Find Higher Yields for Your Cash

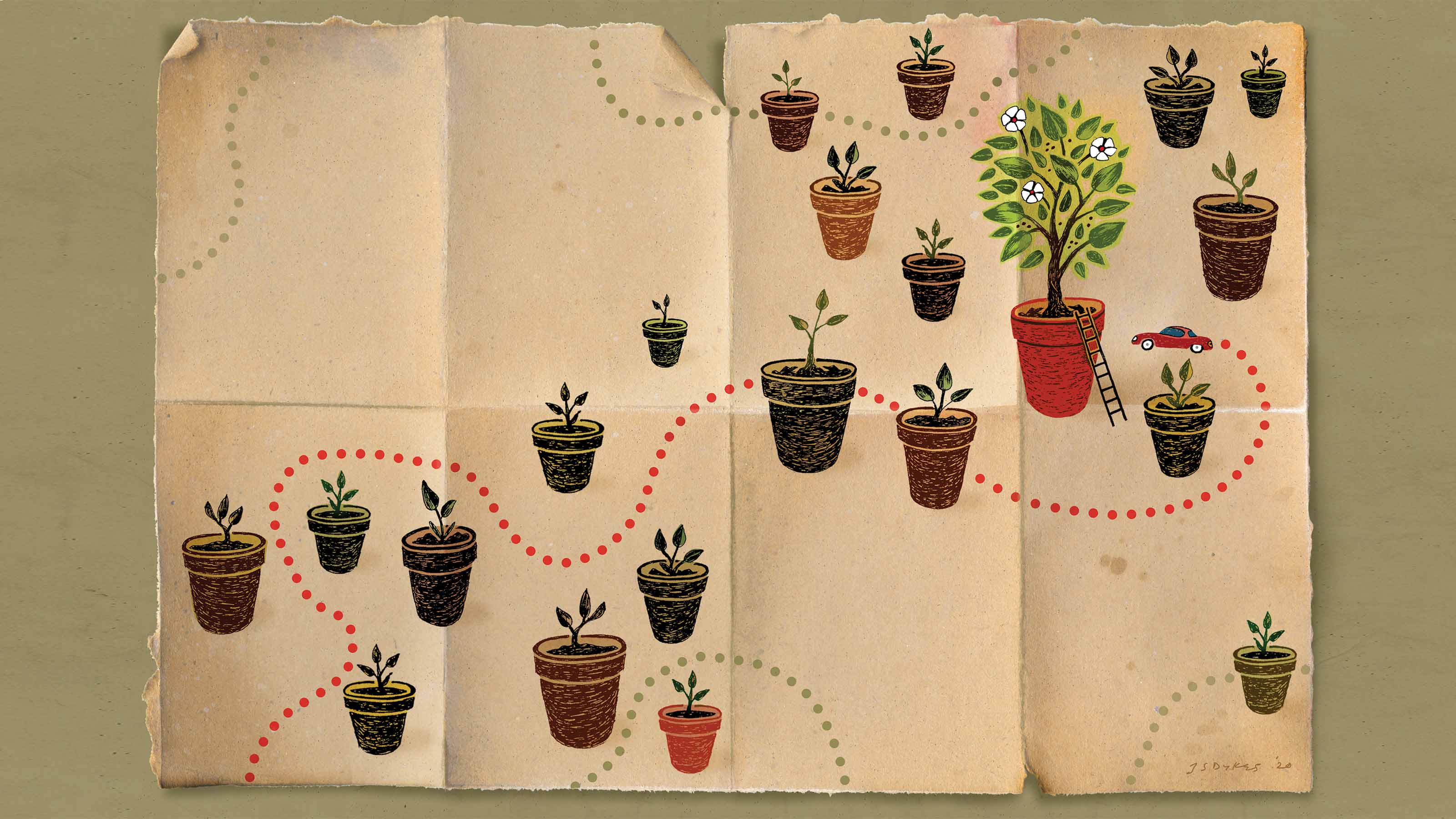

Interest rates are scraping bottom, but here’s a road map to accounts that will help your money grow.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There’s no way to sugarcoat it: Yields on savings accounts, certificates of deposit and other safe places to park your cash are disappointingly low, and interest rates will remain in the dumps for a while. In response to the coronavirus crisis, last spring the Federal Reserve slashed short-term rates back to the near-zero levels at which they had hovered from late 2008 through most of 2015. “It’s pretty much ‘back to the future.’ We’re revisiting the territory that became all too familiar after the Great Recession,” says Greg McBride, chief financial analyst for Bankrate.com. Kiplinger expects rates to remain near zero through 2024.

Even keeping pace with inflation on your cash holdings is a tough prospect. Annual inflation recently ran at 1.4%, and nearly all the top-yielding savings accounts and money market deposit accounts offer less than 1%. The Fed has stated that with inflation running persistently lower than its long-term goal of 2%, it will aim to achieve inflation “moderately above 2% for some time.” That means that at least for a while, the Fed doesn’t expect to raise interest rates even if inflation starts to accelerate.

Savers who struggled to scrounge up a respectable yield during the last low-rate period may notice that the pickings are even slimmer this time around. Ken Tumin, founder of DepositAccounts.com, notes that rates for several savings accounts and certificates of deposit from online banks and credit unions have fallen to lower levels in the past several months than they did when account rates last bottomed out, around 2012 and 2013. Many banks saw a surge in deposits in 2020 as consumers stepped up their savings rate, reducing the banks’ desire to lure savers with competitive interest rates, says Tumin.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Despite the dim outlook, seeking accounts with above-average rates is worthwhile. If you put $50,000 in a savings account yielding 0.75% (compounded monthly) and maintain that rate for a year, you’ll pocket $376 in interest earnings. If you instead use an account yielding 0.09%—the recent national average, according to Bankrate—you’ll have only $45 in interest after a year.

