How to Take a Pension: A Math Formula Drives 1 Retiree’s Choice

Ever hear of the pension income ratio? This mathematical formula can help you decide whether it makes more sense to take a lump sum or a series of pension payments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For those who have an employer pension, the decision on how to take income at retirement is important. Pensions usually offer a single-life, joint-life or a lump-sum payout. The decision is often irrevocable and can have long-lasting implications. Here I review what to consider if you are offered a lump-sum payout or an annual pension.

Lump-sum pension payouts can be rolled into an IRA tax-free upon retirement. Whereas an annual pension payment, such as a single or joint-life option, provides a guaranteed income stream for one or two lives. Let’s review an example, my client Catherine. Catherine is 65 and recently retired. She is single and has two grown children. Her pension choices are a one-time lump sum or a single-life payout, meaning the payments stop when she passes away. Specifically, she could take a $750,000 lump sum or annual payments of $30,000 for the rest of her life.

How to Figure Your Pension Income Ratio

So, which option makes the most sense for Catherine? One way to analyze her pension choice is to calculate the “pension income ratio” or PIR.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The PIR is the annual pension payment amount divided by the lump sum. Catherine’s pension income ratio is 4%. This is the $30,000 single-life income divided by the lump sum of $750,000. If her single-life pension payout was $50,000 per year, her pension income ratio is 6.67% (the $50,000 divided by the $750,000 lump sum). Note: Not all pensions offer a lump sum. For pensions without a lump sum available a different analysis is required.

Why is the pension income ratio important? The higher the PIR, the harder it is for the lump-sum payout to beat the pension income. Let me explain.

