10 Beaten-Down Tech Stocks to Buy for the Long Term

Tech stocks have taken a walloping in 2022, but these 10 discounted picks are poised for long-term growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tech stocks have traversed a rocky road since we turned the calendar over to 2022.

General fears that the pandemic recovery was fully priced in heading into the new year, coupled with concerns about inflation and higher interest rates, caused many of the biggest and most widely held names out there to take a spill.

And the equities market has become even more volatile lately amid Russia's invasion of Ukraine – creating even bigger headwinds for already struggling tech stocks.

Sure, there are times when a stock takes a beating for good reason. One-time growth darling Netflix (NFLX), for instance, waved red flags in its January earnings report about future subscriber growth, sending shares tumbling to a nearly 22% single-session loss as a result.

However, some of the best tech stocks have been beaten down without the same kind of headlines to blame. And in some cases, popular tech stocks have seen declines despite earnings reports that show a decidedly positive outlook.

If you're interested in looking beyond the day-to-day volatility, here are 10 beaten-down tech stocks trading at stiff discounts relative to where they started the year. The names featured here will likely be familiar to most investors and all have solid growth prospects over the long term.

Data is as of March 7.

Alphabet

- Market value: $1.7 trillion

- Year-to-date decline: -12.8%

Google parent Alphabet (GOOGL, $2,527.57) announced earlier this year it would execute a 20-for-1 stock split in July, taking its share price down significantly to allow for greater liquidity in trading. But investors might not want to wait until that restructuring, because in many ways, GOOGL stock could already be "cheap" – despite its price tag of roughly $2,500 a share at present.

That's in part because Alphabet is humming along quite nicely, with projections of an 18% increase in its top line this fiscal year and another 15% rise in fiscal 2023. Part of this improvement is because Google's ad network remains the go-to platform for digital marketing, and we continue to see brisk growth in this category. Consultancy firm Zenith Media has estimated that of all global ad spend, 60% of marketing budgets are dedicated to digital channels.

But it's also because Alphabet's only serious rival to reach digital channels is social media giant Meta Platforms. And FB has been hard hit by a series of missteps that have weighed on both user engagement as well as advertisers' willingness to put their cash on channels such as Facebook and Instagram.

There is certainly a "risk-off" environment in early 2022, but there's not a lot of risk in the assertion that Alphabet will remain the dominant venue for digital ad spend going forward. That may make this a solid choice for patient investors seeking out discounted tech stocks.

Amazon.com

- Market value: $1.4 trillion

- Year-to-date decline: -17.8%

Aside from the fact that it's down roughly the same amount as the broader stock market since Jan. 1, what's not to like about tech giant Amazon.com (AMZN, $2,749.06)?

It's the go-to name in e-commerce, with an estimated 40% of all dollars spent online, according to a 2021 analysis conducted by research firm eMarketer. What's more, AMZN continues to grow as consumers increasingly spend their cash digitally thanks to long-term uptrends in this category.

Digital transformation research company Insider Intelligence estimates that even after the exponential growth in e-commerce seen during the pandemic – a trend that is now baked in to consumer behavior – we'll still see online retail sales jump an additional 16% in the U.S. in 2022.

If that wasn't enough, Amazon Web Services (AWS) is an equally compelling reason to love AMZN stock. This platform is the leader in the space, with roughly a third of global cloud infrastructure spend going to Amazon, according to software-as-a-service (SaaS) firm ParkMyCloud.

And it's telling that CEO Andy Jassy, who was brought up in the organization running AWS, took over the reins from founder Jeff Bezos last July. That shows investors the company is looking to this high-growth, high-margin division to carry it forward.

Inflationary pressures are not always good for spending trends in the short term, but Amazon has what it takes to thrive for many years to come, so it might be premature to write off this discounted tech stock just because of volatility caused by a broad "risk-off" environment in 2022.

