25 Dividend Stocks the Analysts Love Most for 2021

Income investors looking for more than just a little yield: These are the top dividend stocks for 2021, according to the pros.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

One thing is clear when looking at the analysts' best dividend stocks right now: Wall Street expects big things from the beaten-down energy sector in 2021.

The pros are betting that the post-pandemic landscape will feature an increase in energy needs and perhaps a recovery in commodity prices, among other factors. And with the oil and gas industry expected to bounce back in the year ahead, the Street's most highly rated dividend stocks for 2021 include energy stocks of all stripes: oil and gas drillers, pipeline companies, oilfield services, and other sector names.

Although energy-sector names are over-represented on our list of analysts' favorite dividend payers, banks, pharmaceuticals and consumer staples also make appearances.

To find analysts' most beloved dividend stocks, we scoured the S&P 500 for dividend stocks with yields of at least 3%, excluding a number of extremely high yielders because of excessive risk. (Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble.)

From that pool, we focused on stocks with an average broker recommendation of Buy or better. S&P Global Market Intelligence surveys analysts' stock ratings and scores them on a five-point scale, where 1.0 equals Strong Buy and 5.0 means Strong Sell. Any score of 2.5 or lower means that analysts, on average, rate the stock a Buy. The closer the score gets to 1.0, the stronger the Buy call.

Lastly, we dug into research, fundamental factors and analysts' estimates on the top-scoring names.

That led us to these top 25 dividend stocks for 2021, by virtue of their high analyst ratings and bullish outlooks. Read on as we analyze what makes each one stand out.

Stock prices, dividend yields, analyst ratings and other data are as of Dec. 17, courtesy of S&P Global Market Intelligence, unless otherwise noted. Companies are listed by strength of analysts' average rating, from lowest to highest. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Truist Financial

- Market value: $63.5 billion

- Dividend yield: 3.8%

- Analysts' average rating: 2.00

Almost exactly one year ago, regional banks BB&T and SunTrust Banks merged in a $66 billion deal to form Truist Financial (TFC, $47.10), the nation's sixth-largest bank for both assets and deposits.

And to hear analysts tell it, the combined company is just getting started in terms of leveraging all the benefits of this corporate marriage.

"We look for the newly combined BB&T and SunTrust to benefit from their overlapping branch footprints and similar corporate cultures," says Argus Research, which rates shares at Buy. "We believe that the combination has created a company with a steady growth profile, strong revenue diversification, and an above-average dividend yield, and that the stock merits a premium valuation."

TFC shares have gained 20% over the past three months vs. an increase of 11% for the S&P 500, but they are still down 17% for the year-to-date. Analysts see value to be had. Of the 24 analysts covering TFC tracked by S&P Global Market Intelligence, 10 rate it at Strong Buy, four say Buy and 10 say Hold, putting it among the market's top-ranked dividend stocks heading into 2021.

Chevron

- Market value: $170.2 billion

- Dividend yield: 5.8%

- Analysts' average rating: 1.96

The lone energy play among the 30 Dow Jones stocks is taking advantage of the downturn in oil prices to scoop up attractive assets at more attractive valuations.

In early October, Chevron (CVX, $88.41) completed its acquisition of Noble Energy, which had a market value of more than $4 billion as a publicly traded company. UBS applauded the deal, calling it a "bolt-on at an extremely attractive price" that reinforces CVX's financials in a tough cycle for oil prices.

"We believe the strong balance sheet and additional measures brought in to bolster resiliency reinforce the quality of the dividend and Noble reinforces, not jeopardises, that status," says UBS. "CVX grew its 2020 dividend by more than 8% to $1.29 a share and it will have been the 33rd consecutive year CVX has raised. With low leverage, and financial resilience, we believe CVX is well placed to navigate through the down cycle."

UBS nonetheless rates the stock at Neutral (equivalent of Hold), but it's in the minority. Of the 26 analysts covering Chevron tracked by S&P Global Market Intelligence, 10 rate it at Strong Buy, seven say Buy and nine have it at Hold. A generous dividend yield of nearly 6% helps the bull case.

Fifth Third Bancorp

- Market value: $19.3 billion

- Dividend yield: 4.0%

- Analysts' average rating: 1.95

Fifth Third Bancorp (FITB, $27.13) gets mostly high marks from analysts, some of whom see the large regional bank as a pandemic recovery play bolstered by solid quarterly results.