What It Tells You

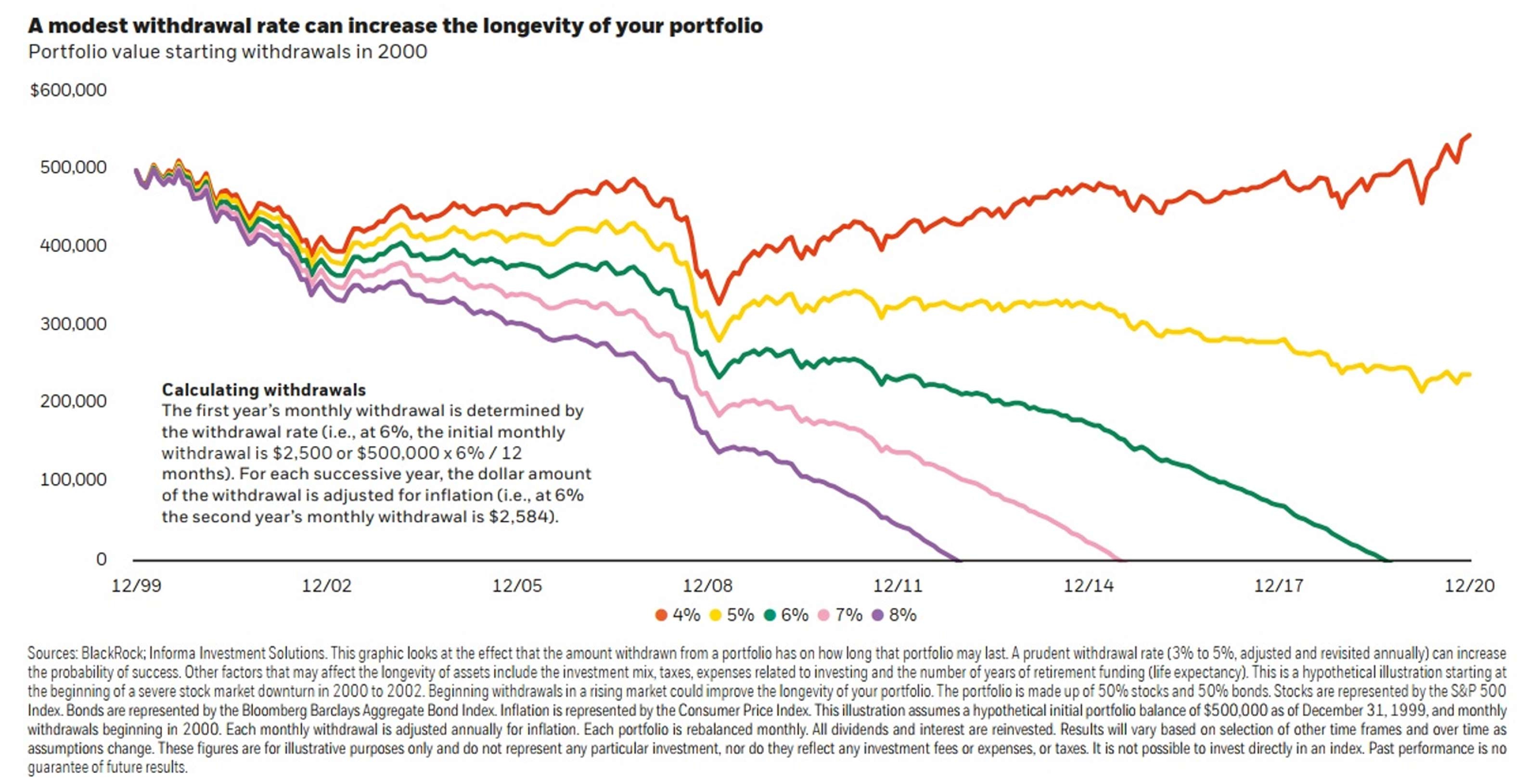

It has to do with withdraw rates. A withdraw rate is the amount of money withdrawn from the nest egg in retirement to support your living expenses. A withdraw rate is calculated by dividing your annual withdraws by your nest egg. A retiree who withdraws $40,000 per year from a $500,000 IRA has an 8% withdraw rate.

This is like the pension income ratio. An 8% withdraw rate is considered high. That retiree is taking a lot of money out of the IRA each year and may deplete the account early. A 4% or 5% withdraw rate is more reasonable, meaning the nest egg should last longer.

Let’s get back to Catherine. Catherine’s pension income ratio is 4%. If she goes with the lump sum option, the question is can we take that lump sum, put it in an IRA and safely use it to replicate what she’d get with the 4% single-life pension income? In other words, is taking 4% each year from the lump-sum IRA a “safe withdraw rate,” or will she run out of money?

That depends on several variables, such as how Catherine invests the lump sum and how long she lives. However, research has shown that a 4% or 5% withdraw rate is considered reasonable and should last for her retirement (see chart below). Had her pension income ratio been higher, like 7% or 8%, then that would harder to replicate by rolling the lump sum into an IRA. Her IRA would probably run out of money before her lifetime. So, the single-life pension may be worth more to her at that rate.

However, considering that Catherine’s pension income ratio is 4% — a reasonable rate — she could go either way with her decision. But there are a few other factors for her to consider.

Why bother with the lump sum?

The lump-sum rollover to an IRA gives Catherine more flexibility. She can withdraw additional money in any given year. If she wants to take out an extra $50K for a home renovation, she can. If she wants more money to travel or splurge on a luxurious vacation, she can. Of course, she may have to temper her IRA withdraws later, but she has that flexibility. The single-life pension locks her into a fixed income; there is no additional money she can withdraw.

Investing the lump sum in an IRA also helps her money keep up with inflation. This is important because prices rise over time. Had she opted for the traditional single-line pension payout, her monthly payment loses purchasing power from Day One. Inflation is a real risk for retirees. For someone who lives 20 or 30 more years in retirement, it is quite possible that prices will double, even triple. While prices rise, pension income stays level for life (unless inflation-adjusted, which some pensions offer but at a reduced payout).

Source: How Much Did Things Cost in the 1980s?

At least with the IRA Catherine can invest in a balanced portfolio of stocks and bonds and have a chance to grow her money and outpace inflation.

Finally, taking the lump sum preserves the asset for the family. If Catherine elects the single-life pension, nothing goes to her children at death — the income stops. However, if she were to choose the lump sum and roll it into an IRA, the children or grandchildren inherit whatever is left in the account at Catherine’s death. That is an important consideration for families who want to leave some money for the next generation.

What else to consider

This is not a one-size-fits-all decision. If Catherine was more conservative and didn’t feel comfortable investing in the stock or bond market, taking the single-life payout may give her more peace of mind.

It’s also important not to only focus on the pension income ratio. The PIR is one tool in the toolbox. If Catherine had a spouse, that changes the analysis. The single-life pension stops at the pensioner’s death; nothing goes to the surviving spouse. Married couples should review the joint-life option or the lump-sum option for this reason.

Decision time

In the end Catherine opted to take the pension as a lump-sum rollover to her IRA. I showed her retirement projections using varying rates of return for a well-diversified IRA. Through good years and bad, taking 4% from the IRA each year for her life was achievable. We also played around with varying the withdraw rates from the IRA. We tested her retirement numbers with a 6% withdraw rate from the IRA, or $45K per year in her first five years of retirement then lowered it to 3%. Again, the numbers looked good. Catherine liked the idea of being able to withdraw more money in her early years of retirement while she was healthy and active.

There are many factors that go into a pension decision. Age, family, life expectancy and income needs play a part. There are other options too, like rolling the lump sum into an annuity and replicating the pension income stream. There is also a “pension maximization” strategy where you can opt for a single-life pension and then purchase life insurance to replace the pension asset for the family.

The pension income ratio is a good start, but there is much more to consider. Proper planning is required to make an informed and proper decision.

If you would like to learn more, please join me April 6 and April 8 at 12:05pm EST for a complimentary webinar on “Pension Planning: What’s the best way to take a pension?” Register here: https://attendee.gotowebinar.com/rt/4490766541479462928.

The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600. This material is for your information and guidance and is not intended as legal or tax advice. Legal and/or tax counsel should be consulted before any action is taken.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.