Apple

- Market value: $2.6 trillion

- Year-to-date decline: -10.3%

The fact that many major stock market indexes weight their components by size has undeniably worked against Apple (AAPL, $159.30) lately. As the largest U.S. corporation – with a current market capitalization of roughly $2.6 trillion – it is in many ways the stock most affected by broad-market sentiment instead of its own fundamentals.

Consider that Apple represents about 7% of the popular S&P 500 Index and 12% of the Nasdaq-100. And technology sector funds like the popular Vanguard Information Technology ETF (VGT) are even more Apple-heavy. For instance, while this fund is ostensibly spread across 360 tech stocks, AAPL represents a staggering 23% of the entire fund at present!

Simply put, when investors sell off their ETFs, they are likely punishing Apple more than any other stock on the market simply because of its dominance in market-cap-weighted funds.

However, the fundamentals of Apple are simply too attractive to pass up despite these structural pressures. The iPhone maker nets over $100 billion in annual cash flow and according to its 10-K in September boasted $172 billion in cash equivalents and marketable securities. And despite its already impressive scale, analysts expect 8% revenue growth and a roughly 10% increase in earnings per share this fiscal year.

What's more, AAPL stock has been one of the biggest wealth creators over the past 30 years.

There is no way Apple is going away anytime soon, and it continues to show strength. And more importantly, the index weightings that have held it back because of broad selling in early 2022 can and will reverse – and might deliver outsized gains for investors who choose to pick up this tech stock at a discount to where it was trading not long ago.

Block

- Market value: $56.6 billion

- Year-to-date decline: -39.6%

Technically, the company is Block (SQ, $97.51), but the ticker comes from its dominant mobile payments platform Square – which, by the way, continues to drive performance. In fact, some stubborn investors refuse to call it Block just as they won't call Alphabet (GOOGL) anything but Google, or Meta Platform (FB) anything other than Facebook.

Investors haven't been fooled by the rebranding as Block back in December 2021, but they have been fooled in another more material sense lately. That's evident by the fact that shares have cratered since Jan. 1 for seemingly no particular reason other than the rebranding itself. Unfortunately, the effort was a rather ill-timed exercise by management to align themselves with the emerging technology of blockchain. As a result, SQ stock has been punished in 2022 as volatility in cryptocurrencies has been the norm.

But let's be clear: While there may be limited crypto on the balance sheet of this company, this is fundamentally a mobile payments play. Consider that when Block reported earnings in February, it gapped up more than 26% in a single session thanks to spectacular results. These included gross profit of $1.18 billion in its fourth quarter, up 47% over the prior year, driven by 37% growth in its Cash App arm and an impressive 54% increase in its previously prominent Square ecosystem.

With continued growth projected in both earnings and sales going forward, the poorly timed choice to focus attention on blockchain shouldn't detract from the long-term value proposition of this mobile payments firm. And SQ's recent pullback allows investors the opportunity to pick up a solid play among beaten-down tech stocks.

Cisco Systems

- Market value: $230.9 billion

- Year-to-date decline: -12.3%

Admittedly, Cisco Systems (CSCO, $55.59) isn't quite as dynamic as some of the other tech stocks on this list. The infrastructure platforms company has seen plenty of ups and downs over the years on concerns about "disruption" by evolving technology and hungry competitors, and, in many ways, that remains the same as it ever was.

However, Cisco used the already disruptive events of the pandemic to embark on another round of restructuring that included $1 billion in planned cost reductions. These included an accelerated exit from unprofitable IT markets and a revamp of the financial team that included the departure of its chief financial officer.

That decision was pretty well-timed, and CSCO notched its fourth straight quarter of year-over-year revenue growth in its most recently reported quarter, with sales up 6% over the year prior. It also beat Wall Street expectations on profits to boot.

What's more, Cisco just authorized another $15 billion stock buyback plan. The company also raised its quarterly dividend 2.7% to 38 cents per share, marking its 12th dividend hike since instituting payouts back in 2011.