"We see net interest income stabilizing in the fourth quarter on declining deposit costs as higher-cost CDs roll off, albeit muted loan growth remains a headwind," says CFRA, which rates the stock at Buy. Core fees rebounded on improving trends in service charges & card fees and brokerage with further momentum expected in Q4."

Baird Equity Research is likewise bullish on the nation's 15th largest bank by assets, which it added to its Best Ideas List late in Q3.

"FITB is one of best positioned banks to handle this unprecedented environment in several ways," says Baird, which rates the stock at Outperform (Buy). "FITB is well positioned from a credit perspective. Loan deferrals (a great leading indicator for credit quality) are declining. And it announced a new expense initiative to combat a tougher revenue environment. Most of the expense savings are expected to fall to the bottom line."

This generous dividend stock, yielding 4% at present, is forecast to generate average annual earnings growth of 8.2% over the next three to five years, according to S&P Global Market Intelligence. As for the Street's take, FITB has nine Strong Buy recommendations, five Buy recommendations and eight Holds.

Citizens Financial

- Market value: $14.9 billion

- Dividend yield: 4.4%

- Analysts' average rating: 1.95

Citizens Financial (CFG, $34.78), another regional lender, gets a thumbs-up from most of the analysts on the Street.

Of the analysts covering Citizens, nine call it a Strong Buy, six have it at Buy, five say it's a Hold and one rates it at Strong Sell. Helping the bull case is that CFG remains upbeat when it comes to the trajectory of the economic recovery and what that means for business.

"On the commercial side, management noted that customers are starting to think about potential opportunities to take advantage of lower rates," says Piper Sandler, which rates the stock at Overweight (Buy). "On the consumer side, mortgage continues to have legs, student lending remains robust, and merchant finance has strong potential."

The market looks to be aware of the fact that better times lie just over the horizon. Shares in CFG are up about 30% over the past month.

As for equity income, Citizens is one of the more generous dividend stocks on this list. The bank has raised its quarterly payout every year over the past half-decade, most recently to 39 cents a share. That represents an improvement of 290% over the 10 cents a share it paid in 2016.

Sempra Energy

- Market value: $38.0 billion

- Dividend yield: 3.2%

- Analysts' average rating: 1.94

Sempra Energy (SRE, $131.74) is a diversified utility stock that should benefit from current industry trends. The electric and natural gas infrastructure company is expected to get a big boost from its utilities business as we progress through the COVID-19 crisis.

"We expect higher residential electricity usage from increased working and learning at home to boost kilowatt-hour sales at Sempra," says Argus Research, which rates the stock at Buy. "We also expect Sempra to benefit from rising commercial and industrial kWh demand as businesses reopen in its Southern California service territory."

Sempra also has been good to investors looking for income. Over the past five years, SRE has raised its dividend at a compound annual rate of 8.3%. The company has paid out $4.1025 per share across 2020; Argus Research estimates the company will pay out $4.38 in 2021.

Lastly, Sempra has a pretty attractive long-term growth rate for a utility. Analysts on average forecast earnings growth of 7.5% annually for the next three to five years, according to S&P Global Market Intelligence. They're also solidly bullish: SRE boasts eight Strong Buys and three Buys versus seven Holds.

Realty Income

- Market value: $21.4 billion

- Dividend yield: 4.6%

- Analysts' average rating: 1.89

The Street is betting that commercial real estate investment trusts (REITs) can rebound hard once the vaccine takes effect and life returns to normal. Realty Income (O, $61.03), with its wide exposure to retail space, should be as spring-loaded as any.

The company owns more than 6,500 commercial real estate properties that are leased out to more than 630 tenants – including Walgreens, 7-Eleven, FedEx (FDX) and Dollar General (DG) – operating in 51 industries.

That assortment of assets took a hit at the depths of the pandemic, but UBS, which calls the stock a Buy, notes that the company's rent collections improved in each subsequent month during the third quarter. July collections came to 91.8%, August was 93.3% and September hit 94.1%. The collection rate for the entire quarter was 93.1%, up from 86.5% in Q2.

O is of a slightly different breed from your typical dividend payer. It's one of the few monthly dividend stocks on the market, and it prides itself so much on said fact that it has trademarked its nickname, "The Monthly Dividend Company." And it's as steady as they come. Realty Income was added earlier this year to the exclusive S&P Dividend Aristocrats list of stocks that have raised their dividends every year for at least 25 years.

Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. Indeed, O shares have delivered 605 consecutive monthly dividends to date, including 93 consecutive quarterly increases. The current 23.45-cent distribution is 3.1% larger than it was a year ago.

