Investing for Retirement Income Is Different – Rethink 60/40 Rule

Investors saving for retirement are familiar with the 60/40 rule, concerning stocks and bonds. But for retirees, a different kind of 60/40 rule applies – one designed to deliver lifetime income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A lot of retirement guidance I have read lately continues to treat baby boomers the same as the rest of the investor public. Even after the first six months of 2022, when the traditional 60/40 stock/bond portfolio sank more than 20%.

I may not dispute the traditional approach for investors who are 25, 35 or 45 years old and accumulating savings for retirement or the kids’ college education. As we know, markets historically rebound, and younger investors with time to recover from market corrections have the benefit of dollar cost averaging.

But boomers entering or already in retirement have different needs than all the “Gens” that have come after them: They may not be able to wait around for their depressed accounts to grow again. For boomers, income is the important consideration — income that stays steady and grows over the decades of retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Where to find income

Economic downturns always provide winners along with the many losers, and annuity payment contracts (also called income annuities) — which with rising interest rates have increased the payouts on new contracts — are the current winners. As of August 15, 2022, new purchases of income annuities at certain ages are providing 20% to 50% (depending on the income start age) more than at the beginning of the year, and that could go up even further. They’re almost the mirror image of mortgage interest rates, which are also going up.

How much do you think a 20% increase in annuity payments is worth? Just imagine that your starting Social Security benefit you could claim next year went up from $3,000 to $3,600 per month. Would that get your attention?

Yet, most financial pundits are still talking only about investment assets, not about income. Maybe because it’s easier — not because it’s better — to lump these boomers in with everyone else.

Another Type of Allocation is Needed for a Retirement Income Plan

While a 60% stock/40% bond allocation may not be appropriate for boomers, a different type of 60/40 allocation may be: one that includes a mixture of stocks and bonds along with income annuities. We call that a Go2Income plan.

When you build a Go2Income plan for retirement income, you may start with 60% of your retirement savings in investment portfolios and 40% in income annuities. But that allocation is different than the 60/40 referred to above.

- It is based on output and not input, and in a Go2Income plan you might end up with splits of 67/33, 75/25 or another allocation.

- The split will change over time, with an increasing allocation to income annuities — to assure lifetime income.

- Most importantly, the split is designed to meet your personal objectives and priorities and not your neighbors’.

We’ve talked about the allocation among types of annuity payments (see For Sustainable Retirement Income, You Need These 5 Building Blocks). So, let’s talk about the allocation within the investment portion.

Allocation of Investment Portion of Go2Income Plan

A Go2Income plan will use a share of the investment portion of your retirement savings to be a source of safe income rather than strictly as a source of capital growth.

In the Go2Income strategy there are three types of portfolios:

- High Dividend Portfolio: This is primarily a source of increasing tax-advantaged income plus growth of capital and is invested in an account with after-tax or non-qualified savings.

- Fixed Income Portfolio: A source of fixed income plus general safety of capital, replaced in part by guaranteed annuity payments. It will be invested in your non-qualified retirement savings account.

- Balanced Portfolio: A source of withdrawals of capital from your rollover IRA account to achieve increasing income and at the same time meet RMDs. This will be a blend of a growth portfolio and a fixed income portfolio to reduce withdrawal risk.

The allocation to stocks within the investment portfolios can be high, medium and low but you should consider what percentage your stocks take up in your overall portfolio. A high allocation of stocks within the 60% in investment portfolios may often be selected when a high allocation to income annuities is chosen within the 40% portion. The overall impact of these two elections is a higher allocation to fixed income assets, primarily in annuities.

Tactical Allocation within Each Portfolio

The tactical implementation of the investment portfolios within a Go2Income plan must address (1) whether you use an outside adviser or set up a self-directed investment account, (2) the types of investments (ETF, mutual fund or individual securities), and (3) the allocation to specific sectors of the market.

We start with the premise that you want to achieve your income objectives, with low fees and low planning risk, while achieving your legacy objectives. We add in easy plan monitoring and plan management so you might be able to manage portfolios on your own. In any event, working out a personal Go2Income plan will help a do-it-yourselfer decide what questions to ask an adviser.

Some investors may research and buy individual stocks and bonds in these portfolios, but there are other options for the investment portion of a retirement income plan that are perhaps easier to manage and understand, including mutual funds and ETFs

