9 Best Metaverse Stocks for the Future of Technology

With the market size for metaverse stocks expected to balloon by the end of this decade, these nine names are worth a closer look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The metaverse is expected to see impressive growth over the next several years, creating a considerable opportunity for those invested in the best metaverse stocks.

The concept of the metaverse is far from new. Science fiction author Neal Stephenson coined the term in 1992 in his novel, "Snow Crash." This would inspire many other stories and movies, such as Ernest Cline's "Ready Player One." Steven Spielberg turned this into a hit movie in 2018.

But the metaverse is really no longer about science fiction or Hollywood, rather it has become a reality. Consider that virtual reality (VR) headsets can provide realistic experiences in virtual worlds.

Don't count the metaverse out

True, the metaverse has presented challenges for some companies. Microsoft (MSFT), for instance, has reportedly shut down or pared back its metaverse initiatives to focus on artificial intelligence (AI). And Walt Disney (DIS) closed its division that was focused on next-generation experiences, which included the metaverse.

Despite all this, the metaverse should not be counted out. According to research from Contrive Datum Insights, the market is worth more than $50 billion and is forecast to reach $1.3 trillion by 2030. This works out to be a stunning 44.5% compound annual growth rate.

"We're convinced the Metaverse represents the next iteration of the internet," said Tejas Dessai, AVP and research analyst at Global X. "As users continue to spend more time online and as the broader economy gets digitized, consumer tech will have to evolve to service emerging user demands – creating room for deeper participation via immersive experiences, multi-modal input,and intuitive interfaces."

How we chose the best metaverse stocks

For investors, there are no pure-play metaverse operators. However, there are some companies that should get a boost from this technology. The key when choosing the best stocks to buy is to focus on those that are set to benefit the most from this new technology.

With that in mind, here are eight of the best metaverse stocks and one exchange-traded fund.

Data is as of May 12. Analysts' consensus recommendation courtesy of S&P Global Market Intelligence. Stocks listed in reverse order of analysts' consensus recommendation.

Snap

- Industry: Internet content & information

- Market value: $13.9 billion

- Analysts' consensus recommendation: 2.93 (Hold)

Snap (SNAP, $8.55) isn't the first stock that comes to mind when thinking of the best metaverse stocks. Snap CEO and cofounder Evan Spiegel has said before that does not like the term "metaverse," yet he still is pursuing many of the core concepts of this category.

The big difference between the two executives is in the approach. Spiegel is more interested in AR, where the user is still part of the real world. It's not completely virtual.

Keep in mind that Snap is a pioneer in augmented reality via its Camera platform. This includes both hardware – such as Spectacles, which are AR glasses – and software. There are over 250 million users that use this technology everyday.

In the meantime, SNAP is integrating sophisticated generative AI into its AR platform. The company is a strategic partner with OpenAI and has leveraged GPT-4 to create a new service called My AI, which is available for Snapchat+ paid subscribers. "My AI can recommend birthday gift ideas for your BFF, plan a hiking trip for a long weekend, suggest a recipe for dinner, or even write a haiku about cheese for your cheddar-obsessed pal," said Snap in a press release.

It's true that Snap has struggled both on and off the price charts during the past year as advertising budgets have tightened. And not everyone is a fan of the communication services stock.

"Snap faces increasing competition for the slow-growing or even shrinking pool of digital advertising dollars, and its poor results contrasted with growth at rival Meta," says Argus Research analyst Jim Kelleher. "Given weakening digital ad-spending trends, along with Snap's inability to adapt to changes to ad tracking on Apple iOS that have hurt advertiser demand, we believe a HOLD rating on SNAP remains appropriate at this time."

However, it should be noted that the company has made tough decisions to restructure its operations. There has also been a retooling of its ad platform, such as for improving conversations and quality of engagements. Such actions will position the company to better monetize its large user base as the market starts to get back on track.

Roblox

- Industry: Electronic gaming & multimedia

- Market value: $23.7 billion

- Analysts' consensus recommendation: 2.63 (Hold)

Roblox (RBLX, $39.36) is a pioneer of virtual worlds. Founded in 2004, the company allows users to create their own 3D immersive experiences and interact with their friends.

The system has three main components. Roblox Client is for users to explore virtual worlds; Roblox Studio is a powerful set of tools to build, publish and manage 3D experiences; and Roblox Cloud is a sophisticated infrastructure platform.

The company even has its own virtual currency, called Robux. This is a way to encourage users to create engaging experiences. In fact, there are some members who make a living operating their virtual worlds.

