For a Move Abroad, Choosing a Fiduciary Financial Planner Who Sees Both Sides of the Border Is Critical

Working with a cross-border financial planner is essential to integrate tax, estate and visa considerations when moving abroad and avoid costly, unexpected liabilities that a non-specialized adviser could miss.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When Americans move abroad, their financial lives become significantly more complex. From navigating foreign tax systems to understanding how U.S. retirement accounts are treated overseas, the stakes rise even as the margin for error narrows.

That's why choosing the right cross-border financial planner is so important. High-earning and high-net-worth U.S. taxpayers must find someone who understands the full scope of cross-border financial planning and is committed to a long-term relationship.

About Adviser Intel

Kiplinger's Adviser Intel is a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

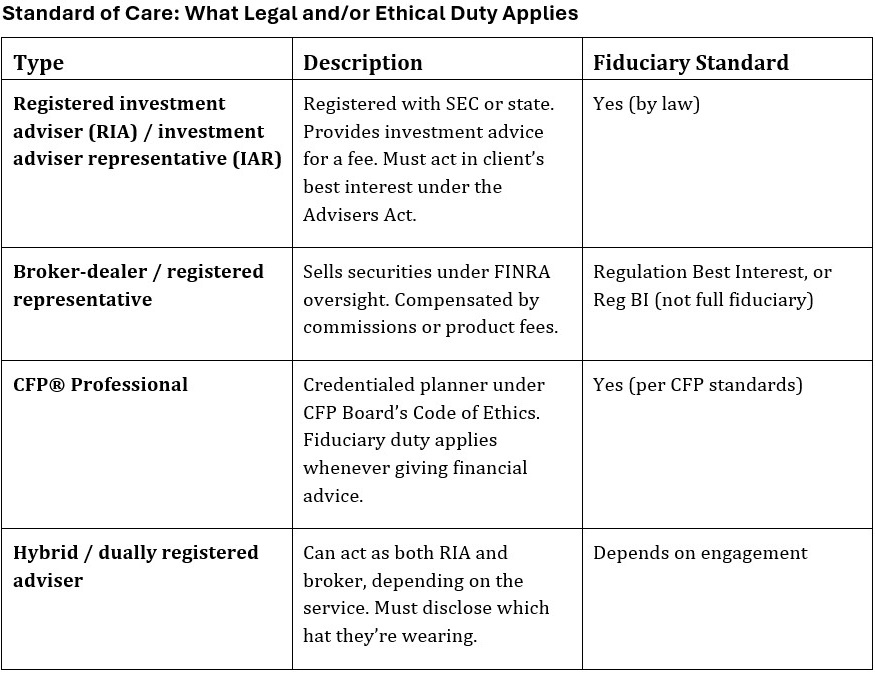

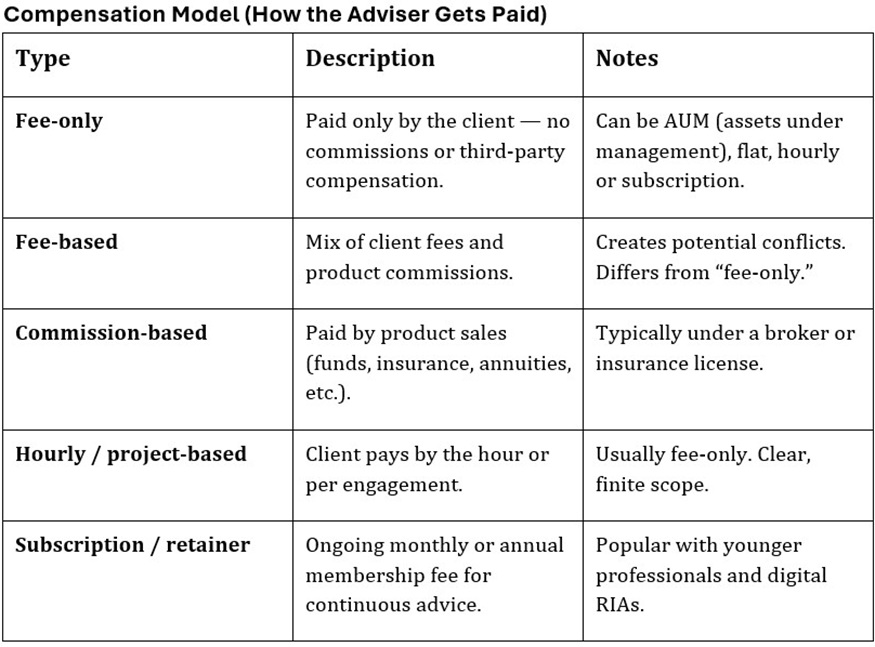

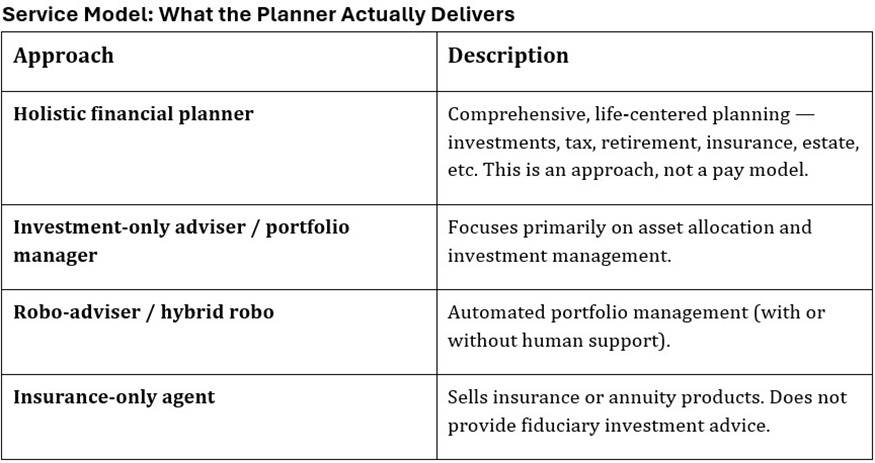

A brief review: Types of financial planners

When we talk about different "types" of financial planners, they can be differentiated across three spectrums:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For Americans living in the U.S., these distinctions help guide their choice of professional financial planning service. But for those moving abroad, the meaning of these categories takes on new importance.

