Should You Take Pension Payments or a Lump Sum? A How-To Guide

With buyout offers, when deciding whether to take it or leave it, a couple of calculations can be enlightening. This how-to guide walks you through the steps to help make the right choice for you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Your employer doesn’t want to be in the pension business. It’s too expensive. Low interest rates force employers to beef up their pension contributions or invest in riskier assets to meet their plans’ assumed rates of returns.

For this reason, employers offer lump-sum buyouts. The company wants you to take the buyout so they can exit the pension business and save money. You can take the pension lump sum and roll it tax-free into an IRA.

But how do you evaluate a one-time lump-sum offer against the possibility of lifetime payments that a pension offers?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Should you take it or leave it? Here is one approach I use when evaluating a client’s pension offer:

Step 1. Run the numbers

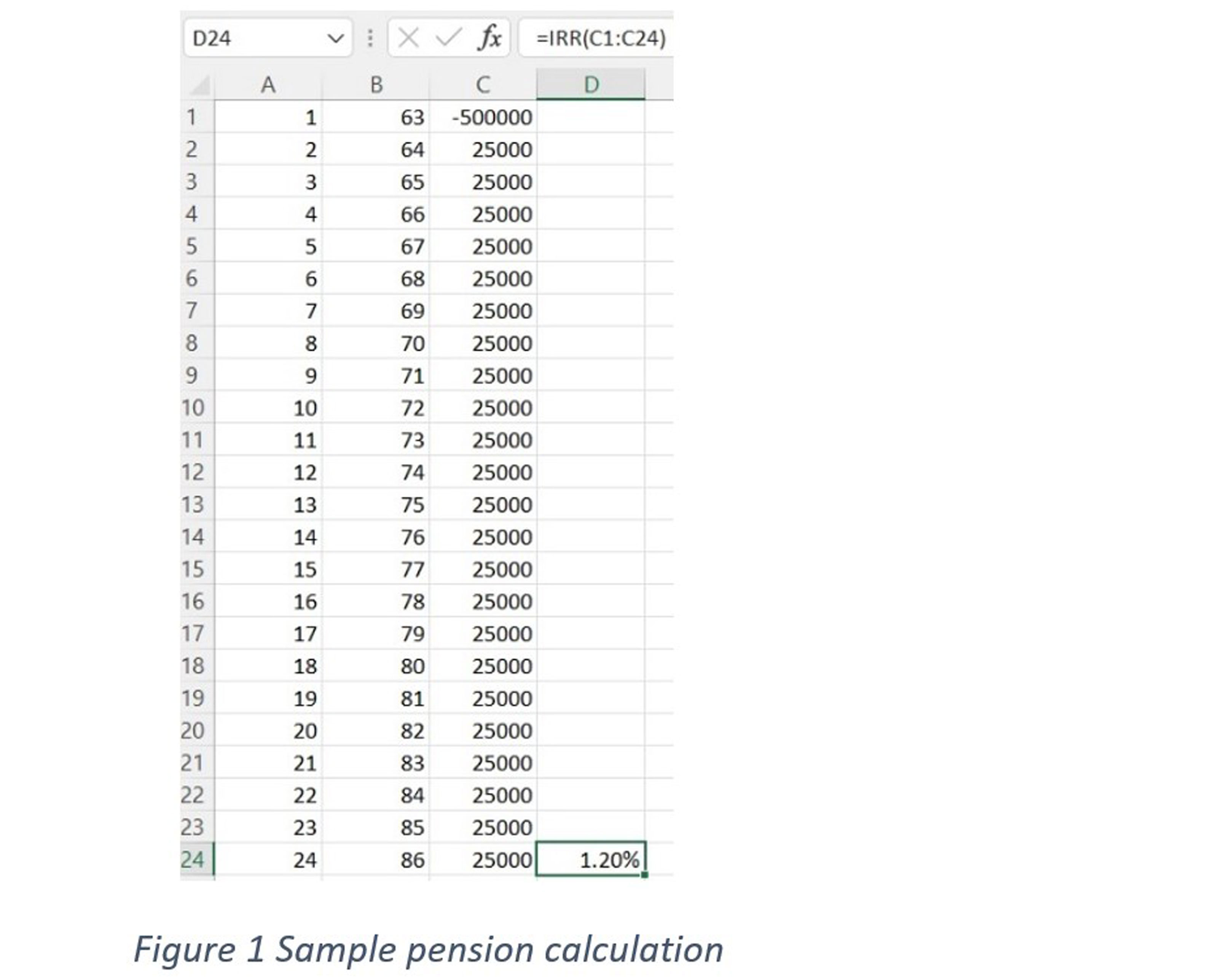

Start by calculating the internal rate of return (IRR) of the pension. The IRR tells you the rate of return you would need to beat by investing your lump sum in order for it to make sense to take one. Here are the steps in Excel:

- In Column A enter the year in every row, 1-30 for example. In Column B enter your age in every row till life expectancy. See Figure 1.

- In Column C, enter the lump sum as a negative number in the year the lump sum is paid out. Don’t worry, it’s only negative because that’s representing a cash outflow.

- Below the lump sum value in Column C, copy and paste the annual pension payout into every row for each year you live, till your life expectancy used in step 1.

- In Column D, at your life expectancy, enter this formula: =IRR(C1:C24) and then press Enter. If the answer that appears is a whole number, chances are you need to allow for a few more decimal places. Right click on the cell, click on “Format Cells” and then set your decimal places to two places.

- If all else fails, there are many free online IRR calculators. Remember to enter the lump sum as a negative cash flow and the pension payout as positive cash flow. Use the joint life payout if you are married and the straight life if you are single.

To see how this all works, let’s look at an example. In Figure 1, I compare a lump-sum offer of $500K to the 100% joint survivor pension option, which is $25K a year. Single investors use the single-life pension payout. The formula in this case results in an internal rate of return of 1.20%.

What does this IRR of 1.2% mean? It means that if you lived to age 86, then you’d have to generate a return of 1.2% on your lump sum each year in order to match what your pension would pay over the course of that same time period.