Digital Realty Trust

- Market value: $37.5 billion

- Dividend yield: 3.5%

- Analysts' average rating: 1.84

Digital Realty Trust (DLR, $133.93) operates in a market in which demand is all-but guaranteed. The REIT comprises the data centers and related assets that support cloud and information technology services, communications and social networking, and a swath of businesses from financial services to healthcare.

The ongoing explosion in information should and a global economic rebound should goose DLR's bottom line, and by extension, share price.

Mizuho Securities in early December initiated coverage of data center REITs, slapping a Buy call on DLR and telling investors the stock is "Still in a Sweet Spot, Buy the Dip!!"

"Fundamentals should remain strong in 2021 with 1.) worldwide IT spend set to rebound; 2.) cloud and enterprise demand remaining strong; 3.) new technology such as IoT, 5G and AI contributing to demand; and 4.) strong demand/supply trends in most of the major US markets, Europe & Asia," Mizuho says. "We believe the recent sell-off on news of successful COVID-19 vaccines is overdone and investors should buy the dip."

Mizuho adds that although there might have been some pull-forward of demand during the pandemic, "rising demand is a secular, not cyclical, trend."

The broader community of analysts tends to agree. Of the 25 analysts who cover DLR tracked by S&P Global Market Intelligence, 11 call it a Strong Buy, five have it at Buy and nine say it's a Hold. They're also projecting average annual profit growth of 6% over the next three to five years.

Edison International

- Market value: $23.8 billion

- Dividend yield: 4.2%

- Analysts' average rating: 1.82

Edison International (EIX, $62.90), which generates electricity for 5 million customers in California, is another utility that analysts like for defense and generous dividends.

The first glaring risk that comes to investors' minds with this name is the impact of California's seemingly relentless wildfires and other natural disasters. But analysts say fire season is coming to an end, and policy support ensures that the risk is adequately reflected in the company's stock price.

"The end of fire season is in the fourth quarter," says UBS. There were no negative data points with regard to the current Silverado and Blue Ridge fires. Although wildfire season is unpredictable, the state fund and liability reform has helped."

Eight of the 15 analysts covering the stock tracked by S&P Global Market Intelligence call EIX a Strong Buy, while two more say Buy. Six have it at Hold.

Collectively, the pros expect EIX to deliver average annual earnings growth of 5% over the next three to five years. That's good news for the dividend, which continues to swell. Edison International recently announced a 3.9% dividend hike to 66.25 cents per share, representing 38% dividend growth over the past five years.

Meanwhile, the pros also estimate about 11% upside over the next 12 months, based on their 12-month price target of $69.75.

Entergy

- Market value: $20.1 billion

- Dividend yield: 3.9%

- Analysts' average rating: 1.78

Entergy (ETR, $100.56) is yet another electricity utility that the Street likes for income and defense. Of the analysts covering the stock, nine say it's a Strong Buy, four say Buy and five have it at Hold.

Argus Research analysts are in the Buy camp, noting that Entergy has been reducing its exposure to wholesale markets in an effort to stabilize earnings.

"Over the long term, we like the company's strategy of investing in regulated utilities to replace aging infrastructure and improve reliability," says Argus. "Additionally, we like utilities relative to other sectors in the current environment, as low interest rates make utility dividends more attractive."

Argus pegs estimates 2021 earnings per share will hit $5.97. That's a penny higher than the Street's consensus view. A survey of all 18 analysts covering Entergy expect the firm to generate average annual earnings growth of 5.7%. That should help ETR continue to bolster its dividend, which it recently hiked by 2.2% to 95 cents per share.

Entergy should also benefit from its investments in environmental, social and governance (ESG) initiatives. The company plans to retire 100% of its coal plants over the next 10 years.

"We also note that the company's pipeline of planned renewable projects is growing," Argus says.

AbbVie

- Market value: $185.2 billion

- Dividend yield: 5.0%

- Analysts' average rating: 1.77

AbbVie (ABBV, $104.89), the first healthcare stock on our list, should be very familiar to long-term dividend investors. That's because the pharmaceutical company is a Dividend Aristocrat, by virtue of having raised its dividend for 48 consecutive years. Even better, Argus Research, which rates the stock at Buy, notes that ABBV has hiked its dividend at a 20% rate over the past five years, including a 10.3% hike announced in October.

The strong track record of dividend growth probably factored into Warren Buffett's thinking in Q3. Berkshire Hathaway initiated a position in ABBV, buying 21.3 million shares in the biopharmaceutical firm.

