For Sustainable Retirement Income, You Need These Five Building Blocks

Combining elements that you understand is the smartest way to create a secure retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sometimes we have all the elements for a great retirement, but until we put them together the right way, we don’t get the result we want.

I call it the H2O problem. We have plenty of oxygen in the atmosphere. Likewise, hydrogen. It seems simple, but until two atoms of hydrogen combine with one of oxygen, we will never get water.

When planning for retirement income, it is risky to wait for the right combination of elements to join on their own. They don’t just fall into place; you have to know what each can do and put them together in a way that produces a whole greater than the sum of the parts.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

You may sit with financial advisers who can describe all the elements required for a successful retirement, but they might not offer all of those elements in their own retirement planning practice. Maybe it’s because of regulatory or business model considerations. And even when all these elements are available, the adviser may not know how to assemble them.

It’s not easy. Retirement income requires consideration of many more elements than just the two needed to create water (H2O), and many more combinations — like 50 trillion. Literally.

The requirements of a plan for retirement income

As a starting point, your plan should be about income: starting income to meet your current needs, increasing income to help offset inflation, lifetime income so you don’t run out, and less volatile income so you feel secure.

But most investors have additional concerns, such as a legacy they want to pass on to kids and grandkids, and availability of liquid funds in case of unexpected needs or emergencies. They might also want the plan to be convenient and easy to manage, with income payments made on a regular monthly basis, and flexible so that the plan can adjust to changing circumstances or economic conditions.

And the plan elements should be easily understood, offered by highly rated companies, low-cost and tax-efficient. Bottom line: Focus on the plan and make the elements as time-tested as possible.

Identify the elements of a successful plan for retirement income

Just like in chemistry class when reviewing the periodic table, go to the list of financial products available to investors like you and select those that make sense. Or ask your advisers for their list.

Here is our list of retirement plan elements (including the most likely savings source):

- PD: Portfolio of high-dividend stocks (invested from personal savings)

- IAN: Income annuity with guaranteed payments starting now (invested from personal savings whenever possible)

- PF: Portfolio of fixed income bonds (invested from personal savings)

- IAF: Income annuity with guaranteed payments starting at future dates you select (invested from both personal savings and rollover IRA)

- PB: Portfolio balanced between growth stocks and fixed income securities (invested from rollover IRA as source of withdrawals)