During the latest quarter, the average daily active users (DAUs) came to 66.1 million, up 22% year-over-year. The hours engaged were 14.5 billion, a 23% increase over the year prior.

With its large audience, Roblox has been successful in attracting top-notch brands. The company has partnerships with the NFL and FIFA, as well as entertainers like Mariah Carey and Elton John.

Roblox has been investing heavily in innovating its platform, and the company's vision is to create a next-generation communications system. To this end, Roblox has introduced features for voice, eye and arm tracking, and facial animation.

Generative AI is likely to be an important factor for the growth as well. Roblox recently launched tools that allow for the creation of virtual worlds by using natural language prompts. This will go a long way to make it possible for anyone to become a creator in the metaverse.

True, RBLX is another one of the metaverse stocks with a consensus Hold recommendation from analysts. Oppenheimer analyst Martin Yang sees "risks to [the company's] long-term growth outlook, namely, the ability to improve its content quality to reach older and more lucrative audiences." Yang has a Perform rating on RBLX stock, which is the equivalent of Hold.

However, there are plenty of bulls to be found. "We believe the reason to own shares is the amount and trajectory of engagement the platform generates and the future monetization opportunities are not fully appreciated by the market," says Needham analyst Bernie McTernan, who has a Buy rating on Roblox.

Verizon Communications

- Industry: Telecom services

- Market value: $158.2 billion

- Analysts' consensus recommendation: 2.61 (Hold)

It may seem odd to have Verizon Communications (VZ, $37.59) on a list for metaverse stocks. What does this Dow stock have to do with this industry?

Well, Verizon is actually a critical part of the ecosystem.

"5G and technologies like mobile edge computing are a critical part of the ability to support fast, data-intensive experiences on the go," said Tal Elyashiv, founder and CEO of venture capital firm SPiCE VC. "The metaverse experiences involving 3D and augmented real applications, which overlay visuals over a user's real-world vision well as the need for smooth transition between the real world and the metaverse in real time will require the ability to deal with huge quantities of data and edge computing capabilities that are not possible given today's mainstream network and mobile phone technologies."

Then it won't be a surprise that Verizon has been making moves into the metaverse. Last year, the company announced a partnership with Meta Platforms (META). While the details of the arrangement are vague, it seems likely that Verizon's 5G UWB (Ultra Wideband) technology will be critical. This allows for low-latency broadband access, which will be ideal for metaverse applications.

Unity Software

- Industry: Software – application

- Market value: $11.2 billion

- Analysts' consensus recommendation: 2.50 (Buy)