AbbVie is best known for blockbuster drugs such as Humira and Imbruvica, but analysts are also optimistic about the potential for Rinvoq and Skyrizi, which treat rheumatoid arthritis and plaque psoriasis.

UBS says the market isn't giving the revenue potential of those two latter drugs enough credit. "Rinvoq/Skyrizi is under-appreciated: if ABBV is able to recreate its success in current indications to future indications, then Rin+Sky alone will replace Humira completely," says UBS, which rates the stock at Buy. Humira is a $20 billion-a-year business, analysts note.

Of the 19 analysts covering the stock tracked by S&P Global Market Intelligence, 11 call AbbVie a Strong Buy, five say Buy and six rate it at Hold.

Baker Hughes

- Market value: $22.3 billion

- Dividend yield: 3.4%

- Analysts' average rating: 1.75

Oil-field services companies have been slammed by low prices for crude oil, but now traders and investors are positioning themselves to benefit from upside as the sector bounces back.

When it comes to that trade, driller Baker Hughes (BKR, $21.50) is among analysts' favorite names.

"Based on the progress the company has made realizing cost savings since the 2017 merger with GE Oil & Gas, combined with improving market conditions across several of its product lines and robust LNG orders, we expect BKR to generate earnings and cash flow growth over the next several years," says Stifel, which rates the stock at Buy.

With crude oil down roughly 33% year-to-date, Stifel advocates owning "high-quality names with differentiated products and services" with compelling risk vs. reward.

Stifel isn't alone in laying out the bull case. Twelve analysts call BKR a Strong Buy, 11 say Buy and five have it at Hold. Collectively, they expect the company to deliver 18% average annual earnings growth over the next three to five years.

Coca-Cola

- Market value: $228.9 billion

- Dividend yield: 3.1%

- Analysts' average rating: 1.73

Equity income investors have always looked to Coca-Cola (KO, $53.27) as a fount of dividends. The Dow stock has increased its payout every year for 58 consecutive years. And with interest rates plumbing the depths, analysts say the fizzy drinks maker looks like a good bet for income and stability in a rocky market.

In the near term, KO stock will be attuned to recovery from the pandemic, which could spring-load it for growth, analysts say.

"Admittedly, challenges and uncertainty do remain in certain markets, noting signs of lockdowns and reduced mobility in select parts of Europe and traffic-driven stagnation in food service and on-premise consumption in North America," says Deutsche Bank (Buy). "However, elsewhere, countries and regions appear to be more fully recovering, evidenced by volume growth in China, sequential improvement in India and Japan following severe lockdowns in 2Q."

Deutsche Bank adds that Brazil's strong volume performance is a beacon of strength in Latin America.

The 22 analysts covering KO are mostly bulls – 11 rate it at Strong Buy, with another six saying Buy. The remaining five pros say Coca-Cola is merely a Hold.

Analysts expect earnings excluding special items to rise 11.6% in 2021 to $2.11 per share. Revenue is forecast to increase 10.9% to $36.6 billion.

DTE Energy

- Market value: $23.9 billion

- Dividend yield: 3.5%

- Analysts' average rating: 1.72

Shares have lagged the broader market all year, but analysts are bullish on DTE Energy (DTE, $123.55). The electric utility serving 2.2 million customers in southeastern Michigan has 10 Strong Buy recommendations, three Buys and five Holds, according to S&P Global Market Intelligence.

The optimism is fueled in part by the company's announced plans to spin off its midstream operations.

"The move will turn the company into a pure-play regulated utility, reducing earnings volatility," says Argus Research, which has a Buy recommendation on the stock. "In the past, the company has done a good job of controlling costs in its regulated utilities segment. Additionally, the Detroit-based energy company stands to benefit from strong demand from the automobile industry. Automotive customers account for more than 50% of DTE's sales in the industrial line of business."

In another boost to the bull case, DTE's board has approved a 7% dividend increase for 2021.

The Street's average target price of $137.47 gives DTE Energy implied upside of more than 11% in the next 12 months or so. Analysts project the firm to generate average annual earnings growth of 5.8% a year over the next three to five years.

Citigroup

- Market value: $125.0 billion

- Dividend yield: 3.4%

- Analysts' average rating: 1.72

Citigroup's (C, $60.05) diversification and global footprint should give it an advantage, even in a tepid economic recovery next year, analysts say.

Indeed, C is far more diversified than other large U.S. banks, says CFRA, with a strong banking franchise in southeast Asia and Latin America.

