Is Your Retirement Solution Hiding in Plain Sight?

Here’s how to use your home equity in combination with an annuity contract to produce late-in-life income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Editor’s note: The earlier article How Your Home Can Fill Gaps in Your Retirement Plan discussed the “why” of incorporating the equity in your home in your plan for retirement income. This article discusses the “how.”

In retirement, your home means something more than it did while you were raising kids, getting promotions at work, and dreaming about how the future might unfold.

Now, it can provide the opportunity that helps you realize your future in retirement — financially at least.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For most of us, our house carries much more equity than it did when we were just starting out. Home prices have more than doubled in the past 20 years. How to use that equity to benefit you and your family is a key retirement question that your home can answer. But as you will see, it may work better when combined with an annuity contract that produces late-in-life income.

Combining two financial products in the right proportions

I pointed out in my earlier article For Sustainable Retirement Income, You Need These Five Building Blocks that hydrogen and oxygen have their own good properties, but they create the magic of water (also known as H2O) only when combined in the right proportions. In a similar way, the combination of a home equity conversion mortgage (HECM) and longevity protection in the form of a QLAC, or a qualifying longevity annuity contract, in a new program we call HomeEquity2Income (H2I) provides a beneficial mix of an immediate income boost and additional long-term liquidity. H2I can be the “solution” to pay for both planned and unplanned expenses.

H2I uses the equity in your home, accessed through an HECM, a type of reverse mortgage backed by the Federal Housing Administration (FHA), that enables homeowners age 62 or older to convert a portion of their home equity into cash, as a source of tax-free drawdowns early in retirement until age 85. Then payments from a QLAC (or another deferred income annuity contract) start at age 85 to pay HECM interest and continue the income for life.

Payment of interest is not an HECM requirement (more on this below); paying the interest from QLAC payments is simply a way to grow a line of credit and liquidity for the future.

Note: The stock traders’ technical definition of financial liquidity refers to the ease with which an asset or security can be converted into cash without causing a significant impact on its market price. In this case, the definition of liquidity is the ability to access funds for unplanned expenses without upsetting your plan for retirement income. It could be that your liquidity is the “set aside,” or reserve, fund, the money market fund or equity in your home that’s convertible into cash to cover say, health care expenses or 529 contributions.

A little more about the components of H2I

There are a lot of financial products out there, and we have studied most of them. As I suggested above, most will not interact with others in a way that produces a better fit to meet your objectives. Here’s how we determined the elements that would work in H2I.

A QLAC works because it is designed to produce lifetime income from a rollover IRA account (but not later than your age 85), which means you’re deferring otherwise taxable required minimum distributions (RMDs) and purchasing income at a deep discount. As important, the income kicks in to pay your HECM interest and continue your age 85 income the HECM was providing — for the rest of your life. They fit like hand and glove. Visit our calculator to see how you much lifetime income a QLAC will guarantee.

There is a virtual clone of a QLAC that you can purchase from your personal (after-tax) savings called a conventional deferred income annuity (DIA). If the $200,000 limit on a QLAC restricts your H2I benefits, you can purchase a DIA to fill in the gap.

Like other income annuities, your income under a QLAC/DIA is a function of age, gender and whether a surviving spouse receives income. One other option is to protect your beneficiary in case of early passing.

An HECM is the element that binds with a QLAC to make H2I. Several advantages make it a good fit, enabling the homeowner to convert a percentage of home equity into tax-free cash. The benefits include:

- No required monthly principal and interest payments

- Borrower or heirs won’t owe more than the appraised value of the home at the time of repayment

- The FHA insures HECMs

Let’s pause here for a short discussion of HECM vs HELOC (home equity line of credit). Retired homeowners may be thinking that they can delay establishing a line of credit from the value of their home until they actually incur large expenses, but they risk waiting until it’s too late. With a HELOC, lenders often consider the borrower’s age along with creditworthiness and what you owe on the house. If you’re 62 or over, age is not a consideration with an HECM, which also offers a line of credit that grows each year based on the mortgage’s interest rate. Finally, HELOC requires payment of interest; not so with HECM.

How does H2I work for our sample investor?

Let’s look more closely at the example of this “water” of retirement income planning for a typical retiree or near retiree. Her net worth is $2.5 million, with $1.5 million in retirement savings and $1 million in the value of her home. She really loves her home and doesn’t want to sell. She wants to age in place, recognizing that a home health aide probably costs $60,000 a year or more. That’s a good reason to have a source of liquid funds available. If she needs in-home care, she can pay for it. If she stays healthy, she can leave the equity in her home to grow.