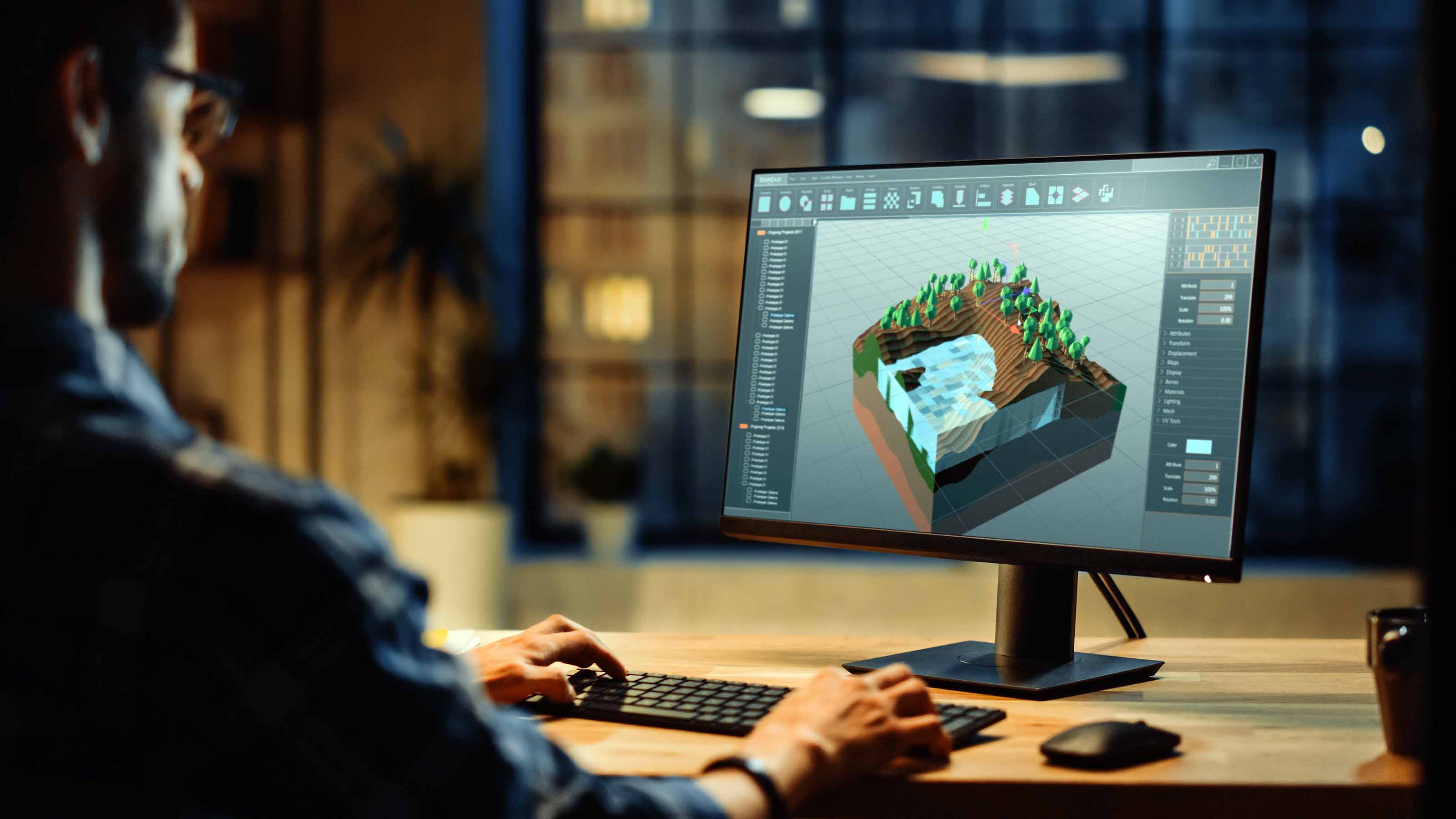

Unity Software (U, $29.65) is a leader in tools for designers to create interactive 3D experiences. Customers range from developers to artists to designers.

Unity's software comes in two main versions. Create Solutions allows for the development of real-time 2D and 3D content. There are also tools for animation, audio, and user interfaces.

There is also Grow Solutions. These provide for improving the acquisition, engagement, marketing and monetization for user bases. The focus is primarily on mobile games. Unity has its own ad network, but also integrates with third-party platforms.

While gaming is a critical business for the company, there are other verticals that will help with the growth. These include film, retail, auto, engineering and construction.

The Unity platform is definitely robust. It accounts for about 3.9 billion monthly active users (MAUs) and 70% of the top 1,000 mobile games have been written with the company's tools.

According to Unity CEO John Riccitiello, he considers the metaverse to be the next version of the internet, but it will not be just a handful of virtual worlds. Instead, Riccitiello believes there will be many metaverses, each catering to certain categories. They will be real-time, interactive and highly immersive.

If this vision winds up being reality in the coming years, this will bode well for Unity – and for investors seeking out the best metaverse stocks.

Meta Platforms

- Industry: Internet content & information

- Market value: $597.3 billion

- Analysts' consensus recommendation: 1.88 (Buy)

In October 2021, Mark Zuckerberg changed the name of Facebook to Meta Platforms (META, $233.81). The move signaled a major strategy shift for the social network, with the company's focus now on the metaverse.

It was a bold move, but it has been difficult. Wall Street is skeptical and this has weighed on Meta's stock price. It also did not help that tech stocks came under pressure as interest rates spiked.

Regardless, Zuckerberg remains confident in the prospects of the metaverse – at least for the long term. He certainly understands that the company needs to evolve to stay competitive. Afterall, the tech industry is littered with companies that have failed to do so, including Yahoo! and Myspace.

Meta certainly has significant advantages for its metaverse strategy. The company has various franchises like Facebook, Instagram and WhatsApp that have roughly 3 billion MAUs.

Then there is the VR hardware business, with an installed base of about 22 million headsets. Later this year, Meta plans to release the next generation of its systems. There are also plans for AR (augmented reality) glasses.

With the emergence of ChatGPT and GPT-4, Meta has been redirecting its resources to generative AI. Yet this is actually good news for the metaverse business. Generative AI will be critical for building interactive environments.

Zuckerberg's theme for this year is "efficiency." He initiated several rounds of layoffs and has been flattening the organization structure. This is also good news for one of Wall Street's best metaverse stocks. It means that the focus is more about commercializing the metaverse technology – not experimentation with it.

