How Could the Russia-Ukraine Conflict Affect Your Investments?

Russia's invasion of its European neighbor is extending 2022's volatility in the stock and commodity markets.

Russia's invasion of Ukraine is sending shockwaves through pretty much every asset class across the globe. Risk assets such as stocks are tumbling. Traditional safe havens like Treasury debt and gold are rising. And oil and other key commodities are spiking at a time when U.S. inflation just hit a four-decade high.

But as disastrous and disorienting as the impact of Europe's largest military conflict since World War II might be, the best course of action for most retail investors is to keep calm and carry on, market strategists say.

Put more simply: Don't panic.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For one thing, selling into a falling market (the S&P 500 is officially in correction territory now) is the opposite of what successful investors do. The idea is to buy low, after all.

Equally important is the fact that no one knows what Russia's invasion of Ukraine ultimately means for everything from energy prices to monetary policy.

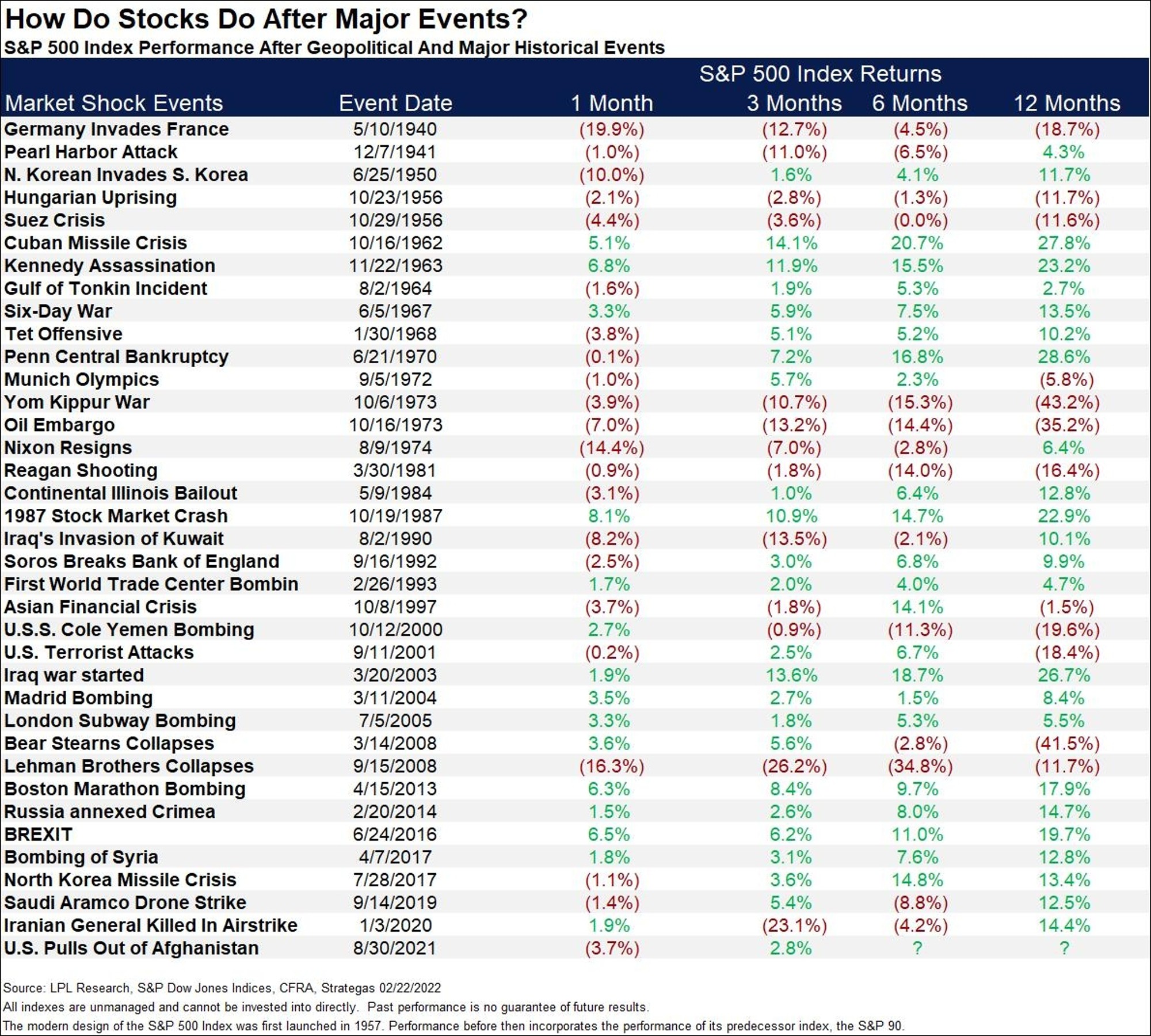

And then there's the case that, historically speaking, stocks tend to recover quickly after being derailed by international turmoil.

