Investment Strategies for the 4 Stages of the Economic Cycle

The U.S. economy is cyclical in nature, surging ahead and pulling back in waves over time. Investors’ portfolios need to change with the rise and the fall of that economic tide.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

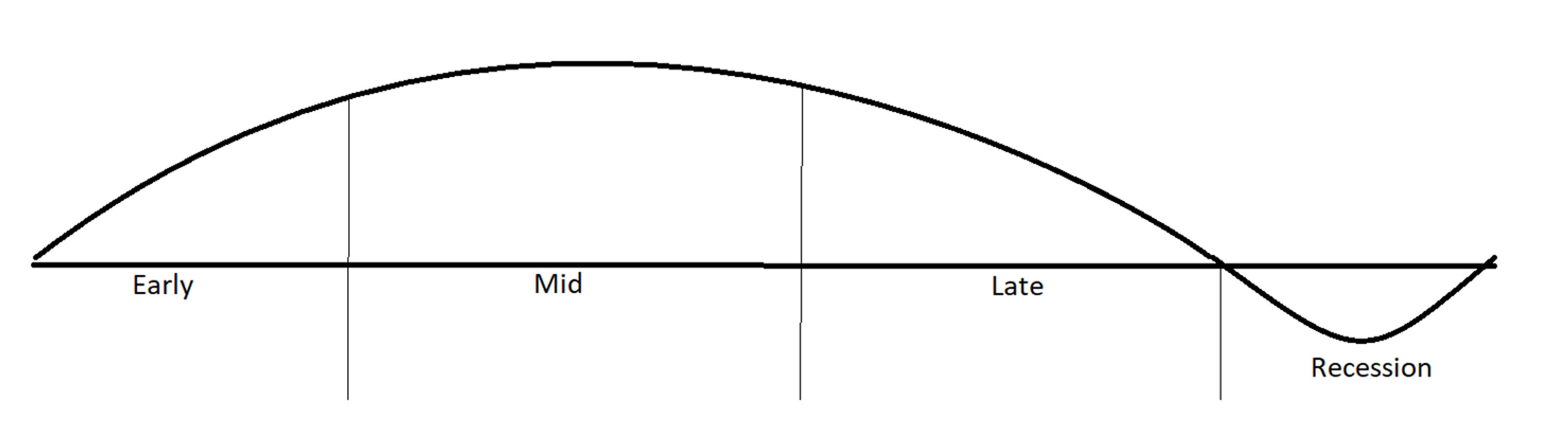

My approach to investing is based on the economic cycle (see below). Our economy goes through different stages of the economic cycle, where different types of investments will do better or worse. At my firm, we adjust the general allocation of stocks, bonds and other investments based on where we are in the cycle and where we think we are going, as well as the underlying investments in sectors.

Our goal is to manage the portfolio to find the highest potential rate of return for the least amount of risk (also known as risk-adjusted returns), adding growth potential during growth periods and adding principal protection through the use of insurance products, in times of uncertainty.

The 4 Cycles of the Economy

This graph above is a representation of the economy as we go through the four stages of the economic cycle. The part of the curve that’s above the baseline represents a period of economic expansion, and the part that’s below the line represents economic contraction.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We believe that we’re currently in the mid cycle, poised to continue growth due to the cash savings that Americans have been able to accrue over the pandemic. As they get to go back to eating out, traveling, shopping, etc. we could see a good portion of that cash go back into the economy. Another factor is the federal reserve monetary policy being favorable to stocks.

There are many risks that we are keeping our eye on, including inflation, taxes, government policy and spending, COVID-19 policies and more. As challenges arise, we asses and monitor them and make the appropriate changes to our investment strategy in order to manage the portfolios as efficiently as possible.

What Tends to Do Well in the Early and Mid-Cycle

In a diversified portfolio, the allocation of stocks and bonds will generally determine the risk of the portfolio. The more stock in the portfolio the more risk. Stocks tend to do better in the early and the mid cycle, and bonds tend to do better during a recession. The reason for that being that as investors are wary of investing in stocks, which generally carry more risk, they look for safety in bonds. Thus, dollars shift from the stock market to the bond market, so the demand for bonds goes up, and therefore so does their price. This typically provides an inverse relationship in a recession designed to add protection and stability to the portfolio.

There are other categories of investments that make up a much smaller piece of the portfolio but are stable in the late stage and recession as well, including high-yield bonds and potentially commodities. (All investments involve risk and the potential loss of principal so it’s important to keep that in mind when building your retirement portfolio.)

Beyond the general stock and bond allocation, we also look at what sectors do well in which parts of this cycle. In the early stage, where we are seeing high growth, usually economically sensitive sectors will outperform, while more defensive sectors will underperform. Examples of economically sensitive sectors include technology, industrials and consumer discretionary. The early part of the cycle is relatively short, on average one year, and on average has returned about 20% returns.

What About as We Progress Toward the Late Cycle?

The mid cycle is a longer stage in the economy, averaging about four years. This stage is one of steady growth where we do not see any sector significantly outperform the others. This stage is a good opportunity to reset the asset allocation to avoid losing some of the gains made by previous growth. The average return during the mid-cycle has been about 14%.

The late cycle is one where we look to defensive and inflation-protected categories, such as materials, consumer staples, health care, utilities and energy. This stage is simply a slowdown from the higher growth period of the mid cycle — it does not mean that we are having negative growth in the economy, it just means we are no longer growing at the same pace. The return historically has been less, on average about 5%.

How We Position Portfolios During the Recession Cycle

Finally, in the recession cycle there are typically no sectors that do very well. Stocks perform poorly most of the time. The investment sectors we look for in a recession are companies that provide stability and are more defensive. These include consumer staples, meaning companies that provide goods and services that people need regardless of economic condition.

A good example of this is health care, because people need health care services and drugs, regardless of the economic conditions. Another example would be utilities. These are non-negotiable for people. Additionally, the more defensive companies typically will have higher dividends, which help to weather the storm of recession, which has averaged -15% returns.

No Matter What, Some Adjustments Are Always Necessary

Every market cycle is different, and we can see different sectors perform in different ways depending on the economic conditions, and we are seeing that coming out of a pandemic-inspired recession vs. a typical cycle. Real estate and financials are a good example of this today, where they are positioned for growth versus in 2009, where they were definitely not positioned for growth! Additionally, we can move forward and backward on this curve, not always in constant motion from early, to mid, to late, to recession.

We use our research and indicators to determine where we are in this cycle and what sectors we believe will perform well, and we slightly tilt the allocations of the portfolios to find the greatest risk adjusted returns.

These strategies, along with our research-based teams, are designed to allow us to preserve and help protect our client’s retirement portfolio, which is so important to our retired clients.

Stuart Estate Planning Wealth Advisors is an independent financial services firm that creates retirement strategies using a variety of investment and insurance products. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). AEWM and Stuart Estate Planning Wealth Advisors are not affiliated companies. Neither the firm nor its representatives may give tax or legal advice. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Any references to protection benefits, safety, or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Bond obligations are subject to the financial strength of the bond issuer and its ability to pay. Before investing consult your financial adviser to understand the risks involved with purchasing bonds. 01010056 08/21

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sean Burke joined Stuart Estate Planning Wealth Advisors as Vice President and Director of Institutional Money Management from Fidelity Investments. He holds his master’s degree in financial valuation and investment management. At Fidelity, Sean worked with clients on plans and strategies to help achieve their financial goals, focusing on tax-efficient investing, investment strategy with proper risk management, estate planning, principal and income protection and more.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.