The Case Against Owning All Dividend-Paying Stocks in Retirement

Income investors are often all about dividends, but that may not be a smart strategy for retirees. Here’s why, and what investment model they should consider instead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I host various seminars for retirees. At every seminar, one retiree always raises his or her hand and tells me they recently loaded up on dividend-paying mutual funds and preferred stocks. I shake my head and wish them luck.

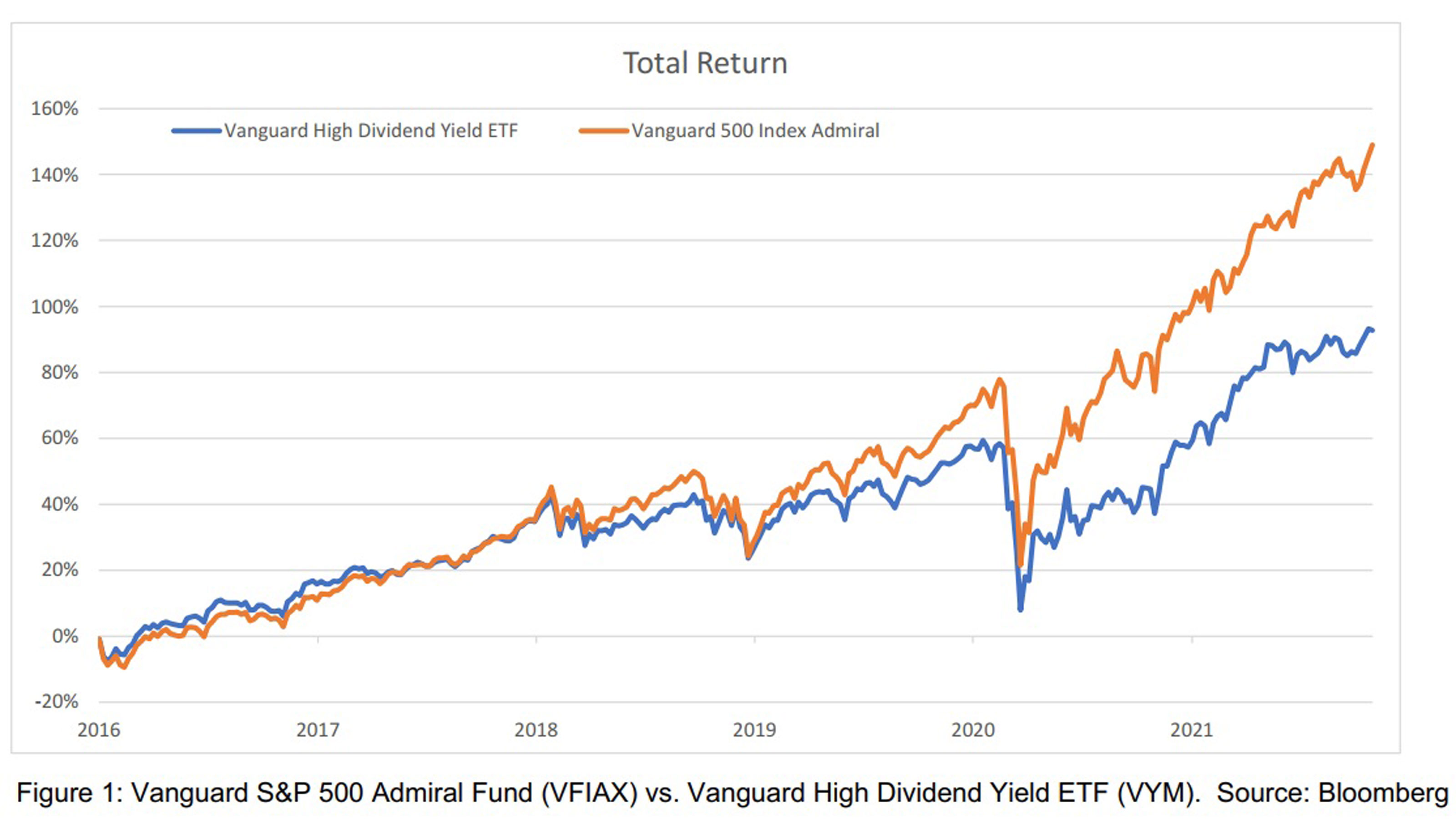

I understand the logic but disagree. The last few years bear this out. Since 2016, the Vanguard High Dividend Yield ETF (VYM) – which owns high-dividend-paying stocks – has severely underperformed the broad market as measured by the Vanguard S&P 500 Index fund (VFIAX) (see Figure 1). Dividend investors in VYM gave up a tremendous amount in overall performance and diversification.