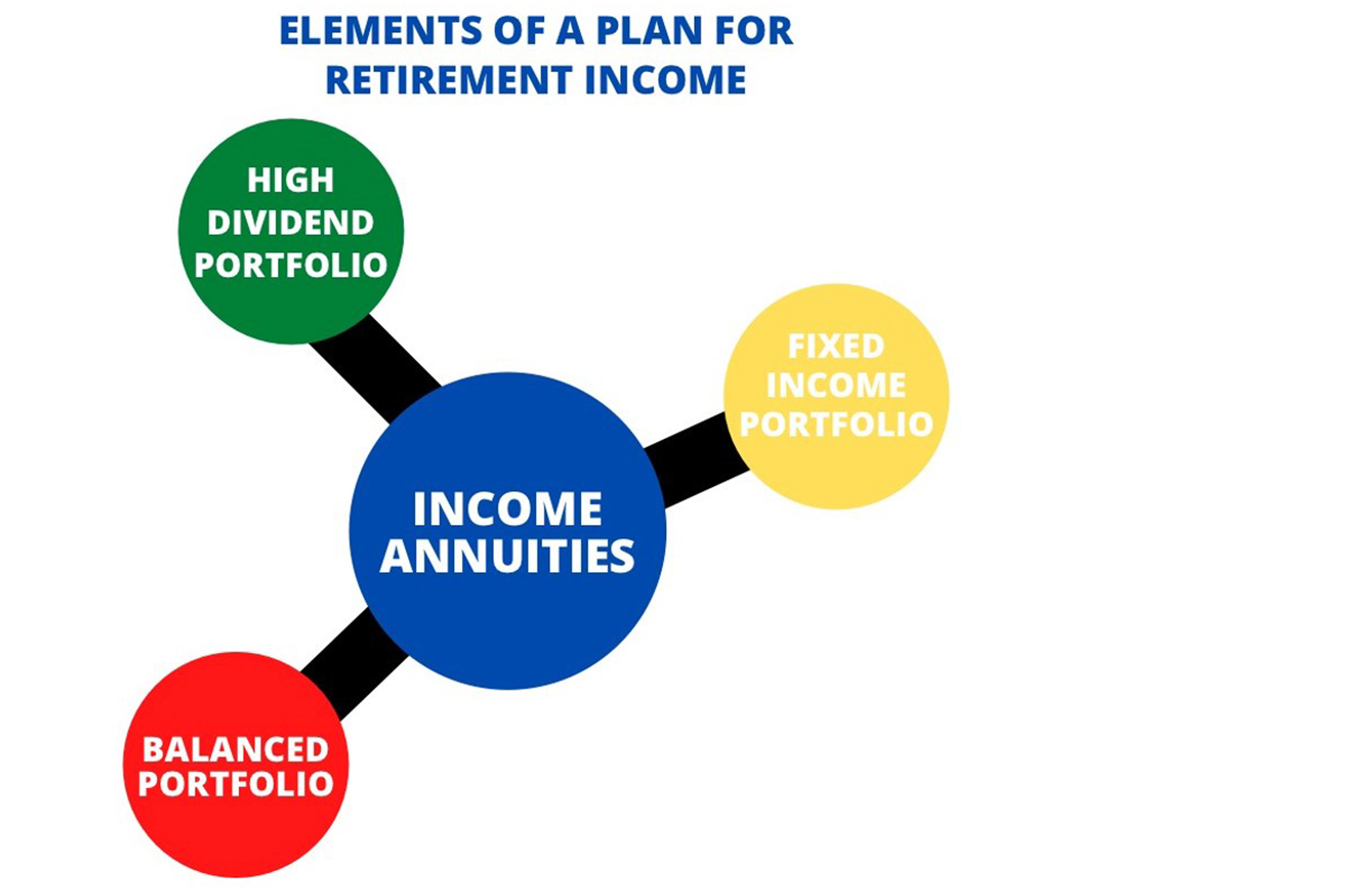

Here’s a picture of how the elements might look if you were creating a retirement molecule.

Putting the elements together

As a compound your plan might look like PD3IAN4PF1IAF2PB4. However, and this is the tricky part, unlike this jumble of elements, the compound you’ve engineered needs to be designed to be able to change form over time and continue for your entire lifetime.

