Where to Invest in 2021

With the election in the rearview mirror, investors can turn their full attention to the economic recovery and progress on the pandemic.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

How can the outlook for anything in 2021 not be an improvement on 2020? Stocks are certainly poised for a strong performance as progress combating the pandemic, an economy on the mend and strong corporate profits pave the way for continued gains. Rotten year though it was, however, in the end, 2020 may be a tough act to follow for investors.

Since our last investing outlook, the S&P 500 index has gained 15%, or 17% including dividends. For 2021, we’re looking for returns more along the lines of high-single-digit to low-double-digit percentages. But if we’re wrong, it will likely be because we’re too conservative. (Prices, returns and other data are through November 6, when the S&P 500 closed at 3509.)

The new year will be transitional in many ways. When it comes to your portfolio, that means a mix of old and new leaders may work best. Large, U.S. growth-oriented stocks—which ironically do best when overall economic and profit growth is tepid—still have much to recommend them while the economic recovery is nascent and uneven. And many are in industries you’ll want exposure to for the long term. But in 2021, it will pay to bet on the recovery, with economically sensitive stocks, small- and midsize-company shares, and overseas holdings, particularly in emerging markets.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“My expectation is that 2021 will be a tale of two markets,” says Kristina Hooper, chief global market strategist at Invesco. The pivot from one to the other will depend on broad distribution of an effective vaccine, she says—an inflection point that investors grew decidedly more hopeful about following recent good news on a vaccine being developed by pharmaceutical giant Pfizer and biotech firm BioNTech.