For this reason, I tell investors who are in retirement not to take an income-only approach. Instead, consider a core-and-satellite investment strategy like the one I outline below, or tune into our complimentary retirement planning webinar on Nov. 16 to learn more (register here).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Dividend investing versus the broad market

It’s all about balance. If we go all in on dividend-paying stocks and mutual funds, our dividend income may increase, but at the expense of overall portfolio appreciation and diversification. Figure 1 bears this out. Many technology stocks are not high-dividend-paying stocks and are not in the Vanguard High Dividend Yield ETF. In other words, investors in the high-dividend fund missed the tech run. The S&P 500 index fund grew 70% more versus the high-dividend ETF over the past five years.

Dividend mutual funds lack diversification

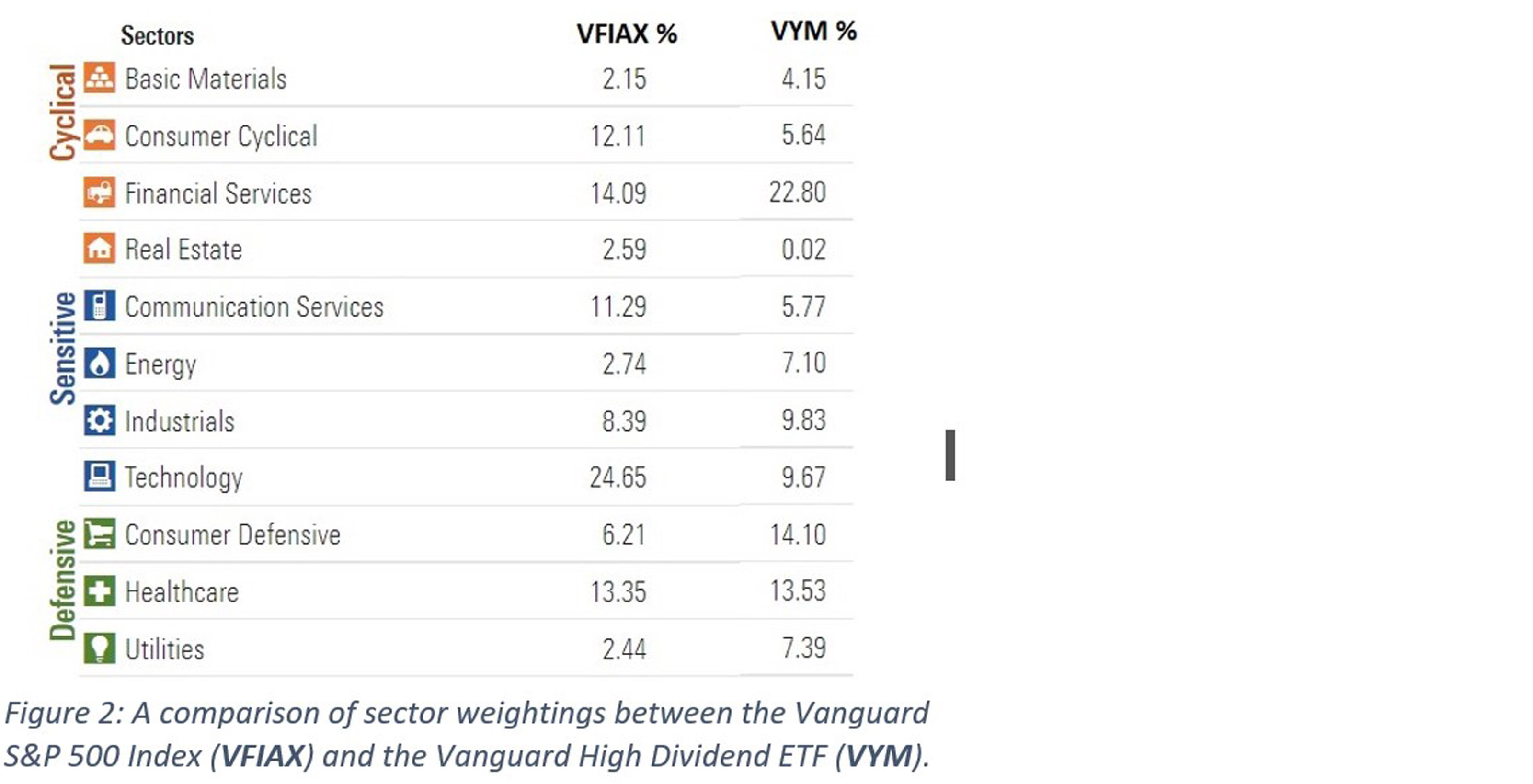

Many dividend-focused mutual funds and ETFs own a greater proportion of bank, energy and utility companies than the index. The Vanguard High Dividend Yield ETF (VYM), as of Sept. 30, 2021, had about 1.5 times more in in financial service companies and roughly three times as much in energy and utility companies as the Vanguard S&P 500 Index (see Figure 2). The high dividend ETF also owns significantly less in tech: 9.67% versus 24.65%.

This is no surprise since banks, utility and energy stocks usually have higher dividends than tech stocks. However, since 2016 those bank and energy stocks did not perform as well as tech stocks. This year is a little different as energy stocks have soared.

The key is to be aware that owning dividend-paying mutual funds can lead to a portfolio that tilts heavily to three sectors of the economy. As a result, the performance can vary significantly from the broad benchmark and rely heavily on the health of banks, energy and utility companies. Granted, the S&P 500 Index owns a significant amount of tech right now. That too is a concern and something investors need to be aware of.

Therefore, I advocate for a more balanced core portfolio, adding income satellites for retirees where it makes sense. Here’s how that works:

Create a good core

Instead of a focusing on income-only investments, retirees should hold the bulk of their nest egg in a core portfolio of low-cost broadly diversified index funds. For my core, I use large cap indexes, small cap indexes, international and emerging market indexes. I also use equal-weighted indexes. Equal weighting is a simple idea: We buy the same dollar value in each stock, representing an equal part of the value of the portfolio. Equal weighting reduces the glaring overexposures to tech, banks and energy stocks I mentioned earlier. I may also build my own index, which gives me more control of the sector allocations.