Russia-Ukraine's Impact on the Broader Market

"Geopolitics rattling markets is nothing new," says Lindsey Bell, chief markets and money strategist for Ally Invest. "It's typical that the immediate reaction to geopolitical events is the most dramatic. The good news is that the impact tends to be short-lived, only lasting anywhere from one to three months."

Most importantly, history shows that 12 months after events such as our current crisis, the market edges higher, Bell adds.

Indeed, the market's record is one of resilience amid times of strife, notes Ryan Detrick, chief market strategist of LPL Financial.

"As devastating as a major conflict could be between Russia and Ukraine, the truth is stocks likely will be able to withstand the geopolitical struggle," Detrick writes.

Have a look at the table below, courtesy of LPL Financial, which shows past market performance following major geopolitical or historical events since WWII.

"Bottom line is if there isn't a recession, stocks tend to take most in stride," Detrick says.

But that doesn't mean Wall Street won't suffer some serious short-term disruptions.

Oil Takes the Spotlight

The current crisis has rippled across commodities markets. Global benchmark Brent crude oil futures topped $100 a barrel for the first time since 2014. Consumers can expect higher prices at the pump – and soon – with $4-plus-per-gallon gas becoming the new norm.

It's important to remember, however, that $100 a barrel is a nominal price. Adjusted for inflation, crude would need to top $120 a barrel to reach 2014 levels. The last time we got there, U.S. shale oil producers burned through roughly $500 billion in capital to lift production – and crude prices crashed in short order.

The U.S. shale industry has adopted a mantra of "capital discipline" for the current cycle, not wanting to repeat its mistakes of eight years ago. How long producers hold out on making new investments remains to be seen, but oil has always been – and always will be – cyclical. As the saying goes, the cure for high prices is high prices.

Inflation Fears Ramp Up

Action across other commodities pits is likewise adding to inflation anxiety. Prices for a number of agricultural commodities are jumping, as Russia and Ukraine together account for about 20% of global corn exports and 25% of wheat exports.

It's important to know that some economists disagree about whether these geopolitical and inflationary developments are the automatic economy-killers investors most fear.

"Any direct effects on the U.S. economy should be limited because trade links are weak and energy prices are likely to be affected far less in the U.S. than in Europe," writes Goldman Sachs Chief Economist Jan Hatzius. "Our rules of thumb imply that a $10 per barrel increase in the price of oil boosts U.S. headline inflation by 0.2%, but lowers GDP growth by just under 0.1 percentage point."

Haitzus adds that he doesn't expect the Russian invasion of Ukraine to stop the Federal Reserve from "hiking steadily by [0.25 percentage points] at its upcoming meetings, though we do think that geopolitical uncertainty further lowers the odds of a [0.5-percentage-point] hike in March."

More bearishly, David Rosenberg, chief economist and strategist at Rosenberg Research, says price shocks couldn't come at a worse time. Oil, nickel and aluminum futures are soaring as investors weigh the risk of supply disruptions from potential Western sanctions, he points out.

"This is clearly a potentially huge stagflationary shock for the world economy at a time when pandemic-induced bottleneck pressures were just showing signs of a thaw," Rosenberg writes.

It's certainly true that rising energy and agricultural prices only exacerbate worries about inflation – a top-of-mind anxiety for investors and the Fed alike. As such, the conflict in Eastern Europe could reinforce the market's current preferences, which include an appetite for value names at the expense of growth stocks.

"[Although] Russia-Ukraine tension is a low earnings risk for U.S. corporates, an energy price shock amid an aggressive central bank pivot focused on inflation could further dampen investor sentiment and growth outlook," says Dubravko Lakos-Bujas, JPMorgan Chase's global head of equity research.

Good News for Commodity Plays, However

But while a number of strategists share similar concerns – especially as they relate to energy prices – the outlook is by no means black and white, says Raymond James senior economist Scott Brown.