Sure, the Dow Jones stock might not set the world on fire like a disruptive start-up. But it has solid operations and a generous 2.7% yield at current pricing to provide peace of mind.

Shares had climbed to new multi-year highs in December in part because the stock seemed to be on the right track. And the pullback we've seen in the last few months could be an opportunity for patient investors to jump in and enjoy continued dividend growth in the coming years.

Lyft

- Market value: $12.0 billion

- Year-to-date decline: -19.3%

Ride-sharing service Lyft (LYFT, $34.48) was one of the hottest names out there at the time of its 2019 IPO. And after some initial struggles and the disruptions of the pandemic, it seemed like things were getting back on track in 2021. But as Wall Street started to get risk-averse in the new year, LYFT stock's struggles resumed.

Still, Lyft is clearly in recovery mode and getting back to the previously planned successes that made investors enthusiastic about the company before the pandemic. Namely, fiscal 2022 revenue is predicted to hit nearly $4.3 billion, up 32% from fiscal 2021 and easily eclipsing the $3.6 billion in revenue from back in fiscal 2019 – before social distancing put a damper on ride sharing and travel trends.

Additionally, unlike rival Uber Technologies (UBER), Lyft is projected to be comfortably profitable this year – and if projections hold, should see 62 cents per share in earnings in fiscal 2022, which is projected to more than double to $1.45 per share in fiscal 2023.

There's a reason the long-term growth narrative in ride-sharing stocks was all the rage a few years ago: Demographic trends show more people are living in urban areas and fewer people are eager to own their own cars. Between a resurgence in travel as the worst of COVID-19 is behind us and this multiyear megatrend toward ride sharing, it might be worth looking beyond the recent declines and enjoying a leisurely ride on Lyft for the long term.

Microsoft

- Market value: $2.1 trillion

- Year-to-date decline: -17.1%

Second only to Apple, Microsoft (MSFT, $278.91) clocks in at $2.1 trillion in market value. And similar to its fellow Dow stock, MSFT faces structural challenges thanks to being overweight in index funds. The stock accounts for roughly 6% of the S&P 500, compared with 7% for Apple.

It's also important to recognize Microsoft also shares many of the same dominant balance-sheet characteristics that AAPL does. Last year, the software provider reported cash and investments worth $130 billion, on top of net operating cash flow of $77 billion.

But Microsoft somehow has been punished even more than Apple despite its staying power. Part of that might be because MSFT at the end of last year dipped into its war chest to buy embattled video game studio Activision Blizzard (ATVI) for $69 billion. The deal not only reduces its cash cushion, but has also been the target of shareholder lawsuits and Federal Trade Commission (FTC) review.

However, it's not like the core business of Microsoft has been struggling. In January, it posted great earnings that featured year-over-year revenue growth of 20% and a 22% increase in earnings per share. What's more, it is increasingly important that Microsoft's cloud segment surpassed $22 billion to see an even faster growth rate of 32%.

Microsoft remains the dominant name in enterprise technology, and no geopolitical tensions or inflationary pressures will change that. As such, the recent decline in share price allows investors the opportunity to scoop up one of Wall Street's favorite stocks at a much lower price than where it was to start the year.