Here, we’ve highlighted several ways to earn a relatively strong yield without sacrificing safety. All the deposit accounts come with protection against bank failure, with up to $250,000 insured per depositor at each bank or credit union. (To calculate whether your balances are covered, use the tools at edie.fdic.gov and mycreditunion.gov) And savings bonds are backed by the full faith and credit of the U.S. government.

The accounts listed here are available to customers nationwide. Rates are as of November 6 and are subject to change, so be sure to confirm the current rate before you open an account. To see current top rates at institutions both near you and nationwide, visit DepositAccounts.com, where you can choose the type of account you’d like to open, then enter your deposit amount and zip code.

Checking Accounts

If you’re looking for a no-fuss checking account, you’ll likely have to settle for a rate well under 1%. One exception: The no-fee, online T-Mobile Money checking account offers a 1% interest rate even to those who are not customers of the company’s wireless services. T-Mobile and Sprint wireless customers who deposit at least $200 monthly into the account get an impressive 4% rate on balances of up to $3,000 and 1% on the portion of the balance higher than $3,000.

Digital Federal Credit Union recently offered 0.5% on up to $100,000 in its free checking account if you activate the “Earn More” feature, which sweeps your funds into FDIC-insured accounts with partner institutions (you retain normal access to your money). The credit union is temporarily refunding all out-of-network ATM charges; typically, you must have a direct deposit and make five transactions per month to get $300 in fees reimbursed yearly. You can become eligible for Digital membership if you join a partner organization, such as Reach Out for Schools (the membership fee starts at $10), and deposit $5 into a savings account.

The free, online checking account from FNBO Direct yields 0.4%, but the account does not come with check writing. To move money out of the account, you can use a debit card, make online transfers or pay other people with peer-to-peer payment service PopMoney. TIAA Bank offers a fixed 0.4% yield for the first year (0.12% thereafter) on up to $250,000 in its free Yield Pledge Checking account, and you get unlimited reimbursement of ATM withdrawal fees if you keep at least $5,000 in the account, or up to $15 in ATM fees refunded monthly if you have less than $5,000.