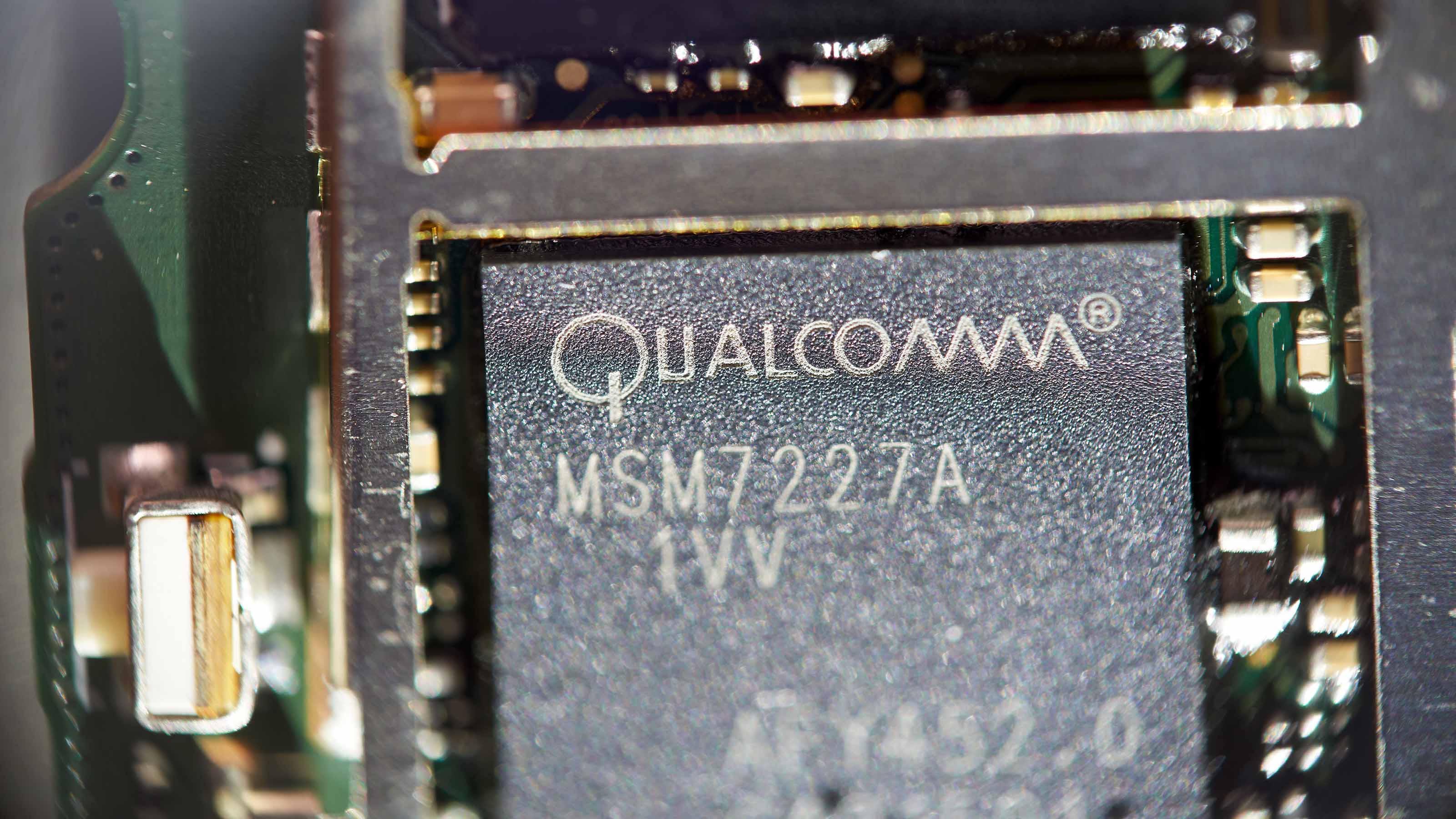

Qualcomm

- Industry: Semiconductors

- Market value: $118.6 billion

- Analysts' consensus recommendation: 1.87 (Buy)

Since 2015, Qualcomm (QCOM, $103.62) and Meta have partnered on creating virtual reality chips and systems, but this important relationship got a boost last year. The two firms entered into a multi-year strategic agreement to develop metaverse experiences with Qualcomm's Snapdragon XR platform and Meta's Quest system.

This deal is likely to lead to highly immersive VR headsets. "Qualcomm, as a leader behind developing 5G capabilities, stands to dominate a huge market share as a provider of chips for 5G based AR/VR capabilities for Metaverse devices," Elyashiv said.