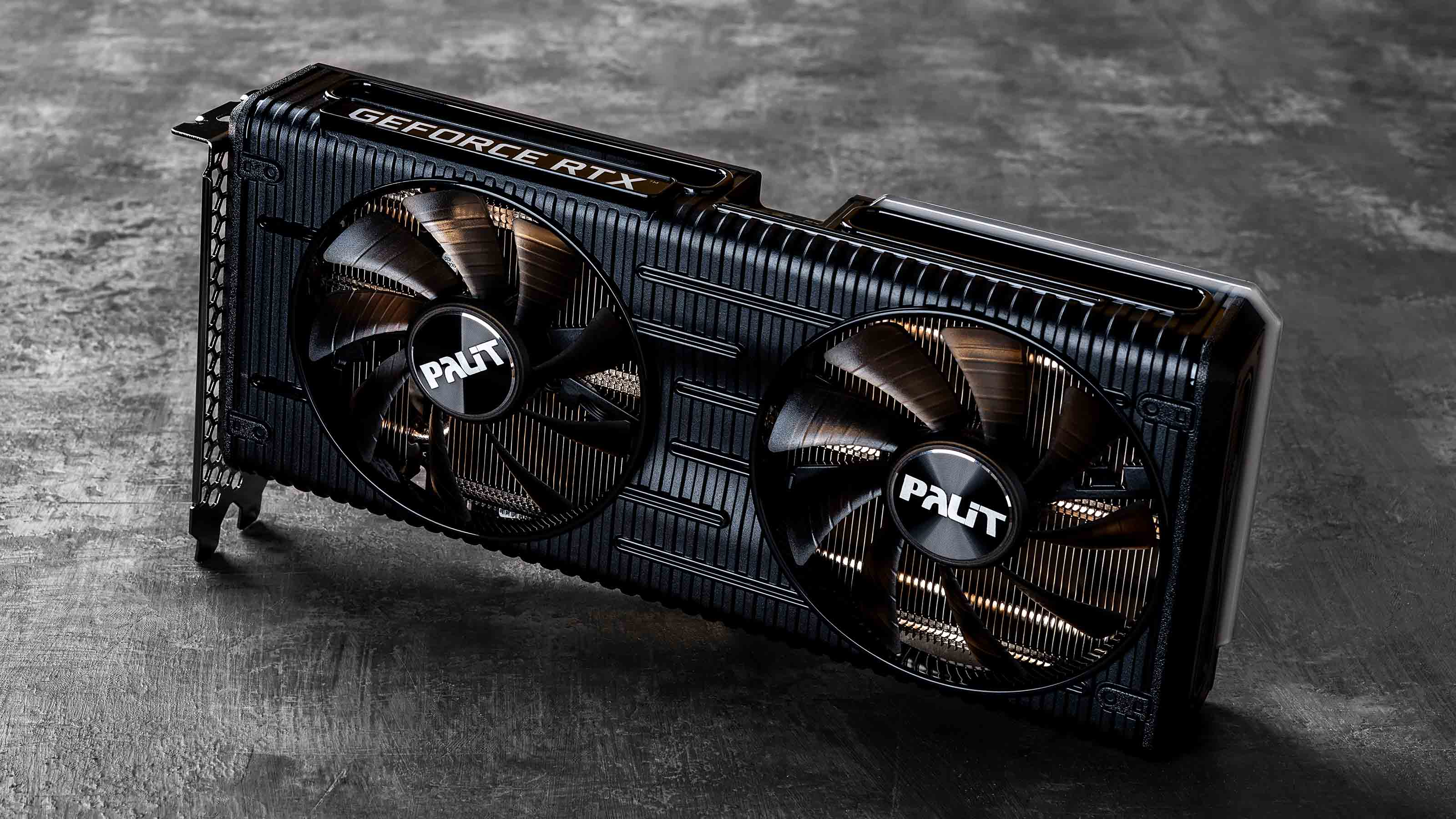

Nvidia

- Market value: $532.1 billion

- Year-to-date decline: -27.4%

For much of the past few years, it seemed like Nvidia (NVDA, $213.52) could do no wrong. The high-growth chipmaker had been trading at less than $40 per share as recently as late 2019 before surging to an all-time high of about $350 at the end of 2021 – prompting some billionaire investors to take profits off the table in Q4.

Of course, the story has been much different lately as shares have rolled back in a big way thanks to the general volatility on Wall Street that has hit many tech stocks. Exacerbating headwinds are NVDA's perceived exposure to negative cryptocurrency trends thanks to its mining-related hardware.