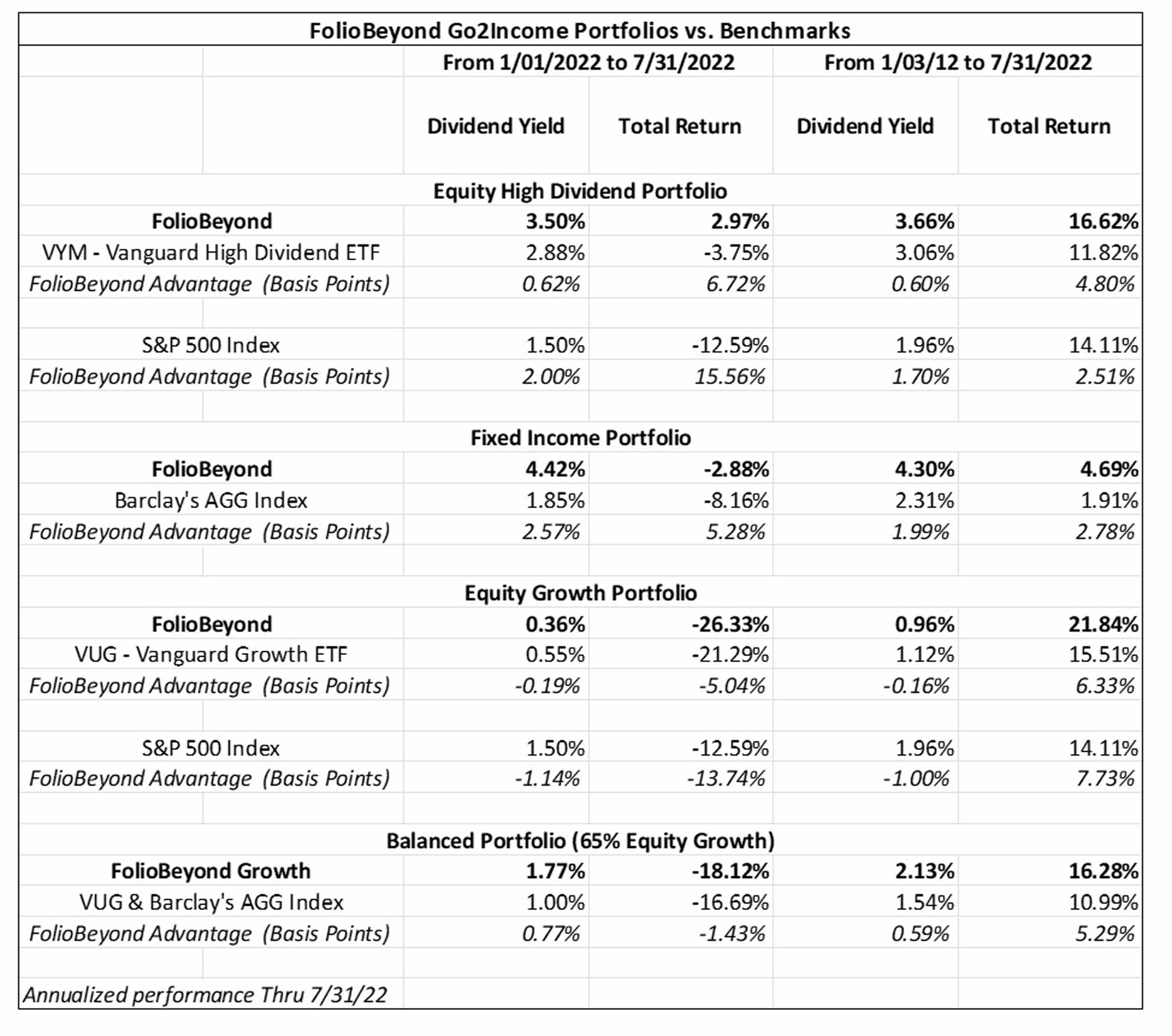

Portfolios Designed Specifically for Go2Income

In addition to mutual funds and ETFs for the investment portfolios, there are other pooled investments that can be targeted to a specific objective and managed with the help of artificial intelligence (AI) tools. We decided to explore that option for Go2Income.

We consulted with a company, FolioBeyond, which is a “quantamental” manager using advanced algorithms, including artificial intelligence (AI) tools, to construct portfolios. Quantamental investors employ quantitative methods, tools and technologies to make investment choices.

FolioBeyond was asked to design the high-dividend, fixed-income and balanced portfolios to align with Go2Income planning. The objectives of each portfolio were to match the interest and dividend yields of comparable low-cost ETFs and to outperform those ETFs on a total return basis by 1% to 2% per year. We also wanted them to keep fees low.

Set out below are back-tested investment results of these portfolios vs. benchmark indices for the first seven months of 2022, and the 10½ years since 2012. The FolioBeyond portfolios exceeded both yields and total returns of comparable benchmarks (see “FolioBeyond Advantage”) in most scenarios. Of course, back-tested results are achieved while knowing what occurred in past markets and can’t be used to predict future performance. See the discussion below chart for other caveats.

The return performance shown above is based on back-tested simulations prior to February 2021 for the equity model and November 2020 for the fixed income model. Actual performance for client accounts may be materially lower than that of the modeled portfolios.

Back-tested performance:

- Does not represent actual performance and should not be interpreted as an indication of such performance. Such results do not represent the impact that material economic and market factors might have on an investment adviser's decision-making process if the adviser were actually managing client money.

- Differs from actual performance because it is achieved through the retroactive application of model portfolios designed with the benefit of hindsight.

- Could be either favorable or unfavorable if portfolio models are changed from time to time.

Three Take-Aways From This Article

- Allocating for retirement income is different than allocating for accumulating retirement savings.

- Allocating the investment portion of a retirement income plan to specific portfolios must align with income goals and how income is sourced.

- There are lots of options for managing individual portfolios but make sure to look at both yields and returns net of fees and how each impacts your plan.

If you are interested in creating a plan for retirement income that reflects your specific needs, visit Go2Income for a complimentary personalized plan that delivers both a high starting income and growing lifetime income, as well as long-term savings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.