What the HECM? Combine It With a QLAC and See What Happens

Combining a reverse mortgage known as a HECM with a QLAC (qualifying longevity annuity contract) can provide longevity protection, tax savings and liquidity for unplanned expenses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In a recent article about QLACs, we said, “A QLAC doesn’t make your retirement. It makes it better.”

We offered up several ideas about using a QLAC as part of your plan for retirement income. One was to use a portion of QLAC lifetime payments to pay interest on a reverse mortgage called a HECM, resulting in a combination called HomeEquity2Income, or H2I.

The twofer benefits of a QLAC and a HECM

I’m a numbers guy, and I follow the patter of a former local New York sports broadcaster who used to urge, “Let’s go to the videotape!” for details of the game just played.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

My primary reason for favoring a combination of a QLAC (qualifying longevity annuity contract) and a HECM (home equity conversion mortgage) is what I call the twofer rule applied to both components.

QLAC twofer:

- Save taxes by deferring distributions from a rollover IRA account until age 85

- Lifetime income, also called longevity protection

HECM twofer:

- Additional tax-free income

- New source of liquidity for unplanned or uninsured expenses

To get an idea of how much income a QLAC can generate, you can get a personalized quote using this QLAC calculator. That income, when combined with a HECM as part of your retirement planning process, can help you achieve your retirement goals:

- Lifetime income

- Liquidity to cover long-term care

- A financial legacy for your heirs

And at the same time, you can defer taxes and lower risk.

Here's the triple play when you combine a QLAC and a HECM: By taking care of longevity protection and using some of that QLAC income to pay HECM interest, you dramatically increase the liquidity to pay for long-term care expenses, which a lot of us will face.

A recent report by Morningstar shows that about 45% of all baby boomers will need long-term care — ranging from in-home services to a nursing home — in retirement. The QLAC-HECM combination in the form of H2I allows you to anticipate a long life and also pay for that LTC.

Now, let’s do the numbers and focus on how the right combination can benefit retirees.

Sally's current situation

Sally, 70, has a traditional IRA worth $1 million invested in a stock-and-bond portfolio. She fully owns her home, which has a value of about $650,000. She’s reevaluating her financial situation, particularly with regard to long-term care expenses.

Sally’s adviser told her that with her income spending starting at around $60,000 per year, the IRA alone should last until age 95 if she is careful. (Unplanned withdrawals would upend that plan.)

Having read our previous articles about the benefits of adding guaranteed lifetime income, she considered adding a single payment immediate annuity (SPIA) contract to reduce the risk of running out of money.

She created a plan with a 30% allocation to a SPIA and a 50/50 split between equities and fixed income for the balance. Under this plan, her starting income increases to $63,500, and her money doesn’t run out.

While the SPIA contract in Sally’s plan went a long way to address the “don’t run out of money” issue, she recognized that the only liquid assets would be her rollover IRA account, which she might need for planned and unplanned expenses.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Her liquid IRA account, starting at $1 million, didn’t run out, as she found out when she “tested” the plan, but it wasn’t adequate to pay for any substantial amount of unplanned or uninsured expenses.

She needs more help in adding liquidity to her plan, especially because when she takes money out of the IRA to pay for those expenses, her remaining savings will produce even less income.

Adding the H2I strategy to her retirement plan

Sally realizes her home is a valuable asset and that she can consider it as a way to ensure her money not only lasts for her lifetime, but also provides a resource for unplanned expenses.

She could simply apply for a reverse mortgage in the form of a federally endorsed HECM that provides not only access to cash but also an increasing line of credit during the life of the loan.

However, the H2I combination provides even greater benefits. That’s because if she converts some of her IRA savings to a QLAC, a form of deferred income annuity, she can use a portion of that income to pay interest on the HECM and preserve more of her liquidity and her ability to leave a legacy to heirs.

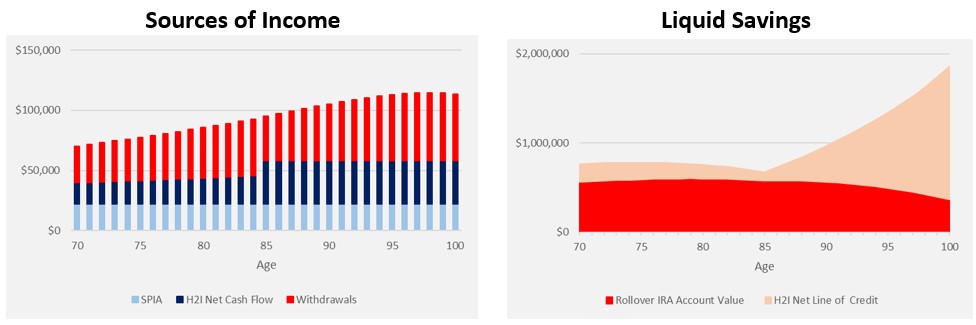

The charts demonstrate how H2I can bolster spendable income while providing access to a HECM line of credit that can finance large unplanned expenses after age 85.

Her total liquid savings under this plan reach $968,000 at age 90. And she can draw on it without tax if it comes from an H2I line of credit.

A simple explanation of advantages

Some of you may be skeptical about the benefits that a QLAC and then a HECM can offer together. Here’s a simple description of what you saw above:

1. A HECM taps into the “largest savings source” of retirees (your house, per experts):

- Tax-free cash flow until age 85 from HECM drawdowns

- Finds the liquidity missing from many plans

2. A QLAC provides longevity protection in two ways:

- Increases your guaranteed lifetime income

- Pays a portion of HECM interest after 85 to grow liquidity and legacy

3. A QLAC and a HECM together provide increases in income and liquidity

4. Importantly, that liquidity from a HECM comes without income taxes

And none of the above is subject to today’s stock and bond market volatility.

Visit Go2Income to order a Go2Income plan that with H2I inside can meet more of your retirement objectives. A Go2Specialist can answer questions about the plan or refer you to a qualified adviser.

Related Content

- Transform Your Retirement Plan With This Powerful Combo

- How Combining Your Home Equity and IRA Can Supercharge Your Retirement

- Is Your Retirement Solution Hiding in Plain Sight?

- How Your Home Can Fill Gaps in Your Retirement Plan

- Would a Reverse Mortgage Work for You in a Gray Divorce?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.