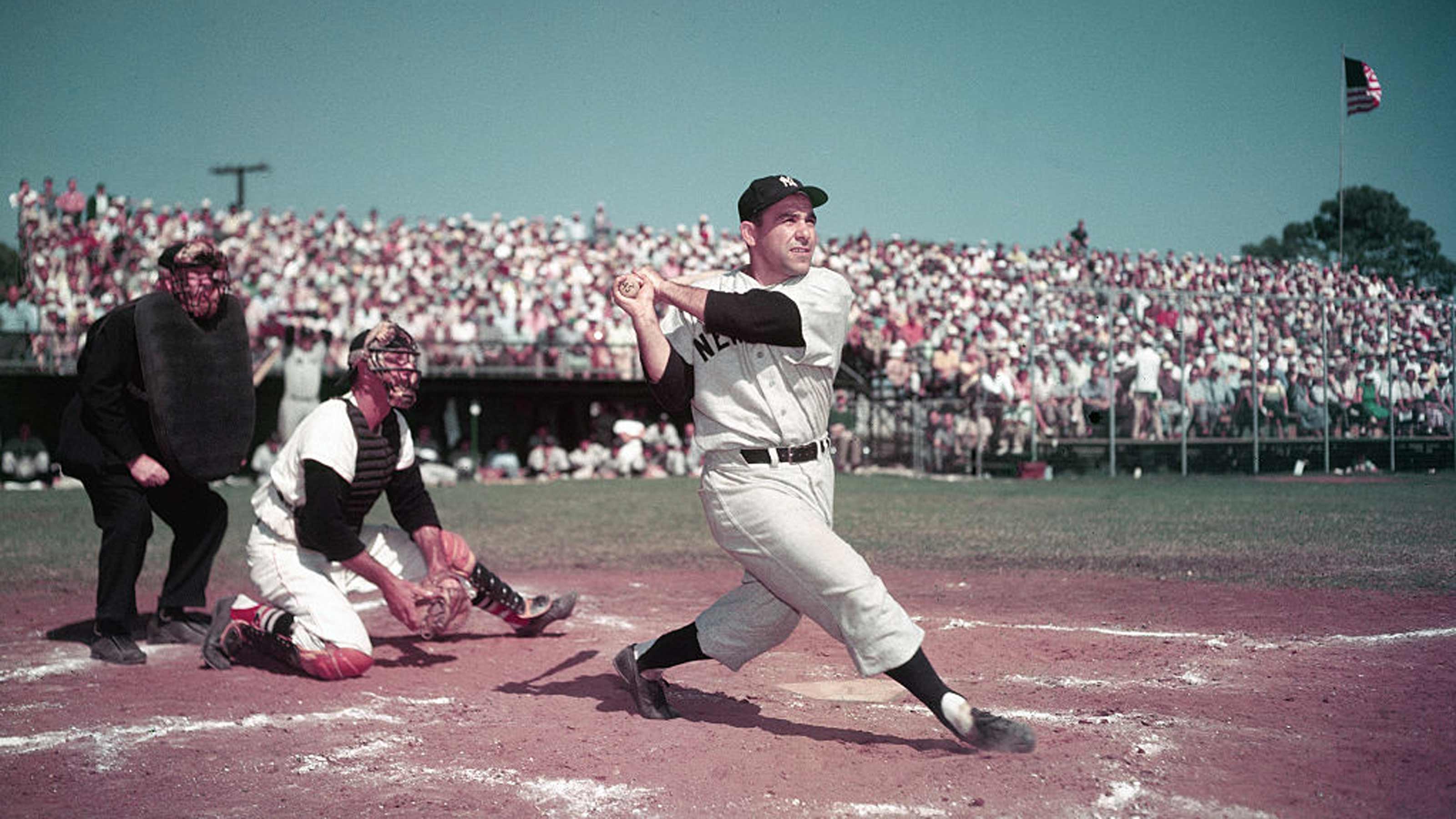

Yogi Berra Quotes Investors Can Live By

Baseball legend Yogi Berra was wise, in his own muddled way, about more than just sports. His words hold truth in life – and in investing. Here are three lessons any investor can glean from famous Yogi Berra quotes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Yankee great and Hall of Fame catcher Yogi Berra may be the most quotable athlete ever. The malapropisms attributed to him are legendary and, when viewed through a particular lens, are more useful than at first glance. While not likely to threaten Warren Buffett’s ‘oracle’ status, if Yogi hadn’t chosen baseball, he might have become a Hall of Fame financial planner.

