If You'd Put $1,000 Into Google Stock 20 Years Ago, Here's What You'd Have Today

Google parent Alphabet has been a market-beating machine for ages.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Google parent Alphabet (GOOGL) has been a buy-and-hold bonanza since it first went public more than two decades ago. Even better, analysts say the frenzy over all things AI gives GOOGL stock more room to run.

Investors knew they had something special with Google when it went public via a Dutch auction (don't ask) back in those innocent days of the early 21st century.

The company clearly offered the best internet search product, one that would eventually give it a near-monopoly in that lucrative market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But Google hardly rested on its search laurels. The company rolled out a steady stream of new products – mail, maps and the Chrome operating system, for example – that extended its reach across the world wide web.

In 2006, the same year GOOGL was added to the S&P 500, the company acquired a quirky startup that allowed users to upload videos to the internet.

Critics questioned the wisdom of spending $1.7 billion on what looked to be a fad, but the YouTube deal turned out all right. After all, the business generated $60 billion billion in subscription and ad revenue in 2025, or 15% of Alphabet's entire top line.

Google, now dominant in search and omnipresent on the web, soon set its sights on mobile.

When smartphone sales exploded following Apple's (AAPL) release of the iPhone, Google entered the booming segment by creating the open-source Android mobile operating system.

And those are just a handful of highlights from the early days. By 2015, Google was operating so many diverse projects that it reorganized into a holding company called Alphabet.

Today, Google commands roughly 90% of the market for global search, and its Android operating system is found on approximately 70% of all smartphones.

Future success, however, is predicated on competing with fellow Magnificent 7 stocks Amazon.com (AMZN) and Microsoft (MSFT) in artificial intelligence and cloud-based enterprise services. Note too that analysts feel pretty good about GOOGL's prospects in these endeavors.

Although Amazon Web Services and Microsoft Azure claim higher total cloud market share, Google Cloud is currently the fastest-growing major hyperscaler. Alphabet also has a competitive advantage thanks to its vertical integration, including chips, infrastructure, training datasets and end-user applications.

But before we get to where Wall Street thinks the communication services stock is going, let's take a look at how it’s performed for the truly faithful over the past couple of decades.

The bottom line on Google stock?

GOOGL stock has been one of the best stocks of all time, according to research by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Over its entire lifetime as a publicly traded company, Alphabet generated more than $1 trillion in lifetime wealth creation, which accounts for a stock's increase in market cap adjusted for cash flows in and out of the business and other factors.

How impressive is that? Only Apple, Microsoft and Exxon Mobil (XOM) created more wealth for shareholders, per Bessembinder's findings.

Heck, GOOGL is one of just four stocks to ever top $4 trillion in market cap.

But then retail investors are probably more interested in what a long-term investment in GOOGL stock looks like on a brokerage statement.

Spoiler alert: Alphabet's outperformance has been nothing less than stupendous.