More-Rewarding Accounts

You can earn a considerably higher yield on your checking balance if you’re willing to jump through some hoops, such as making several monthly purchases with your debit card, having a direct deposit and using online banking features. The rates on high-yield checking are often better than what you can get with a savings account, so you may consider keeping some of your savings stash in one of these accounts, too.

Consumers Credit Union (based in Illinois) has long offered chart-topping rates on its Rewards Checking account. You get 4.09% on up to $10,000 if you make at least 12 debit card transactions monthly; have at least $500 monthly in direct deposits, mobile check deposits and transfers into the account; spend at least $1,000 monthly on a CCU Visa credit card; and receive electronic statements. You get a 3.09% rate if you spend $500 on the credit card monthly and meet the other requirements, and a 2.09% rate if you do not use the credit card but meet the other requirements. All out-of-network ATM fees are reimbursed if you meet the monthly requirements. Anyone in the U.S. can join CCU by paying a one-time, $5 fee to the Consumers Cooperative Association and depositing $5 into a savings account.

The free Vertical Checking account from Evansville Teachers Federal Credit Union yields 3.3% on up to $20,000 if you make at least 15 monthly debit card purchases, have a monthly direct deposit, log in to online or mobile banking monthly, and receive electronic statements. The account refunds up to $15 monthly in ATM surcharges if you meet the activity requirements. Anyone in the country can join the credit union by donating $5 to the Mater Dei Friends & Alumni Association and depositing $5 in a savings account.

One free account with a long track record is Rewards Checking from Axos Bank. It has offered a rate of 1.25% since 2011, says Tumin, and the rate applies to balances of up to $150,000. You’re eligible for the 1.25% yield if you have monthly direct deposits of at least $1,000 and make 15 debit card purchases (minimum $3 per transaction) monthly. Plus, you get unlimited reimbursement of out-of-network ATM fees.

Savings and money market accounts

Savings accounts and money market deposit accounts are prime places to store your emergency fund—a backup cash stash that you can tap if you have a sudden loss of income or an unexpected expense. They are also good parking spots for other money that you’d like to set aside for a goal, such as a vacation or a big purchase.

Among savings accounts, the free, online account from ConnectOne Bank recently offered one of the best available rates: 0.9% on balances between $2,500 and $250,000. First Foundation Bank has a 0.75% yield on its online savings account ($1,000 opening deposit but no ongoing minimum required). The free savings accounts from Live Oak Bank (0.7% yield) and SFGI Direct (0.67% yield) have consistently had strong yields over the past few years.

Several prominent internet banks, including Ally Bank, American Express , Marcus by Goldman Sachs and Synchrony recently matched one another with a 0.6% rate on their free, no-minimum savings accounts. Notably, Synchrony’s account comes with an ATM card, and the account refunds $5 monthly in ATM fees. At 0.61%, the rate on Axos Bank’s free savings account is a smidge higher. If you prefer to keep your savings and checking with one institution, consider Ally or Axos—both offer free checking accounts.

If you’re physically active—or are looking for more motivation to exercise—check out Fitness Bank. Its savings account yields 0.4% if you walk fewer than 5,000 steps a day, on average—or 0.5% if you’re at least 65 years old—but if you step up your walking regimen, the yield jumps. You get 0.85% if you walk an average of at least 12,500 steps a day (10,000-step minimum if you’re 65 or older), 0.75% if you walk at least 10,000 steps daily (7,500 steps for those 65 or older), 0.65% for walking at least 7,500 steps (5,000 steps if 65 or older), and 0.55% if you walk at least 5,000 steps. To count steps, link a fitness tracker such as a Fitbit or an Apple Watch to Fitness Bank’s step-tracking app. You must keep $100 in the account to avoid a $10 monthly fee.

Top Money Market Accounts

Money market deposit accounts are similar to savings accounts but often come with a debit card or check writing for easy access to your money. To get the best rates or avoid fees, you may have to meet certain activity requirements or keep a big balance.