Why cross-border planning changes everything

Let's say you're working with a U.S.-based investment manager who doesn't offer planning services. That might work fine while you're stateside; many people feel more comfortable steering their own financial planning ship and personally checking that their compass is pointing due north.

But moving abroad without the support of cross-border expertise to guide the revision and implementation of your financial planning framework can lead to costly mistakes.

Take France, for example. It's often considered one of the "easier" Western European countries for Americans to retire to, thanks to a favorable tax treaty and a relatively straightforward long-stay visitor visa.

But even there, there are common tripwires. One of the most overlooked is the cotisation subsidiaire maladie, more commonly known as the PUMa tax.

The PUMa tax was introduced to help fund France's universal health care system and applies to residents who receive significant passive income, such as dividends, rental income or investment gains, but have little or no earned income.

Here's how it works:

- If your earned income is below 20% of the French social security threshold (PASS), which is €9,273.60 in 2024 (the most recent tax year), and

- Your passive income exceeds 50% of the PASS, or €23,184 in 2024, then

- You may be subject to a 6.5% tax on the portion of your passive income above that threshold.

This tax does not apply if you receive replacement income such as pensions, disability payments or unemployment benefits.

It also doesn't apply if your spouse or civil partnership (PACS) partner earns above the threshold or receives qualifying replacement income.

The formula used to calculate the tax is nuanced, adjusting the rate based on how much earned income you have.

For example, Jean and Marie, both U.S. citizens, move to France and become French tax residents. They draw no earned income in France (well below the €9,273 threshold for 2024) and instead live off €120,000 of U.S. investment dividends.

Because their passive income easily exceeds the €23,184 "50% of PASS" threshold for 2024 and their earned income is minimal, they could face about €6,375 in tax (6.5% of the amount above €23,184) — a surprise many couples who retire abroad don't budget for.

This example illustrates a broader point: Even in jurisdictions considered expat-friendly, the financial landscape requires U.S. financial planners to have a certain familiarity with the local system in order to offer the highest-quality service.

Without a planner who understands both U.S. and local systems, you may be exposed to unexpected liabilities that at best are vaguely annoying, but at worst could derail your retirement plans.

The value of holistic financial planning for expats

When you take a holistic approach to cross-border financial planning, you're able to integrate the following when building a cross-border financial plan:

- Thoughtful relationship-building time in the initial meetings

- Tax planning across jurisdictions, i.e., cross-border tax planning

- Visa and immigration considerations

- Estate planning under foreign laws

- Currency and banking logistics

- Retirement account treatment abroad

A holistic approach ultimately allows the planner to structure the client's portfolio in a way that avoids triggering unexpected taxes or compliance issues.

And, depending on where your cross-border planner is based, they may be equipped to help you navigate the cultural and bureaucratic differences that come with living in another country.

Common pitfalls

1. Continuing with a U.S.-based planner without cross-border experience

Americans understandably want to maintain their existing financial planning relationships when they move abroad.

But, as Arielle Tucker, CFP® and founder of Connected Financial Planning, notes, "Unless your planner has experience with cross-border clients, and ideally specializes in your destination country, they may not be equipped to serve you effectively."

2. Working with EU advisory firms

On the other hand, some expats choose to work with a foreign firm, thinking that working with a local firm in their adopted country is a logical or even savvy financial move. However, this can present challenges.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

"Foreign firms typically have higher fees and transaction costs than the U.S., and foreign mutual funds and ETFs are considered PFICs (Passive Foreign Investment Companies for American investors," says Ricardo Jesus, financial adviser at Liberty Atlantic Advisors (also an Adviser Intel contributor).

"This causes additional reporting and tax complications. Plus, client service expectations differ radically between the U.S. and Europe. As an example, execution timelines are often much slower."

Final thoughts

Candidly, moving abroad can feel like you've turned your life upside down and changed the operating language. So, it's completely understandable to seek familiarity among the chaos.

But, speaking as someone who has moved to different countries nearly half a dozen times, I can attest that prioritizing familiarity can come at the expense of long-term stability, particularly when we're talking about financial planning.

Moving abroad is a major life change, and your financial plan needs to reflect that. That said, it doesn't need to be an overwhelmingly frightening change.

Working with a cross-border planner or firm that takes a holistic approach outsources the challenging task of finding the optimal financial through-line in your life abroad, allowing you to be fully present in the new day-to-day of living your life abroad.

Related Content

- I'm a Cross-Border Financial Adviser: 5 Things I Wish Americans Knew About Taxes Before Moving to Portugal

- How to Manage Retirement Savings When Living Abroad

- Where to Retire: Living in the Dominican Republic

- Want to Move to Portugal? What to Consider Financially

- The Pros and Cons of Retiring Abroad

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over 10 years of experience working in European wealth management firms and family offices, Alex has significant expertise in cross-border financial planning, investment management, and macroeconomic analysis. He enjoys speaking with clients and explaining our investment philosophy while helping them understand the implications of various geopolitical events on their portfolios. Alex graduated with distinction from Grenoble Ecole de Management with a master’s degree in International Business after initially completing a bachelor’s degree in English at Simon Fraser University.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.