Strangely enough, however, the narrative that drove Nvidia to prior highs has persisted even if Wall Street seems to be distracted by other things. Current fiscal-year projections are for 29% revenue growth, followed by 17% growth next year. Similarly, earnings per share are set to expand at 26% and 20% each year, respectively.

Yes, there's a bit of crypto exposure here thanks to its mining hardware. But NVDA is not a direct play on bitcoin or ether or anything else, as it has other very lucrative chips in its arsenal too. Consider that in Nvidia's most recent quarter, video game graphics card sales jumped 37% and data center revenue exploded 71% over the year-ago figures.

If the investing thesis before was that NVDA is a dominant semiconductor stock that has in-demand branded designs offering continued growth and high margins, then that hasn't changed at all. So perhaps it's worth taking a look at this beaten-down tech stock after its recent stumbles.

Shopify

- Market value: $70.9 billion

- Year-to-date decline: -59.3%

If investors are asked to think of a publicly traded company down more than 50% this year, they would likely name a state-owned Russian oil company. But oddly enough, e-commerce platform Shopify (SHOP, $560.80) is among the worst performers since Jan. 1, with a staggering 59% decline over less than three months' time.

And it's hard to see why such a gut-wrenching drop is warranted. Yes, perhaps the valuation of this high-flying tech stock was a little out of whack. Investors piled in during the pandemic and bid up shares from about $300 at the firm's March 2020 lows to a short-lived high north of $1,700 late last year.

But now SHOP stock is back in the mid-$500s, despite predictions of 30% revenue growth to $7.7 billion this fiscal year. And while profitability has taken a hit compared with the juicy pandemic margins, it's not like this is a company bleeding cash as it grows at such a rapid rate. Earnings are still expected to arrive at $4.60 per share in fiscal 2022 and rise to $6.42 per share in fiscal 2023.

It's clear that consumers are only going to be spending more cash on e-commerce and digital platforms in the future too. And while small or local businesses may never unseat online retail behemoth Amazon.com (AMZN), it's dangerously naïve to think they can operate without a digital storefront at all. That means built-in demand for Shopify's services for many years to come; particularly as its software-as-a-service (SaaS) model isn't just a one-time fee, but a subscription for ongoing maintenance.

As with many of the other cheap tech stocks on this list, SHOP's volatility is certainly extreme right now in the wake of its late-2021 high. But seeing as the stock is back to levels not seen since the beginning of the pandemic, it could be worth considering whether the long-term promise of Shopify is the same as it was back in 2019 and early 2020 before COVID-19 or Russia's invasion of Ukraine or inflation fears.

If your answer is "yes," and you are able to stomach the day-to-day gyrations, this beaten-down tech stock could be an aggressive buy.

Tesla

- Market value: $831.5 billion

- Year-to-date decline: -23.9%

Tesla (TSLA, $804.58) has crossed many milestones since selling its first Roadster electric vehicle back in 2009. Any while naysayers sometimes like to pooh-pooh this dynamic manufacturer as a niche play, 2021 brought a very important development as TSLA actually sold more units in the U.S. than popular luxury car nameplate BMW, according to research firm Cox Automotive.

This is proof that Tesla continues to offer unrivaled growth as it eats into the market share of old school automakers. And looking forward, it seems very unlikely anything will stop TSLA stock. The company has forecast vehicle delivery growth of more than 50% in 2022 on top of its already impressive expansion so far and despite lingering supply-chain issues.

The stock has grown rapidly since its 2010 initial public offering (IPO) to become one of the top seven U.S. stocks as measured by market capitalization for a reason. And structurally, it benefits from the fact that its CEO Elon Musk is sitting on roughly 170 million shares – about 17% of the 1.0 billion shares publicly available for trading – that he has no intention of selling.

You can sometimes make money betting against Tesla based on short-term sentiment. But long term, this is a name to be reckoned with and could be a buy among beaten-down tech stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.