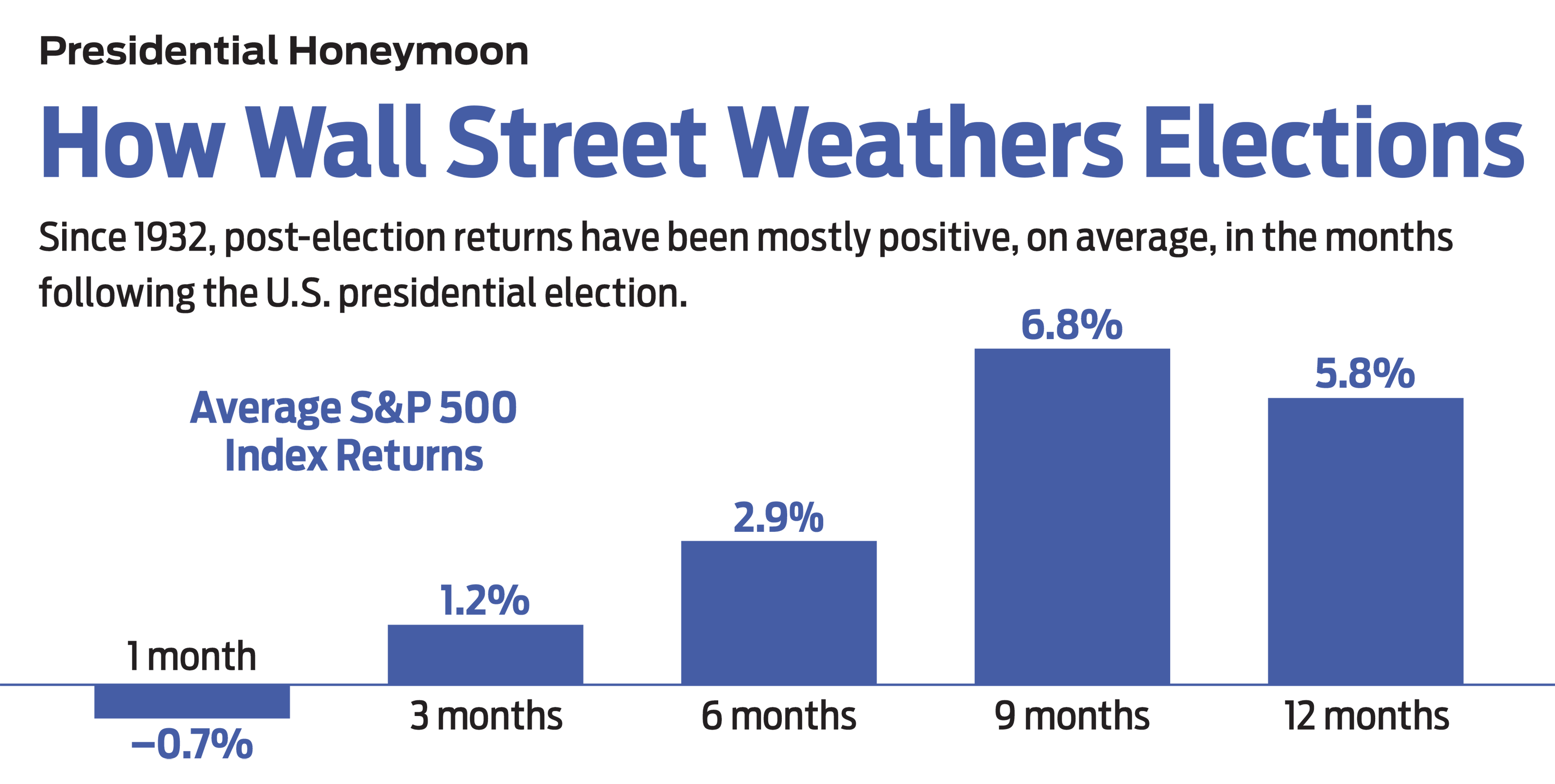

You’ll also want to tweak your portfolio to recognize the new political regime in the U.S., with Democrat Joseph Biden as president, a Democratic House of Representatives (albeit with a smaller majority) and a Senate whose majority was still up in the air at press time. The good news is that, going back to 1933, when Franklin Delano Roosevelt took office, the best-case scenario for stocks has been a divided government, according to investment research firm Yardeni Research. During the seven periods of divided government since then, Yardeni calculates that the S&P 500 rose 60%, on average. If both Senate runoff elections in Georgia go to the Democrats, stocks might not do quite as well: During six Blue Waves over the period, when Democrats held the White House and both chambers of Congress, the S&P 500 increased an average of 56%.

As citizens, we’ve been captivated by a U.S. election season like no other. As investors, it’s important to remember that market fundamentals, such as the trajectory of the economy and corporate earnings, matter far more than who lives in the White House, and those fundamentals are inextricably entwined with the course of COVID. Here are the themes we think will matter most in 2021.

An economy on the mend

Although an end to the recession is not yet official, growth is convincingly on the upswing. Unemployment is down to 6.9%, from a peak of 14.7% in April. Manufacturing has made an impressive comeback, with the ISM Manufacturing index at the highest level in two years, at last report. More fiscal support from Uncle Sam is on the way, including relief for individuals, businesses and state and local government. The only question is how much. Strategists at UBS Global Wealth Management expect a package of $500 billion to $1 trillion, or up to 5% of GDP. “Think of federal stimulus as life support,” says Brad McMillan, chief investment officer at Commonwealth Financial Network. “It’s kept the patient alive, got him up and walking—but the patient is going to keel over again without more.”

In the meantime, the Federal Reserve stands as a backstop for financial markets, having pledged near-zero rates through 2022. More fuel for growth—and for financial markets—could come from consumers, who account for 70% of the economy and currently are squirreling away some 14% of their disposable income. With more than $4 trillion sitting in money market funds, essentially earning nothing, “there’s a lot of ammunition on the sidelines,” says Stephanie Link, chief investment strategist at Hightower Advisors. (For more from Link, see our interview.)

For 2021, Kiplinger expects economic growth of 4.3%. Although growth is likely to moderate in subsequent years, the economy has a lot of room to run, says Matt Peron, director of research at Janus Henderson Funds. “Economic cycles typically last five to six years. We’ve just started a new cycle, and it could be quite a strong one.”

Bet on a worldwide economic revival with T. Rowe Price Global Industrials (symbol RPGIX), our favorite industrial sector fund. Or consider Materials Select Sector SPDR ETF (XLB, $68), which holds commodity-related manufacturers, including chemicals, paper and metals producers.