Here are three financial planning tips based on wise words from Mr. Berra.

'If you don’t know where you’re going, you might end up someplace else.'

In financial terms: Start with a plan.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A comprehensive written financial plan is one of the most underappreciated tools for investor success. Unfortunately, many people ignore this critical effort, in part because it can be very time consuming, detail-oriented and tedious. However, it’s also the blueprint for a person’s entire financial “house” and, done well, provides the firm foundation on which all else rests.

An investor’s personal headlines are at the heart of a financial plan, which is an invaluable tool for helping investors through unsettled times. The plan focuses on the unique goals and considerations that the investor said were most important to them. Portfolios or strategies should change over time, but those alterations should be in response to changes in an investor’s headlines — the birth of a child or pending retirement, for example — rather than the headlines in the news.

Having a well-thought-out financial plan is often the behavioral anchor that investors need to contend with the uncertainty and doubt that investing entails.

'Ninety percent of the game is half mental.'

In financial terms: Realize that investing is often emotional.

In theory, investors make rational decisions, but that theory often fails in practice. Emotions can play a significant role in investment decision-making.

The process of investing is a mental game, often punctuated by unexpected events — some good, others bad — when our very human fight-or-flight reflex seems overwhelming. This is when the temptation to do something different can be strongest.

What can an investor do to improve their odds for investment success?

- First, mentally prepare for losses as well as gains. Investing is an activity that requires the bearing of risk for the hope of a return on the investment. However, there are no guarantees that ensure success. While asset allocation and diversification are the two most effective risk-management tools at our disposal, they do not immunize the portfolio from all volatility or losses.

- Second, prepare for doubt. Something — at some point — in the future is going to make an investor question their investment strategy. Having a financial plan in-hand when this doubt arises frequently pays huge dividends. Often, it is easier to stay the course when things don’t work out as planned, than when things didn’t work out because you failed to plan.

- Lastly, embrace inactivity. Too often, staying the course is interpreted as “doing nothing.” This is a shame because it actually means something powerful: Have a plan and stick with it unless your situation — your personal headlines — changes. During emotionally charged markets, snap decisions often do not play out as well as intended, destroying wealth rather than creating or preserving it. Ignoring the media and market noise isn’t being ignorant, it’s being enlightened.

'When you come to a fork in the road, take it.'

In financial terms: Perseverance is the key to progress.

As mentioned above, investing is an emotionally challenging journey that forces us to contend with obstacles — both real and imagined — along the way. For some investors, these obstacles cause them to stay put, halting their progress. For others, these “forks in the road” require them to choose a path and continue forward, despite the certain knowledge that the path forward is filled with further uncertainty.

Take the current environment, for instance. With the U.S. stock market at or near all-time highs and bond yields very low, it seems like few investors are completely comfortable with the path ahead. Whether in bull or bear markets, for some investors it never seems to be the “right” time to invest. While most investors invest knowing that higher expected returns come from higher expected risk investments, too often they fail to complete the thought: While this risk-return relationship is reasonable, it is over the longer-term — not the short-term — where it is most (yet, not perfectly) reliable.

Preparation is the key to overcoming these obstacles. If you know that you’ve prepared a thoughtful financial plan that focused on your long-term objectives, and incorporated asset allocation and diversification to help temper risk, you should find it easier to persevere through whatever the market may throw at you in the short-term.

All information presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This information is distributed for education purposes, and it is not to be construed as an offer, solicitation, recommendation or endorsement of any particular security, product or service, nor should it be construed as tax or legal advice. Please click here to see our blog disclosure, which immediately follows the “Applicable Law and Venue” section.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Don Bennyhoff, CFA®, serves as the Chairman of the Investment Committee and Director of Investor Education at Liberty Wealth Advisors, a $1.7B RIA. An industry expert who spent over 22 years at The Vanguard Group, Don was a Founding Member of Vanguard’s Investment Strategy Group, and served as a Senior Investment Strategist.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.