"We believe that C can improve profitability with better execution," CFRA's analysts say. "We also think the COVID-19 impact is likely to lead to a slow road to recovery. However, the bank has a leading global institution network servicing corporate treasuries and other institutions that will recover, after pandemic risks diminish."

Piper Sandler, with a rating of Overweight, pulled a number of positives from the money center bank's third-quarter report. Among the bullish points: better-than-expected asset quality metrics; lower-than-expected loan loss reserve build; and capital markets-related revenue strength, especially in fixed income markets.

The nation's fourth-largest bank by assets is also one of the pros' 25 best dividend stocks for 2021. Of 25 analysts covering the stock tracked by S&P Global Market Intelligence, 12 call it a Strong Buy, eight have it at Buy and five say Hold.

Those analysts expect revenue to decline in 2021, but earnings are forecast to rise 43% to $5.95 a share, according to a survey by S&P Global Market Intelligence.

Marathon Petroleum

- Market value: $26.4 billion

- Dividend yield: 5.6%

- Analysts' average rating: 1.71

Marathon Petroleum (MPC, $40.58), which refines, markets, transports and retails petroleum products in the U.S., has seen its shares lose about a third of their value so far this year. But the market seems to be coming around as we head to the end of 2020; shares are up 35% in just the past month.

Most analysts believe there's still value to be found in the stock. Eight analysts covering MPC tracked by S&P Global Market Intelligence rate the stock at Strong Buy, while six have it at Buy. Three call it a Hold and one says Sell.

As for the sell call, CFRA is concerned that margins remain under pressure due to pandemic-affected utilization, and that this will persist into much of 2021.

On the upside, CFRA notes that the sale of the Speedway business – a collection of gas and convenience stores – will strengthen the balance sheet. "MPC may use some of the planned $21 billion in Speedway proceeds to retire shares outstanding, which would reduce MPC's dividend burden."

Analysts' average target price of $45.81 gives MPC implied upside of 13% in the next 12 months or so. Combine that with a generous payout, and Marathon could be among the more fruitful dividend stocks of 2021.

Merck

- Market value: $201.9 billion

- Dividend yield: 3.3%

- Analysts' average rating: 1.68

Merck (MRK, $79.82), a Dow healthcare stock, has seen shares languish in 2020. And that has made the stock too cheap for most analysts to ignore.

Analysts forecast Merck to generate average annual earnings growth of almost 8% over the next three to five years, and yet the stock changes hands at only 12.1 times expected 2022 earnings.

Central to Merck's fundamental performance is Keytruda, a blockbuster cancer drug approved for more than 20 indications. That said, analysts are quick to point out that Merck is not a one-trick pony.

"The company continues to see strong sales of Keytruda, Lenvima and Lynparza," says Argus Research, which rates shares at Buy. "Expanded indications for these oncology therapies are driving sales growth. Merck is also adding to its pipeline through innovative acquisitions, such as its transaction with VeloBio."

Importantly, Merck is seeing sequentially stronger end-market demand for its products as physician offices reopen, elective surgeries resume and pet owners return to veterinary offices, adds Argus.

As for the dividend: The payout had been growing by a penny per share for years, but now it's starting to heat up. The Dow stock upgraded its payouts by 14.6% in 2019, then followed that up with a nearly 11% improvement for 2020.

Hasbro

- Market value: $12.8 billion

- Dividend yield: 3.0%

- Analysts' average rating: 1.67

Shares in Hasbro (HAS, $93.21) have been big-time market laggards in 2020, but the toy maker's stock is accelerating as we head into the end of the year. HAS stock is up about 16% over the past three months to bring its year-to-date declines to 11%.

Some of the upside is likely seasonal, boosted by the holiday selling season. But there are ample reasons to like this name for 2021 and beyond.

"Driven by strong global brands, including Nerf, Power Rangers and Transformers, Hasbro remains a leader in the $30 billion toy industry," notes Argus Research, which calls the stock a Buy. "Hasbro's digital products, licensing agreements and ability to create content differentiate it from other toy companies."

Argus Research adds that it expects last year's $3.8 billion acquisition of Canadian indie studio Entertainment One to bolster Hasbro's leadership in digital. Known as eOne, the studio's family brands include Peppa Pig, PJ Masks and Transformers.

The buy case is popular on the Street; 11 analysts rate shares at Strong Buy and two say Buy. The remaining five analysts surveyed by S&P Global Market Intelligence say Hold. They forecast average earnings growth of 10% annually over the next three to five years.