With that knowledge, here's what one customized H2I program provides in comparison to our investor’s current plan.

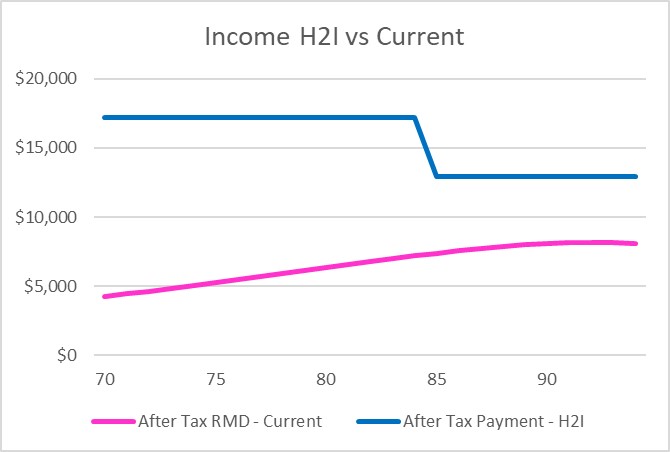

Income. H2I will provide about $17,200 a year from HECM drawdowns until age 85, when a QLAC will begin, replacing that income and also paying the interest on the loan balance. Our investor can use the $17,200, which is received income tax-free, on expenses or reinvest it in a tax-favored account that she expects to grow over time. As an alternative to using the $150,000 to purchase a QLAC, she could keep that amount in her IRA account and pay out RMDs. After tax, that’s generating about $4,300 to start.

The H2I income translates to 11.5% per year on the $150,000, tax-free until age 85 vs. about 2.85% from her rollover IRA account. Of course, if she tried to match the 11.5% from her current rollover savings each year, the account would shrink more rapidly than she planned

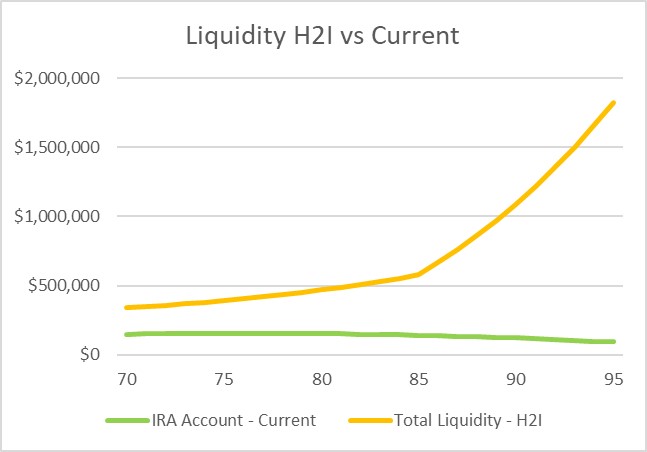

Liquidity. With the income boost and tax benefits, what about liquidity in her new H2I program?

To start, HECM provides tax-free liquidity from a line of credit, and under her H2I program, it will grow from $340,000 to $580,000 at age 85 to use as she sees fit. That liquidity grows even faster after age 85 with the payment of interest, exceeding $1 million by age 90. Importantly, that line of credit grows regardless of the appreciation of the home.

Under her current plan, while her home is growing in value, there is no automatic liquidity unless she set up a HELOC in advance.

Is it a good deal?

Compare the legacy. An H2I plan provides more income and greater liquidity at the expense of a lower legacy payoff to the kids because of income generated earlier in retirement. However, they will appreciate that you took on the burden of your health care and other costs. And you also may use some of the line of credit to finance things, like your grandchildren’s college expenses.

To do the full analysis of the pros and cons of H2I, you really need to look at your total plan. A future article will show the value of combining H2I with Go2Income.

Visit here to create your own Go2Income Plan. After you have a chance to review that plan, you’ll be able to appreciate how adding H2I can prepare you for the future.

Related Content

- How to Cut Your Taxes as Short-Term Interest Rates Come Down

- How a Fixed Index Annuity Can Manage Retirement Income Risks

- A Challenging Retirement Plan Mission: Not Impossible

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

- Annuity Payments Are 30% to 60% Higher: Time to Reconsider

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.