Dow Climbs 327 Points, Crosses 48,000: Stock Market Today

Markets are pricing the end of the longest government shutdown in history – and another solid set of quarterly earnings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

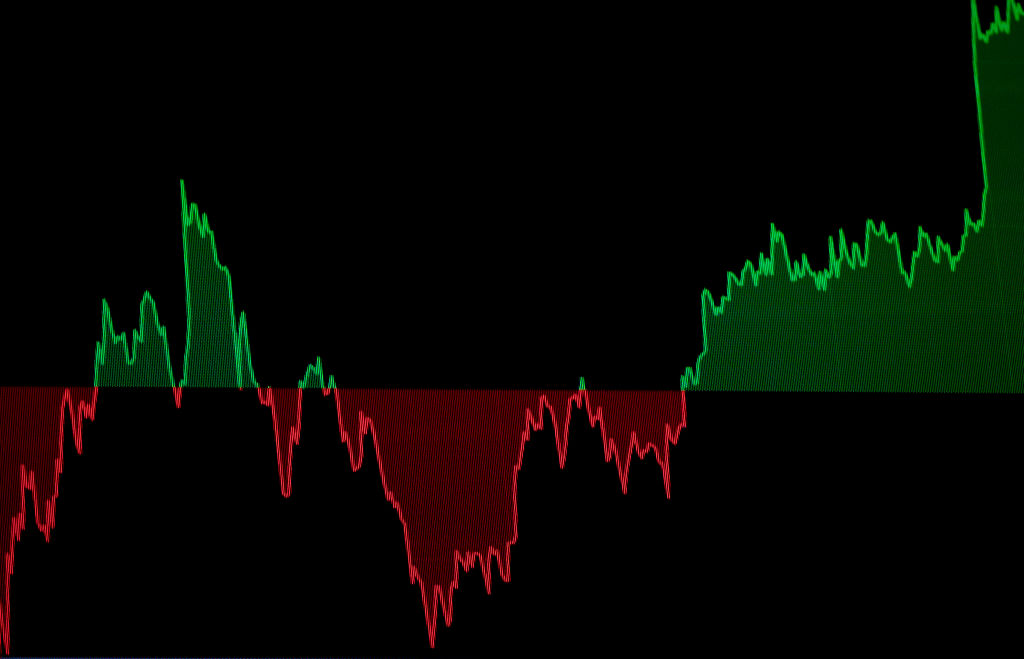

Optimism about a deal in Washington, D.C., to reopen the federal government provided an early boost on Wall Street Wednesday, though questions about valuations continue to dog mega-cap tech names. The Dow Jones Industrial Average, relatively light on tech exposure, added to its impressive run during the shutdown and closed at another new all-time high.

The Dow is now up more than 6% over the trailing month. UnitedHealth Group (UNH, +3.6%) led the 30 Dow Jones stocks higher today after Chief Financial Officer Wayne DeVeydt reaffirmed management's expectation that performance will improve in 2026 before new strategic initiatives begin to pay off in 2027.

Software maker Cisco Systems (CSCO, +3.1%) was up ahead of its post-closing-bell appearance on the earnings calendar. Nvidia (NVDA, +0.3%), meanwhile, surged late to post a gain a day after SoftBank sold its entire $5.8 billion stake in the bellwether of the artificial intelligence (AI) revolution so CEO Masayoshi Son can concentrate on a $30 billion OpenAI bet.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Among other Magnificent 7 stocks in the world's second-oldest equity index, Microsoft (MSFT, +0.5%) also posted a gain. Apple (AAPL, -0.7%) was down modestly, and Amazon.com (AMZN, -2.0%) finished at the bottom of the index.

At the closing bell, the blue chip Dow Jones Industrial Average was up 0.7% at 48,254, a new all-time closing high and the first time Papa Dow has finished a trading session above 48,000. The broad-based S&P 500 had inched up 0.06% to 6,850, but the tech-heavy Nasdaq Composite was down 0.3% at 23,406.

AMD has EPS power

Advanced Micro Devices (AMD, +9.0%) did its part on behalf of semiconductor stocks after Truist analyst William Stein reiterated his Buy rating and his $279 12-month target price for the "emerging DC/AI 'trusted partner'."

According to Stein, AMD stock remains cheap, noting the company is growing earnings per share at a compound annual rate of approximately 45% through 2030 but trades at about 10 times 2030 "EPS power."

AMD management said at its investor day presentation on Tuesday that it also expects 35% total sales growth and expanding margins, citing an 80% growth rate for server accelerator sales.

OKLO is still going nuclear

Oklo (OKLO, +6.7%) continues to demonstrate why it's one of the best ways to invest in the nuclear revolution. And Wedbush analyst Dan Ives reiterated his Outperform rating and his $150 12-month target price on the stock.

"Oklo continues to see regulatory acceleration for its projects," Ives writes, "with the DOE authorizing an approval to construct and operate a nuclear facility creating a modern pathway to get new nuclear plants built quickly."

As Ives explains, "Oklo is setting the stage for nuclear energy to become widely adopted over the next decade as the AI Revolution data center buildout is driving significant demand for new energy to power these initiatives."

Indeed, AI-driven computing power is expected to grow 10 times by 2030.

Shutdown math

The House of Representatives is poised to approve legislation to end the longest-ever government shutdown in a vote expected to happen around 7:15 pm Eastern Standard Time today. The compromise bill, which provides funding to keep the government operating through January 30, would then move on to President Donald Trump's desk for signature.

Despite the added uncertainty, notes LPL Financial Chief Technical Strategist Adam Turnquist, stocks have risen. "Since the shutdown began on October 1," Turnquist writes, "the S&P 500 has gained 2%, with a peak-to-trough decline of only 3%." Both of those performance figures are better than average for government shutdown periods.

Turnquist says there could be more upside from here: "Historically, removing the uncertainty from a government shutdown tends to support equities." After 20 shutdowns since 1976, the S&P 500 has generated average one- and three-month returns of 1.2% and 2.9% vs 0.8% and 2.4% during all periods over the same time frame.

Landsberg Bennett Private Wealth Management Chief Investment Officer Michael Landsberg explains the stock market's moves from a fundamental perspective: "There is a simple reason that stocks are up so much, and that's because S&P earnings have handily beaten street estimates time after time this year, forcing much of Wall Street to play catch up."

Landsberg is cautious, though: "The market had been flying blind with no data, and now as the fog lifts, we will see if market positioning has been correct and it is still clear sailing or if there is a big repricing necessary."

With an abundance of incoming data filling up the economic calendar in the near future, investors, traders and speculators will re-focus on inflation, jobs and the next Fed meeting.

Related content

- Worried About an AI Bubble? Here's What You Need to Know

- The Best Homebuilder ETFs to Buy

- The Best Monthly Dividend Stocks to Buy Right Now

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Dittman is the former managing editor and chief investment strategist of Utility Forecaster, which was named one of "10 investment newsletters to read besides Buffett's" in 2015. A graduate of the University of California, San Diego, and the Villanova University School of Law, and a former stockbroker, David has been working in financial media for more than 20 years.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.