NiSource

- Market value: $8.7 billion

- Dividend yield: 3.7%

- Analysts' average rating: 1.67

NiSource (NI, $22.81), a natural gas and electricity utility, finds itself among analysts' favorite dividend stocks for 2021.

NiSource, the third-largest U.S. gas distribution utility and the nation's fourth-largest gas pipeline company, provides electric utility services in Northern Indiana. Although the company has pledged to retire all of its coal-fired electric generation plants by 2028, that may not be fast enough to satisfy the incoming Biden Administration, analysts note.

NiSource's low capacity for renewables and high capacity for coal leaves it vulnerable to policy changes, analysts say. "NI could potentially see a requirement to retire its coal faster-than-expected, ultimately limiting the cash flow it currently expects to extract from those plants," says CFRA, although it thinks the worst is behind the stock. "We have a hold on the shares as we note some of the downside has likely been priced in already."

CFRA holds a minority view, however, as much of the Street thinks NI stock's 18% decline this year makes the price compelling.

Regardless, the majority of the Street is bullish on the name. Seven analysts rate NI shares at Strong Buy, six say Buy and two call them a Hold. Those same pros are looking for average annual profit growth of 5.5% over the next three to five years.

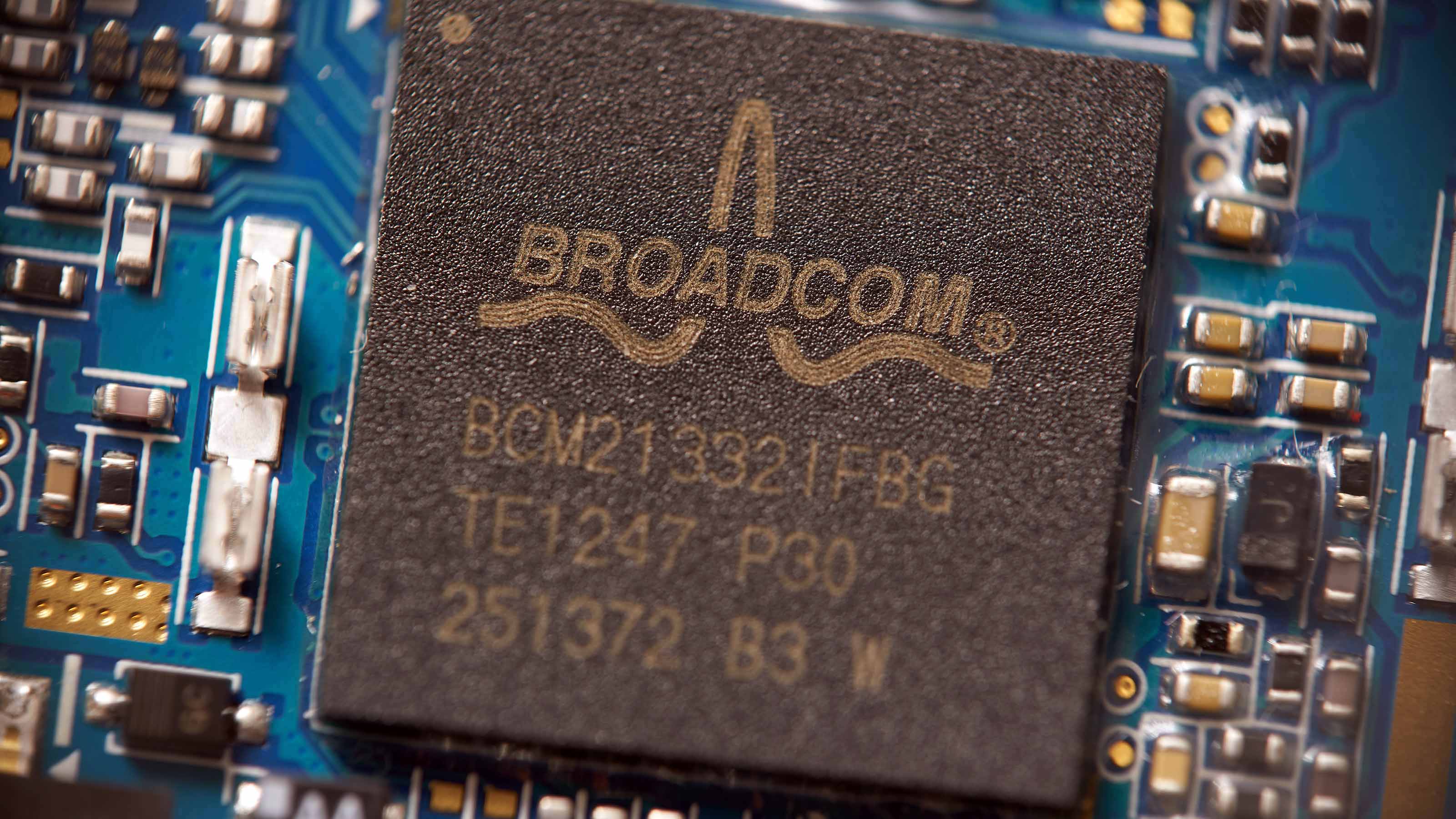

Broadcom

- Market value: $172.4 billion

- Dividend yield: 3.4%

- Analysts' average rating: 1.64

Investors looking for growth shouldn't ignore Broadcom (AVGO, $426.10) these days. It's among the best semiconductor stocks on offer right now, and analysts expect the chipmaker to generate average annual earnings growth of 10.9% over the next three to five years.

But Broadcom is more than growth: It also sports a healthy dividend yield of more than 3%. That combination of price appreciation and income has made a lot of fans on the Street. Indeed, 19 analysts rate shares at Strong Buy and eight say Buy, five have it at Hold and a single analyst calls it a Sell.

Part of the optimism on AVGO stems from its position as a supplier for Apple (AAPL) and its wildly popular iPhone. Demand for Broadcom's chips should get a tailwind as the iPhone and other smartphones are upgraded to run to 5G networks.

Also boosting the bull case is the fact that AVGO isn't a one-trick pony. It also supplies software and devices used in applications such as center networking, home connectivity, set-top boxes and more.

That diversity should serve the company well, analysts say.

"Broadcom's order visibility is strong," say Baird analysts, who rate the stock at Outperform. "Management expects to grow free cash flow at least 10% in 2021 organically. We believe valuation remains inexpensive when looking at the software portion of the business, with the potential for multiple expansion as investors gain confidence in management's software execution."