"If the result [of the current crisis] is similar to Russia's annexation of Crimea, there should be little impact on the U.S. economy," Brown writes. "Higher oil prices could be a factor, but energy is a lot more neutral in its effect on the economy than in past decades."

Brown adds that if gas prices do continue to rise, even that is not an entirely bad thing. Although higher prices at the pump would add to inflation and dampen consumer spending, they also could boost business investment by encouraging more exploration.

Besides, ballooning energy prices have clearly been good news for energy ETFs, which have surged amid the crisis. That includes stock-centric funds such as the Energy Select Sector SPDR Fund (XLE, $67.64), as well as ETFs such as the United States 12 Month Oil Fund LP (USL, $33.48) that expose investors to commodity futures.

Additionally, gold and gold ETFs have flourished as the "fear trade" has re-emerged. The SPDR Gold Shares (GLD, $178.29), an ETF backed by physical gold held in a vault in London, is up about 4% since the start of 2022, versus a nearly 9% decline in the S&P 500.

"In just a couple of months, investors have done an about-face with gold," says Edward Moya, senior market strategist at currency data provider OANDA. "Ukraine tensions remain the primary driver behind gold's earlier rally above the $1,900 level."

The Russian invasion of Ukraine also increases certain industry-specific risks.

The global auto industry, for example, is already grappling with shortages, notes Kristina Hooper, Invesco's chief global market strategist. And stocks such as Ford (F, $16.95) and General Motors (GM, $46.38) have struggled of late in part because of the conflict's potential to create additional supply-chain headaches.

"Russia is the world's largest exporter of palladium," Hooper writes, "so there is the potential for more auto supply-chain disruptions given that palladium is used in catalytic converters."

Conversely, that could mean good things for the likes of the Aberdeen Standard Physical Palladium Shares ETF (PALL, $231.48), an ETF that, similar to GLD, is backed by physical palladium held in a London vault. PALL is the most popular such fund at about $400 million in assets.

Bottom Line

"Global markets will remain choppy over the next few weeks," says Kunal Sawhney, CEO of Kalkine Group, an independent equities research firm. "Thursday's attack on Ukraine has thrown up all sorts of possibilities that were unforeseen until a few weeks ago."

This is the unfortunate market backdrop retail investors have to live with right now. But as dramatic as the price action across various asset classes might be, that shouldn't change most retail investors' basic calculus or long-term plans.

"While there may be some additional volatility in the short term, these dislocation events historically present opportunities, as long as recession doesn't follow," says Cliff Hodge, chief investment officer for registered investment advisory firm Cornerstone Wealth. "At this stage, recession is not a concern."

As difficult as it might be, sitting tight is often the best course of action when uncertainty and volatility reign supreme.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Higher Summer Costs: Tariffs Fuel Inflation in June

Higher Summer Costs: Tariffs Fuel Inflation in JuneTariffs Your summer holiday just got more expensive, and tariffs are partially to blame, economists say.

-

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

If You'd Put $1,000 Into Procter & Gamble Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Procter & Gamble Stock 20 Years Ago, Here's What You'd Have TodayProcter & Gamble stock is a dependable dividend grower, but a disappointing long-term holding.

-

My Three-Day Rule for Investing: And If it Applies Now

My Three-Day Rule for Investing: And If it Applies NowStock Market I've seen a lot in my career. Here's what I see now in the stock market.

-

Is It Time to Invest in Europe?

Is It Time to Invest in Europe?Stock Market Europe is being shaken out of its lethargy, militarily and otherwise, by Donald Trump's changes in U.S. policy. Should investors start buying?

-

Why Is Warren Buffett Selling So Much Stock?

Why Is Warren Buffett Selling So Much Stock?Berkshire Hathaway is dumping equities, hoarding cash and making market participants nervous.

-

If You'd Put $1,000 Into Google Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Google Stock 20 Years Ago, Here's What You'd Have TodayGoogle parent Alphabet has been a market-beating machine for ages.

-

Stock Market Today: Stocks Retreat Ahead of Nvidia Earnings

Stock Market Today: Stocks Retreat Ahead of Nvidia EarningsMarkets lost ground on light volume Wednesday as traders keyed on AI bellwether Nvidia earnings after the close.

-

Stock Market Today: Stocks Edge Higher With Nvidia Earnings in Focus

Stock Market Today: Stocks Edge Higher With Nvidia Earnings in FocusNvidia stock gained ground ahead of tomorrow's after-the-close earnings event, while Super Micro Computer got hit by a short seller report.