Investor Success: Measure in Dollars, not (Per)Cents

You can’t control the markets, but a big part of your success in investing for retirement is entirely in your own hands.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The concept of “investing success,” as it often appears in the media, is a tangled web to me. Every time I read something about the topic, I can’t help but feel that the authors are confusing two very different efforts: investment success and investor success.

Yes, this is nuanced, but yes, it matters. Too often, investment success is defined in either absolute or relative returns (which is another nuance for another time). While I understand why a portfolio manager would focus on higher returns, I’d argue that this shouldn’t be the benchmark for success for the typical investor. Instead, they should be focused on building the wealth they need to fulfill the objectives that matter most to them. Wealth is measured in dollars, not percents.

Your Savings Rate Is a Huge Factor in Your Success as an Investor

Sure, better returns build more wealth faster, but higher returns are not essential to building wealth. Investing is a partnership between an investor and the markets, where an investor provides the capital and the markets provide the prospects for a return on that capital. Understanding this relationship introduces a most important point for building wealth — capital contributions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A portfolio’s value can grow through both capital contributions and the return on capital, but only one part of this equation can grow wealth reliably: our capital contributions, or more generally, our savings. It’s our contribution to our own investment success and importantly, unlike the investment returns we seek, its benefits are both more certain and within our control.

Contributing More to Savings vs. Taking More Risk

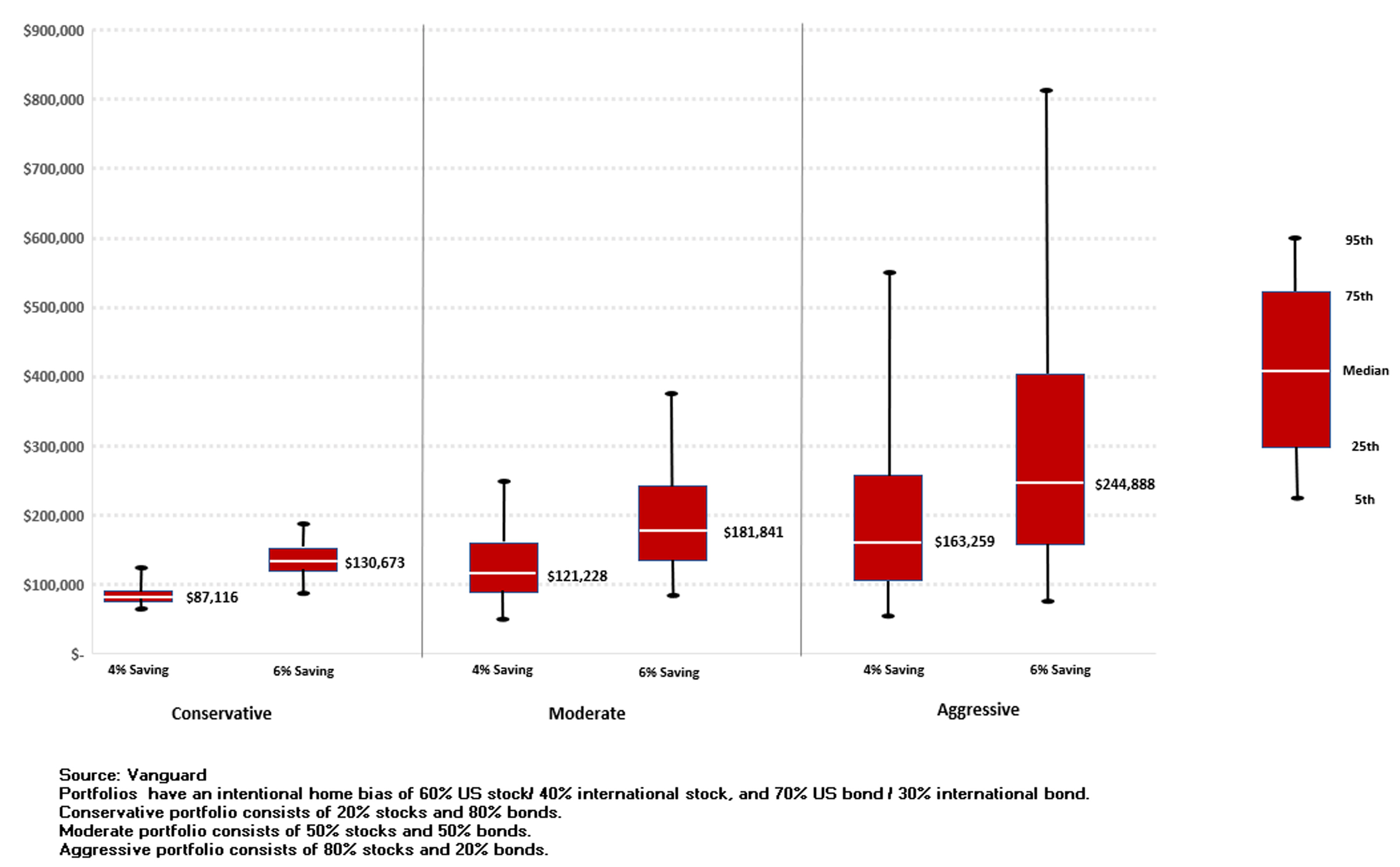

As illustrated in the figure below, moving from a more conservative asset allocation (50% stocks/50% bonds) to a more aggressive one (80% stocks/20% bonds) tends to widen the range of expected outcomes. At any asset allocation choice, higher savings levels contribute to higher best, worst, and median expected outcomes, due to the higher levels of capital contributions.

What is often overlooked, however, is that higher levels of capital contributions allow investors to improve their expected outcomes not only relative to the same asset allocation, but also relative to a higher risk allocation. For example, for the 50% stocks/50% bonds portfolio, a 6% contribution rate provides a better range of total potential outcomes than a 4% savings rate for the same asset allocation and for the majority of expected outcomes in even riskier allocations.

Higher returns are welcomed, but they are a less reliable source of asset growth and wealth creation.

A most extreme version of this scenario played itself out on the national stage when the Powerball lottery offered a $1 billion-plus jackpot. While the lottery gave a player a chance for a fabulous return on their $2 ticket, probability-wise, a player’s wealth would increase more certainly if they didn’t play the lottery at all (since they’re most likely to lose their whole “investment” in lottery tickets).

The Bottom Line for Investors

Investing involves tradeoffs, and an important part of the financial planning process is for an investor to define their willingness to forgo spending now to improve their prospects for building wealth that can provide for their future needs. This is critically important, as a higher savings rate provides a higher probability of investor success. This is due to the partial shift in responsibility for building wealth from the less certain returns from risky assets to a more certain stream of capital contributions.

In the end, if an investor is trying to maximize future wealth, we believe a marginally higher savings rate, rather than a substantially higher risk portfolio, will be more likely to lead to investor success.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Don Bennyhoff, CFA®, serves as the Chairman of the Investment Committee and Director of Investor Education at Liberty Wealth Advisors, a $1.7B RIA. An industry expert who spent over 22 years at The Vanguard Group, Don was a Founding Member of Vanguard’s Investment Strategy Group, and served as a Senior Investment Strategist.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.