To see the IRR at different life expectancies, try typing the formula in Column D into different rows. Be sure the cell range in the IRR formula always starts with the lump-sum cell in Column C and ends with the age you want. For example, =IRR(C1:C18) would be the formula used at age 80 in Column D.

The longer you live, the greater the return your pension would be delivering — and the higher the return you’d need to generate on your own with your lump sum to match it. This makes sense, because you are getting more money returned to you over time with your pension payments. In my example, the true IRR is a little higher since we technically can’t take the lump-sum till 65, not 64, but the way we set it up here makes it easier for you to view.

Two more ways to do the math: Another approach is to figure the Pension Income Ratio (PIR). The PIR is the annual withdraw divided by the lump sum. A PIR greater than 5% may be hard to replicate in an IRA.

Finally, know the break-even point. If you took the pension option, how long would it take to get the full lump sum amount? In this example, at $25K a year it takes 20 years to get back the $500K lump sum amount. Twenty years for a 65-year-old is a long time to wait to get all your money.

Step 2. Ask yourself: Can I beat the payout?

In our example, at age 86, the return is 1.20%. With that low of a return, I’d rather take the lump-sum and invest in a diversified portfolio of stocks and bonds. This is the case with most pensions I review.

Some retirees are more conservative. Conservative investors may not trust the stock market. Others may feel they have enough assets at risk with their 401(k) and they may not want to take risk with the pension. Those investors put a higher value on the annual pension income stream and may not want to try to beat the IRR of the pension.

Step 3. Analyze the trade-offs

Loss of purchasing power

In my opinion, taking the traditional joint and survivor pension income only looks good in year one, then loses its luster, because after that, inflation takes hold. Pension income is typically level: You steadily lose purchasing power over time as prices increase. In our example, the $25K of pension income in year one is roughly worth only $15K in 25 years, assuming a 2% inflation rate. The loss of purchasing power is an important trade-off to understand. Your future self may regret taking the annual pension payout if it doesn’t keep up with your standard of living.

On the other hand, your spending may decrease later in life. If you are less active, you may need less income. (Unless a severe health event like long-term care is needed, which is a large expense.) If you have other assets growing in the stock market that can make up for the loss in pension purchasing power that helps too. Some pensions provide inflation-adjusted income, which is highly valuable.

