A Retirement Plan Isn't Just a Number: Strategic Withdrawals Can Make a Huge Difference

A major reason not to set your retirement plan on autopilot: sequence of returns risk. A flexible strategy with cash reserves and smart withdrawal moves can help ensure that a bad market doesn't sink your golden years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Here's a startling truth: Two retirees with identical portfolios and withdrawal rates could experience the same average annual return and end up with vastly different outcomes.

In the worst-case scenario, one might run out of money, while the other sails through retirement comfortably.

This isn't a coincidence; it's a critical retirement threat known as sequence of returns risk.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Kiplinger's Adviser Intel, formerly known as Building Wealth, is a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

The problem with 'average' returns

Most investors know that the S&P 500 has averaged gains of about 10% a year in the long term, but that smooth average hides a bumpy road.

For instance, from 1995 to 2024, the S&P 500's annualized return was 10.9%. However, in only two of those 30 years did the market's return fall within two percentage points of that average.

This volatility is a minor concern during your working years when you're accumulating assets. But as you transition from a paycheck to living off your investments, market declines — especially early in retirement — can be devastating.

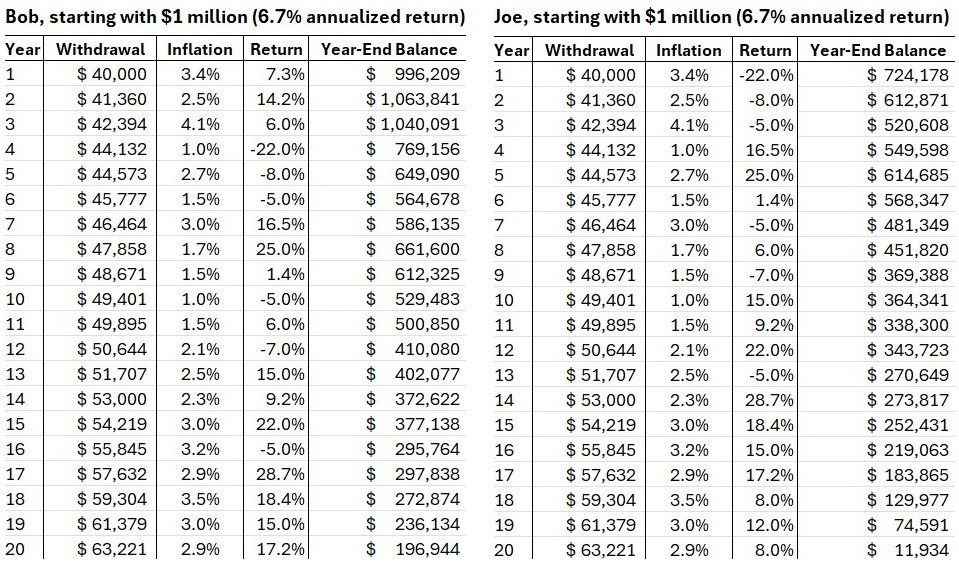

Consider the tale of two retirees, Bob and Joe. Both started with a $1 million portfolio and followed the same 4% withdrawal rule, adjusted for inflation.

- Bob experienced a "favorable" sequence of returns, and after 20 years, he had more than $196,000 remaining in his portfolio.

- Joe, however, experienced a "negative" sequence, with losses in the first three years of his retirement. Despite the same annualized return over the full period, Joe ran out of money in year 21.

Here's how 20 years unfolded in both cases:

Beyond the Monte Carlo simulation

Many advisers use tools such as the Monte Carlo simulations to illustrate the range of possible outcomes, but a simulation is not a plan. It's a single dashboard indicator, such as the speedometer on your car.

A true retirement plan is a dynamic strategy that requires continuous monitoring and adjustments.

Think of it as a football game. Good coaches don't just stick to the playbook; they make proactive adjustments based on the score, weather, injuries and the opponent's strategy.

Your retirement is the same. The rules of the game — the tax code, market conditions and your personal situation — are always changing. A flexible plan is your best defense.

Here's how you can reduce the sequence of returns risk:

Build a cash reserve. We advise clients to have 18 to 24 months of expected living expenses in cash or cash equivalents at the start of retirement. During a market downturn, you can draw from this reserve instead of selling portfolio assets at a loss.

In our earlier example, if Joe had forgone portfolio withdrawals during his first two years of losses, his outcome would have been completely different.

Use a reasonable, flexible withdrawal rate. Many retirees are familiar with the 4% rule, formulated based on research by Bill Bengen in the early 1990s. This rule states that you can take 4% of the initial portfolio value and adjust your annual withdrawals by inflation each year.

Bengen's initial research looked at 39 30-year periods covering 1926 to 1993 and had a 100% success rate using a 50/50 asset allocation. Bengen's latest research suggests a slightly higher sustainable withdrawal rate of around 4.7%.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel (formerly known as Building Wealth), our free, twice-weekly newsletter.

However, we often see clients use a fluctuating rate. For example, a retiree who delays Social Security until age 70 might withdraw a bit more in the early years of retirement, then drop their withdrawal rate once Social Security benefits begin.

Implement an efficient withdrawal strategy. A smart plan is about more than just a percentage. It's about drawing from the right assets, in the right accounts, in the right order. This means:

- Selling winners, not losers: When you need to raise cash, you can sell from asset classes that have performed well to avoid selling at a loss.

- Strategic tax planning: Tax laws change, and a good plan adapts. Recent tax changes, such as the enhanced deduction for people who are 65 and older, might make it more tax-efficient to draw more from your IRA than from a taxable account.

Sequence of returns risk is a very real challenge, but it's not insurmountable. The good news is that with a solid plan, you can significantly reduce its impact.

When it comes to retirement planning, a "set-it-and-forget-it" strategy is unlikely to work. It requires a disciplined process and continuous monitoring.

A good financial adviser acts as your financial coach, helping you make smart, informed decisions so you can navigate the bumps in the road and enjoy a secure, confident retirement.

Related Content

- Sequence of Return Risk: How Retirees Can Protect Themselves

- I'm a Financial Planner: How to Dodge a Retirement Danger You May Not Have Heard About

- Don't Let Sequence of Returns Risk Cook Your Goose

- Three Ways to Protect Your Retirement From Sequence of Returns Risk

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Mike Palmer has over 25 years of experience helping successful people make smart decisions about money. He is a graduate of the University of North Carolina at Chapel Hill and is a CERTIFIED FINANCIAL PLANNER™ professional. Mr. Palmer is a member of several professional organizations, including the National Association of Personal Financial Advisors (NAPFA) and past member of the TIAA-CREF Board of Advisors.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.