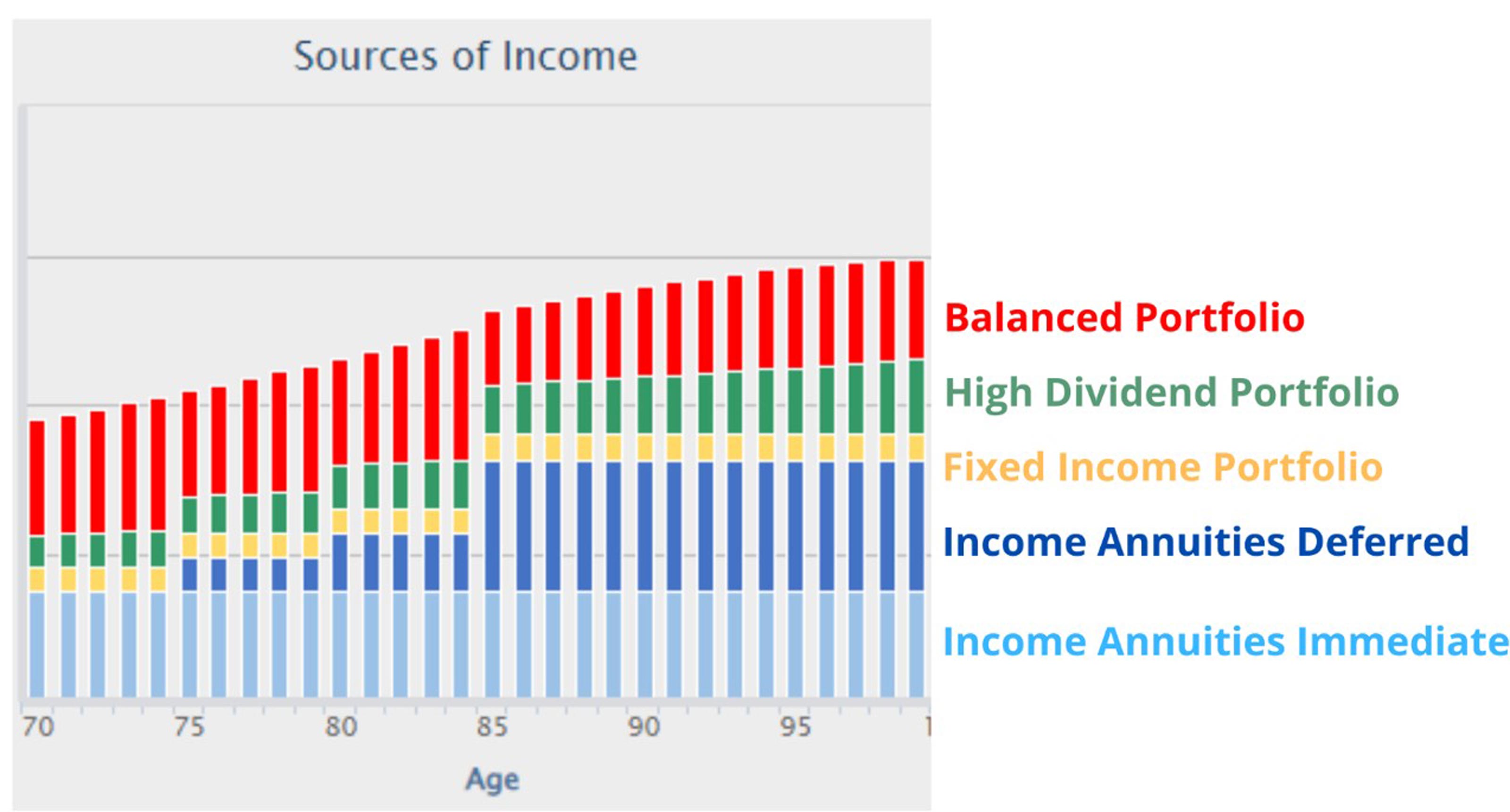

The bar chart below demonstrates the income these elements produce when combined using the Go2Income planning algorithm. Note how each element contributes different amounts at different times over your lifetime. Of course, the portfolios will contribute income based on the planning assumptions, while the annuity payments are guaranteed* and serve as the plan’s foundation.

Results of your plan

To evaluate your plan, see if it meets your income requirements: starting income to meet your current needs, increasing income to help offset inflation, lifetime income so you don’t run out, and less volatile income so you feel secure. And also look at your objectives for legacy and liquidity.

Unlike H2O, there are virtually an infinite set of possible combinations to match your objectives and personal circumstances.

In the end, creating a successful plan will allow you to:

- Use basic elements in the most effective and efficient way

- Create a plan that combines the right mix of elements

- Personalize the combination to meet your objectives

If you are interested in working on your own “chemistry” project, visit Income Allocation Planning at Go2Income. We will ask a few easy questions so you can design a plan that meets your objectives.

* Guarantees are subject to the claims-paying ability of the insurer.

Related Content

- How a Fixed Index Annuity Can Manage Retirement Income Risks

- A Challenging Retirement Plan Mission: Not Impossible

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

- Annuity Payments Are 30% to 60% Higher: Time to Reconsider

- Don’t Bet Your Retirement on Stocks: Follow These Four Tips

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.