If You'd Put $1,000 into Intel Stock 20 Years Ago, Here's What You'd Have Today

Intel stock has been red-hot in recent months, but the chipmaker has been a catastrophe for long-term investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Imagine a company that's enjoyed overwhelming success in its key markets for ages and also claims one of the most valuable and recognizable brands in the world.

This company was so important to both its sector and the broader economy that it was a component of the Dow Jones Industrial Average for nearly a quarter of a century.

One would expect this blue chip stock to have been an outstanding buy-and-hold bet. To be fair, for a good long while, it was.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That was then. This is now.

Unfortunately, the former Dow Jones stock we're talking about is Intel (INTC).

Shares almost doubled in 2023, helped by a multibillion-dollar cost-cutting campaign and the generalized euphoria surrounding all things artificial intelligence (AI). Intel bulls harbored hopes that the year marked an inflection point for the long-time market laggard.

It hasn't worked out that way. Intel fell as much as 60% from its late 2023 peak before climbing back to about breakeven today. Heck, shares remain about 33% below their all-time high.

It's hard to believe now, but once upon a time, INTC was one of the best stocks on the planet. Cut to the present, and it's not clear if the company can reclaim its glory days.

Intel still dominates the markets for central processing units (CPUs) for PCs and servers, but it's been losing share to rivals at an accelerating rate for some time. Nvidia (NVDA) and Advanced Micro Devices (AMD) are just a couple of its formidable competitors.

Where the semiconductor company really went wrong — apart from execution missteps and manufacturing delays — is the way it missed some of the biggest changes in technology. Intel famously whiffed on mobile, and now Nvidia is running away in generative AI.

There's a reason Nvidia replaced Intel in the Dow Jones Industrial Average in 2024.

It's been a curious ride for INTC investors. Thanks to its dot-com era heyday, Intel was one of the 30 best stocks in the world from 1990 to 2020.

In those three decades, INTC stock generated more than $340 billion in wealth for shareholders, or an annualized dollar-weighted return of 16%, says Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

However, the past two decades of that 30-year span have been another story.

The bottom line on Intel stock?

If you go all the way back to Intel's debut in the early 1970s as a publicly traded company, it beats the broader market handily. The chipmaker's annualized all-time total return stands at 14.4%. The S&P 500's annualized total return comes to 10.8% in the same span.

If you look at pretty much any other standardized period, an investment in INTC has been a major dud.

Intel stock trails the broader market by distressingly wide margins in the past five-, 10- and 20-year periods. Indeed, its five-year annualized total return is negative.

What does this sort of performance look like on a brokerage statement? Nothing short of ugly.