I also add in various active and passive fixed income managers, as well as active equity managers where it makes sense, like in ESG, or a specialty strategy, such as hedging or merger arbitrage. I then adjust the allocations as time goes on depending on performance and perceived opportunities. This is my core portfolio. A good core should keep pace with the broad market, but with less risk than the broad market.

Create income satellites

If you have a strong core, you can round out your portfolio using satellites. A satellite is a tilt or a slight overweight in the portfolio. For my retired clients, I may recommend a high-dividend-paying individual stock manager or ETF as a satellite. I like individual stocks and ETFs for their tax efficiency. An individual stock manager can use tax-loss harvesting to minimize taxes. ETFs are typically more tax friendly than mutual funds. There are also passive dividend index mutual funds that can work.

Preferred stocks are a satellite. Preferred stock is a separate class of stock that companies issue. Preferred stock has higher yields than regular common stock, usually around 3%-5%. There are different risks with preferred stocks, such as interest rate risk, so be sure to do your homework.

Real estate investment trusts (REITs) are a good income satellite for retirees, too. REITs have high yields, usually 4%-5%. I typically recommend retirees have 2%-5% of their overall portfolio in REITs. That’s enough of a tilt to boost the income and diversification, but not enough to wreak havoc on the overall portfolio if the sector performs badly. There are several types of REITs, such as multi-family housing, warehousing and data centers, active and passive mutual funds, and ETFs. I usually mix in all the above.

Focus on total return, not income

Instead of focusing on income, I tell my clients to focus on total return. In a good year for the stock market, such as 2019, 2020 and so far 2021, I take the profits or gains from the portfolio and my clients use them for spending. In a bad year, we may take less from the portfolio or use our bonds and cash, so our stocks have time to recover.

I prefer the total return approach because dividend and interest income are usually not enough to cover clients’ lifestyle expenses. Taking profits is also like rebalancing. It reduces our risk. For the past five years taking profits from growth stocks has reduced our exposure to IT and software companies. This approach didn’t help the portfolio grow, but it did reduce our risk of being overexposed to tech – risk of loss is something I find retirees usually care more about than performance.

Conclusion

Unless you have a strong conviction about financial, energy and utility companies, I would steer away from high-dividend-yielding funds and ETFs for the bulk of your money. Instead, try a core-and-satellite approach. A good core is well-balanced and well-diversified across industries, large and small companies, and domestic and foreign stocks. Consider adding income satellites like high-dividend stocks, preferred stocks and REITs in small amounts. Satellites can increase the portfolio income without changing the risk too much. It’s all about balance.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.