Many Retirees Don’t Know About This Major Market Risk: Do You?

Flat market cycles can wreak havoc on your retirement planning. Here’s why you shouldn’t focus only on average returns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It is common to meet someone who believes that all of their assets should be in equities, even in retirement. The rationale is that, over the long term, equities tend to be one of the best places for growth, which is true. However, these claims often point to long-term averages, which, when you dive a little deeper into the application, can be misleading.

This article is intended to address two major arguments. The first is that averages are a great tool to use when you are planning your retirement, but there’s more that needs to be addressed. The second is that the markets have a history of going flat for 10-plus years every 20 years or so, which can create some serious problems in retirement.

My intention in writing this article is to help raise your awareness of certain risks while inviting you to think outside the box and consider a more balanced and deliberate approach to your retirement income planning and portfolio management. Let’s dive in.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Averages can be deceptive

If you had an account with $100,000 and expected that account to grow, on average, about 10%, then you would probably expect the following to happen:

- Year 0: $100,000

- Year 1: $110,000 (10% gain)

- Year 2: $121,000 (10% gain)

However, the markets are often not that consistent. For example, if you experienced a 30% loss and a 50% gain, you would still average a 10% return year over year, but you’d get a very different outcome.

- Year 0: $100,000

- Year 1: $70,000 (30% loss)

- Year 2: $105,000 (50% gain)

You may be thinking I’m rigging the math to prove a point by putting the 30% loss in year one. Let’s reverse it and see what happens.

- Year 0: $100,000

- Year 1: $150,000 (50% gain)

- Year 2: $105,000 (30% loss)

The volatility (ups and downs) matters. Taking a simple average and projecting the growth of your accounts may be problematic. This is especially true if we enter into a flat market cycle.

The flat market cycle can be rough

Historically speaking, the markets have gone flat (zero return over a period of time) for 10 years every 20 years or so. Some of the more notable flat markets over the past 100 years started in 2000, 1966 and 1929. (For more on this, see my article Four Historical Patterns in the Markets for Investors to Know).

If you put all of your assets in equities and follow the 4% rule (take 4% out of your portfolio as income each year), then you may find yourself in a difficult situation if the markets go into another flat cycle.

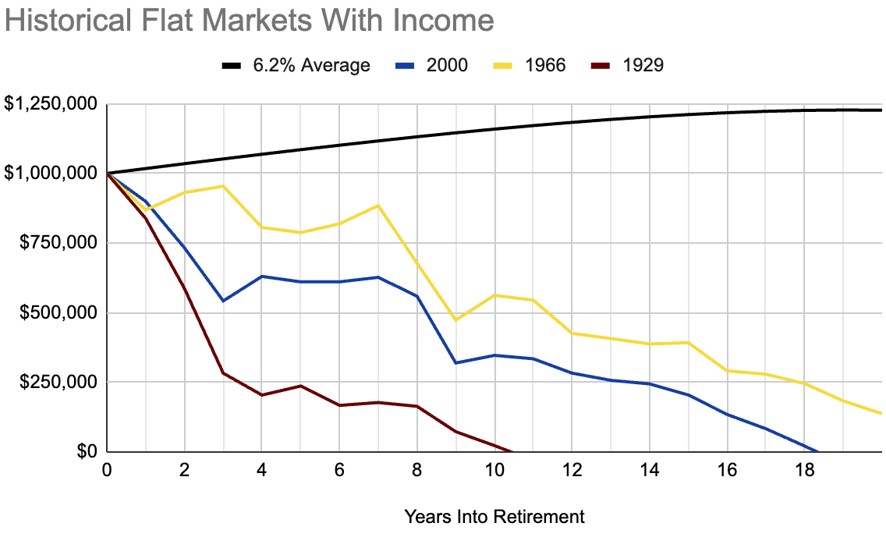

For context, the average return from 2000 through 2020 was about 6% to 7%. The same is true for the average return from 1966 through 1986. We will omit the 1929 average because it is significantly worse. So, assuming we take a conservative average return of 6% and draw only 4% from our portfolio, the averages would suggest that we should be fine (see the black line in the graph below).

However, if we account for the ups and downs in a flat market cycle, there’s a very different story to be told. For reference, this risk is often referred to as sequence of returns risk. See below what would have happened had you started with the same amount of assets while pulling the same amount of income but started your retirement at the beginning of one of the three historical flat market cycles.

Notice how each example has significantly less money left in the account than the “conservative 6% average” expectation. Many people could be retired for 30 years. If that is the case, and the historical flat market pattern continues, then it would be reasonable to guess that there could be a flat market cycle in your retirement. Are you prepared?

No one knows the future of the market. We could be in a flat market right now. Creating a retirement income plan based on averages when all of your assets are at risk in the equities market may not be in your best interest. How you pull income each year, especially during the first 10 years of your retirement, may matter more than your long-term average expectation.

If you feel like maybe you have too much exposure to equities, consider moving some of your assets into less risky investments or products. Many financial professionals would recommend you buy an annuity and then annuitize it into lifetime income.

I recommend using something I call a Principal Guaranteed Reservoir™, which I discuss in my book, How to Retire on Time. The idea is to have some assets in accounts that offer principal protection so that when the markets go down, you can draw income from your reservoir while you allow your other accounts to recover. This helps avoid sequence of returns risk without locking up assets for life in annuitized income.

Regardless of which way you go, remember, there’s no such thing as a perfect investment or investment strategy. It is important to put a plan together and then design your portfolio to support that plan.

Related Content

- Retirees’ Anti-Bucket List: 10 Experiences You Don’t Want

- Social Security Optimization If You Save More Than $250,000

- Five Things I Wish I’d Known Before I Retired

- The Four Headwinds of Retirement and How to Combat Them

- 1031 Exchange: Do You Know Your ‘Like-Kind’ Options?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Mike Decker, NSSA®, is the founder of Kedrec Wealth, a flat-fee financial planning firm that offers one-time services or ongoing management for a fixed monthly fee. He is also the creator of Cash Flow and Capital, an app designed to help people develop a healthier relationship with money by improving awareness around spending and decision-making. Mike is the author of How to Retire on Time, How to Prepare to Retire on Time (coming soon) and The Bear Market Protocol (also coming soon). He shares practical retirement and wealth-building strategies through his podcast, weekly newsletter and two YouTube channels.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.