Higher corporate earnings

When the books close on 2020, profits for companies in the S&P 500 will be down 16% from 2019 levels, according to estimates from Wall Street analysts reported by earnings tracker Refinitiv. For 2021, analysts are forecasting growth of 23%, with Link and other strategists even more optimistic. Not including energy stocks, which are climbing out of a deep hole, the biggest gainers are expected to be in so-called cyclical sectors that do well when the economy does. Analysts are forecasting a 78% jump in profits for industrial companies, 61% for those providing nonessential consumer goods or services, and 29% for materials firms.

The risk as the year progresses is that such dazzling improvements will be tougher to come by. “For 2021, the bar has been raised significantly,” says Michael Arone, chief investment strategist at State Street Global Advisors. “We’ve paid in advance for those earnings. If we don’t get them, it could be a risk to market returns,” he says. High valuations leave little room for disappointment. Stocks are selling at 22 times expected earnings for the next 12 months, above the five-year average of 17.3 and the 10-year average of 15.5.

A COVID vaccine

The most resilient companies during the COVID-19 crisis have been richly rewarded. With news of an efficacious vaccine on the horizon, COVID losers deserve a second look. “The services sector and the banks are the biggest beneficiaries of a successful vaccine,” says global stock strategist Sean Darby, at investment firm Jefferies. Janus Henderson’s Peron likes high-quality consumer stocks, including some travel-related companies waiting for pent-up demand to become unleashed. “Millennials are itching to go,” he says. Biotech and medical device firms should gain as clinical trials for diseases besides COVID come to the fore and the pace of elective procedures picks up, he says.

Stocks to explore that fit these themes include Booking Holdings (BKNG, $1,784), which operates Booking.com and Kayak, providing online travel reservations and related services. Analysts at Deutsche Bank view the online travel sector as a “top performer” in 2021. Medical device maker Boston Scientific (BSX, $36) has been pressured by COVID concerns despite “the clearly excellent nature of the company’s track record, balance sheet and management team,” say analysts at investment firm Stifel, who rate the stock a “buy.” Among banks, we favor JPMorgan Chase (JPM, $103). (See more stocks to buy in 2021.)

Shares of some COVID-19 winners have been knocked back by positive vaccine news. But some trends that were induced or accelerated by the pandemic have legs for the longer term. Those include working remotely, cocooning at home and an increasing digitization of business overall. Communications firm Twilio (TWLO, $292), for example, is a “centerpiece of customer digital transformation plans, and should remain a long-term beneficiary of the new world order,” according to research from Canaccord Genuity Capital Markets. Research firm CFRA has cooled slightly on “staycation” beneficiary Pool Corp. (POOL, $382), but it still recommends the firm, which builds and services swimming pools.

A new president

If the legislative check-and-balance in Congress holds following the Senate runoff elections in Georgia, then the market could be in a sweet spot for 2021. That would point to a more modest fiscal support package than Democrats originally envisioned, less of a likelihood of spikes in tax rates, and a more traditional approach to trade policy—a combination that could produce a “Goldilocks” environment (not too hot and not too cold).

A key question is whether a Biden administration would be able to advance its “green” agenda. Many alternative-energy stocks pulled back as the “Blue Wave” appeared to ebb. But strategists at UBS Global Wealth Management remain bullish. They note that Biden has committed to rejoining the Paris Agreement on reducing greenhouse gas emissions; solar and wind sources are already the cheapest sources of power generation to build now; and state-level and corporate policies are supportive of green initiatives. Outside the U.S., the European Union is focused on a green recovery, says UBS, and China and Japan have set carbon-neutral targets.

Investors must be choosy about volatile climate stocks, however. Argus Research recommends First Solar (FSLR, $88) on the strength of its balance sheet and future growth prospects. The stock recently traded at 22 times Argus’s estimated earnings for 2021, below the midpoint of the historical range of 16 to 36. Invesco WilderHill Clean Energy (PBW, $73) is a member of the Kiplinger ETF 20, the list of our favorite exchange-traded funds. It invests in firms working with a variety of renewable energy sources and clean-energy technologies. Or take a look at Etho Climate Leadership US ETF (ETHO, $48), a fund just about to reach $100 million in assets (a good sign).