Valero Energy

- Market value: $23.0 billion

- Dividend yield: 6.9%

- Analysts' average rating: 1.62

Companies like Valero Energy (VLO, $56.34), which manufactures gasoline, diesel, ethanol and petrochemical products, are looking at net losses amid low oil prices and a sluggish global economy. But those that are best able to survive now and thrive later are the Street's favorites.

"We believe that a company's balance sheet strength and place on the cost curve are critical, and favor those refining and marketing companies that are well positioned to manage a potentially long period of low oil prices," says Argus Research, which rates Valero at Buy. "We believe that VLO is one of these companies as it benefits from its size, scale, and diversified business portfolio, which includes refining, midstream, chemicals, and marketing and specialty operations."

This year won't be pretty; Wall Street is modeling an adjusted net loss of $3.40 per share this year. The good news is VLO is forecast to swing back to profitability with adjusted earnings per share of 35 cents in 2021. Next year's revenues are expected to rebound by 22% to $75.5 billion, too.

For all its problems, VLO is popular among the pros. Ten of the 21 analysts covering Valero call it a Strong Buy, and 10 say Buy. The remaining analyst says Sell. As a group, they expect modest average annual profit growth of 5.5% over the next three to five years.

The Williams Companies

- Market value: $26.5 billion

- Dividend yield: 7.4%

- Analysts' average rating: 1.60

The Williams Companies (WMB, $21.80), which operates interstate gas pipelines, is another energy infrastructure stock that analysts expect to rally as the energy market slowly recovers.

"With a diversified gathering footprint and the largest U.S. long-haul natural gas pipeline in Transco, Williams' footprint should remain insulated from commodity price swings with over 95% fee-based margins," says Stifel, which calls the stock a Buy. "We view the company's financial profile conservatively, with top-tier distribution coverage and an investment-grade rated balance sheet. Despite macro headwinds, Williams' cash flows should remain stable and remains a good yield vehicle for investors."

The great majority of analysts are solidly bullish on this dividend stock. Of the 25 analysts covering the stock tracked by S&P Global Market Intelligence, 15 rate it at Strong Buy, five say Buy and five have it at Hold.

Williams also offers a 1-2 punch, if analysts' price targets are … well, on target. They're spying $24.92 per share within the next year, which implies 14% upside. Add in the 7.4% yield, and the potential total return sits above 20%.

NRG Energy

- Market value: $8.2 billion

- Dividend yield: 3.6%

- Analysts' average rating: 1.56

Not all utility stocks were safe havens during the market crash. NRG Energy (NRG, $33.54) was among the laggards and remains down by 15% in 2020.

