-

Which Goods and Services Are Still Driving Inflation?

-

67 Dividend Stocks for Dependable Dividend Growth

dividend stocks -

Three Gen X Retirement Mistakes for Millennials, Gen Z to Avoid

-

What Is a Lifestyle Analysis in Divorce?

-

How (and Why) to Talk Money at Your Family Dinner Table

-

International Investment Opportunities Through Immigration Investment

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Investing

-

Stock Market Today: Dow Flirts With 40K After Walmart Earnings

The 30-stock index briefly traded above the 40,000 mark as blue chip retail stock Walmart surged after earnings.

By Karee Venema Published

-

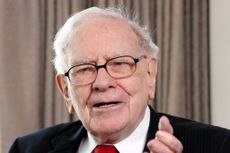

Warren Buffett Stocks: Analyzing The Berkshire Hathaway Portfolio

The Berkshire Hathaway portfolio is a diverse set of blue chips and some lesser-known growth bets. Here, we look at all stocks picked by Buffett and his lieutenants.

By Dan Burrows Last updated

-

4 Stocks Warren Buffett Is Buying (and 6 He's Selling)

Warren Buffett Warren Buffett's Berkshire Hathaway initiated a big stake in Chubb and dumped HPQ, among other moves.

By Dan Burrows Last updated

Personal Finance

-

Key Things To Know About Travel Medical Insurance

Travel medical insurance can help you pay for emergency medical expenses that arise when you’re on a trip, so you won't have to pay medical costs upfront.

By Erin Bendig Last updated

-

What is the 80% Rule in Homeowners Insurance?

The 80% rule in homeowners insurance says to receive full coverage, homeowners must have coverage costing at least 80% of their home’s total replacement cost value.

By Erin Bendig Last updated

-

Nearly 50% of Workers Are Thinking of Quitting Their Jobs, Study Shows. Are You?

Nearly half of all workers are thinking about quitting their jobs in 2024, according to new research from Microsoft and LinkedIn. Here's why.

By Kathryn Pomroy Published

Meet Kiplinger's Experts

Taxes

-

Is High-Yield Savings Account Interest Taxable?

Savings Accounts Think a high-yield savings account is a good idea? Don’t forget taxes on savings account interest.

By Katelyn Washington Last updated

-

Kansas State Tax Guide

State Tax Kansas state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.

By Katelyn Washington Last updated

-

File By May 17 for $1 Billion in Unclaimed IRS Tax Refunds

Tax Refunds Unclaimed tax refunds from years ago are waiting for millions who might not know it. Are you one of them?

By Kelley R. Taylor Last updated

Kiplinger Advisor Collective

-

Why Financial Literacy Month Still Isn’t Working

Awareness has its limitations.

By Howard Dvorkin Published

-

Worried About Layoffs? Six Steps to Ease Your Financial Fears

Having a plan in place can give you peace of mind during a crisis.

By Kiplinger Advisor Collective Published

-

11 Tips for Talking to Your Aging Parents About Their Finances and Future Care

Such a sensitive subject requires a careful approach.

By Kiplinger Advisor Collective Published

Retirement

-

Best Jobs for Retirees

retirement Your career job is ending. It’s time to consider how to earn extra cash in retirement by doing the work you’ve always wanted to do.

By Bob Niedt Last updated

-

Social Security Expands Access To SSI Benefits

Social Security just expanded access to Supplemental Security Income (SSI) benefits and reduced the administrative burden for low-income households.

By Erin Bendig Published

-

How to Estimate Your Social Security Benefits in Six Steps

To plan smart for retirement, estimate your Social Security benefits years before you'll need the money. Here's how to do it.

By Kathryn Pomroy Published

Economic Forecasts

-

Kiplinger Inflation Outlook: Inflation Eases a Bit for the First Time This Year

Economic Forecasts A Federal Reserve interest rate cut is still unlikely before November, but July can’t be ruled out yet.

By David Payne Last updated

Economic Forecasts -

After Decades of Promise, the Virtual Reality Era Has Finally Arrived

The Kiplinger Letter VR is a paradigm shift for consumer technology. The tech has a long road ahead, but amazing hardware already puts the huge potential on full display.

By John Miley Published

The Kiplinger Letter -

Fed Rate Cuts Still on Hold

The Kiplinger Letter With inflation stubbornly elevated, the Federal Reserve will keep interest rates high for now.

By David Payne Published

The Kiplinger Letter