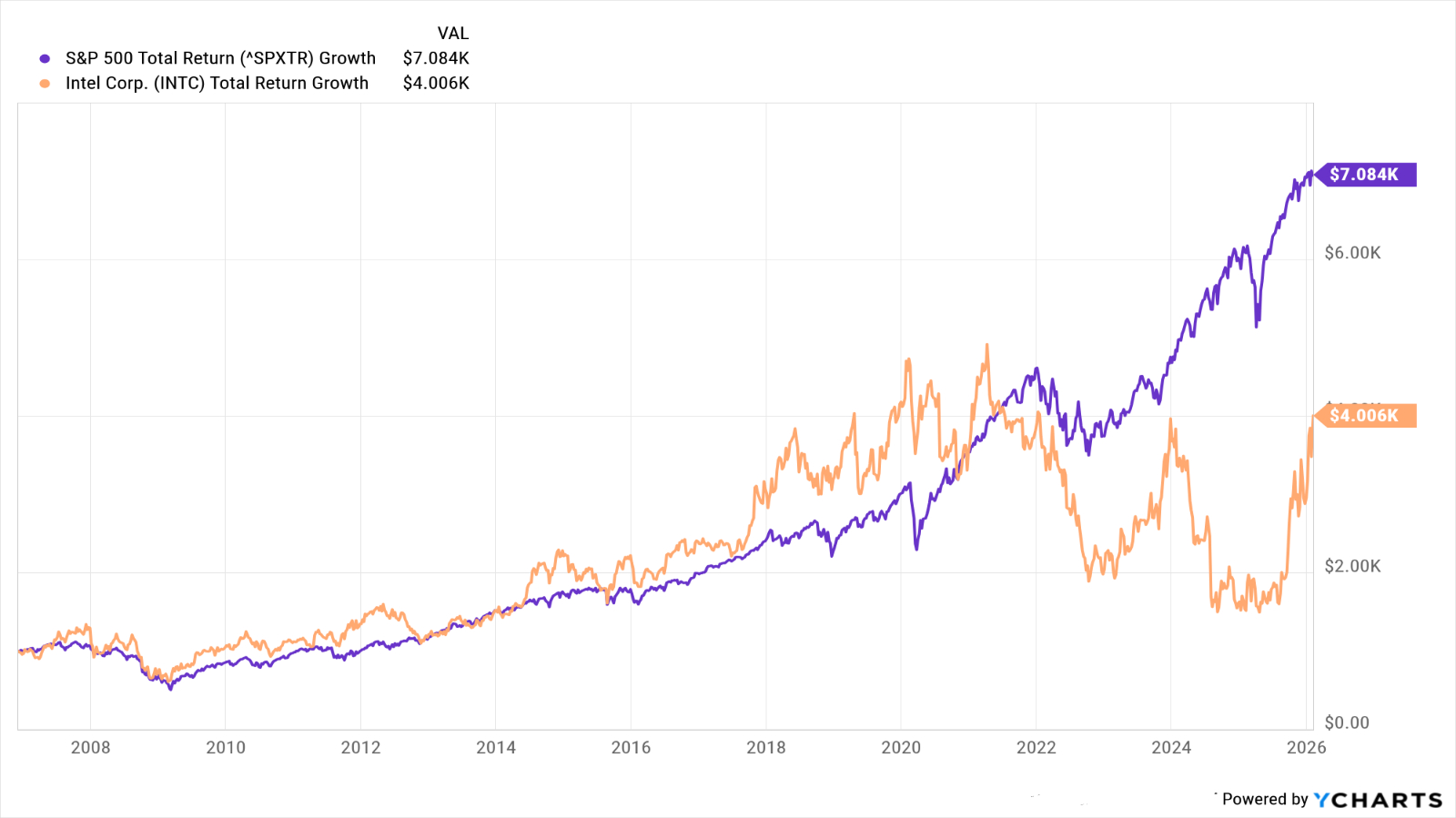

Have a look at the above chart, and you'll see that if you invested $1,000 in Intel stock 20 years ago, today your stake would be worth about $4,000, or an annualized total return of 7.4%.

The same amount invested in the S&P 500 would theoretically be worth about $7,000 today. That's good for an annualized total return of 11%.

As illustrious and iconic as the Intel brand might be, Intel stock has been nothing but a sinkhole of opportunity cost for buy-and-hold investors for a very long time.

So where does INTC stock go from here? Wall Street is mostly sitting on the sidelines, giving it a consensus recommendation of Hold. Of the 47 analysts covering Intel surveyed by S&P Global Market Intelligence, eight call it a Strong Buy, one says Buy and 32 have it at Hold. Four analysts rate INTC at Sell, while two say it's a Strong Sell.

Among their worries: the company is in the midst of a major restructuring as it struggles to right its floundering foundry business. True, the federal government took a 10% equity stake in 2025, and that's given INTC stock a boost. However, the foundry business continues to generate operating losses and is having difficulty lining up outside customers, among other issues.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into IBM Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Private Capital Wants In on Your Retirement Account

Private Capital Wants In on Your Retirement AccountDoes offering private capital in 401(k)s represent an exciting new investment opportunity for "the little guy," or an opaque and expensive Wall Street product?

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.

-

Fix Your Mix: How to Derisk Your Portfolio Before Retirement

Fix Your Mix: How to Derisk Your Portfolio Before RetirementIn the run-up to retirement, your asset allocation needs to match your risk tolerance without eliminating potential for growth. Here's how to find the right mix.