Less-dominant tech

Most investors are aware that a handful of tech behemoths have been leading the market for years. “We think there are a lot of good businesses there—they’re great, we own them,” says Peron. “But as people are convinced that we’re out of the woods of coronavirus and are recovering, the market will broaden out,” he says. State Street Advisors’ Arone agrees, especially considering the increased antitrust scrutiny on so-called FAANG stocks—Facebook, Amazon.com, Apple, Netflix and Alphabet’s Google, which is already facing a federal lawsuit. “We’re encouraging clients to shift to lower-cap companies,” he says. The portfolio of Invesco S&P SmallCap Information Technology ETF (PSCT, $99) has an average market value of just $1.7 billion and has held up relatively well during the recent pummeling of larger tech fare.

Arone likes companies on the cutting edge of growth areas, including artificial intelligence, robotics, the Internet of Things and machine learning, among others. One place to find them is in an ETF introduced by State Street in 2018: SPDR S&P Kensho New Economies Composite (KOMP, $48). We like Kip ETF 20 member ARK Innovation (ARKK, $102), which holds leaders in genomics, automation, next-gen internet and financial technology.

A boost for international markets

A more predictable trade policy under a Biden administration is a boost for emerging markets—especially Asian markets, dominated by China. And just as a more bellicose stance on trade under the previous president tended to push the dollar higher, the Biden approach could lead to pressure on the greenback, say experts, as will low U.S. interest rates and rising budget deficits. That’s good news for foreign markets in general, and emerging markets in particular. Stronger local currencies tend to benefit commodity-exporting countries, those that rely heavily on foreign investment, and countries that hold significant amounts of debt denominated in U.S. dollars.

Asian markets also stand out for the success they have shown in controlling the virus and restarting their economies, says Mike Pyle, chief investment strategist for investment giant BlackRock. “There are likely to be two significant growth engines over the next decade—the U.S. and East Asia,” he says. “Most investors’ portfolios are underexposed to East Asia.”

To remedy that situation, consider iShares Asia 50 (AIA, $80), an ETF with exposure to China (41% of assets), South Korea (23%), Taiwan (19%) and Hong Kong (14%). Terri Spath, chief investment officer at Sierra Investment Management, would zero in on South Korea—the “gold standard” for controlling economic, political and health care risks. An ETF she recommends is iShares MSCI South Korea (EWY, $70). For a broader take on emerging markets, consider Baron Emerging Markets (BEXFX), a member of the Kiplinger 25, the list of our favorite no-load mutual funds.

Weaker-dollar beneficiaries also include U.S. multinationals that derive a good chunk of sales overseas—which translate into more profits here when that money is repatriated. Cosmetics firm Estée Lauder (EL, $239) generates more than two-thirds of revenues overseas. Mainland China is a bright spot, with the company’s most recent quarterly report showing that net sales there are up by double digits from the same period a year earlier. E-commerce continues to be a global growth driver for the company, according to Stifel, which rates the stock a “buy.”

A new fixed-income strategy

Fixed-income investing will creep further outside the box in 2021. It’s possible that long-term interest rates could start to inch higher in 2021, nudging the yield on 10-year Treasuries up from just 0.08% recently—but the overall lower-for-longer vibe is intact. “Most investors will need to move beyond traditional fixed-income assets,” says Invesco’s Hooper. A more diversified portfolio might hold dividend-paying stocks, real estate investment trusts, convertible bonds and emerging-markets debt, she says.

You’ll find both consistent payers and high-yielders among the Kiplinger Dividend 15, our favorite dividend-paying stocks. Members include Air Products & Chemicals (APD, $307), with 38 years of consecutive hikes, yielding 1.7%; and Verizon Communications (VZ, $59), recently yielding a plump 4.3%. Fidelity Convertible Securities (FCVSX) is a low-cost convertible-bond fund.

BlackRock’s Pyle has a “strong preference” for high-yield debt. “The market is pricing in more defaults than we’re likely to see,” he says. Kip 25 stalwart Vanguard High-Yield Corporate (VWEHX) is a low-fee fund with a cautious approach.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.