reasons, the average age of retirement continues to rise, particularly for men and entrepreneurs over the age of 65. Making the choice to continue working is one thing, but feeling obligated to maintain an income stream is another. Stress-testing your portfolio will help you gain a better understanding of your preparedness to life’s curveballs — and will hopefully help you sleep better at night.

Of course, the steps above are fairly easy to understand in theory, but are much more difficult to execute in practice. Building a budget, measuring risk and assessing expected value are difficult tasks. While they are not necessarily impossible to perform on your own, the above framework — at the very least — should be used as a template when selecting a financial adviser.

One way in which financial advisers test different scenarios — and their subsequent impact on portfolios — is through the Monte Carlo Simulation.

Monte Carlo Simulations

Dwight Eisenhower once said, “Plans are nothing, planning is everything.” While the first part of that sentence might be too harsh, one is forced to agree that the actual planning is more important than the plan. Plans depend on circumstances, and circumstances change, but the ability to adapt — and construct a plan — is valuable at all times.

Monte Carlo simulations work by taking a financial plan and simulating how it would fare under different conditions; the most important of which are changes to your income and expenses, savings, your life expectancy, and expected returns from long-term investments.

Some of these factors are under your control — income, expenses and expected returns due to asset allocation largely depend on you. However, market conditions such as inflation, your investment horizon and many other factors do not. So, in order to get a result, the Monte Carlo method assigns a random value to those uncertain factors. The simulation is then run thousands of times to get a probability distribution.

If this sounds complicated, there’s no need to worry. Even if you’re an experienced investor, this is a topic that requires professional experience in the field. The fact is, even if the software used to run stress-tests were available to the general public (which it isn’t), you would still be left with the trouble of deciphering the results of the test and putting them to use.

Final Thoughts

It’s an arduous task to stress-test a financial plan on your own. Leveraging a professional is the most popular path here. You can, however, do some prep work yourself to better understand the process and select a financial adviser you trust. Most of those preparations will revolve around budgeting and making contingency plans for yourself — think of them as your own prelude to a stress-test.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tim Fries is co-founder of Protective Technologies Capital, an investment firm focused on helping owners of industrial technology businesses manage succession planning and ownership transitions. He is also co-founder of the financial education site The Tokenist. Previously, Tim was a member of the Global Industrial Solutions investment team at Baird Capital, a Chicago-based lower-middle market private equity firm.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.