QCOM has the advantage of a massive set of intellectual property assets. The company has thousands of patents for critical technologies for 5G, RF systems, Wi-Fi networks and AI. These will help with the needs of the metaverse for low latency, as well as work across devices, the cloud and the edge.

According to a blog from Qualcomm: "We view the metaverse as a persistent spatial internet with personalized digital experiences that span the physical, digital, and virtual worlds."

Qualcomm has also set up a $100 million fund for the metaverse. The focus will be on cutting-edge startups that are developing foundational technologies in the market.

Apple

- Industry: Consumer electronics

- Market value: $2.73 trillion

- Analysts' consensus recommendation: 1.78 (Buy)

In an interview in late 2022, Apple (AAPL, $172.57) CEO Tim Cook showed skepticism toward the metaverse. Part of this uncertainty was that the concept has not been well-defined.

But Cook is still interested in various technologies like VR and AR, all of which are essential to the metaverse. Consider that Apple is expected to announce a new headset at the upcoming WWDC event in June. Wedbush analysts estimate the price tag on those will about $2,500.

The details are sketchy, though that's no surprise. AAPL definitely has a long history of being secretive.

But Cook has still hinted at some of the capabilities Unlike a bulky VR headset, the new system will likely be much lighter. Yet it will still allow for deeply immersive experiences.

"And so it's the idea that there is this environment that may be even better than just the real world – to overlay the virtual world on top of it might be an even better world," Cook recently said in an interview with GQ. "And so this is exciting. If it could accelerate creativity, if it could just help you do things that you do all day long and you didn't really think about doing them in a different way."

All in all, an Apple VR/AR headset should make for a cool demo. It could also encourage inspiration for the development of new apps.

A key strategy for the blue chip stock is to bolster its services business. In the latest quarter, the unit posted record revenue of $20.9 billion and there were over 975 million paid subscriptions. A new breakout device could help propel Apple's services business.

Nvidia

- Industry: Semiconductors

- Market value: $714.4 billion

- Analysts' consensus recommendation: 1.67 (Buy)

The metaverse requires cutting-edge chip technology to allow for the immersive graphics and high performance. This is why Nvidia (NVDA, $283.40) is positioned nicely for this opportunity – and on this list of the best metaverse stocks.

"NVDA is an enabler of the metaverse, by that I mean they provide much of the plumbing that the metaverse is built on," said Matthew Stith, portfolio manager and director of equity research at Bartlett Wealth Management. Stith points to the fact that Nvidia is a market leader in the production and distribution of graphic processing units, and that an important end market for the company's graphic cards is gaming.

"Gaming is and will continue to be a big piece of the metaverse," Stith says. "In addition to gaming NVDA's products are sold to data centers which support the metaverse work-loads."

At the heart of the metaverse strategy is the Nvidia Omniverse system that allows for the creation and management of immersive experiences. For example, it can simulate physical behavior, whether for human activity or materials. There are also features for real-time path tracing and AI-powered search.

But the Nvidia Omniverse is not just for games. It is also for the development of sophisticated industrial applications.

Recently, the semiconductor stock announced an agreement with Microsoft to integrate the Nvidia Omniverse on the Azure Cloud. This will make it easier for enterprises to create digital twins for advanced simulations and leverage sensors for IoT (Internet-of-Things).

Global X Metaverse ETF

- Assets under management: $2.2 million

- Expenses: 0.50%, or $50 annually for every $10,000 invested

Staying abreast of the developments of the metaverse isn't always easy. This is why an exchange-traded fund can be a good option for investors in that it provides exposure to metaverse stocks, but also allows for diversification.

One option is the Global X Metaverse ETF (VR, $22.39). The portfolio extends across the many parts of the ecosystem, including with chipmakers, creator platforms, payments systems and infrastructure.

To be included in the fund's portfolio of about 40 stocks, a company must generate at least 50% of its revenues from metaverse business activities. Holdings can also include "pre-revenue metaverse leaders," or those that have primary business operations in the metaverse, but do not currently generate revenue from those activities.

Top holdings at present include several names on this list like Meta Platforms and Nvidia, as well as online gaming company NetEase (NTES) and Japan's Nintendo (NTDOY).

Roughly half of the portfolio are companies based in the U.S. However, there is also high exposure to metaverse stocks in Japan (21%), China (14%) and South Korea (9%).

Given that the metaverse is still in its early stages, it should be no surprise that VR is fairly new, having been launched in April 2022. The current expense ratio is 0.50%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Taulli has been developing software since the 1980s when he was in high school. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction. He can be reached on Twitter at @ttaulli.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.