If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

Amazon stock is lagging the broader market badly this year, but it's still been a buy-and-hold investor's best friend.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Amazon.com (AMZN) stock is underperforming the broader market by a wide margin so far this year, but it's been a remarkably remunerative bet for long-term shareholders.

Truly patient investors in Amazon stock have enjoyed astonishing returns through the decades.

Amazon, which joined the Dow Jones Industrial Average in February 2024, suffered some profound sell-offs over the years. At one point during its history, from peak to trough, Amazon stock lost more than half its value, wiping out more than a trillion dollars in market value.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That's just the price of admission to one of the best stocks of all time.

An analysis by Hendrik Bessembinder, finance professor at the W.P. Carey School of Business at Arizona State University, found that AMZN was one of the 30 best stocks in the world through three decades.

Between its initial public offering in 1997 and December 2020, Amazon stock created nearly $1.6 trillion in wealth for shareholders, according to Bessembinder's model, which includes cash flows in and out of the business and other adjustments.

Amazon started as a modest website for book buyers. Today, it's the nation's largest e-commerce company.

That's only part of the story behind its extraordinary wealth creation. The firm is a giant in cloud-based services and artificial intelligence (AI), and a leader in streaming media and digital advertising.

Amazon has a massive footprint in the analog world, too. It owns the Whole Foods grocery store chain and maintains sprawling logistics operations. The latter comprise a vast assemblage of distribution centers and fleets of commercial aircraft and trucks, among other capital-intensive assets.

The bottom line on Amazon stock?

Which brings us to what $1,000 invested in Amazon stock 20 years ago would be worth today.

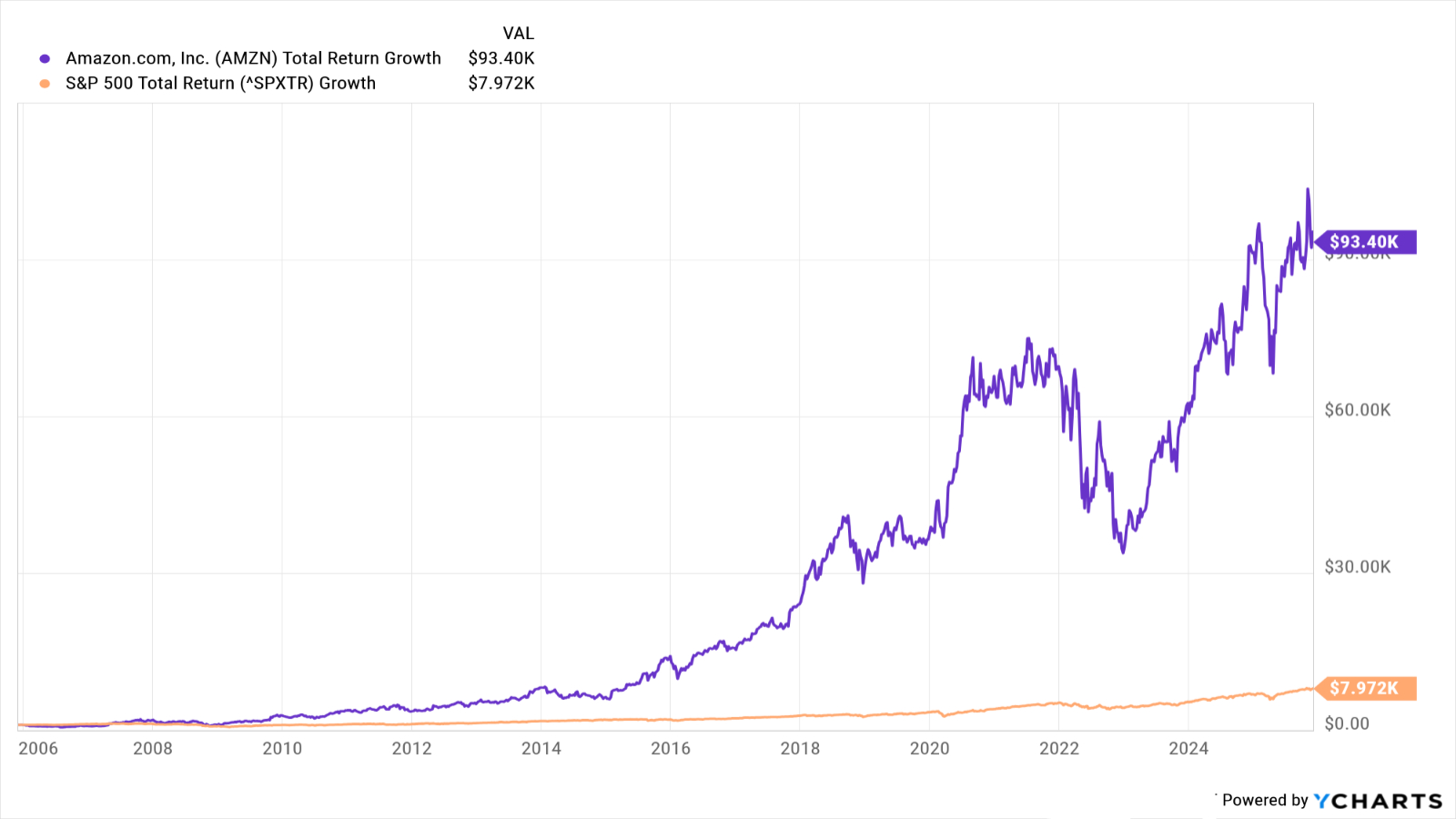

As you can see in the chart, if you'd invested $1,000 in Amazon stock a couple of decades ago, it would today be worth about $93,000. That's good for an annualized total return of almost 26%.

By comparison, the same sum invested in the S&P 500 in the same time frame would theoretically be worth about $8,000 today. That comes to an annualized total return (price change plus dividends) of 10.9%.

If past is anything like prologue, Amazon will continue to outperform the broader market at a healthy clip. For its entire history as a publicly traded company, Amazon stock generated an annualized total return of more than 31%. The S&P 500's annualized total return comes to 10.8% in the same span.

Put another way, Amazon stock has more than tripled the performance of the broader market since it went public. The way things are going, bulls are probably feeling pretty confident about Amazon keeping its streak alive.

Wall Street sure thinks it can — at least in the next 12 months or so. Of the 66 analysts issuing opinions on Amazon surveyed by S&P Global Market Intelligence, 47 call it a Strong Buy, 16 say Buy, and three have it at Hold.

That works out to a rare consensus recommendation of Strong Buy, and with high conviction. Amazon makes the list of analysts' best Dow Jones stocks, as well as the Street's top S&P 500 stocks to buy now.

"Amazon.com is one of the few large-cap companies benefiting from the secular shift to e-commerce," notes Oppenheimer analyst Jason Helfstein, who rates shares at Outperform (the equivalent of Buy). "The Whole Foods acquisition created another leg of growth. Finally, AMZN's Web Services segment is now the global leader in cloud computing and has significant value."

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.