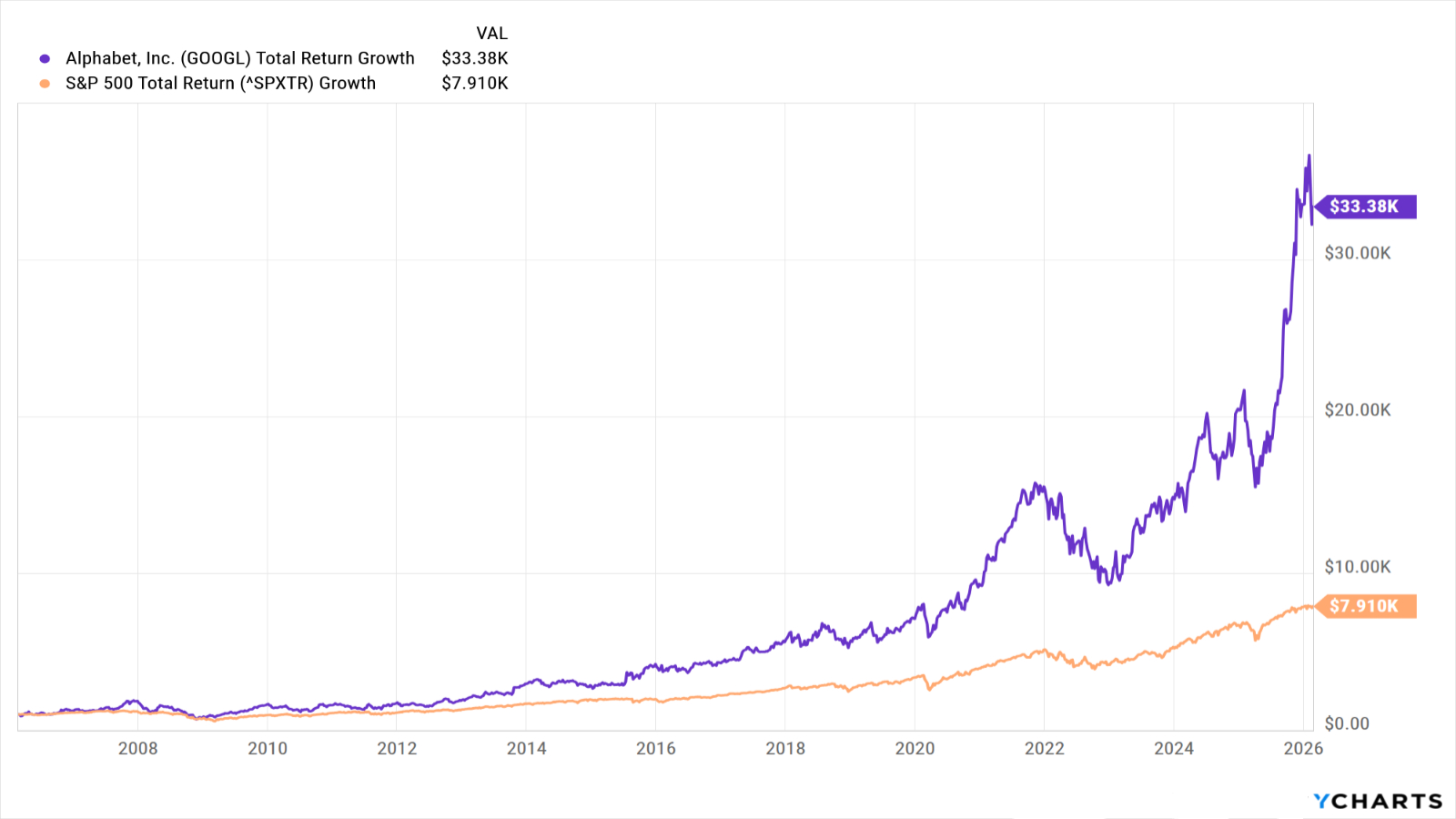

GOOGL stock outperforms the S&P 500 over any pretty much any standardized time period investors care to measure.

Over its entire life as a publicly traded company, GOOGL stock has generated an annualized total return (price change plus dividends) of 25.2%. That more than doubles the broader market's total return of 10.8%.

GOOGL's 20-year performance might be slightly less impressive, but it’s been highly remunerative nonetheless. Over the past two decades, GOOGL stock delivered an annualized total return of 19.2% versus 10.9% for the S&P 500.

Have a look at the above chart. You'll see that if you put $1,000 into GOOGL stock 20 years ago, it would be worth more than $33,000 today. The same amount invested in an S&P 500 index fund would be worth almost $8,000.

Happily for GOOGL shareholders, analysts see plenty more upside ahead for the blue chip stock. Of the 65 analysts covering GOOGL stock surveyed by S&P Global Market Intelligence, 48 call it a Strong Buy, 10 say Buy and 7 have it at Hold.

That works out to a rare consensus recommendation of Strong Buy. Indeed, Alphabet routinely ranks among analysts' top S&P 500 stocks.

Speaking for the bulls, Argus Research analyst Joseph Bonner praises the company's success outside of its core search product and its potential in AI.

"While Alphabet has been criticized as a Johnny-one-note for its dependence on digital advertising, the rapid growth of Google Cloud and YouTube have started to diversify the company's revenue," writes Bonner, who rates GOOGL at Buy. "Alphabet remains at a minimum competitive, if not a leader, in the development of generative AI, the rapidly developing and perhaps disruptive new computing paradigm."

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.