How to Cut Your Taxes as Short-Term Interest Rates Come Down

Using after-tax savings to buy an immediate annuity could shift your taxes on income to later years, when you might have expenses that can offset higher taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If interest rates come down, according to our fixed income investment guru, “the reductions will likely be at the short end of the yield curve with rates holding steady at the longer end.” Or in layman’s terms, if we move to a more typical yield curve, you’ll see rates on long-term bonds (underlying annuity rates) be substantially higher than on short-term securities and CDs. That may also mean that rates on new annuity contracts are holding steady — although maybe not for long.

For our typical investor, Sally, who is 70, her lifetime income from a $500,000 investment sits at about $42,000 per year, or 8.4%, which means nearly double the current short-term rate of, say, 4.25%. But do you give that advantage away in taxes? That answer and more below.

Taxes on immediate annuities vs short-term securities

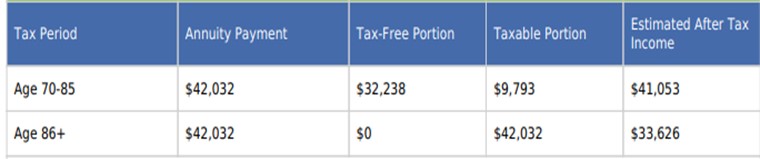

For our investor above, here’s a portion of the information she got on March 24 in her annuity quote.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We learn this from her report:

- Only $9,800, or 23%, of her payment is taxable during an initial exclusion period

- Her initial exclusion period continues to age 85

- Assuming an overall income tax rate of 20%, she receives: 97.5% of her annuity payment after taxes through age 85 and 80.0% of her annuity payment after taxes at ages 86 and over

This means her after-tax yield during the exclusion period is 8.21%. If short-term rates settle at their long-term average of 3.50% and she nets 2.80% after tax, she’s more than tripling her after-tax income — until she’s 85. Of course, the annuity is not preserving principal, and thus the allocation to this annuity should be limited. You can find out your income and tax benefits here.

Where does the tax benefit come from? The general rule to consider is that when purchasing an immediate annuity from personal savings, your already-taxed principal is excluded from tax. Once you recover the principal from your purchase, though, taxes kick in on the full payment. However, later in life when the annuity exclusion disappears, you may have medical or other expenses that will help you offset the higher taxes.

Also consider that women tend to live longer than men, so their annual annuity payments are smaller than those of men, everything else being equal. However, the exclusion formula does not reflect gender so that the tax tables figure both genders will have the same life expectancy, and thus women are advantaged by having a smaller percentage of income taxed (23.0% vs 27.5% for this example).

Tax benefits across your entire plan

We understand that your tax bill is not the sum of taxes on individual sources of income like annuity payments, Social Security payments, dividends, interest, IRA withdrawals, etc., but on your aggregate taxable income less deductions and exclusions. So, we need to dig a little deeper into our investor’s plan for retirement income to view the total tax bill as follows.

She has $2 million in retirement savings, with half in a rollover IRA, and her house is worth $1 million with no mortgage. She can count on $36,000 in Social Security benefits and $26,400 in pension payments each year. Her savings, with 30% in stocks and 70% in taxable bonds, will produce an additional $90,000 of income.

Her current plan would leave her about $20,000 short of her income goal, which is intended to cover all her bills, including premiums for long-term care and health insurance, the cost of renovations to her home and 529 contributions for her grandkids.

To help her figure out how to get that extra $20,000 in income, Sally went to Go2Income. Without taking greater investment risk, a Go2Income plan allocated a portion of her fixed income portfolio to annuities like the above. The plan also incorporated a HomeEquity2Income program for both income and liquidity to address the possibility of long-term care or a health crisis. Bottom line, she found the $20,000 and then some.

But here’s the bonus. While you’d think more income equals more and a higher rate of taxes, her Go2Income plan actually reduces the taxes by $4,500 and lowers the tax rate from over 13% to below 10%. Wow!

What drives Go2Income planning tax outcomes?

Besides considering the usual — inflation, percentage of safe income, legacy objectives, etc. — the Go2Income plan considers the following when it comes to taxes:

Difference between personal and rollover savings. Taxes on the money you save in a 401(k) or rollover account are deferred until they arrive in your bank account as payments. That benefits savings, but you have to account for the taxes upon retirement. Adjustments in other accounts can help keep your tax rate as low as possible, particularly using the exclusion benefit on income annuities above. Or using a QLAC to defer taxes is another tax benefit that is granted annuities. (To learn more about a QLAC, read my article For Longevity Protection, Consider a QLAC.)

Difference between immediate and deferred income annuities. A deferred income annuity defers payments and taxes on that batch of savings into the future. Immediate annuities have the tax benefits above, and using a mix of these annuities within the annuity asset class can contribute to tax reduction.

Tax-free drawdowns from home equity. Accessing the equity in your home can be a source of tax-free income. Using this strategy for a temporary period and then combining with a deferred income annuity can be effective, as you can see in my article How Your Home Can Fill Gaps in Your Retirement Plan.

What to do about taxes in your planning?

A lot of planning systems don’t consider taxes in their allocation.

When you do your planning or review your adviser’s plan for you, look at:

- All income streams. Social Security benefits, annuity payments, IRA distributions, dividends, interest and capital gains

- All accounts that are sources of income

- Taxes in all life stages and objectives — Income, liquidity, and legacy

- Taxes when reallocating from current strategy or rebalancing new plan

- Both the immediate and long-term impact of plan allocations

The federal government creates ways to save on tax payments for several reasons, including to promote retirement savings and to make retirement more comfortable. It makes sense to take advantage. Visit Go2Income and build your own retirement income plan that minimizes your taxes.

Related Content

- How Your Home Can Fill Gaps in Your Retirement Plan

- How a Fixed Index Annuity Can Manage Retirement Income Risks

- A Challenging Retirement Plan Mission: Not Impossible

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

- Annuity Payments Are 30% to 60% Higher: Time to Reconsider

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.