No access to principal

If you elect to take the pension income, you can’t take more or less money in any given year. If you take the lump sum, you can. If you elect to take the lump sum you can skip a withdraw or take out more for a vacation or an emergency. You have more control over a lump sum.

Of course, more control can mean more trouble. Will you use the lump sum to buy a boat, a lavish vacation each year, or simply spend it all too soon? As Shakespeare wrote, “To thine own self be true.” You must be honest with yourself. Spendthrifts may be better off taking the pension or buying an annuity with the lump sum if it helps with monthly budgeting. A financial adviser can help too. Having an arm’s length relationship with your money may be all you need to prevent you using the lump sum as an ATM.

No inheritance

The final trade-off is how much do you value leaving the pension asset to your family? Most retirees I speak with think it is important, but it is not the sole driver in their decision making. Still, just about everyone I speak with agrees it is a tragedy if Mom and Dad pass at the same time in the proverbial plane crash three years into retirement, leaving the kids nothing because the pension income stops. At least with moving the lump sum to an IRA your kids can inherit the balance.

Another solution is pension maximization. Pension maximization is buying life insurance with the straight-life pension payout. The straight-life pension payout provides the most income, but the income stops at death. Pension maximization uses the extra payments from the straight-life pension to buy life insurance. The life insurance death benefit “replaces” the lost pension income at death. The math works best for those who are younger and healthy, because life insurance rates are based on age and health history.

Pension income has merits — don’t get me wrong. Studies have shown retirees who have a guaranteed source of income in retirement report less worry and greater retirement satisfaction. However, you must understand the math in Figure 1 and the trade-offs listed above to make a wise decision.

Which is the better choice?

It really depends on your situation and the pension numbers. Figure 2 is a helpful way to get you started:

Figure 2: To thine own self be true

| Circle one item in Column A or B that identifies you. | Row 0 - Cell 1 |

| Column A | Column B |

| I value access to principal | I value certainty of income |

| I want to leave something to the kids | The kids are fine, or they are getting enough elsewhere. |

| I value the potential growth on the IRA, understanding losses may be incurred along the way. | I am not OK with risk taking in retirement. It makes me uncomfortable to see my account balance go down. |

| I value the ability to take more income in good years of the stock market, knowing I should take less if the account goes down. | I value guaranteed income regardless of what the stock and bond markets do. |

| The pension is a small amount relative to my net worth. | The pension is all I have. |

| I have other sources of reliable income (rents, royalties, spouse’s pension) | I have no or very little guaranteed income in retirement. |

| I generally am OK with taking risk, knowing I may get rewarded. | I am as conservative investor as they come! |

If you circled more in Column B than Column A, you value the pension income over investing the lump sum. That is OK, there is no right or wrong decision, this is a personal choice! If you circled more in Column A, then you are comfortable with risk and probably already have a diversified portfolio in the stock market. Column A people should consider taking the lump-sum option and build out an investment portfolio that will hopefully outlast them.

If you are somewhere in between Column A and Column B, then you might want to evaluate using the lump sum to purchase an annuity in an IRA. Certain annuities provide a steady monthly income stream that may mirror the pension payout, but still allow for access to principal. That’s a win-win, for those who value guaranteed income but still want to leave the balance to the kids. There is much more to consider on whether an annuity strategy is right for you. I encourage you to speak to a qualified, independent financial planner.

Final thoughts

The decision on how to take a pension — straight life, joint payout or lump-sum — is not easy. Each pension, like each person’s situation, is unique. And the choice you make you are stuck with. It is irrevocable, affecting your retirement and your spouse’s. No pressure!

Given the weight of the decision, in my opinion, the decision on whether to take a pension or a lump sum requires a careful and thorough analysis of the various trade-offs, risks and opportunities. I suggest seeking guidance from an independent financial adviser who has fiduciary responsibility to you and is experienced in this field. Call me if you need me.

For help in analyzing your pension options email me or subscribe to my blog for more retirement planning insights.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares in This Situation

How to Get the Fair Value for Your Shares in This SituationWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.