Affinity Plus Federal Credit Union pays an outstanding 1.5% on balances of up to $25,000 (0.7% on the portion of the balance higher than $25,000) on its free Superior Money Market Account, which offers check writing and a debit card. But to get that rate, you must have a direct deposit of at least $500 into an Affinity Plus checking, savings or money market account and sign up for electronic statements. You can join the credit union by paying a $25 fee to the Affinity Plus Foundation and depositing $10 into a savings account.

The Impact Money Market account from National Cooperative Bank yields 0.91% on all balances, and you can request checks and a debit card. But to avoid a stiff $25 monthly fee, you must keep at least $5,000 in the account. The High Yield Money Market Account from CFG Bank yields 0.8% if you hold a balance of at least $25,000, but it does not come with check writing or a debit card. You must keep a minimum $1,000 balance to avoid a $10 monthly fee.

As with savings accounts, several banks are offering money market rates hovering at 0.6%. One of the best options is the free account from Axos Bank, which requires a $1,000 opening deposit (no ongoing minimum) and includes check writing and a debit card. The money market account from Northern Bank Direct yields 0.6% on up to $250,000, with no monthly fee. (If your balance is higher than $250,000, you get 0.25% on the entire amount.) You must make a $5,000 opening deposit (no ongoing minimum required) and it comes with an ATM card.

Certificates of deposit

With a CD, you agree to keep your money in the account for a certain period in exchange for a guaranteed interest rate during that time. If you decide to reclaim the money before the CD matures, you’ll usually owe an early-withdrawal penalty, which may range from a few months’ worth of interest to a year or more of interest. If you’d like to hedge your bets—especially if you invest in CDs with maturities of a few years or more—look for certificates with light early-withdrawal penalties. Ally Bank, for example, penalizes you a relatively forgiving 150 days’ worth of interest on its five-year High Yield CD (no minimum amount required), which recently yielded 1%.

If you have a CD nearing its maturity, shop around for the best interest rate rather than letting it renew at the institution’s current rates, which may be considerably lower than the previous rate you earned. The highest rates on one-year CDs aren’t much better than those of the top-yielding savings accounts, and five-year CD rates don’t offer much of an advantage over yields on CDs with shorter terms. But for long-term savings that you’re willing to lock away for a while, you may be able to squeeze out a little more yield than you can get with your savings account—and you can rest easy knowing that the interest rate won’t fall during the CD’s term.

Recently, you could get a 0.95% yield with a one-year term, or a 0.9% yield with a six-month term, on CDs from CommunityWide Federal Credit Union ($1,000 minimum deposit). You can join the credit union by making $5 donation to an affiliated organization, including Michiana Goodwill Boosters or Habitat for Humanity Helpers, and depositing $5 into a savings account. State Bank of Texas offers 0.95% on a one-year CD with a $25,000 minimum deposit.

Pen Air Federal Credit Union offers one of the leading rates for a five-year CD, at 1.35% with a minimum deposit of $500. Its early-withdrawal penalty is 180 days’ worth of interest. For membership eligibility, Pen Air will make a $1 donation on your behalf to the Friends of the Navy–Marine Corps Relief Society, and you must deposit $25 into a savings account. Hiway Credit Union also offers 1.35% on a five-year CD, but the minimum deposit is $25,000. If you withdraw money early from a five-year CD from Hiway, you’ll owe one year’s worth of interest. To become a member of Hiway, join the Minnesota Recreation and Park Foundation, with a $10 fee, or the Association of the U.S. Army ($40 for a two-year membership), and keep $5 in a savings account.

Savings bonds

Savings bonds are another option for long-term cash holdings. Series EE and Series I bonds are not redeemable the first 12 months you own them, and if you cash them out before five years have passed, you’ll owe a penalty of three months’ interest. One nice benefit is that you pay no state or local income tax on savings bond interest, and you can defer federal income tax until you redeem the bond or when it reaches maturity in 30 years, whichever comes first. You can purchase up to $10,000 in EE bonds and $10,000 in I bonds per year.