But NRG nonetheless is popular among the analyst crowd. The electric company gets six Strong Buy recommendations, one Buy and two Holds, according to S&P Global Market Intelligence. And they see about 28% upside over the next 12 months, which is epic by utility standards.

UBS, which rates shares at Buy, looks favorably on a deal struck in July whereby NRG will acquire Canadian utility Centrica's retail U.S. energy business for $3.6 billion. The analysts add that NRG is targeting annual dividend growth of 7% to 9%.

Wall Street expects next year's adjusted earnings to grow 19% in 2021. That's not a bad growth rate for a utility, a sector that is known for being poky. With shares trading at just 6.2 times 2022 earnings, NRG does indeed look like a bargain.

Phillips 66

- Market value: $29.3 billion

- Dividend yield: 5.4%

- Analysts' average rating: 1.55

Credit Suisse, which covers a large number of energy stocks, makes a buy case for Phillips 66 (PSX, $67.17) based, in part, on the market taking off as the pandemic recedes.

"At some point in the next 6-9 months, the 'Vaccine Trade' will likely kick in," says Credit Suisse. "We believe this will drive a big reversal in momentum (there will finally be light at the end of tunnel), and portfolio managers will likely get neutral or even long on the energy sector. We recommend sticking with Outperform-rated PSX, as it has a history of generating free cash flow and rewarding their shareholders to be patient by not cutting the dividend even in a tough macro."

Analysts expect the independent energy company to generate average annual earnings growth of 7.5% over the next three to five years, according to S&P Global Market Intelligence.

Earnings projections for the next three to five years are modest, at about 4.5% annual growth. Still, this is a strongly bullish camp – nine Strong Buys and 11 Buys – that expects more than 9% upside, as implied by their average $74.10 price target. At the same time, shares remain favorably valued, changing hands at less than 10 times 2022's expected earnings.

Diamondback Energy

- Market value: $7.5 billion

- Dividend yield: 3.2%

- Analysts' average rating: 1.52

Diamondback Energy (FANG, $47.38) currently sits in second place on this list of the analysts' favorite generous dividend stocks. Of the 33 pros covering FANG tracked by S&P Global Market Intelligence, 20 have it at Strong Buy and nine call it a Buy. Only four analysts rate it at Hold. Not a single one says to sell it.

Analysts point to the oil company's cost structure, asset mix and financial strength as reasons for their bullish views.

"We believe Diamondback Energy is well-positioned to outperform in the current lower-for-longer operating environment," says Stifel, which calls the stock a Buy. "In our view, the company's relatively low cost of supply, balance sheet, minerals, and midstream ownership are a few of the reasons it is well-positioned to weather the downturn."

The pros' long-term growth forecast is particularly bullish, with average annual earnings growth pegged at 13.5% over the next three to five years. At the same time, FANG trades at an inexpensive 9.7 times 2022 earnings.

In addition to a decent 3% yield, analysts have a price target of $55.27 that implies about 7% upside. All told, that's a projected 20% total return in 2021.

ConocoPhillips

- Market value: $44.8 billion

- Dividend yield: 4.1%

- Analysts' average rating: 1.48

If it isn't clear by now, the Street currently loves dividend stocks from the energy sector, and none is more popular than ConocoPhillips (COP, $41.97). Indeed, the oil and gas exploration and production company earns some of Street's highest praise.

ConocoPhillips' October announcement that it would acquire rival Concho Resources (CXO) for $9.7 billion in stock only added to their ardor.

"We think COP is getting a good price for control of CXO, and significantly boosting its Permian Basin acreage in the bargain," says CFRA, which rates COP at Buy. "The pending acquisition of Concho Resources is anticipated to close in Q1 '21. If the deal closes as planned, we see COP benefiting from applying CXO's best practices in Permian development, and from an expected $500 million in cost synergies."

CFRA adds that CXO has the advantage of a large acreage position in the Permian Basin and has more time than most peers before significant long-term debt milestone payments arrive.

Further cementing its spot among the pros' favorite dividend stocks for 2021 was a rare dividend hike in the energy sector – a penny-per-share improvement announced for the December payout.

Of the 23 analysts covering the stock tracked by S&P Global Market Intelligence, 14 say it's a Strong Buy, seven say Buy and two have it at Hold. They also see a solid year ahead for COP's shares. Their $48.09 average price target implies a respectable 15% upside in the next 12 months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.