Don't Let Sequence of Returns Risk Cook Your Goose

Adjusting your portfolio to minimize the sequence of returns risk could help your money last well into retirement and beyond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

New and soon-to-be retirees can minimize the “sequence of returns risk” by adjusting both their portfolio and their investing mindset. Investors who don’t manage this risk might wish they’d paid more attention to the old Aesop’s fable about the farmer who had a goose that laid one golden egg each day.

If you don’t remember that one, I’ll cut to the chase: Instead of thinking about how he could best protect his goose — and the comfortable lifestyle it provided him — the farmer decided he wanted to get more eggs faster. So he ended up gutting the goose … and a heck of a retirement plan.

The moral of the story — “those who have plenty want more, and so lose all they have” — could serve as a cautionary tale to anyone, young or old, who chooses to invest aggressively despite the potential for big losses. But it’s particularly relevant, I think, for new and soon-to-be retirees, who are more vulnerable to something called “sequence of returns risk.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That’s because once you retire and start taking regular withdrawals from your investment portfolio, annual market returns become key to maintaining a reliable retirement income stream. If your stocks experience a significant loss in value because of a correction or crash, and you find yourself having to sell more shares to generate the income you need, it can affect how long your retirement savings will last.

And if that loss comes early in your retirement, or just before you retire, the unfortunate timing could end up killing the goose you’re depending on for a steady flow of golden eggs — even if your portfolio’s “average” rate of return is favorable.

How sequence of returns can affect your retirement outcome

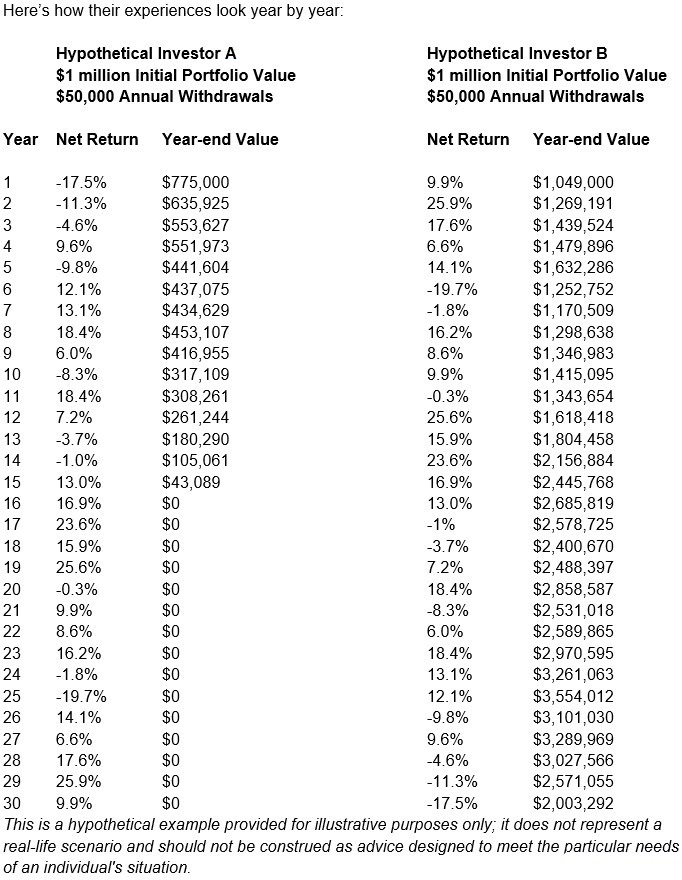

Here’s a hypothetical example of how the sequence of returns can affect your retirement outcome. Let’s say we have two investors, both of whom start retirement with $1 million and a plan to withdraw $50,000 a year. Over the next 30 years, they experience the exact same average rate of return (6.3%), but their annual returns occur in the opposite order.

Investor A experiences three down years at the start of retirement, and it nearly cuts his savings in half. Despite several good years later on, he never recovers and eventually runs out of money.

Investor B gets off to a much better start. And though he has some tough times going forward, after three decades, he doubles his money to more than $2 million.

If they weren’t taking distributions, Investor A and Investor B would have the same big-bucks balance at the end of 30 years, regardless of the sequence of their returns. But because they were pulling out $50,000 annually, their real rates of return were much different than their average rates of return.

Of course, you can’t control the markets, so you can’t control the amount or order of your returns. But you can adjust your portfolio (and your investing mindset) to help minimize sequence of returns risk.

Have a plan that minimizes sequence of returns risk

The investing you did in your 20s, 30s, 40s — and even 50s — is different from what you should be doing as you near retirement. (Think 10 or at least five years out.) Thanks to continuous contributions and the power of compounding, you had a chance to bounce back if you faced a market meltdown in your younger years. That rebound may be no longer a given, unfortunately, when you have a decade or less left until your retirement date.

You should have a plan that prioritizes safeguarding the wealth you’ve accumulated.

That likely will mean lowering your exposure to volatility with a more conservative stock-bond mix. You also may choose to add some reliable income producers (such as annuities or dividend-paying stocks). And you may find it makes sense to create a flexible withdrawal plan so you don’t have to sell stocks at a low to maintain your lifestyle in a bad year.

You can still keep some growth in your portfolio to generate income for the future. Just don’t let greed, fear or complacency cook your goose. Talk to your financial adviser about how to preserve the steady stream of golden eggs through your golden years.

Kim Franke-Folstad contributed to this article.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Investment advisory products and services made available through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. Ted Thatcher License #: 0L09326 Pinebrook License #:0M84694 Insurance products are offered through the insurance business Pine Brook Financial. Pine Brook Financial is also an Investment Advisory practice that offers products and services through AE Wealth Management, LLC (AEWM), a Registered Investment Adviser. AEWM does not offer insurance products. The insurance products offered by Pine Brook Financial are not subject to Investment Advisor requirements. This article is intended for informational purposes only. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. Insurance products are sold based on the suitability standard at both the state and insurance carrier level; this means that product recommendations must meet the stated financial needs and objectives of the client. Investment advisory services are required to be provided in accordance with a fiduciary standard; this means that the advice must be in the best interest of the client with any conflicts of interest fully disclosed to the client. 1539974 – 11/22

Related Content

- Three Ways to Protect Your Retirement From Sequence of Returns Risk

- Many Retirees Don’t Know About This Major Market Risk: Do You?

- Seven Big Retirement Risks to Avoid

- How to Invest at Any Age

- What’s the Difference Between Average and Actual Rate of Return?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ted Thatcher is president of Bright Lake Wealth Management and a financial adviser. As a holistic financial planner, he assesses his clients’ financial standings and retirement outlooks. Then, with integrity and transparency, he makes recommendations always with his client’s needs in mind. Ted also serves as president of the Redding, Calif., and Medford, Ore., chapters of the American Financial Education Alliance. When he isn’t behind his desk, Ted enjoys spending time with his wife and two children, and cheering on the Fighting Irish of Notre Dame.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.