I bonds are a bright spot at a time when yields on many other savings options trail inflation. The bonds combine a fixed interest rate, which remains the same for the life of the bond, with an inflation rate that is based on the consumer price index and resets every six months. The two rates form a composite yield, which is 1.68% for those who purchase I bonds between November 1, 2020, and April 30, 2021. That’s a higher rate than you can get with even the top-yielding five-year CDs. And adjustments to the inflation component of the bonds should help your savings keep up with inflation.

Series EE bonds purchased between November 1, 2020, and April 30, 2021, earn a measly 0.1% interest. But if you’re willing to hang on to the bond for a couple of decades, it becomes a more attractive investment: After 20 years have passed, if interest earnings haven’t caused the EE bond to double in value, the Treasury will make a one-time adjustment to bring the bond’s value to twice the purchase price. That’s a guaranteed return of about 3.5%.

Get a high rate on the go

If you spend a lot of time on your smartphone, you may not mind doing all of your banking on the device, too. These two mobile banks, which operate primarily through a smartphone app, offer noteworthy yields.

Chime offers a free “Spending” account, which comes with a debit card, plus a free savings account that recently yielded 1% on all balances. (You must have a Spending account to use the savings account, and you can transfer money into the savings account only from Spending.) Each time you use your debit card for a purchase or bill payment, Chime automatically rounds up the transaction to the nearest dollar and deposits the difference into your savings account. You can withdraw money with the debit card at 38,000 ATMs nationwide fee-free.

Like Chime, Simple offers a free basic checking account for everyday spending. You can pair it with the free “Protected Goals” checking account, which yields 0.6% on all balances and is designed to hold money that you’re saving for future expenses. You can instruct Simple to round up debit-card purchase amounts to the nearest dollar and transfer the difference to Protected Goals, and you can use budgeting tools to see your progress toward savings goals, such as going on a vacation. You can access 40,000 ATMs fee-free with Simple’s debit card.

Both of these financial-technology companies partner with institutions insured by the Federal Deposit Insurance Corp. to hold your funds, and they have been established for several years. Take caution, however, with tech companies that are newer to the game of offering bank accounts. Customers of Beam, a mobile bank that launched in the fall of 2019, recently had problems withdrawing money from their accounts. When investing app Robinhood first announced a checking and savings account in 2018, it claimed that customers’ funds would be covered by the Securities Investor Protection Corp., which protects brokerage accounts. The SIPC disputed the claim, and Robinhood later introduced a cash management account that sweeps funds into FDIC-insured bank accounts.

Build a CD ladder

A CD ladder is a tried-and-true method to ensure that a portion of your savings will regularly become available to capture current interest rates, while the rest of your money benefits from the higher rates that longer maturities offer. Divvy up your pot of money dedicated to CDs among several maturities—say, $5,000 each in CDs with maturities of one, two, three, four and five years. When a CD matures each year, you can reinvest the money at current rates or use it for other needs. If you reinvest, one option is to put the money in a five-year CD each year after your initial investment in CDs of various maturities, suggests Tumin. You’ll eventually have all of your money in five-year CDs, with one CD reaching maturity each year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed September CPI Report is Out. Here's What it Signals for the Fed.

The Delayed September CPI Report is Out. Here's What it Signals for the Fed.The September CPI report showed that inflation remains tame – and all but confirms another rate cut from the Fed.

-

Banks Are Sounding the Alarm About Stablecoins

Banks Are Sounding the Alarm About StablecoinsThe Kiplinger Letter The banking industry says stablecoins could have a negative impact on lending.

-

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's Finances

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's FinancesTax Tips The Trump tax bill could help your child with future education and homebuying costs. Here’s how.

-

What Will the Fed Do at Its Next Meeting?

What Will the Fed Do at Its Next Meeting?The Federal Reserve is expected to keep rates unchanged at the next Fed meeting.